Mining companies are set for a golden wave this earnings season but look at what is plunging.

Mining Stocks Poised For Great Earnings

April 25 (King World News) – Fred Hickey: Plummeting diesel & shipping costs combined with near-record gold prices should make for some excellent earnings reports from gold miners going forward (in contrast with most other stock group sectors). Labor cost moderation(key cost input) would help too…

ALERT:

Legendary investors are buying share of a company very few people know about. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

Copper Production Plunging

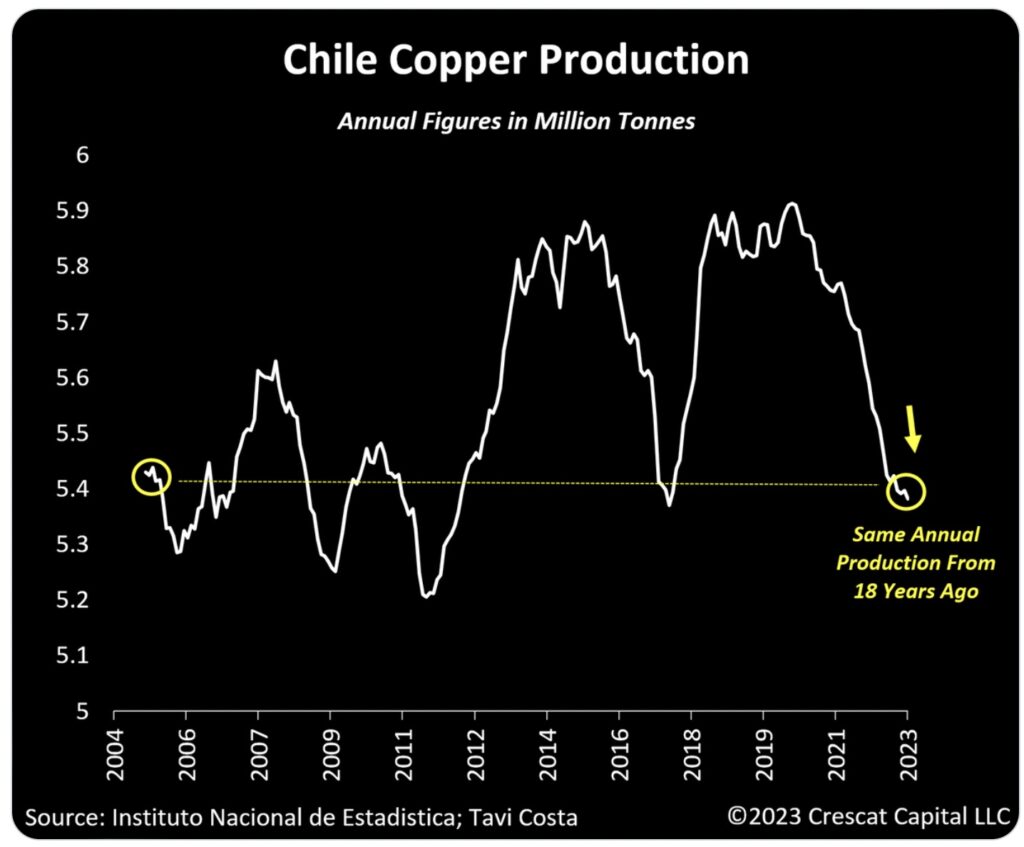

Otavio Costa: Chile’s overall copper production is currently as low as it was 18 years ago, nearly down 10% from its recent peak.

It is important to note that Chile holds a dominant position in the supply of this metal, accounting for nearly 30% of the total global production, akin to the OPEC of the copper market.

The potential transition to a green economy relies on an ample and accessible supply of metals, which is unattainable today.

High-grade copper discoveries are becoming increasingly challenging as most deposits found in the last decade are characterized by having low-grade mineralization that would not be economically viable at the current metal prices.

Additionally, the potential nationalization of Chile’s lithium industry raises critical questions about the stability of the country’s copper market, which could further complicate the global supply of this metal…

This Company Has A Massive High-Grade Gold Project In Canada And Billionaire Eric Sprott Has A Huge Position! To Learn Which Company Click Here Or On The Image Below.

These factors are among the main reasons for such a compelling demand and supply case for copper in the long-term.

If you ask me:

Metals and mining industries are well-positioned for the next likely run-up of this commodity cycle.

S&P Fails To Hold

Art Cashin, Head of Floor Operations at UBS: As we suggested in the late morning update, the next leg down did take the S&P through 4100. It did not quite go into freefall but did go down to test the next support level, which was 4080 to 4088.

The crushing selling in First Republic Bank is raising anxiety throughout the banking system. Is there another shoe to fall or will it be Imelda Marcos’s closet?

At any rate, let’s see if they can hold above that 4080 level [S&P failed to hold and closed at 4071]. The yield on the ten-year has been stuck at that low level of 3.40% and seems to be holding.

The action in the final two hours could be important because it will indicate whether the anxiety truly is reaching a fevered pitch.

So, watch the level in the S&P and see if we move off that yield base in any direction. Lower would certainly hint the speeding toward a flight to safety.

Cross your fingers and stay safe.

Arthur

ALSO JUST RELEASED: Art Cashin Just Warned About VIX But Look At What Is Already Collapsing CLICK HERE.

ALSO JUST RELEASED: The 1930s Great Depression: Is History Set To Repeat? CLICK HERE.

ALSO JUST RELEASED: Silver On Cusp Of Major Upside Breakout As Gold Approaches $2,000 Level Again CLICK HERE.

ALSO JUST RELEASED: There Are So Many Signs Of Financial Disaster Across The World CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.