Man connected in China at the highest levels says the gold bull is ready to stampede.

Gold: The End Of Cheap Money

January 20 (King World News) – John Ing: Markets fell 20% last year, in its worst yearly performance since the 2008 financial crisis. However rising market optimism on signs of cooling activity is perversely based on the belief that the increase in rates would tame inflation and a recession leading to slower rate increases or even a reversal. Some investors have even declared its death, perhaps prematurely. We believe inflation’s momentum has only slowed and face a 70’s style rebound thanks to a mixture of events. Higher prices and rates loom ahead. Interest rates are only part of the problem as we head into a new era of economic uncertainty. Robust employment numbers show that the economy is ALIVE. Wages are up 0.5% reflecting tight labour markets, defying expectations of a sharp downturn. The unemployment rate remains near historic lows due to retiring baby boomers, pandemic checks and a changing labour market. Noteworthy is that the cooler December “core” inflation rate at 5.7% excludes volatile food and energy which is three times higher than the Fed’s target.

Our view is that secular forces have taken hold, triggering underlying inflationary pressures and little hope for rate relief. Inflation is dynamic. The biggest mistake is to under-estimate inflation. While many disagree over its causes, investors, economists and central bankers simply misjudged inflation, believing the factors causing it were “transitory” driven by the pandemic and supply shocks. They were wrong. Noted US economist Milton Friedman observed that, “Monetary policy is not about interest rates; it is about the growth rate of the quantity of money”. Central banks led by the Fed have become the creators of money and for the past few decades have worked overtime, aided by the fiscal policies of their masters. Today, both are making things worse.

It’s Not Just about Interest Rates

The historical record shows that the key driver of inflation is the profligacy of governments and their propensity to spend, no matter the financial costs. Not surprisingly their record debt and central banks’ ultra-loose monetary policies resulted in too much money chasing too few goods and services, sparking the biggest stock market boom in history. Wars too cost money. Today, the US is waging wars on climate, tech as well as paying for previous wars in Iraq, Afghanistan and now, a proxy war in Ukraine. There is still the war against Covid and of course America’s culture war. As a result, public borrowings have soared to record levels as well as public debt which has been monetized, leading to the inflation of today. Worst of all in Weimar Germany, war reparation helped cause hyperinflation. And spurred by Russia’s invasion of Ukraine, the world is rearming itself. Former-pacifist Japan and Germany are ramping up spending. Even Canada has boosted defense spending.

Debt Limit Disaster

Today the cost of servicing this debt has skyrocketed. America’s gross public debt is 130% of GDP at $31 trillion, a record amount of red ink and the red line for the Republicans who are pushing for spending cuts and a standoff. A game of chicken looms between the Biden administration and newly empowered House Republicans to raise the debt ceiling which could spark a self-inflicted debt crisis and a default that would have dangerous financial consequences around the world. In 2011, a major fight caused a downgrade of America’s AAA rating and a dramatic 15% stock market plunge that forced lawmakers to declare “chicken” and kick the can down the road. Since then the debt limit has been raised three times, but only at the last minute. What would happen if the can kicked back?

Yet despite the end of cheap money, central banks remain reluctant to take the punch bowl away and continue to monetize debt, maintaining an accommodative monetary stance in their role as lenders of last resort. Thus, we believe there is more pain to come as cracks in the financial system grow…

To find out which gold & copper explorer is looking to hit significant mineralization click here or on the image below

Inflation Shockwaves Continues

Reinforcing today’s surge in inflationary pressures are the uncertainties behind geopolitics and energy which has left the global economy with fewer supplies whilst demand remains strong. Russian food and fertilizers are exempt from Western sanctions and have skyrocketed in price. The never-ending Ukraine war caused volatile energy and grain prices as governments spent billions to subsidize energy and food prices, with the likelihood that the post-invasion energy shock spike will continue for years. Second, the great power rivalry between China and the US has spread to other wars such as a climate and tech war with the efficiencies of global markets giving way to huge spending for government subsidies and handouts. Also adding to the pressure is America’s choice of both “guns and butter”, resulting in the issuance of massive amounts of debt and printed money, a classic recipe for hyperinflation.

