Dumb money has been pushing the stock market higher…for now.

Dumb Money Rules The Stock Market…For Now

January 18 (King World News) – Jason Goepfert at SentimenTrader: Dumb Money Confidence breaks out.

Key points:

- Dumb Money Confidence has reached its highest level since November 2021

- A high level of Confidence in bear markets is often a warning sign, ala last August

- When Confidence recovered strongly after a prolonged downtrend, though, stock returns were consistently positive

Dumb Money Confidence breaks out to a new high

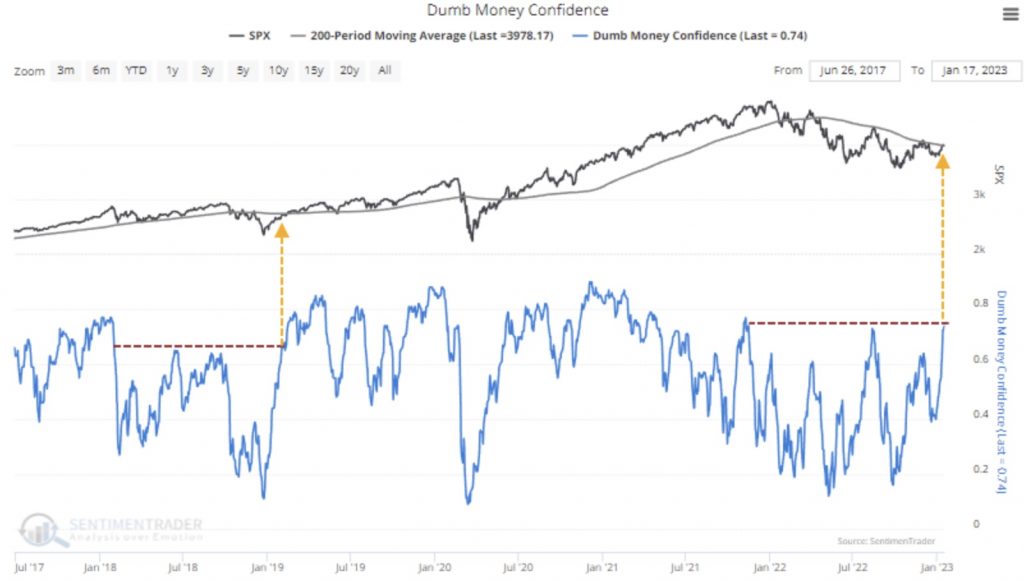

After a promising start following a miserable year, investors are feeling much better. While some metrics disagree, the indicators that constitute Dumb Money Confidence have recovered enough to exceed the peak from last August. Trend-following investors are now the most optimistic they’ve been in over a year.

During a bear market, high levels of Confidence are not a good thing. We saw that spectacularly in August. Almost immediately after Dumb Money Confidence exceeded 70%, stocks plunged.

