Today Art Cashin warned another black swan may be on the horizon, plus a look at what else is happening across the globe.

Buy Gold, Sell Stocks

January 5 (King World News) – Otavio Costa: The “Buy gold and sell stocks” strategy has been on fire recently.

As a result: Miners started to significantly outperform overall equities.

The gold stocks-to-S&P 500 ratio just broke out from key resistance.

A historically cheap industry ripe for a big move to the upside.

Gold & Silver Miners Will Now Radically Out perform S&P 500

Uranium

Graddhy out of Sweden: URNM needs to make a decision here fairly soon; break down, or break up.

Uranium Market Soon To Break Decisively Up Or Down

To Find Out Which Uranium Company Is Positioning Itself To Become A Powerhouse In Nevada Click Here Or On The Image Below.

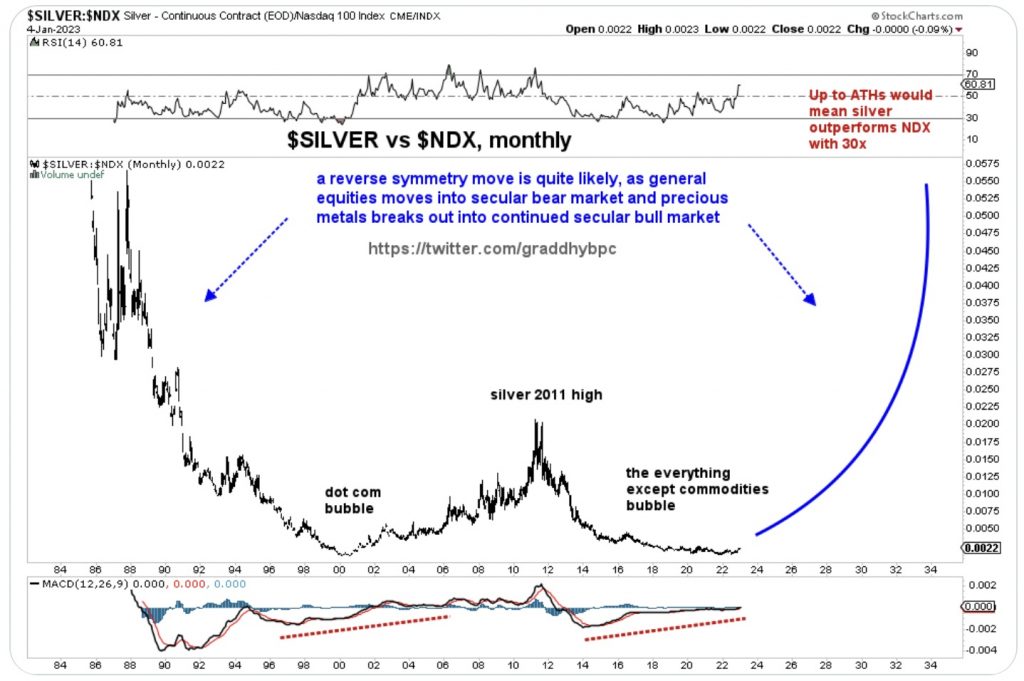

Silver: The Most Undervalued Asset On Earth

Graddhy out of Sweden: This very big picture ratio chart shows how undervalued silver really is vs the stock market technology sector. And its recently posted 14 year falling wedge clear break out, means global capital flows into precious metals from stock market is starting for real.

Time To Regroup

Art Cashin, Head of Floor Operations at UBS: We will need to regroup here and look for some of the incoming changes of the market technicals and what is happening with the Fed balance sheet along with bond yields, which, once again in their recent give and take tug of war, will get our attention. As we had said, as the week began – we old fogey’s have a couple of conflicting cycles that said this might be a whipsaw week and, while we escaped with Santa Claus successfully, there is a lot more to be looked at, but first let’s look at what our foreign friends are going overnight.