The change in the geopolitical climate not only creates an uneven playing field but the protectionist erection of trade barriers and sanctions, and in the decoupling from China, the duplication of supply chains will prove to be expensive with taxpayers footing the bill and of course, paying higher prices. Although China’s emergence from lockdowns will begin to drive growth and give commodities a demand boost, economic protectionism on both sides will prove costly. Another boost to inflation is the governments’ push to green our planet which has already pushed up prices. As an example, Joe Biden’s climate bill alone will cost almost $400 billion and yet no country will meet promised targets, despite the grandiose promises and spending plans. So much money, so little results. Given these uncertainties, the inflationary fires will continue to be stoked.

Deglobalization And Protectionism Go Hand-In-Hand

Although the tensions between China and the United States thawed a bit, or at least the rhetoric following the tête-à-tête between China’s leader Xi Jinping and President Biden, US businesses have been pushing for a bilateral moderation to return to a “co-dependance” over climate, trade and investment. For decades China provided the markets that American businesses needed with China recycling those dollars by buying Treasuries, helping fund America’s deficits and spending.

That has changed with decoupling as Biden views China more of an adversary, through the lens of economic and military terms. While China has softened its rhetoric, a combination of Trump’s and Biden’s tariffs, together with the looming political election cycle has America taking a much more aggressive stance, particularly on xenophobic national security issues. The result is the weaponization of everything from semi-conductors, quantum computing, critical infrastructure and green technology in an effort to check China’s ambitions. The US has deployed sanctions, subsidies and initiated a dangerous protectionist tech war to prevent China from obtaining chips and technology to make cutting-edge chips, of which China already has a dominant share of the market. Washington has also imposed employment bans, and export controls. However while Mr. Biden declared, “American manufacturing is back, folks”, the new capacity will prove costly as the $52 billion CHIPS and Science Act is merely a down payment, and yet another boost to inflation.

Still, the more sophisticated chips will remain in the East where the demand is larger and where China is already in control of 80% of the critical materials market. China, already the global leader in AI and quantum computing, manufactures the majority of iPhones and Teslas with thousands of components used in electric cars also made in China, using Chinese tech and supply chains which are more globally integrated than ever. What would happen if China followed Western governments’ recent indicts to displace American technologies and buy local and impose a ban on chip exports? Or, as we discovered when Russia weaponized energy, the weaponization of chips or artificial intelligence can be a slippery and costly slope.

Paradoxically, if Western governments were serious about climate, they would provide the framework for raw material security and fast- track the development of critical mineral mines required to fulfill their decarbonization mandates. Rather than rely on China, more engineers, miners and prospectors are needed as well as infrastructure like rails, ports and roads to transport the critical materials. None of this is in the current legislation. Deglobalization will prove expensive and impose hardships on both countries and is inflationary…

ALERT:

Billionaire mining legend Pierre Lassonde has been buying large blocks of shares in this gold exploration company and believes the stock is set to soar more than 150% in the next 6 months. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

A New Multi-Polar Is Taking Shape

But that’s not all. In an echo of the Thirties, Biden and the Democrats have gone further than Trump’s tariffs in a “beggar-thy neighbour” approach, erecting a climate protectionist wall against allies and the EU as part of a climate race and economic rivalry that in the past led to major international conflicts. Climate policy and a global subsidy race have become central in the fight for global power. Mr. Biden’s misleadingly named landmark Inflation Reduction Act (IRA) includes $369 billion of subsidies and tax credits for green technologies but does little in the fight against inflation. It is a disguised climate bill that allows the world’s biggest emitter of carbon emissions to subsidize clean energy production, but only if built or created in the United States, giving domestic producers an advantage.

Lost in this shuffle is that incentives to invest in EVs and climate technology were already in place as every automaker rolled out new and improved models. The doling out of $7,500 tax credits or subsidies only shifts the cost to taxpayers of whom most own fossil fueled vehicles anyway. Although the IRA bill violates World Trade Organization (WTO) rules, the US has chosen to ignore other rulings that the Trump tariffs on steel and aluminum violated trade rules. The US position is that the trade body is not an “appropriate forum”. The moves have escalated decoupling, triggering fears of a climate trade war and falling into Thucydides’ trap.

The reality is that Mr. Biden’s IRA is about competing with China and blocking Chinese companies from using American technology, breaking long standing alliances that further divides the West, driving businesses and allies closer to China. Currently two-thirds of all goods China sells to the US are subject to tariffs. Yet the American consumer keeps on blindly paying for this tax, adding to the “made in America” inflation.

