Gold and silver may finally be set for major spikes, plus US dollar troubles, and those who can least afford it.

US Dollar May See Huge Plunge

December 16 (King World News) – Top Citi analyst Tom Fitzpatrick: The US Dollar Index traded below a horizontal support level at 90.48 overnight and has broken to new lows. There is no good support down to 88.25, which is a neckline of a huge double top that targets 73.51.

$120 Gold Surge?

Gold is testing a neckline of a potential inverted head and shoulders at $1862 with the 55 day MA at $1875. A break above this range would suggest extended gains towards $1965-1980.

Silver May See $30+ Soon

Silver broke above a good resistance range at the $24 handle and is now headed to a good horizontal resistance level at $26.01, which is a neckline of a potential double bottom that targets $30+…

To learn about one of the most exciting silver plays in

the world click here or on the image below

Those Who Can Least Afford It…

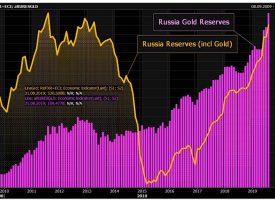

Peter Boockvar: I want to reiterate my belief that all Fed policy is doing at this point is only helping those large companies that have access to the capital markets, those that own stocks and bonds (or Wayne Gretzky hockey cards), those that own a home and they are monetizing the US budget deficit. All of this is fine if you’re included in this group. If not, sorry.

Via the loan margin squeeze on regional banks, they are hindering loan growth to small business as it is not the cost of money that is the issue but the access to it. To this and a quote from a Fed staffer himself named Matthew Plosser in yesterday’s FT said:

“The terms for smaller firms are much more constraining, the maturities of the loans are shorter, the loans more likely require collateral, the interest rates are higher and the covenants are more binding.”

The Fed is also again creating a wide differential between the value of asset prices and the underlying earnings power of publicly traded companies and the economy. And they are making it more challenging for that young, first time home buyer to save up for a downpayment who are seeing 6-7% annual home price gains and are also competing against private equity firms and all cash investors that are buying homes to rent. As for the financing of the exploding US budget deficit and debts, the US dollar continues to bleed lower with the DXY now approaching 90, hurting the purchasing power of those least able to afford it.

Did You Miss Kirkland Lake Gold’s 50-Fold Share Price Increase?

Kirkland Lake Gold Skyrocketed From $1 To Over $50!

Two Billionaires Just Bought Huge Stakes In The Next Kirkland Lake Gold!

To find out which company two billionaires just bought huge stakes in what they believe will be the next Kirkland Lake Gold click here.

Alasdair Macleod has been giving really incredible interviews each week in the KWN Wrap CLICK HERE OR ON THE IMAGE BELOW TO LISTEN.

And Gerald Celente talks about the top trends for 2021 in his audio interview CLICK HERE OR ON THE IMAGE BELOW TO LISTEN.

© 2020 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.