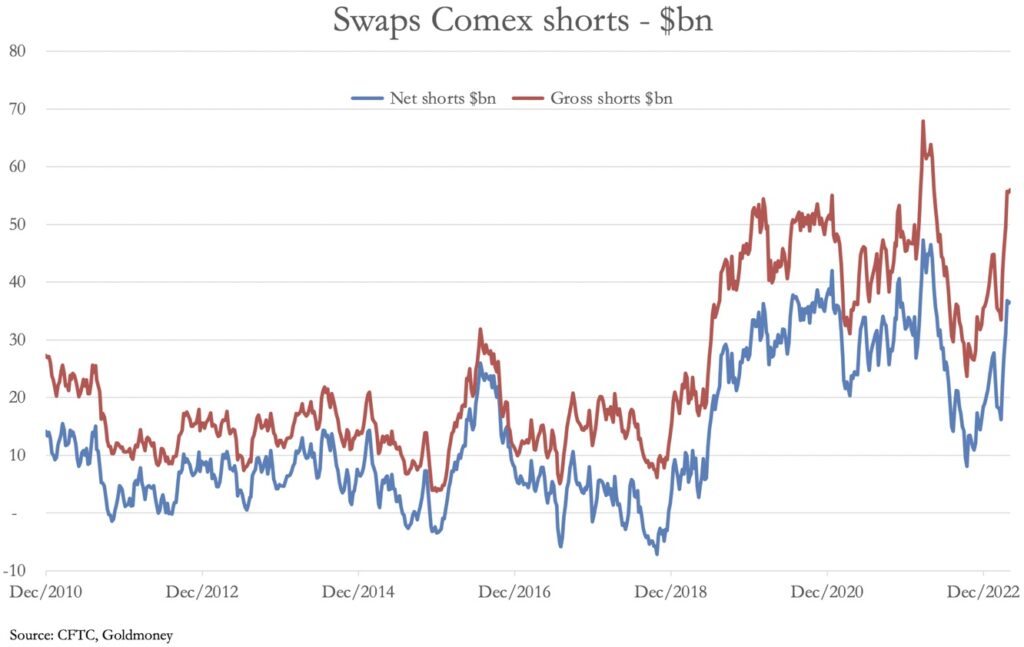

For the second week in a row we have bullion bank net short positions near an all-time record in the gold market. What is happening in the silver market is equally fascinating.

But first a quick email from a KWN reader…

April 28 (King World News) – Email from KWN reader Charles P. referencing this King World News piece: It’s not just housing, EVERYTHING is “bizarre”. And all of it – every last piece! – can be traced one way or another to the mis-allocation and mis-pricing of capital, courtesy of the Federal NOT Reserve.

The next bank failure – large, medium, or even small – should be the “Minsky Moment” that sets off the real asset avalanche. KUTGW!