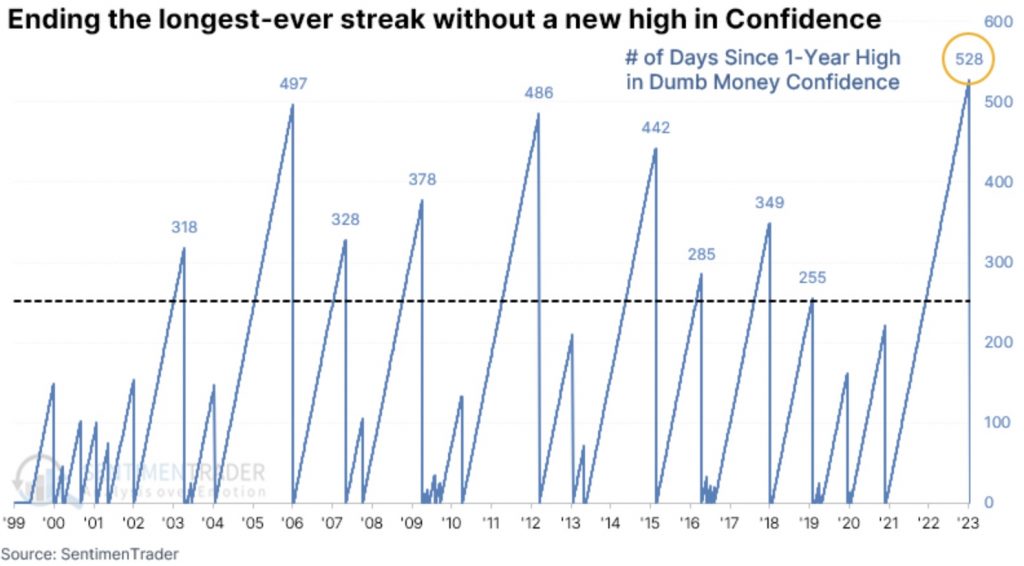

This ended the longest-ever streak without a one-year high in Dumb Money Confidence.

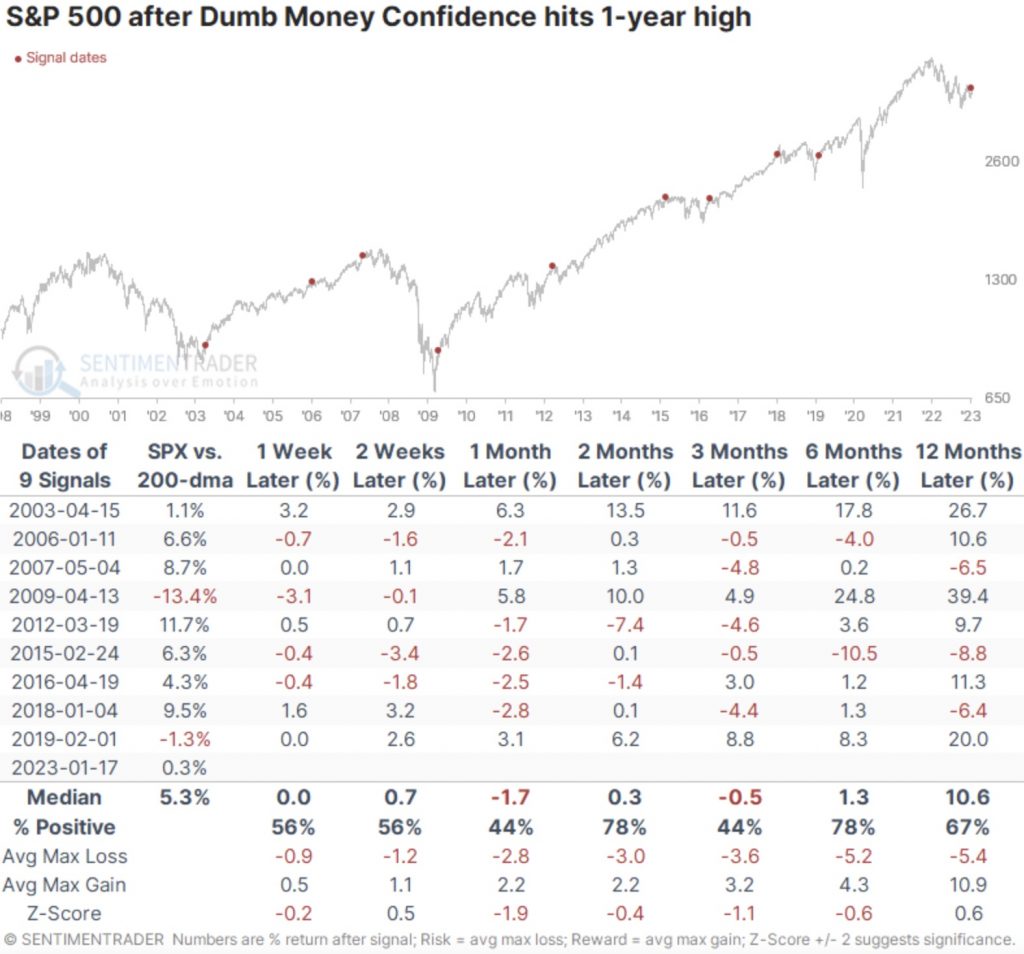

Historically, a breakout to a fresh one-year high in Confidence has preceded mixed results for the S&P 500. Between one and three months later, the index gyrated between positive and negative returns. Longer-term returns were mostly positive simply because that’s the base case.

