We are now looking at a countdown to midnight and what is at stake is a monetary showdown and gold’s reaction to financial chaos.

COUNTDOWN TO MIDNIGHT: The Monetary Showdown

May 25 (King World News) – Here is a portion of a fantastic report from Incrementum: It’s a showdown foregone. For as we predicted in the two In Gold We Trust reports “Monetary Climate Change” and “Stagflation 2.0”, it was only a matter of time before the consequences of years of zero and low, sometimes even negative, interest rates, come to light. Actions have consequences – expected consequences, that is.

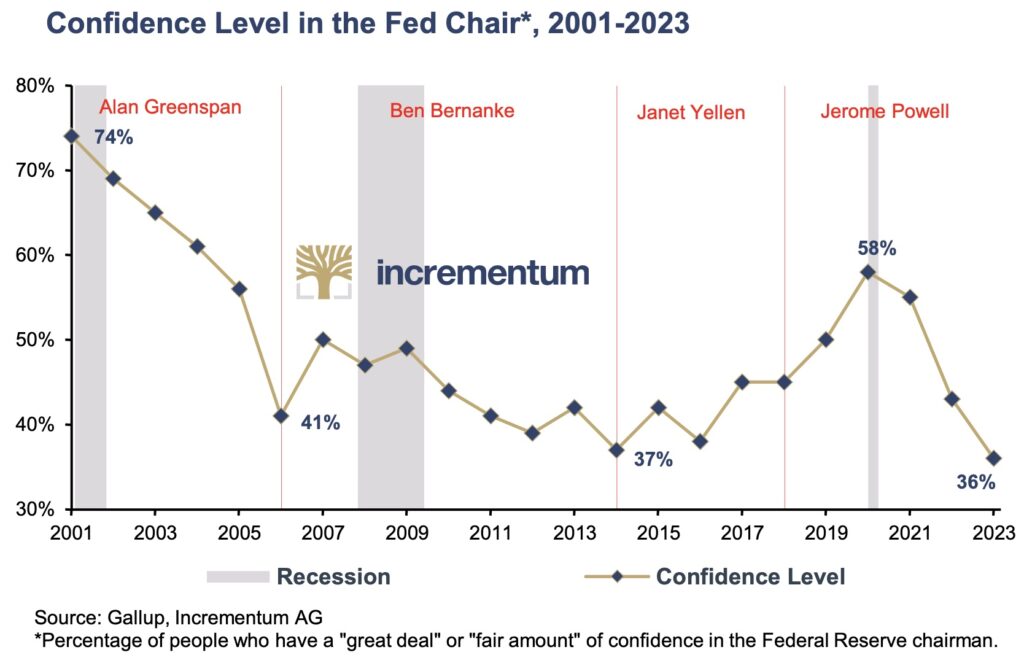

However, central bankers had trotted out appeasement rhetoric even at inflation rates well beyond their 2% inflation target. Jerome Powell’s insistence that inflation was merely transitory is now as legendary as Christine Lagarde’s belittling description of the inflation surge as a hump. Not surprisingly, confidence in central banking is in a steep decline.

This negligence resulted in an emergency monetary policy brake. With the economic slowdown now underway and inflation rates still clearly too high, the monetary policy trilemma – price stability vs. financial market stability vs. economic support – that we warned about is now a reality.

