As we kickoff trading in what could be a very wild month of October, global markets are still nervous as the US Government shutdown looms. Plus “Rent (still) too damn high.”

Global Markets Still Nervous Because Of Interest Rates

October 2 (King World News) – Art Cashin, Head of Floor Operations at UBS: Overnight, global equity markets are relatively quiet due to a variety of holidays. Hong Kong and Mainland China are closed for Golden Week and will be so for several days. India, on the other hand, is closed for the birthday of Mahatma Gandhi Jayanti. Japan traded and wound up closing down the equivalent of about 100 points in the Dow.

Over in Europe, as we go to press, markets are a little anxious. London is down the equivalent of about 100 points in the Dow. Paris and Frankfurt are down more like 50 points in the Dow. So, it is a bit of an edgy, quiet morning.

We will also not have much on the economic calendar here in New York. Right after the opening, we get the PMI Manufacturing. At midmorning, the ISM Manufacturing, followed quickly by Construction Spending. That having been said, however, pre- dawn trading maybe giving us a hint as to what we may be looking at for today. Very, very early on, it looked like the Dow and the other equity futures would open higher. That gain slowly slipped away. I think the cause was that the yield on the ten-year inched back up above 4.60%, getting all the way to 4.63%, which seemed to send a bit of a chill through the equity markets.

Let’s recall that the multi-day rally was inspired by what traders assumed may have been a parabolic exhaustion top in the ten-year yield when it shot up to 4.70% and then recoiled backward. As it begins to creep back in that area, it could bring pressure on the market. So, if we had to make up a rule of thumb for this morning, it might be 4.63% is caution. Every basis point above that will bring some pressure to the equity markets and certainly, if they should rally all the way back up to 4.70%, then we would probably see some real pressure develop as traders would begin to worry that the exhaustion spike proved not to be a full top and must be retested. That, I think, is the backdrop you will be working off today. The markets are all also moving near some of the moving averages and so, they will be needing to find some support in those areas.

Other than that, you know the drill, with all the geopolitical speculation going on. Stay close to the newsticker. Keep your seatbelt fastened. Stay nimble and alert and, obviously, watch those yields along the guidelines we just delineated. So, now we have entered the fourth quarter and the guidebook says, we should see new money for the new month. October is known as the month of bottoms, quite often capitulation bottoms. Having studied this game for over 60-years, my personal rule of thumb, is that October bottoms tended to come in the middle of the month, but even more frequently, toward the end of the month and, in fact, in the week just before the last weekend in October.

That having been said, the dartboard suggested that we could see a bottom tomorrow and Jon Stephens, who has been on top of this extraordinarily well, said it might not be his highest priority, but an early October bottom will also fit in to some of his work.

We will watch things and, as I say, I will keep my eye on the yields. Stay nimble, alert and safe…

This Company Has A Massive High-Grade Gold Project In Canada And Billionaire Eric Sprott Has A Huge Position! To Learn Which Company Click Here Or On The Image Below.

The Thing About A Government Shutdown

Peter Boockvar: The thing about a government shutdown, of course temporarily averted, and why most roll their eyes about it, is because of the few guarantees in life, eventually reopening the government is one of them and soon after previous shutdowns. The bigger problem is the government monstrosity that has been created and the current worry about financing it. And higher interest rates for a while makes the situation worse in two ways, it certainly reprices maturing Treasury debt at a much higher level and it further slows the economy which slows tax receipts. My friend Barry Knapp at Ironsides Macro said as much in his weekend piece, “just how big will the deficit be if monetary policy reduces revenues further with spending on autopilot? Of course, if the economy does weaken sharply, it is likely that spending will increase further.”

And when you hear that foreigners have sharply reduced their percentage ownership of US Treasuries to the low 30% range from mid 40’s% about 10 yrs ago, understand that this trend will continue, especially with the recent enlargement of the BRICS community which now numbers 11 countries. That includes, Brazil, Russia, India, China, South Africa, Saudi Arabia, Argentina, Egypt, Ethiopia, Iran and the UAE. As these countries combined produce almost half the world’s crude oil and about 1/3 of the world’s natural gas and with the ability now to transact in a currency not called the US dollar, there is a lot less foreign money being parked in US Treasuries.

I read a great stat over the weekend from my friends at Quill Research where Danielle DiMartino Booth wrote in her weekly Feather about the coming challenge for high yield credits in a higher for longer world. Beginning in September 2005, the high yield maturity profile was about 8.5 years and it “fell to 6.49 in February 2009, 1.87 years of compression over a span of nearly 3 1/2 years. Since forward rates began rising in August 2021, HY’s maturity profile has slid from 6.63 years to 4.96 years.” Each day gets us closer to someone needing to refinance at a much higher rate than the rate on the loan that is maturing, I’ll say for the umpteenth time.

