Look at who is calling a major gold bottom, plus a tale of two economies and relief for new car buyers.

Major Gold Bottom

May 23 (King World News) – Fred Hickey: Over the last decade+, there have been 3 major gold bottoms – end of 2015, summer of ’18 and last fall ’22. At each of those bottoms, Managed Money (hedge funds & CTAs) long gold futures contracts bottomed around 80K. As of the latest COT report, Managed Money longs were 139.8K.

However, that COT report had data thru 5/16. Since then, gold futures open interest has plummeted by 41.2K contracts (combination of long dumping &added shorts). That’ll be data used in this Friday’s COT. Which means -Managed Money longs could be near 100K, fast closing in on 80K.

With gold down $10 this AM, Managed Money longs could be even closer to the 80k long futures bogey. All fits with a very brief gold correction (driven by hot money) & the GLD inflows noted in last night’s tweet. Potentially sets up mid-June bottom (classic seasonality) or earlier.

And those 3 major gold bottoms – end of 2015, summer of ’18 and last fall ’22 occurred with gold at $1,050, $1,180 and $1,610 respectively – and this one could potentially be north of $1,900 – which means a rally would blow through the old highs (& likely way beyond). Exciting!…

ALERT:

Billionaire mining legend Pierre Lassonde has been buying large blocks of shares in this gold exploration company and believes the stock is set to soar more than 150% in the next 6 months. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

High Yields

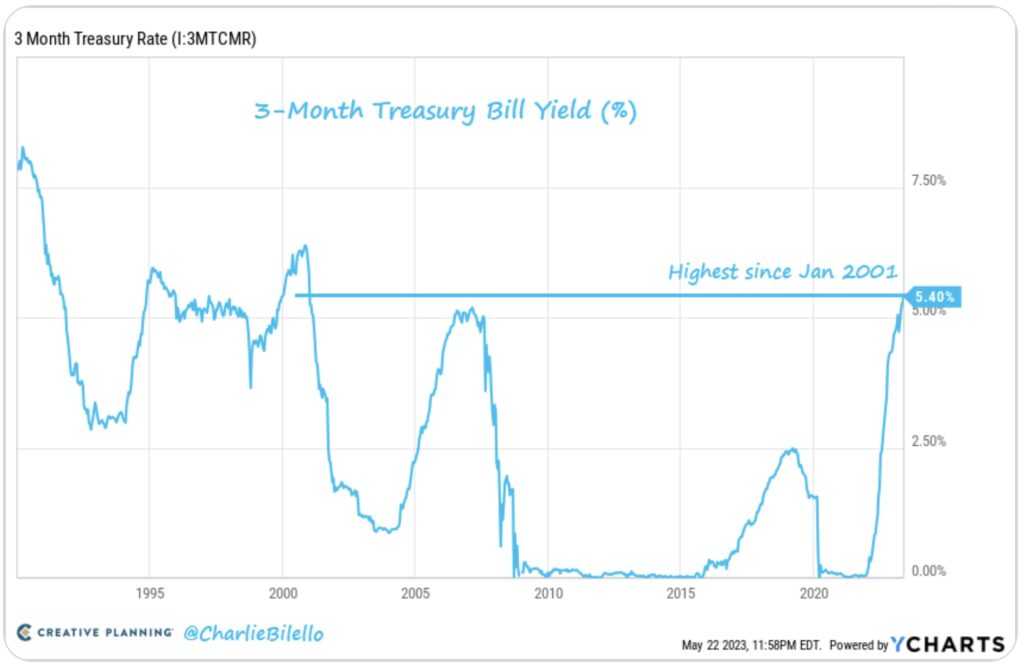

Charlie Bilello: The 3-Month Treasury Bill yield has moved up to 5.40%, its highest level since January 2001. A year ago it was at 1.03% and two years ago it was at 0.01%.