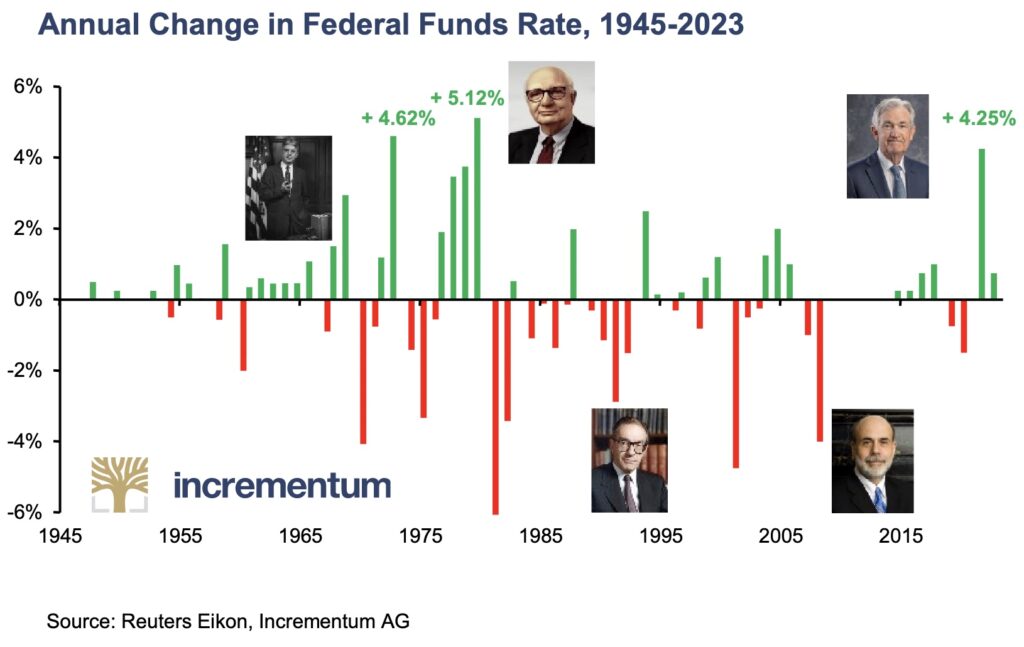

When central bankers finally recognized the severity of the situation, however, they acted with unexpected rigor. Jerome Powell raised interest rates twice as much in less than a third the time that Janet Yellen took in the last hiking cycle. His vehemence surprised us, as it probably did every other analyst, market strategist, fund manager – and astrologer. But it’s true: If you hit the brakes too late, you have to hit harder!

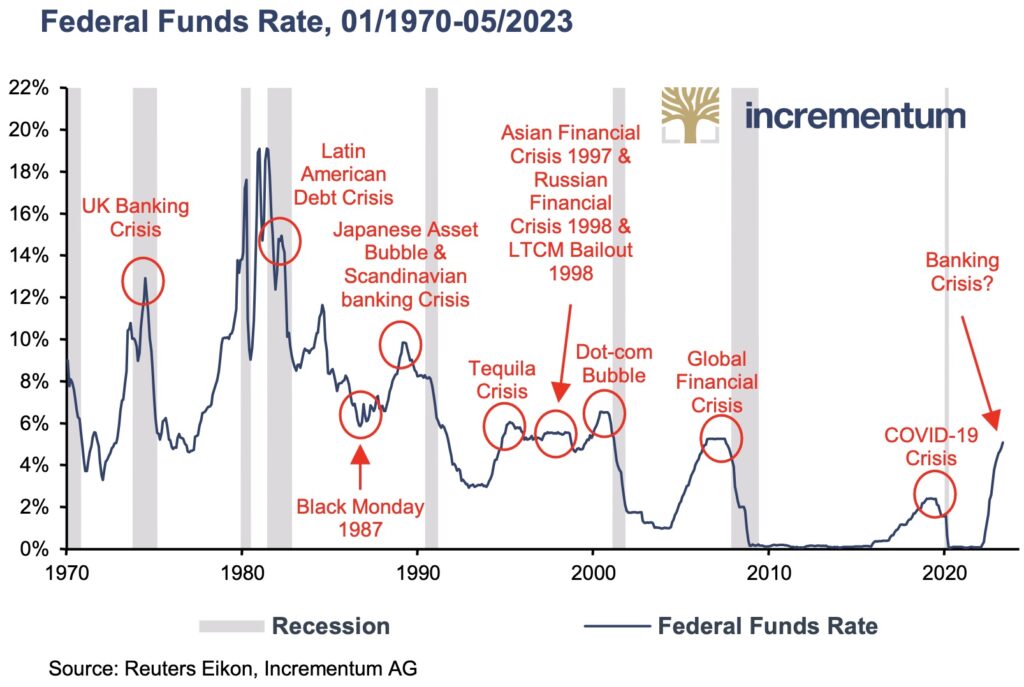

Despite the radical tightening of monetary policy, inflation is proving to be extremely stubborn. Until recently, the Federal Reserve had signaled that it was prepared to do everything in its power to get inflation back under control. After a decade and a half of a flood of liquidity and ultra-low interest rates, withdrawal symptoms are now increasingly appearing after the abrupt removal of the punchbowl. It is becoming apparent which business models have been supported only by low interest rates in recent years and which are fundamentally standing on their own two feet.

