As we come to the end of another wild week of trading in October, here is a look at gold, silver, soaring bond yields and the Great Collateral Squeeze.

Collateral Squeeze

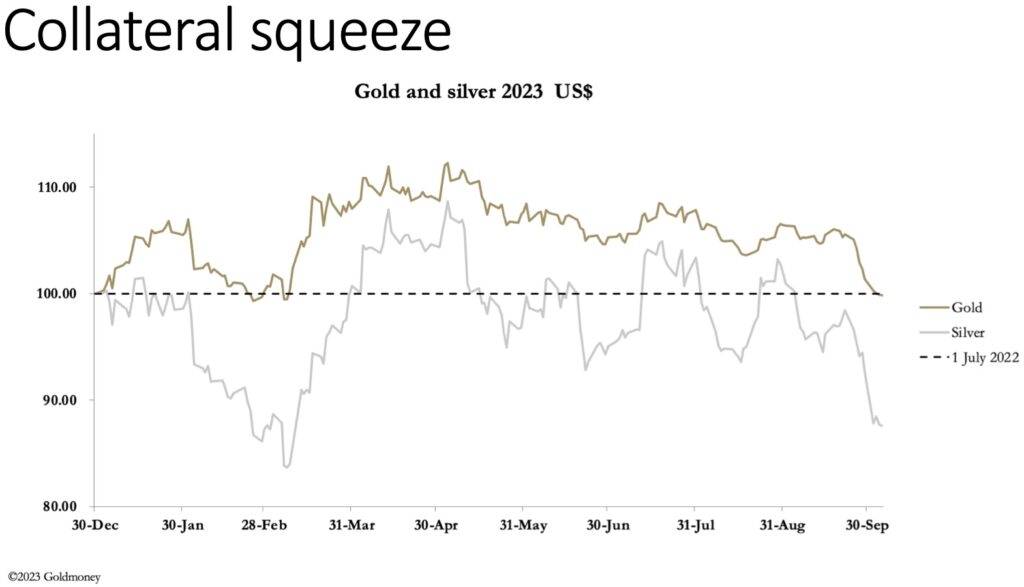

October 6 (King World News) – Alasdair Macleod: The sell-off in precious metals continued as bond yields continued to rise and a strong dollar persisted. In early trade in Europe this morning, gold was $1822, down another $26, unchanged on the year. Silver traded at $21, down $1.17. Comex volumes in both metals declined from good levels, indicating that selling pressure is declining.

Comex deliveries in both metals increased in volume, reflecting the end of the October contract. Including last Friday, 8,735 gold contracts stood for delivery in the last five business days, representing 27.17 tonnes, and 334 silver contracts representing 52 tonnes. This persistent demand for delivery is becoming a must-have source for those turning paper gold and silver into bullion, with 338.25 tonnes of gold and 3,514 tonnes of silver delivered this year so far.

Driving gold and silver lower have been persistently rising bond yields taking markets by surprise. The chart below of the US Treasury 10 year note yield is remarkably bullish — until you remember that this is of rising yields, collapsing bond prices, undermining all financial asset values.

What’s driving this? It appears to be a demand for collateral in a global version of liability driven insurance, which created a crisis in the UK gilt market a year ago. Demand for collateral top-ups is leading to bonds being sold for cash. It is also affecting not just dollars, but euros as well. The problem centres on interest rate swaps, a global market with a notional value of over $400 trillion. Those on the fixed interest leg of an interest rate swap are being forced to provide collateral to those on the floating rate leg. And, like the UK’s LDI market, these swaps are often leveraged by four- or five-times requiring matching multiples of collateral.

At times when interest rate differentials ma]er, bond markets under selling pressure are a headwind for gold. And the liquidation of bonds to meet collateral demands are not yet leading to wider systemic concerns. Consequently, higher bond yields are supporting the dollar’s TWI, which is up next.

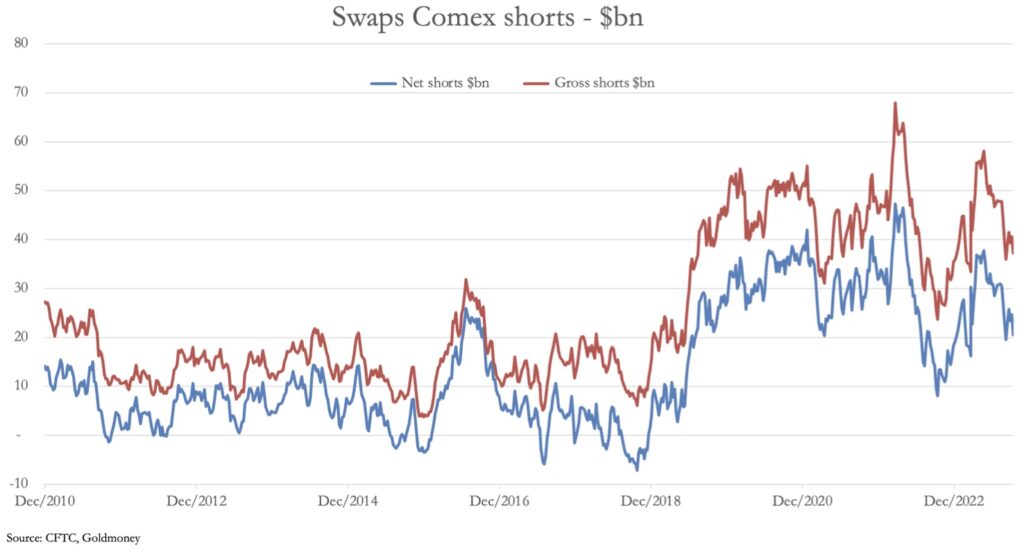

Again, this is seen by traders as negative for gold. It helps the bullion banks to close down their short positions in paper markets. Our next chart is of the value of gold futures shorts in the Swaps category on Comex.

Having reduced the value of their shorts significantly, on 26 September, the last Commitment of Traders report, the Swaps (mostly bullion bank trading desks) were still net short $21 billion. That will have reduced somewhat from there, but they are still some way from closing them out. Other things being equal, there will still be downward pressure from this source.

But this reckons without the damage bond yields are doing to the banking sector. Bond losses on bank balance sheets are mounting and collateral values are falling. Non- performing loans in the commercial real estate sector and a residential mortgage crisis is in the wings. When markets become more aware of these systemic risks, gold and silver prices should soar.

ALSO JUST RELEASED: Look At What Just Hit The Highest Level In History! Plus Gold, Inflation And Fear & Greed CLICK HERE

ALSO JUST RELEASED: More Signs The Economy Is Tanking CLICK HERE

ALSO JUST RELEASED: Worried About Gold & Silver Volatility, Take A Look At This… CLICK HERE

ALSO JUST RELEASED: The Situation Today Is “Many Multiples More Catastrophic” Than 2008 CLICK HERE

ALSO RELEASED: Michael Oliver Just Warned Terrifying Round 2 Of The Global Banking Crisis Is Being Unleashed. Get Ready For Gold To Launch CLICK HERE

ALSO RELEASED: FROM BAD TO WORSE: It’s Becoming Catastrophic For Tapped Out Consumers CLICK HERE

ALSO RELEASED: This Global Ticking Time Bomb Is About To Be Unleashed CLICK HERE

ALSO RELEASED: Global Markets Nervous As Government Shutdown Looms, Plus “Rent Too Damn High” CLICK HERE

ALSO RELEASED: IMPORTANT UPDATE: Gold, Commodities And Inflation CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.