3 Month US Treasury Yield Hits 5.4%, Highest Since 2001

“A Tale Of Two Economies”

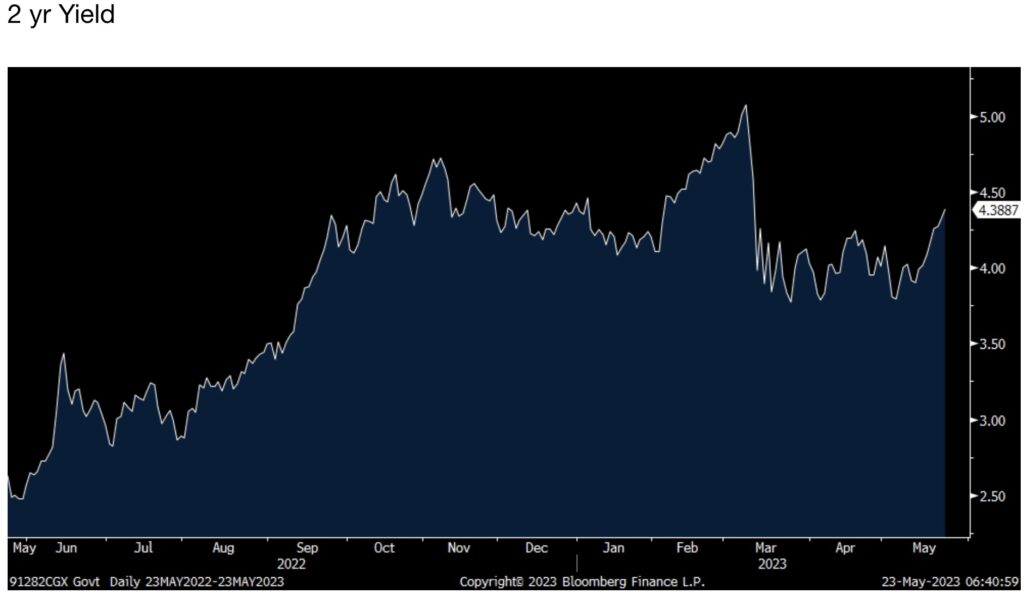

Peter Boockvar: That it now sounds like we’re a day or two away from a debt deal and also after some Fed members teasing us with another rate hike or if not, at least taking away the markets expectations of rate cuts, the 2 yr Treasury yield is at the highest level since where it stood before the SVB weekend at 4.38%.

Getting High

On Wednesday March 8th the 2 yr yield reached its recent peak at 5.07%, by Friday it was at 4.59% and closed that Monday at 3.98%. The 10 yr yield currently at 3.74% compares with 3.99% on that Wednesday in March, 3.70% that Friday and which fell to 3.58% on Monday March 13th. Yields are moving higher too in Europe and closed up in Asia.

The 2 yr Treasury remains very attractive and I’ll say again that I can argue for a 3% 10 yr yield but also one at 4.5%. For those who just want to predict the 10 yr by just looking at inflation and growth, yes maybe we get to 3%. But I’ll argue again that there are just too many other variables that could send the yield to 4.50% and not for good reason. On the likely debt deal within days, the US Treasury is about to flood us with Treasury paper at the same time the Fed, foreign central banks and the banks are just not interested in buying. On the other hand we definitely have retail, pension funds, and insurance companies that are licking their lips at these yields. The net result is a clearing price that I just don’t have any confidence to call. I just don’t know how it will go when the BoJ widens YCC again, which they will. I’m not confident in trying to call how ECB QT will go either…

This Company Has A Massive High-Grade Gold Project In Canada And Billionaire Eric Sprott Has A Huge Position! To Learn Which Company Click Here Or On The Image Below.

Deficits Don’t Matter?