The strongest and fastest interest rate hikes in the industrialized nations in over 40 years have already claimed their first victims. The pension fund debacle in the UK, the closure of the Blackstone Real Estate Income Trust, various calamities in the crypto sector, – above all the spectacular FTX bankruptcy – are just a few examples of the consequences of the abrupt interest rate turnaround…

This Company Has A Massive High-Grade Gold Project In Canada And Billionaire Eric Sprott Has A Huge Position! To Learn Which Company Click Here Or On The Image Below.

In March, another economic problem front opened up when Silicon Valley Bank (SVB ) collapsed without warning, followed shortly by Signature Bank. In early May, another regional bank, First Republic, followed suit. We believe it would be too simplistic to blame the regional bank collapse solely on poor management or on their exposure to the stumbling technology sector, which is known to be highly interest rate sensitive.

Three of the four largest US bank failures in history took place in the past few weeks; only the collapse of Washington Mutual in September 2008 caused significantly higher losses, both in nominal and real terms. All in all, more than USD 500bn has already had to be written off since the beginning of March. This is a clear warning signal that the financial system is much more fragile than generally assumed. And on this side of the Atlantic, too, a major bank has already had to pull up stakes, and with the venerable Credit Suisse, it is not just any bank that has been hit. In mid- March, the bank was sold off to UBS in a smoke-and-mirrors operation.

Undeterred, the mainstream continues to hail the resilience of the US economy and downplay the problems. However, for all those familiar with the Austrian Business Cycle Theory pioneered by Ludwig von Mises and Friedrich August von Hayek, it is no surprise that the radical turnaround in interest rates is causing acute pain. Financial history is full of precedents where flooding the markets with liquidity triggers an artificial boom.

When the artificial stimuli are withdrawn, the misallocations are ruthlessly exposed and then cleaned up by painful price collapses, insolvencies, and recessions. “Only when the tide goes out do you discover who’s been swimming naked,” is how Warren Buffett so aptly described this phenomenon. And there is much to suggest that many more swimmers will turn out to be nudists. In this context, we particularly recommend our chapter on the crack-up boom in this In Gold We Trust report to interested readers.

