Albert Edwards warned investors to brace for a retest of the 2009 lows as the crash in the stock market continued with the Dow collapsing another 3,000 points (12%)! More wild trading took place in the gold market, which saw a jaw-dropping $124 range today as physical gold shortages are now appearing.

In the midst of another wild trading day in global markets, reports of physical gold shortages are being reported, plus a look at panicked markets.

On the heels of the Fed lowering interest rates to zero and promising to inject $700 billion of QE, and the world continues to edge closer to the next crisis, today the man who has become legendary for his predictions on QE and historic moves in currencies and metals told King World News that the collapse of the global financial system is imminent.

On the heels of the recent plunge in the gold and silver markets and collapse in the mining stocks, today legend Pierre Lassonde spoke with King World News about the recent carnage as well as what he is doing with his own money right now as well as where he believes the price of gold is headed from here.

Lassonde is arguably the greatest company builder in the history of the mining sector. He is past president of Newmont Mining, former chairman of the World Gold Council and current chairman of Franco Nevada. Lassonde is one of the wealthiest, most respected individuals in the gold world, and as always King World News would like to thank him for sharing his wisdom with our global readers during this critical period in these markets.

In light of the recent carnage in the gold sector, I reach out to legend Pierre Lassonde to discuss the carnage as well as where the price of gold is headed and what investors should expect from here. That interview will be released immediately, but in the meantime, look at this….

Below is a fascinating email from KWN reader about what is unfolding.

With the Dow attempting a countertrend rally and the US dollar rallying on Friday the 13th, here is an important update on the gold market.

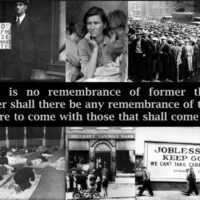

The global Coronavirus panic and stock market crash continued today with the Dow falling another 2,352 points or a staggering 9.26%. Here is an important look at the market panic as well as gold.

It’s been a wild trading day but take a look at this…

Fed not QE reverses some of today’s massive market losses.

On the heels of the Dow tumbling nearly 1,500 points in another day of panicked trading, 7 time Graham & Dodd Award winner and Chairman of Research Affiliates, Rob Arnott, warned 1 million people are infected with the Coronavirus and 30,000 have already died from this pandemic.

On the heels of the Dow tumbling more than 1,000 points in another wild day of trading, look at what is happening with the Bank of England’s gold.

On the heels of more wild trading in global markets from bonds to stocks, crude oil and more, one of the greats just told investors to embrace the chaos.

On the heels of the Dow wiping out a more than 900 point gain before turning around and rallying more than 900 points, while the US dollar and oil rally, here is a gold update, plus look at what just spiked the most since the oil related blow up in 2016.

Yes, the stock market has been collapsing, but with gold remaining strong and the price of crude oil collapsing, the Gold/Oil Ratio is skyrocketing!

On the heels of the Dow plunging along with oil and the US dollar, here is the chart of the day for the gold bulls, plus carnage alert as a bloodbath unfolds in the oil patch.

On the heels of the Dow futures tumbling 900 and the price of gold surging above $1,700, Dr. Stephen Leeb shared with King World News his thoughts on the dangers of the Coronavirus, its impact on markets, and $20,000 gold.

Today the former US Budget Director Under President Reagan, David Stockman, told King World News that the 1,000 Dow intraday swings is a warning that the fantasy of the last few decades is finally coming to an end.

As the chaotic trading in global markets continues, one of the greats just warned “the amounts of QE will be truly staggering,” plus wild trading in gold, bonds and more.

After another wild day of trading in global markets where bonds soared and stocks plunged, gold is heading onward and upward, plus a break of this key level will cause gold bears to throw in the towel.

[CNW Group] – International Tower Hill Mines Files 2015 First Quarter Financial Results

[PR Newswire] – WUHAN, China, May 6, 2015 /PRNewswire/ — Kingold Jewelry, Inc. (“Kingold” or “the Company”) (NASDAQ: KGJI), one of China’s leading manufacturers and designers of high quality 24-karat …

[Marketwired] – and financial statements for more…

[CNW Group] – Sandstorm Gold Announces First Quarter Results

[PR Newswire] – Subsequent to quarter end, acquired 100% of the outstanding common shares of Gold Royalties Corporation (“Gold Royalties”). Gold Royalties had approximately C$2 million in cash and a portfolio of royalties on 12 mining projects located in Canada, including one royalty that is generating cash flow from gold production.

[PR Newswire] – ROSEBEL AND ESSAKANE CONTINUE GENERATING FREE CASH FLOW AS WESTWOOD RAMPS UP ACCORDING TO PLAN All monetary amounts are expressed in U.S. dollars, unless otherwise indicated. Refer to the Management Discussion …