However, if you look more closely at the “SPX vs. 200-dma” column, something should stick out. The most negative returns tended to occur when Confidence became very high and stocks were already doing well. Every time the S&P suffered a loss over the next three months, it had been more than 5% above its 200-day moving average.

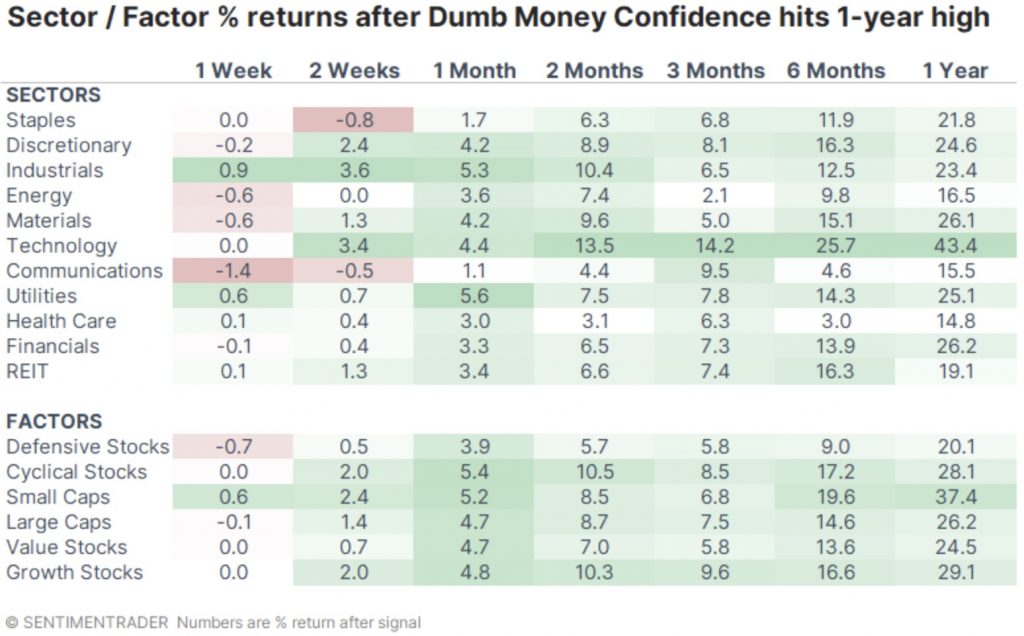

Stock and sector returns after periods of struggle

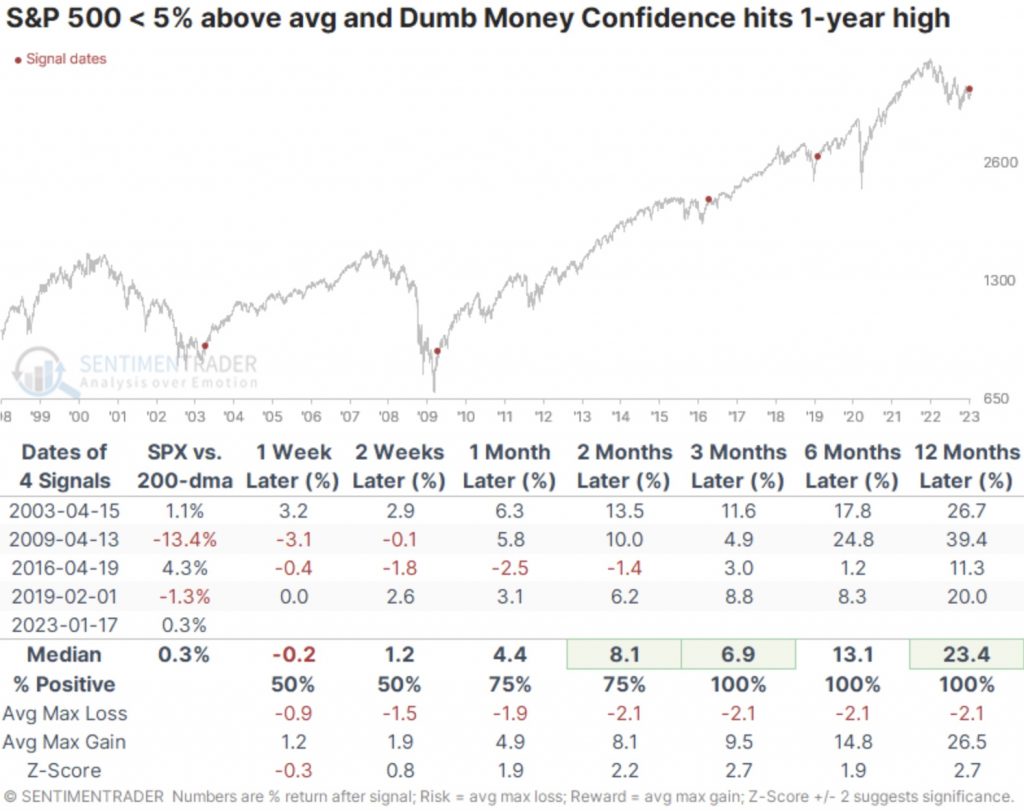

The table below filters the signals to only include those breakouts in Confidence that triggered when the S&P was less than 5% above its 200-day average. There were still some shorter-term losses in the signals, and relying too heavily on a sample size of four is tough. But over 25 years of history, these are the instances that are most similar to our current scenario…

ALERT:

Legendary investors are buying share of a company very few people know about. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

From 3-12 months later, the S&P showed gains every time, with an abnormally positive ratio of risk to reward. The index didn’t decline more than 5% at any point within the next year after any of the four signals, and it gained at least 14% after each of them.

If the current environment looks anything like those signals, then Technology, Discretionary, Industrials, and Small-caps have featured the best returns. Of course, one can argue against this because of Federal Reserve policy now vs. then, but people who make that argument tend to believe the Fed is all-knowing, all-seeing, and all-doing, so nothing else matters, anyway.

What the research tells us…

When a confluence of sentiment measures become optimistic during bear markets, it’s typically wise to become cautious. That was certainly the case last August when we had a similar setup. Unlike then, various models disagree about the extent of optimism, and over the past couple of weeks, there has been a much more robust round of internal momentum. Combined with the idea that stocks have done quite well when Confidence breaks out after a prolonged period of decline, these arguments suggest that the medium- to long-term outlook remains quite positive. This is another example of why Jason Goepfert is the best in the world at what he does – providing actionable market data. To subscribe to the internationally acclaimed work Goepfert produces at SentimenTrader CLICK HERE.

ALSO JUST RELEASED: This Is Fueling Gold’s Surge Back Above $1,925. Plus Inflation Is Killing Restaurants CLICK HERE.

ALSO JUST RELEASED: James Turk – This Is The Key To Gold’s Current Price Surge CLICK HERE.

ALSO JUST RELEASED: SPROTT: Top 10 Things Investors Need To Watch In 2023! CLICK HERE.

ALSO JUST RELEASED: GOT GOLD? Madness In World Bond Markets Ahead Of Global Reset CLICK HERE.

Gerald Celente shares with King World News listeners around the globe what may send the price of gold soaring to $2,100-$2,300 in a matter of weeks. To listen CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.