As a result of the Russian energy boycott, energy too has become weaponized resulting in China, India and the Middle East establishing a new BRIC (Brazil, Russia, India and China) energy world order. Russia has become India’s largest supplier of oil. As Russia attempts to starve the West of oil, cracks are appearing in long standing geopolitical relationships with the formation of a Western buyers’ cartel against Russia, fueling tensions between the West and OPEC+. While over half of China’s oil imports come from the Arab States, Mr. Xi Jinping’s visit to Riyadh highlighted China’s growing role in the region. The signing of historic deals over energy, technology, and security forms a circle that is hard to square as the BRIC countries lock in longer-term contracts, protecting them from higher energy prices.

Meantime while blaming his domestic oil industry for “profiteering”, to keep prices down Mr. Biden had opened discussions with former pariah state, Venezuela, to help boost production because US domestic production is roughly at one million barrels a day or 8% lower than before Covid. Ironically the high prices are due in part to the country’s efforts to wean off fossil fuels by constricting supply, canceling drilling leases, heavier government regulations and the blockage of new pipelines. So what about renewables? Solar and wind tied to the grid has been found to be expensive, more than uranium, coal or natural gas at a time, when ironically the US nuclear industry is to receive a $40 billion handout from the IRA. All in all, Mr. Biden’s climate policy hurts both his domestic producers as well as America’s allies and, ironically has pumped up both the US deficit and prices, another “made in America” problem.

The Ultimate Pyramid Scheme

Meanwhile, a large part of the assets of a widely followed balance sheet, late last year made up of a unit created out of thin air, imploded when that unit was found to be worthless. What followed was a rush for the exits as liabilities substantially exceeded assets. Was this the now bankrupt crypto-exchange FTX, a pyramid scheme built on a foundation of lies and at one time, the world’s largest crypto platform? No, it describes the Federal Reserve, central bank of the largest economy in the world which also possesses the largest debt in the world, financed by dollars which are printed out of thin air. The FTX episode however provides an early warning of what the future might hold, reflecting the fragility of investor confidence, particularly when the interest rate shocks have ended the era of free money and exposed cracks elsewhere in the global financial system. Today we believe the role of the dollar, as the world’s reserve currency has lulled investors into a false sense of security, because the US pays its bills in a currency it prints. However like the crypto giant FTX, the sustainable can not always be sustained…

ALERT:

Billionaire and mining legend Ross Beaty, Chairman of Pan American Silver, just spoke about what he expects to see in the gold and silver markets and also shared one of his top stock picks in the mining sector CLICK HERE OR ON THE IMAGE BELOW TO HEAR BEATY’S INTERVIEW.

The spectacular flameout of FTX was in hindsight another victim of the zero rate and zero risk environment created by the central banks. Now that the horse has left the barn, over one million investors have been left high and dry, shattering confidence in crypto. And now there are calls for more oversight, investor protection and new regulations reminiscent of past financial manias like the tulip bulbs in the 17th century, or the South Sea bubble in 18th century, or the subprime debacle, or the Long Term Credit implosion.

Over the past four decades, super-easy money and rounds and rounds of millions then billions went into riskier bets from the latest crypto platform to private equity, to SPACs as investors drank the Kool-Aid of fast growing “multiples of revenue” from hucksters. Big institutional money joined the FOMO (fear of missing out) meme crowd in a buying frenzy. Billions went into start-ups with little cash flow and too much debt. Then as the price of money became expensive, the Ubers, Netflixes and WeWorks collapsed in a free fall one by one, losing trillions exposing their vulnerability in tech’s “annus horribilis”. Even Blackstone, the world’s largest landlord needed a bailout for its BREIT which faced liquidity problems. Now that the era of growth at any price has faded and instead of an implosion of the banking system, it was crypto’s answer to fiat money that fell apart in a chain reaction implosion. What is next?