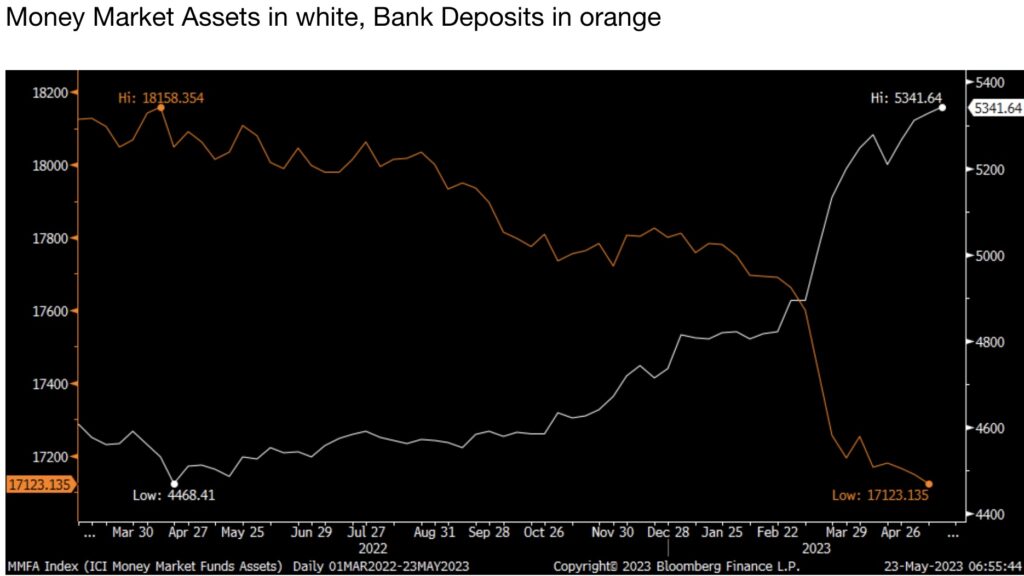

It was 2002 when former VP Dick Cheney told then Treasury Secretary Paul O’Neill that “Reagan proved deficits don’t matter.” With a current budget deficit as a % of GDP at 7% even before a recession has technically begun at the same time the US government is now crowding out the private sector as money shifts from bank deposits to Treasury money market funds, we’re about to find out if they now do matter. I’ll argue they now do, big time. Below is a chart of the dollar amount in money market funds and the amount of bank deposits so you can visualize the crowding out going on.

Timber!

Lowe’s in their earnings release said “we are updating our full-year outlook to reflect softer than expected consumer demand for discretionary purchases.” They are also citing lumber deflation.

Relief For New Car Buyers

We might be finally about to see some relief on the retail price of a new car. Wards yesterday talked about a “month end surge in deliveries” and that inventories continue to improve. This was joined by comments from the CEO of Ford yesterday that said the company is budgeting for a 5% cut in prices. The caveat though with that 5% comment was that it wasn’t clear if that was just for EV’s as they compete with Tesla’s price cuts or also includes ICE cars. Keep in mind too as inventories on dealer lots normalize, the auto sector was one of the few industrial bright spots in Q1 as the inventory build took place.

Stock Market

Art Cashin, Head of Floor Operations at UBS: … the market continues to take its own pulse and check its own temperature. By and large the S&P the yield and the 10-year have stayed within range set by the sliderule. With no new development on the debt ceiling process, and there seems to be not much to stimulate things. The bond auction of two years at 1:00pm was very solid, but it had no reaction in other areas.

So traders are waiting to see if any further signs on the Fed, but right now it seems that the quarter point hike i n June is probably more likely than it had been a couple of weeks ago. It’s interesting looking back a month or so, and the debate was who was going to be right the Fed or the Bond market. It looks like the Fed is better at least for now. But then again they do have the steering wheel in their hands. So we will assume we are going to stay within the projected ranges.

Just a reminder the S&P projected range was 4172 to 4185 and so far that’s exceptionally well. And the range on the 10-year yield was 365 to 375 and the with the exception of the brief moment when it hit 376 the yield stayed in that range throughout the session.

So the Bulls are still on the defense for the day and we will see if they can tiptoe into the close into the close, or will they surprise us.

Stay Safe.

ALSO JUST RELEASED: Unusual Money Flows Into Gold, Credit Crunch, Plus “Transitory” Deflation? CLICK HERE.

ALSO JUST RELEASED: Greyerz On The Derivatives Nightmare, Plus Gold Bottom At Hand CLICK HERE.

ALSO JUST RELEASED: Dollar Woes To Denial: The USA Is Screwed CLICK HERE.

***To listen to 9 time Graham & Dodd Award winner Rob Arnott discuss inflation and the trouble that lies ahead for countries around the globe CLICK HERE OR ON THE IMAGE BELOW.

***To listen to Alasdair Macleod discuss what is happening behind the scenes in the gold and silver markets as well as where the opportunities are right now for investors CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.