Central banks comment as gasoline prices hit the highest level in 7 years, and interest rates rising but what will happen when stock markets collapse?

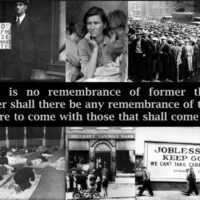

We are living through an extremely dangerous time where people are fed a steady diet of propaganda and outright lies as our economic Rome burns.

Look at who just warned $20,000-$50,000 gold is coming as global financial system may see crashes in everything expect gold.

The gold and silver bull markets are about to reassert themselves as one pro says, “People should expect [high inflation and] negative real rates for years to come.”

Caution, this rising inflation can easily turn into hyperinflation.

It’s decision time for gold, plus a look at China, silver and stagflation.

Today legend Pierre Lassonde told King World News that he has been buying high-quality mining stocks and also sent KWN an interesting chart.

Today the man who is connected in China at the highest levels said the price of gold is set to reverse higher, will surge $450.

It “will be devastating,” another day, another parabola in commodities, gold, silver, and an epic short squeeze.

Today the top trends forecaster in the world, Gerald Celente, warned the situation is about to get much worse in the US.

The gold market is poised to regain its strength, plus this is the harsh reality the US is now facing.

The damage “will be epic.” shortages continue, plus look at what is hitting new all-time highs.

Look at who just warned, “The world faces the prospect of momentous monetary disorder and inflationary mayhem,” plus a look at some truly remarkable charts.

Trouble in Europe and finally a bottom in gold and silver as paper gold longs hit lowest level since 2019.

The man who has become legendary for his predictions on QE and historic moves in currencies and metals told King World News that the price of gold will reach levels that few can imagine today.

On the heels of the recent volatility in gold and silver, Michael Oliver, the man who is well known for his deadly accurate forecasts on stocks, bonds, and major markets, shared with King World News the key levels to watch for major gold and silver upside breakouts.

It’s time to buckle up because this is the beginning of hyperinflation.

Here is a stunning big picture look at where things stand with regards to gold and the stock market.

This remarkable chart says it all when it comes to the silver market…

With the price of gold surging $40, look at what is now up a staggering 26 times in price, 1950s-today, mega inflation, plus this is also skyrocketing.

![GOLD & SILVER BULL TO REASSERT ITSELF: “People Should Expect [High Inflation And] Negative Real Rates For Years To Come” GOLD & SILVER BULL TO REASSERT ITSELF: “People Should Expect [High Inflation And] Negative Real Rates For Years To Come”](https://s43022.pcdn.co/wp-content/uploads/2019/07/King-World-News-Gold-Silver-Update-Plus-A-Bad-Situation-Getting-Worse-And-Dont-Worry...Everything-Is-Okay-275x200_c.jpg)