US Dollar Coming in for Hard Landing

The US dollar has fallen to a seven-month low, the fastest decline since 2009. The big geopolitical risk today is that America’s allies and foes are testing America’s dollar hegemony. Petrodollars are dollars paid to OPEC for their oil in an agreement signed in 1945. Ever since the Seventies, OPEC has recycled those petrodollars helping finance the US debt fueled economy in a symbiotic relationship that made the dollar the dominant currency in the world. However, following the creation of a new multi-polar currency order, China and Russia daily bypass the dollar payment system. In a de-dollarization move, OPEC has traded oil for other currencies than the dollar. At China’s Xi Jinping’s meeting with the Saudi Crown Prince, they signed a number of strategic deals and as a result a new world energy order is taking shape between the world’s biggest consumer of oil and its biggest supplier, in a potential oil for yuan swap, or petroyuans to replace petrodollars. Petrodollars are becoming extinct.

And while the US continues to incur deficits as far as the eye can see, it must rely on foreign capital to finance its consumption. Over the half century, the US share of the global economy has shrunk, replaced by others like China and India who invested huge economic and diplomatic resources to build up their “soft power” around the globe. China has extensive trade and economic links to the global economy, but not its currency. While China has rewritten the rules of the energy market, they are also rewriting the rules of the financial markets. History shows that significant currency shifts can take time. For example, it took over a decade for the British pound to lose its role as a reserve currency after financial losses from the World War. The US dollar has been here before after the breakdown of dollar/gold convertibility, losing half of its value between 1971-1978 against the deutsche mark. Today, the super-strong dollar appears to be losing its edge, falling 11% since September. A weaker dollar will contribute to higher US inflation, just when markets think inflation fires are ebbing.

Today a decoupling world and the geopolitical rivalry requires fewer dollars, and with a dangerous level of US debt built up from the trillions of dollars created under rounds of quantitative easing programmes, the cost of money, and inflation has risen. The US current account deficit and budgetary deficit requires funding. History shows that inflation may be the only way out for the US, a path followed by other indebted economies like Turkey, Argentina and Egypt which are battered by hyperinflation. The issue today isn’t that the US risks a Weimar Republic style inflation, at least not any time soon, but more about trust. The issue is that America’s debt financing of its debt and deficits are problematic and unsustainable.

A Trillion Here, A Trillion There

After living with easy money so long, the Biden administration used the pandemic to dole out record amounts, providing trillions more for healthcare, social spending, green subsidies and energy subsidies, expanding a class of Americans who are permanent government dependents. In a new world of debtors from debt-strapped Hungary to Pakistan, to Turkey, to Ghana and even the UK, markets have pushed for devaluations and lower deficits. Zambia and Sri Lanka have already defaulted on sovereign debts.

Even Japan has abandoned its decades-long ultra-loose monetary policies in its fight against deflation which sent shockwaves across the globe. All share the same problem. Debt monetization, high and growing government deficits financed by unorthodox monetary policies. Yet the United States is in a state of denial.

However, given the globalization of capital flows and rising global rates, the all-important US Treasury market is drying up. The immediate consequence is that in this new era of tight money, balance of payments, fiscal policies and currency risk have become all important, particularly since major holders of Treasury debt such as the Fed and Bank of China have stepped back purchases, leading to a dangerous market dysfunction. A crash in the Treasury markets similar to the UK gilt implosion would have far reaching consequences because it determines the cost the US government can borrow, and the backbone of the financial system. America’s Achilles heel is that it is dependent on flows of international capital. Those flows are fragile today, as Liz Truss discovered and in moments of panic, fragile capital can cause asset prices to plunge. Our concern is that with America’s growing deficits and high level of debt, the country’s finances is vulnerable. Who will buy America’s debt? That depends on America’s biggest creditor, China…

This Company Has A Massive High-Grade Gold Project In Canada And Billionaire Eric Sprott Has A Huge Position! To Learn Which Company Click Here Or On The Image Below.

Mr. Biden’s spending has been financed by Mr. Powell and the cost is mounting. Rising rates and a resultant red-hot inflation have inflicted huge losses in a yield mismatch as global central banks try to unwind the money created to purchase the government debt that once supported the market. Already there are unrealized losses as part of the quantitative tightening (QT). For now, the Fed’s $9 trillion balance sheet has a staggering $5.7 trillion of Treasury debt and $2.2 trillion of fixed rate mortgage assets with a whopping $1 trillion book loss which must ultimately be paid by taxpayers as borrowing costs are set to jump again. Elsewhere the Reserve Bank of Australia reported a $25 billion loss on its bond buying programs. The Bank of England needed a $11 billion bailout and if the losses continue, they will be added to the government’s operating expenses and thus a need for the sovereign state to recapitalize their ward. The Bank of Canada reported a half billion loss, the first in its 87-year history and yet despite the headlines, central banks’ “tighter than previous” policies ensure even more red ink to follow.