Stagflation Rules The Day

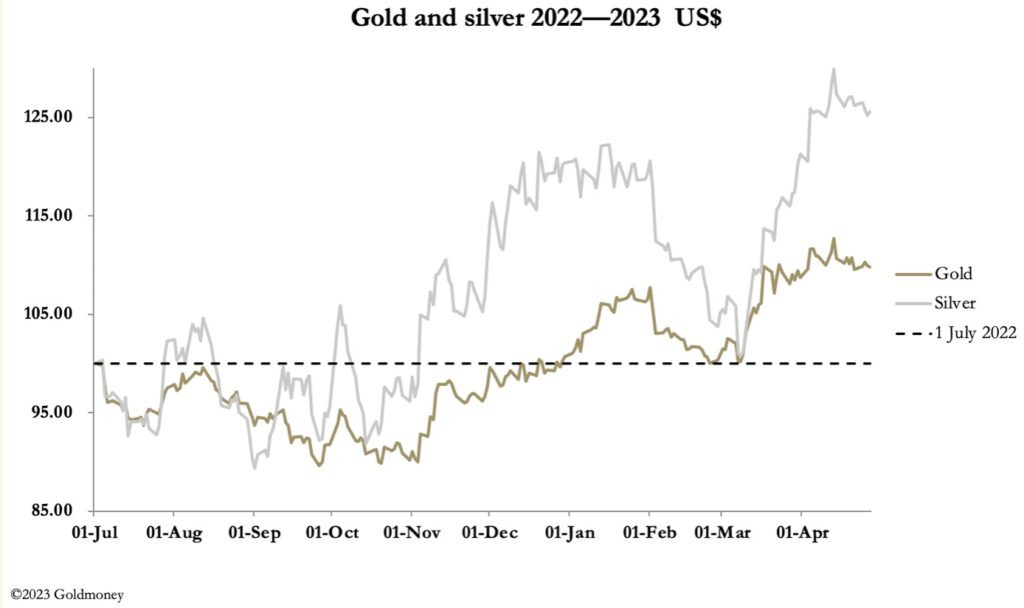

Alasdair Macleod: Consolidation of precious metals prices continued this week, with gold unchanged at $1984, and silver down 26 cents at $24.83.

Turnover in silver futures on Comex was healthy, while in gold futures it was more modest. In the four days of this week, 779 gold contracts were stood for delivery, representing 2.42 tonnes.

Gold and silver prices were undoubtedly “managed” by market makers and bullion bank trading desks, to ensure that April gold call options struck at $2000 and above expired worthless. That being the case, some selling pressure is likely to be alleviated in the weeks ahead. But as always, the battle between the bulls and bears continues, with the establishment shorts continuing to try to call the shots. Their position in the Comex gold contract is shown next.

With gross and net shorts uncomfortably high in dollar terms (which is what bank Treasury departments will be looking at) the Swaps, which are mainly bullion bank trading desks, will be very sensitive to dollar weakness, banking crisis issues, and continuing tightness in bullion markets.

We are having to double guess traders on both sides — speculator and non-specs. It matters because there is growing evidence that the stagflationary conditions of the 1970s are in prospect. This week, with US GDP coming in at 1.1% growth for the first quarter of this year, against expectations of 2%, analysts are saying that the US economy might already be in recession.

What the consensus had missed was the consequences of bank deposits contracting. On the other side of the banking system’s collective balance sheet is bank lending, which must also be contracting. All GDP transactions are settled in this credit, so a downturn in GDP is certain. The only sectors likely to be growing are defence related, given the American administration’s commitment to supply Ukraine, and the belligerent stance against China in the Pacific…

This Company Has A Massive High-Grade Gold Project In Canada And Billionaire Eric Sprott Has A Huge Position! To Learn Which Company Click Here Or On The Image Below.

The best one can say is that even without further contraction in bank lending, the US economy is heading into stagnation, where the real economy is contracting offset by government spending on defence.

But the Fed still plans to raise its funds rate at the next FOMC meeting, and maybe raise it again once again. Therefore, we are faced with interest rates staying higher for longer. Clearly, the Fed has reason to be more concerned over the inflation outlook than recession. These conditions have much in common with the 1970s, when the Fed funds rate rose to record levels, and the gold price rose from $35 to $850. Throw in the fragility of the global banking system, and this time the effects of stagflation on the gold price could be equally, or even more dramatic.

Finally, let’s look at the technical position, which is next.

The moving averages are in bullish conjunction below the price. The obvious resistance is the double top at $2070, which if surmounted will support a far higher gold price.

And surely, that is what the current consolidation is about — supporting a challenge into new high ground.

ALSO JUST RELEASED: Pomboy Warned Something Wicked This Way Comes CLICK HERE.

ALSO JUST RELEASED: We Will Have Hell To Pay For This Government Intervention In Financial Markets CLICK HERE.

ALSO JUST RELEASED: This Will Unleash Silver To All-Time High But Don’t Forget About Key Commodity CLICK HERE.

ALSO JUST RELEASED: An Inflationary Depression Is Being Unleashed CLICK HERE.

ALSO RELEASED: Miners To Have A Golden Wave This Earnings Season But Look At What Is Plunging CLICK HERE.

ALSO RELEASED: Art Cashin Just Warned About VIX But Look At What Is Already Collapsing CLICK HERE.

ALSO RELEASED: The 1930s Great Depression: Is History Set To Repeat? CLICK HERE.

ALSO RELEASED: Silver On Cusp Of Major Upside Breakout As Gold Approaches $2,000 Level Again CLICK HERE.

ALSO RELEASED: There Are So Many Signs Of Financial Disaster Across The World CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.