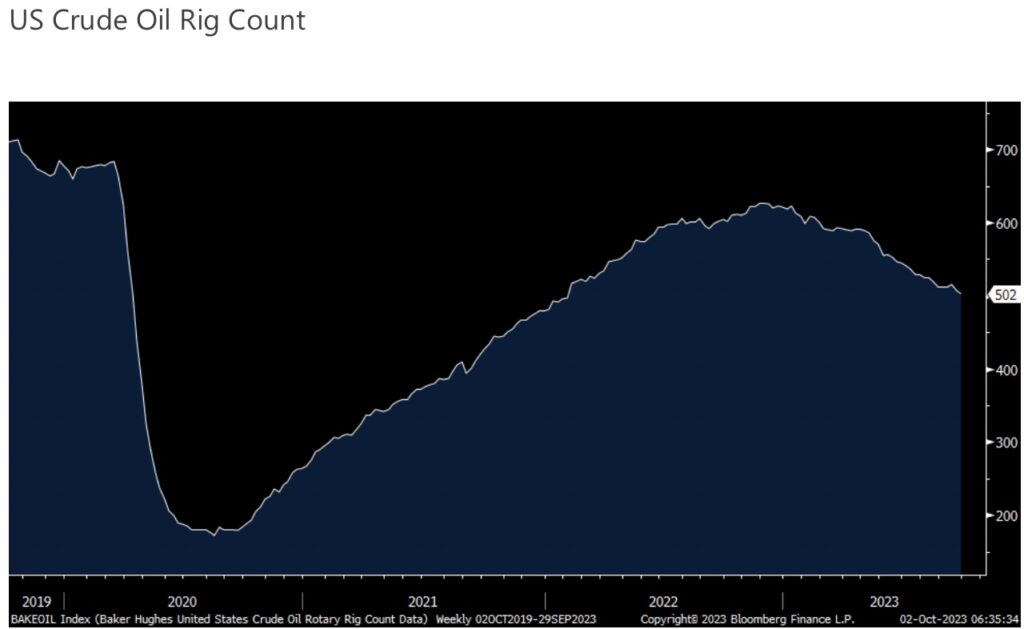

Speaking Of Oil

Speaking of oil, even with WTI now at $90ish, the US crude oil rig count fell by another 5 to just 502. That’s the lowest since February 2022 and it’s clear that OPEC+ is in firm control of the global oil situation (and the BRICS plus 6) as US shale seems to be a shrinking factor, notwithstanding record production but one that is seemingly about to falter with the continued rig count decline.

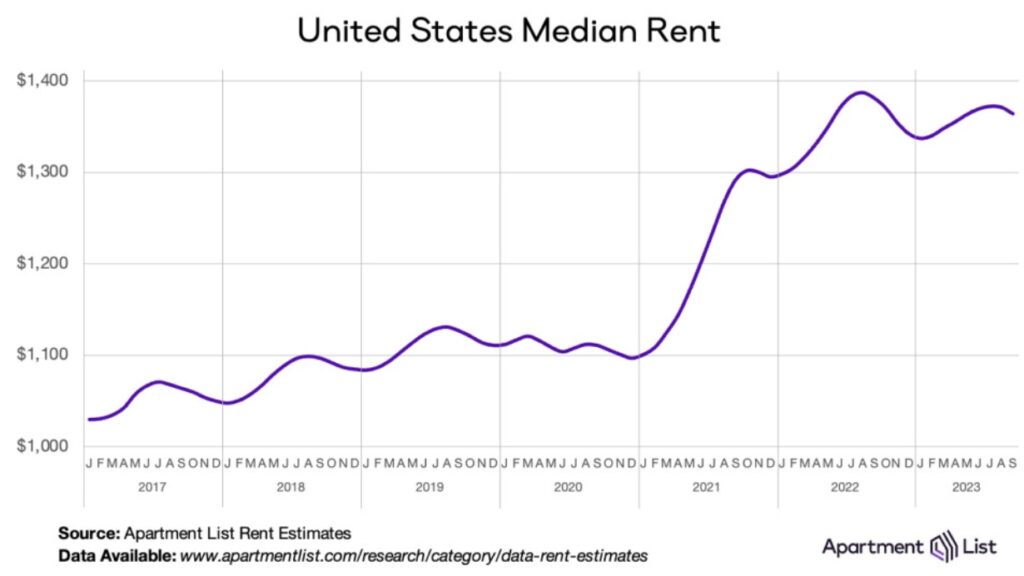

Back to the Fed, and the rental component of CPI, Apartment List reported its September report last week and NEW rents fell .5% m/o/m and brings the y/o/y change to down 1.2%. They said “This is a major deceleration from recent years, when annual rent growth neared 18% nationally and soared to over 40% in a handful of popular cities.” The breadth of rent declines is also wide as 85 of the 100 largest cities saw rents drop m/o/m and prices are lower in 71 of the 100 y/o/y. There is some seasonality to the drop as rents pick up in spring and summer and begins to slow in September and should continue as such through the rest of the year. Year to date rents are up 2.1% vs an average of 4% in the same monthly time frame in 2017-2019.