Our belief is that this financial trickery is marked by fading trust in our institutions, and while the guardians of the world’s currency deny that this is a problem, they are just the messenger. The huge debt in the system puts pressure on the central banks to tolerate higher inflation, rather than significantly raise rates as Mr. Volcker did in the Seventies. We believe central banks are part of the problem. It was never meant to be like this.

Oh Canada!

Then there is Canada with a whopping $36 billion in debt and at the bottom of all OECD countries in terms of 1,000 per capita hospital beds and per capita real GDP growth. Despite this, Canada in puppy dog fashion and after years of dithering has joined the US-led Indo-Pacific strategy and immediately blacklisted Chinese companies from investing in three Canadian lithium exploration companies, despite the fact that the Chinese hold more than 100 stakes in Canadian companies. Moreover, the trio’s properties are in Latin America, not Canada. At a time of an underfunded armed forces, we even sent one of our precious few frigates up the straits of Taiwan in another bravado gesture, at a cost equivalent to what we plan to spend annually to boost Canada’s northern infrastructure. Instead there is a pivot to India, where Canada’s exports to India are seven times smaller than what China purchases from us.

Our new industrial strategy is in response to Mr. Biden’s industrial strategy where Canada and US will spend hundreds of billions to subsidize green technology. Canada’s EV strategy ambitiously requires all personal vehicle sales to be electric by 2035 and, the new Canadian regulations specifically mentions Chinese investments, tightening investment rules and singling out companies as critical suppliers. It is a slippery slope. China supplies some 80% of critical minerals to the global market and can easily discriminate against Canada in a “quid pro quo” that would hurt Canadian companies, particularly at a time when Canada is pushing green technologies and like the United States generously subsidizes the purchase of EVs, which would ironically make us even more dependent on China’s critical minerals.

Chinese exports to Canada were a whopping $52 billion, according to the UN. Yet to put this into perspective, Canada’s new Indo-Pacific strategy allocates a modest $13.5 million over five years to “expand natural resource ties” and saying no to the banker of the world will not further Canadian prospects or our green policies, particularly when investment is lacking. Meantime Canada’s climate policies erected more roadblocks such as the stopping of pipelines to ship all-important energy from Alberta to the East which could be used by eastern provinces or overseas to help Europe. Instead, we are curbing investment in fossil fueled oil and gas. And at the same time, put roadblocks to the discovery of the needed critical green minerals at a time when we only have one domestic lithium mine, owned by the Chinese!

Chinese investors provided the needed capital when capital was not available in Canada. Ottawa today instead has opened the door to American funding, particularly the Pentagon who has the same restricted mineral and supply issues and are poised to takeover our critical deposits by providing the capital. Ironically when an American company threatened to leave Canada because building a pipeline extension proved to be too expensive due to environmental red tape, the Canadian government took over the project and, the price tag doubled to $12 billion, and the Trans Mountain Pipeline is still not built…

This Is Now The Premier Gold Exploration Company In Quebec With Massive Upside Potential For Shareholders click here or on the image below.

Ottawa’s contradictory “critical minerals” strategy rings hollow, particularly when the mining industry’s last saviour was the Brazilians who hollowed out Canada’s large nickel mines in Sudbury and Voisey Bay, only to reoffer the depleted mines to investors today. American money too was welcomed in Calgary to help the oil and gas industry but when the head offices left, Canada was too late to close the door. Capital is mobile and Ottawa’s evangelical policy of blocking fossil fuels and blocking Chinese capital at a time when both are scarce is folly, and expensive.

Mining Is at The Bottom of Ottawa’s To-Do-List

The problem is that helping mining is at the bottom of our politicians’ to-do-list. Although mining has a long history in Canada, it can take a decade or more to build a mine due to permitting, complex government regulations, red tape and the need to get the Indigenous communities on side. Little has been done to untangle or simplify the complex web of regulations and bureaucratic hurdles or even shorten the lengthy timeline to get a mining project off the ground. For example, Ontario’s mineral-rich “Ring of Fire” doesn’t yet have road access despite numerous promises and allocation of $1.5 billion over seven years for infrastructure in the last budget. The discovery of Eagle Nest, one of the world’s largest undeveloped nickel deposits was over 16 years ago and development has been stalled due to the lack of infrastructure and cumbersome regulatory hurdles.