Overnight, foreign equity markets are again showing individual personalities. In Asia, Japan, Hong Kong, and Mainland China are all a bit firmer, focusing in on the Chinese government and Central Bank appearing to continue easing financial policies and signs that they will allow some of the megastars like Alibaba, etc. to become more involved in the global financial markets. All that despite the fact that rumors continue to circulate that the Covid outbreak in China is growing rapidly. So, the traders there seem to be concentrating on a much more different side of the balance sheet. India is a little bit lower, but the rest of Asia is showing small changes.

European markets are a bit more cautious. We are told some of that began to show up after the Fed minutes came out. Obviously, the European markets were closed then, but gossip says that in after hour trading, there was some sign of caution showing up and that appears to be continuing throughout the morning.

The U.S. economic calendar is beginning to pick up as we move into the new year. We will have unemployment data this morning in Jobless Claims, in ADP Payroll estimate, and some signs of trading in international goods and services. We also will hear from a couple of Fed speakers, including Bullard a little bit later in the day. Mid to late morning, we will see the PMI Composite and natural gas inventories and oil inventories also since Monday was a holiday. Nothing appears to jump off the calendar as of super importance.

Santa Claus is in the books and now we will start to go through the first seven trading days, etc. The beginning of the year is always given a certain predictive value. So, you know the current drill. Stay close to the newsticker. Keep your seatbelt fastened. Stay nimble and alert, but most of all try to stay safe and see if we can follow-up on Santa, while the circus in Washington continues. Stay safe.

Black Swan Alert

Hopeful coming attractions – Next week, we hope to delve into the possibility that the recent dramatic collapse in M2 (Money Supply) growth might produce a financial black swan of significant proportions and maybe even speculate the region in which that black swan could occur.

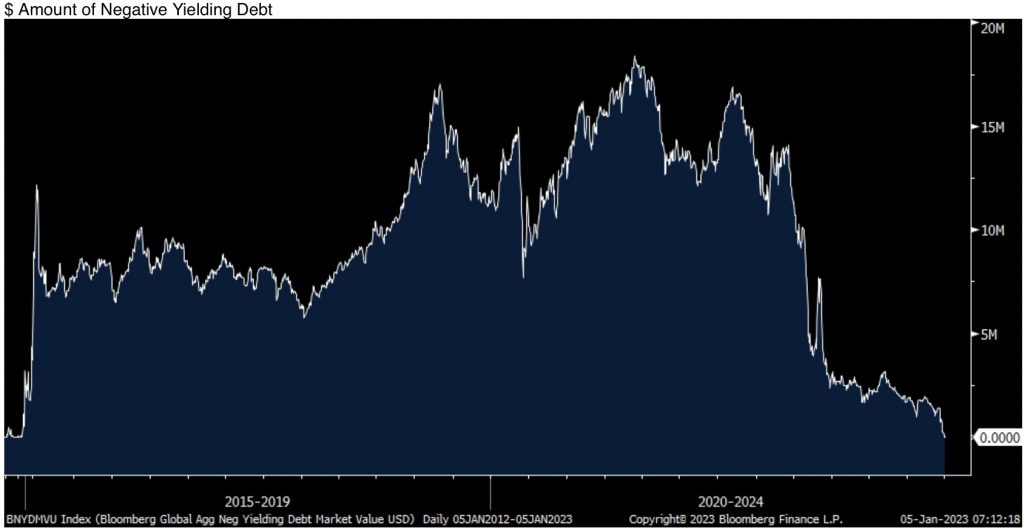

Negative Yields A Thing Of The Past?

Peter Boockvar: We finally made it! Yesterday we saw the last bond in the Bloomberg Global Aggregate Index of Negative Yielding Debt that was yielding below zero to move to zero so there is now NO bonds with a maturity more than 1 yr with a negative yield. Good riddance but we now have to deal with the popping of this epic sovereign bond bubble.