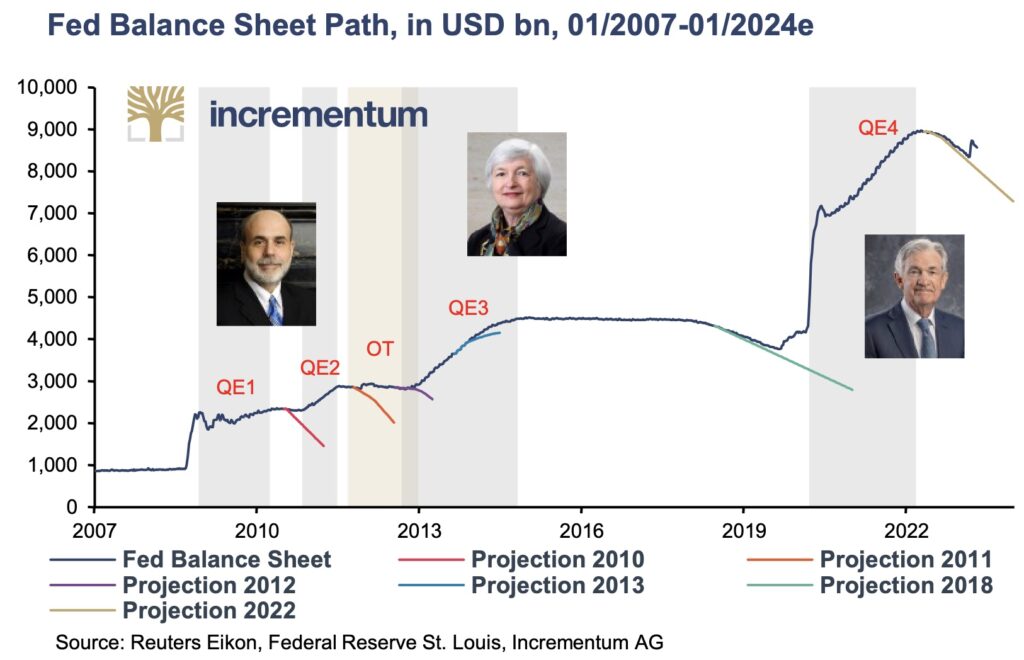

In addition to interest rate hikes, a key component of current policy is quantitative tightening, i.e. the reduction of the central bank’s balance sheet. According to schedule, the Federal Reserve’s balance sheet is currently being reduced by USD 95bn per month, which corresponds to a reduction of 12% p.a. in total assets. However, this schedule already had to be deviated from at short notice in connection with the bank failures in March, and the balance sheet total had to be inflated again by USD 400bn.

Subsequently, there was heated debate in financial market circles as to whether this rescue measure should be classified as a reversion to quantitative easing. In our opinion, this terminological hair-splitting distracts from the much more important point: When systemic problems arise, central banks ultimately have only one remedy, and that is to provide additional liquidity. Every attempt over the past 15 years to reduce the central bank balance sheet has usually failed miserably after only a few quarters.

Against this backdrop, the monetary policy showdown between price stability, economic activity, and financial market stability is now looming. The all-important question is: Can the Federal Reserve continue its restrictive monetary policy and push inflation back down to 2% without triggering a severe recession or a new financial crisis, or will it have to rescue the system once more with expansive stimulative measures and thus risk another wave of inflation? The cards must be laid on the table, at the latest, when the pain at the banks, on the capital markets, or in the real economy becomes too great.

Negative money supply growth is unchartered territory

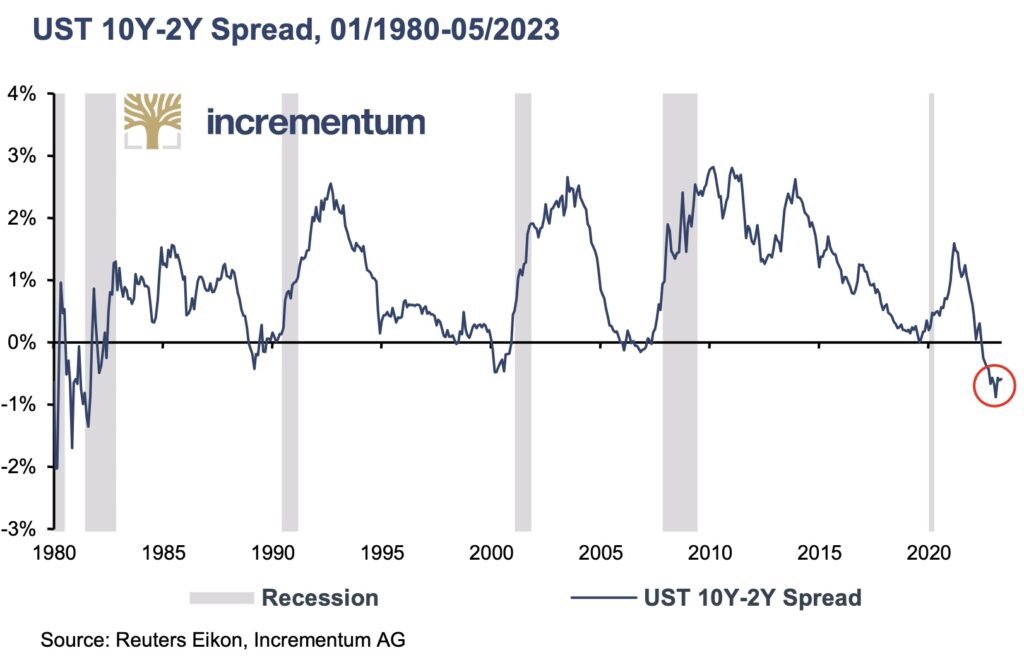

And the signs of an imminent recession in the USA are growing stronger. The strongly inverted yield curve, a slowly weakening labor market, the Conference Board Leading Economic Index (LEI) – all these leave little room for economic optimism. For a more in-depth analysis of the state of the US economy, see chapter 3, “The Monetary Policy Showdown”.