Vast projects like Eagle Nest need to be tied to the electricity grid but there is not enough capacity. Ironically during this hiatus, financial ownership of Eagle Nest passed to the Australians from Canadian hands. Yet not only are “critical mineral” investments being blocked by Canada. There was the aborted takeover of TMAC Resources, a wanabee gold developer by Shandong Gold Mining which was blocked by Canada despite that TMAC, a sinkhole for capital, wasn’t even a producing mine. Gaining urgency, Canada needs more foreign investment because mining for the raw materials is expensive, used in products for everything from iPhones to electric cars and is a strategic resource.

Rather than block investment, we should incentivize investors, including the Chinese, no matter the racial bias or old tropes fashionable today particularly when it appears our companies will be left out of Mr. Biden’s IRA boondoggle. If greening Canada is a priority and to meet our objectives, we must quickly double the mining of metals. Changes are needed. Mining is critical in the critical mineral business as renewable energy requires raw materials such as copper for its high conductivity. EVs require at least eight minerals. A wind turbine is made up of 11 minerals. Up to a third of mining costs is energy. Rather than dole out money to buy an EV, Ottawa should incentivize mining the necessary critical minerals out of the ground. Losing any investment makes Canada poorer. We must rid of “nimby” pressures and stop the “blame game” rhetoric. But things just don’t get done here, from pipelines, to the purchases of F-35s, to the highest cell bills in the world, to airports, to the ArriveCan app. Amid an era of scarce resources, why aren’t we pushing for more, not less?

That Giant Sucking Sound is the Exit from the Dollar

The US fear of Chinese militarism and economic power makes them willing to subvert the world economy with protectionist moves such as weaponizing energy and its currency to pursue both its foreign and domestic policies. Sanctions, the Ukraine War and heightened geopolitical tensions have consequently forced some to circumvent the dollar system and the establishment of a new multi-polar order. Amid a backlash against the dollar and this multipolar world, America’s complacency about its role as steward of the world’s reserve currency, erodes trust in the dollar which underpins both American prosperity and democracy. Just as America displaced Britain as the world’s pre-eminent economic power, so too its large debt and financing pressures undermines the dollar, particularly when the US reached its debt limit, kicking off months of wrangling and a potential default. Isolated, one day as the US debt to foreigners increases, so will the claims and trust in the dollar. That day, the Fed and trust in America will be lost.

Gold prices have rallied more than 5% this year, trading over $1,900/oz, outperforming markets which suffered their worst shellacking in a generation. With inflation at multi-decade highs and geopolitical tensions festering liquidity has dried up and as the cost of borrowing rose, investors retreated from markets in a fight to quality. Gold is a good index of currency fears and often trades inversely to the dollar. In other currencies, gold has done well, up 11% in euro terms, 17% in pounds and 17% in yen. Last year in dollar terms, gold disappointed investors because of dollar strength but the turnabout has changed with the dollar falling almost 11% since its peak last September, helping gold break above its 200-day moving average resistance at $1,800/oz. A weaker dollar will boost commodities and worsen US inflation, already inflamed by higher energy and food prices. We believe gold is a barometer of investor anxiety, and today there is much anxiety. Consequently, a major realignment is taking place between the dollar and gold. Gold’s new bull market is only just beginning and will surpass $2,200/oz in coming months.