“Rent (Still) Too Damn High”

The vacancy rate has risen for 23 straight months and now stands at 6.4%, “just above the pre-pandemic average” and we have a lot of supply coming online in the coming year. With buying a home ever more difficult affordability wise, more of a renter nation we will become and I expect this supply to be absorbed pretty well. And then when the current crop of buildings are done, there will be very little new supply thereafter.

Carnival Cruise Lines Booming

While consumer spending seems to be getting reigned in in many places, it doesn’t seem yet to be happening when it comes to cruising. Carnival said in their earnings call last week that “customer deposits and booking volumes, both important forward indicators, achieved record levels for the third quarter” and the quarterly “outperformance was driven by strength in demand for our brand with both our North American and European segments equally outperforming expectations. The result was yields that were higher than anticipated that exceeded 2019’s strong levels and that reached an all time high.”

Some more, “Now, we appreciate there are heightened concerns around the state of the consumer as of late. But the fact is, we just haven’t seen it in our bookings or our results, and we believe consumers are continuing to prioritize spending on experiences over material goods. And the vacation value we offer will continue to resonate with those seeking more for their vacation dollars.”

Carnival is benefiting in particular for sure from baby boomers that are finally getting a great interest rate yields on their large amount of savings. A positive of a higher interest rate environment in terms of income for those that have savings.

Golden Week

With all the worries about China’s economy, the Chinese consumer wants ‘experiences’ too and Golden Week has them traveling. According to Inside Asian Gaming, in the first two days this year, visitor arrivals to Macau are down by only 4.2% from the first two days of Golden Week in 2019.

We also heard from China that its state sector weighted September manufacturing PMI got back above 50, albeit slightly, to 50.2 from 49.7. The non-manufacturing sector, which does include construction, rose .7 pts m/o/m to 51.7. Also out was the private sector PMI, where the private sector employs about 85% of the workforce, and it fell in contrast, to 50.9 from 51.7 with manufacturing lower by .4 pts but still above 50 at 50.6. The services component was 50.2 vs 51.8.

On manufacturing Caixin said “Overall, the manufacturing sector continued to recover slowly in September. Supply and demand both expanded, price gauges rose, and purchases and raw material inventories increased steadily. However, external demand was weak, employment came under pressure, and business optimism fell to a one yr low.”

With regards to the services side, “The milder increase in total sales occurred despite a fresh improvement in new export business (helped by tourism). At the same time, confidence around the year ahead outlook continued to moderate, reaching a 10 month low in September. Job creation across the sector also slowed, with payrolls expanding only marginally overall.” Cost pressures eased further.

Markets in China were closed for the holiday.

Asian Manufacturing Struggling

Manufacturing PMI’s for September were seen elsewhere and were mostly below 50 still. Taiwan’s PMI was 46.4 vs 44.3, Vietnam’s was 49.7 vs 50.5, Thailand’s fell to 47.8 from 48.9, Australia’s final read was 48.7 vs 49.6, Japan’s dipped to 48.5 from 49.6, Indonesia’s stayed above 50 at 52.3 but down from 53.9 in August.

Specifically with Taiwan, S&P Global said “The latest survey results show some tentative signs of Taiwan’s manufacturing downturn easing in September, with companies noting much softer reductions in output and new orders…There remains a number of headwinds to the sector’s recovery, most notably the weaker global demand environment, which has weighed heavily on sales and led firms to continually cut back production.”

Japanese Yen In Trouble…Again

JGB yields continue higher and a good reason they are up again today in Europe and the US. The 10 yr yield is up to .78%, the 40 yr yield jumped by 4 bps to 1.92%. Even with this though, the yen is knocking on the door again of 150 vs the US dollar.

The Eurozone and UK manufacturing PMI’s were basically left unrevised at figures well below 50 at 43.4 and 44.3 respectively.

ALSO JUST RELEASED: IMPORTANT UPDATE: Gold, Commodities And Inflation CLICK HERE.

To listen to Gerald Celente discuss the unfolding collapse and what surprises to expect next CLICK HERE OR ON THE IMAGE BELOW.

Just Released!

To listen to Alasdair Macleod discuss the financial crisis that is about to erupt and what this will mean for gold and silver CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.