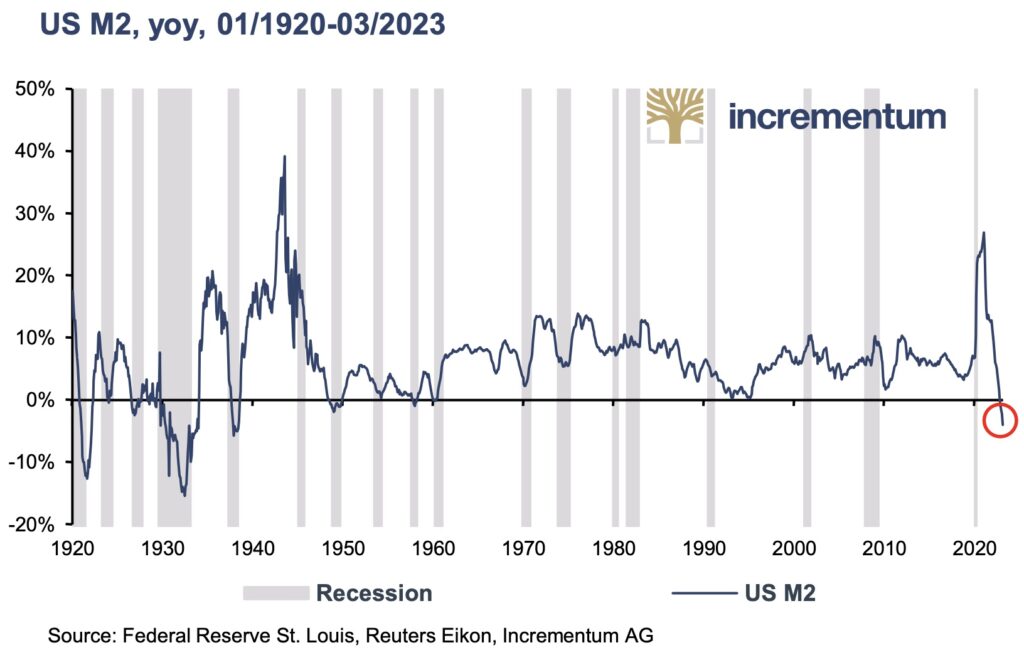

Moreover, money supply growth in the US, calculated on a monthly basis, is negative for the first time since the 1950s, and on an annual basis for the first time since the Great Depression. As the proponents of the Austrian Business Cycle Theory point out, the flattening of money supply growth is already enough to end the artificially created boom and the bubbles on the markets. A declining money and credit supply is a sure sign of profound economic dislocation. Based on their empirical research, our friends at Longview Economics outline the consequences of such a contraction in the money supply:

“Historically, whenever US M2 money supply has contracted on an annual basis, there’s been a banking crisis, a depression and/or deflation. Whilst all those prior occurrences happened prior to WWII, and since then ‘deposit insurance’ has been introduced (1933) and the Fed has become an active ‘lender of last resort’, it’s also the case that M2 money supply hasn’t been contracted since the Great Depression. In that sense the current framework is untested.”

Although recessions but also capital market slumps have a disinflationary and sometimes even deflationary effect, the response will be highly inflationary: QE, YCC, and interest rate cuts. What is certain in these uncertain times is that the longer and deeper the financial markets fall, the more stimulative, aggressive and desperate the monetary and fiscal policy responses will be, ultimately laying the foundation for another, higher wave of inflation.

For us, one thing is certain: The soft landing much invoked by the Federal Reserve seems to become less likely by the day. The coming showdown will reveal whether the Federal Reserve is actually holding the strong hand it claims to be holding, or whether it will be called by the market and its strategy exposed as a bluff.