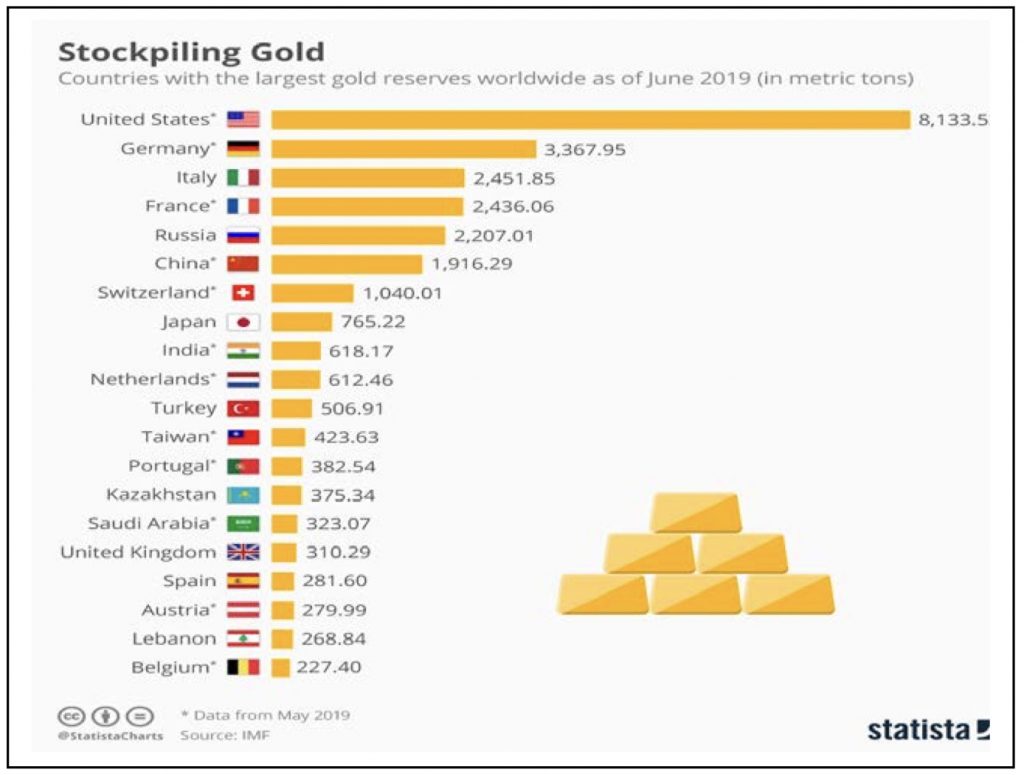

The World Gold Council (WGC) recently reported that central banks purchased a whopping 400 tonnes in the third quarter, the most ever in a single quarter and double the production record. China, the world’s creditor, has been a big buyer purchasing a further 30 tonnes in December, following a 32 tonnes purchase in November for the first time since 2019.

China holds 1,900 tonnes of gold, the sixth largest central bank holding after global heavy-weights Russia, Germany and the United States which holds 8,133 tonnes. Other buyers included Turkey, Egypt, India, Uzbekistan and Kazakhstan chipping away America’s reserve dollar hegemony at the fringes. These central banks are buying gold because in their currencies, gold is an essential part of national reserves and an effective alternative to the dollar, particularly amid the uncertain geopolitical climate.

Simply, gold serves as an effective store of value and diversifies central banks’ reserves away from the dollar. Noteworthy too is that the central bank purchases are conveniently outside the Western financial ecosystem, and a substitute for dollars in a world of growing sanctions. Russia is also a major buyer because Western institutions have frozen Russia’s $300 billion of foreign currency reserves. Gold is a central banker’s solution to too much dollars, particularly with the dollar weakening. With China’s continuing gold purchases and holding the largest foreign exchange reserves in the world, what would happen to the dollar if the Chinese decided to back the yuan with gold, considering it preferable to the dollar as a store of value?

ALSO JUST RELEASED: SPROTT: This Sector Will See A Huge Bull Market In 2023 CLICK HERE.

ALSO JUST RELEASED: Gold Has Seen Huge Breakouts In Many Foreign Currencies CLICK HERE.

ALSO JUST RELEASED: Art Cashin On The Collapse Of Tesla. Plus A Look At The Big Shock CLICK HERE.

ALSO JUST RELEASED: Dumb Money Rules The Stock Market…For Now CLICK HERE.

ALSO RELEASED: This Is Fueling Gold’s Surge Back Above $1,925. Plus Inflation Is Killing Restaurants CLICK HERE.

ALSO RELEASED: James Turk – This Is The Key To Gold’s Current Price Surge CLICK HERE.

ALSO RELEASED: SPROTT: Top 10 Things Investors Need To Watch In 2023! CLICK HERE.

ALSO RELEASED: GOT GOLD? Madness In World Bond Markets Ahead Of Global Reset CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.