Epic Sovereign Bond Bubble Popped

Out Of Touch

I’ve disagreed with just about every macro opinion and monetary policy stance of Neel Kashkari since he took over as president of the Minneapolis Fed in 2016 and 2023 is starting off no different after he gave an inflation apology speech yesterday titled “Why We Missed on Inflation, and Implications for Monetary Policy Going Forward.” He argued that the inflation we saw over the past two years was similar to ‘surge pricing’ that we see with ride sharing companies, which I agree is a pretty good analogy. But, he then goes on to say, “And this is key to our miss: The inflation in this example is not driven by the two primary sources that traditional Philips-curve models used by policymakers, researchers, and investors consider:

1) labor market effects via unemployment gaps, and

2) changes to long run inflation expectations. In these workhorse models, it is very difficult to generate high inflation…From what I can tell, our models seem ill-equipped to handle a fundamentally different source of inflation, specifically, in this case, surge pricing inflation.” So, he just blames it on the econometric models and also wants to raise the fed funds rate to between 5.25-5.5%.

It however doesn’t take an economist degree, a PhD or even a class in Economics 101 to understand that when the federal government spends $5 trillion over two years (about 20-25% of the US economy at the time) and its central bank finances most of it by buying the bonds used to pay for it, that we’re going to most likely have ‘surge pricing’ inflation and realize it then, not after the fact…

ALERT:

Billionaire mining legend Pierre Lassonde has been buying large blocks of shares in this gold exploration company and believes the stock is set to soar more than 150% in the next 6 months. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

My point here is not to ridicule, again, Neel Kashkari, but to highlight the need for central bankers to not ALWAYS rely solely on their faulty econometric models and instead throw in some human nature common sense sometimes. With inflation now rolling over and job growth clearly slowing, some of that non-econometric model thinking is needed so they don’t now overdo it on the tightening side. I’ll say again, just keeping rates higher for longer is itself a continued form of monetary tightening because of all the debt that will be refinanced each and every month at this higher level of interest expense after 15 yrs of ultra cheap money where all the maturing debt was priced off.

Speaking of one of the two most interest rate sensitive parts of the US economy, that being autos, Wards said December vehicle sales out yesterday totaled 13.3mm at a SAAR, 100k less than expected. That’s down from 14.1mm in November but above the inventory starved situation in December 2021 when sales came in at just 12.44mm. Inventories are still not where they were (measured by days of inventory) pre-Covid, and might not ever get back because of a new industry approach, but they have dramatically improved. The problem now though more so is the faltering demand side.

Trouble In Asia

The few remaining PMI’s were reported in Asia. China’s Caixin services PMI for December remained below 50 not surprisingly but did rise to 48 from 46.7. Again, this is old news and in Q2 will improve dramatically. Hong Kong’s PMI rose about 1 pt to 49.6.

The surprising disappointment was in Singapore where its PMI fell under 50 at 49.1 from 56.2. S&P Global said:

“The issue of deteriorating demand that had plagued many neighboring Asian countries has likewise set in for Singapore, albeit at a marginal level. The downturn in demand not only affected firms’ willingness to accumulate inputs and labor, but also shifted the pricing power away from businesses as indicated by the fall in selling price inflation even as input cost pressures mounted.”

As China fully recovers this year, the Asian economies should be a huge beneficiary of that and I repeat that Asia will be the most vibrant economic region in the world this year and in turn will help parts of Europe, like Germany, that do a lot of business with them. International stock markets will thus again outperform the US as will their currencies.

After Spain, Germany and France reported moderating inflation over the past few days, albeit helped by energy price caps and still are very high prints, Italy said its December CPI was up by 12.3% y/o/y as expected but European bond yields are little changed. While we’re likely going to see continued moderation in inflation in the coming months (in part depending on where energy prices go), the ECB is still so far behind that they will continue to hike and will initiate QT in Q2.

ALSO JUST RELEASED: Historic 2022 Panic And How It Will Impact 2023 As Investors Move Into Gold & Silver CLICK HERE.

ALSO JUST RELEASED: Celente’s Shocking Global Predictions For 2023 CLICK HERE.

ALSO JUST RELEASED: Here Is Why 2023 Will Be A Big Deal For Gold, Silver And The US Dollar CLICK HERE.

ALSO JUST RELEASED: BUCKLE UP: The Terrifying Global Reset Is About To Begin CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.