Gold’s Reaction To Financial Chaos

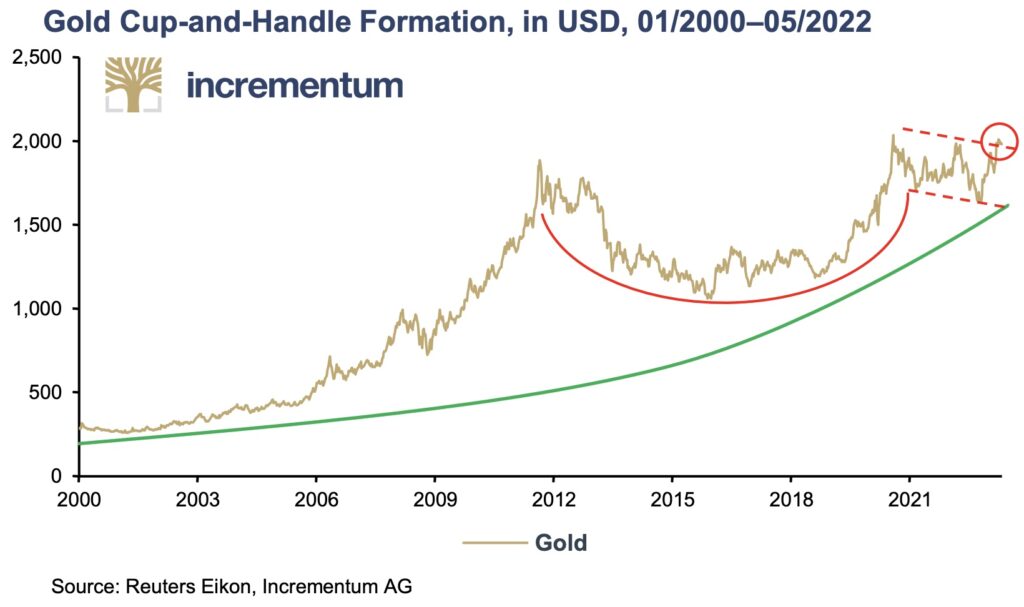

The gold price already seems to anticipate that the restrictive US monetary policy will turn out to be a bluff. Even if the gold price in US dollars has not yet marked a new all-time high, the all-time highs in various other currencies are a harbinger for a breakout in US dollars.

In case you missed it…

Expansion Of Massive High-Grade Gold Deposit

Daniel Kunz: “The news release today coupled with the $45 million cash balance we have, they combine to show a real path towards Los Reyes turning into a 4 million ounce gold deposit.

We are now accelerating our drill program, which will allow us to complete 60,000 meters of drilling this year. This is double what we had originally planned. The continued success we have had on the ground in terms of the drill results as well as the extremely strong cash position are the reasons why we can do this accelerated drill program.

Today’s results are associated with the current resource that we just announced on May 2nd. We are also drilling and expect to release results on areas outside of that — the new potential deposit zones which are nearby. Again, all of this is based on this very impressive geological structure that remains open at depth and along strike providing untapped areas for additional discovery. So this is incredibly compelling in terms of the future expansion of the resource. Prime Mining, symbol PRYM in Canada and PRMNF in the US.

ALSO JUST RELEASED: BUCKLE UP: Housing Bubble Bursting As Financial Tsunami Approaches, Plus People Don’t Work Nearly As Hard CLICK HERE.

ALSO JUST RELEASED: Stunning Big Picture Look At Gold As Stock Markets Tumble Across The Globe CLICK HERE.

ALSO JUST RELEASED: The Global Debt Market Time Bomb Is Close To Exploding CLICK HERE.

ALSO JUST RELEASED: Look At Who Is Calling A Major Gold Bottom, Plus A Tale Of Two Economies And Relief For New Car Buyers CLICK HERE.

ALSO RELEASED: Unusual Money Flows Into Gold, Credit Crunch, Plus “Transitory” Deflation? CLICK HERE.

ALSO RELEASED: Greyerz On The Derivatives Nightmare, Plus Gold Bottom At Hand CLICK HERE.

ALSO RELEASED: Dollar Woes To Denial: The USA Is Screwed CLICK HERE.

***To listen to 9 time Graham & Dodd Award winner Rob Arnott discuss inflation and the trouble that lies ahead for countries around the globe CLICK HERE OR ON THE IMAGE BELOW.

***To listen to Alasdair Macleod discuss what is happening behind the scenes in the gold and silver markets as well as where the opportunities are right now for investors CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.