The price of gold surged along with silver and US bonds but the underlying truth is that stagflation is an ugly thing.

The Game Is On The Table

August 23 (King World News) – Art Cashin, Head of Floor Operations at UBS: We made the suggestion in the late morning update that if bond yields moved below the 4.35% test area to a significant amount, a few traders might assume that the entire testing process could be over, and we have certified a series of highs in yields. It would appear that a few, and we should emphasize a few, may have bought into that since the yields dropped close to 12 bp from those testing highs.

Some bargain hunting/short covering seems to have moved in and given the stock market a more solid bid than it had seen in a few days.

Obviously, everything will depend upon whether yields begin to inch back up to retest those high levels or remain far away to convince even more that an intermediate test may have been successful.

So, the game is on the table. The bulls are in control, and it depends on how far you need your slide rule to move below that 4.35% test area to convince you it is time to get back on board.

The obvious answer to all is to continue to watch for yields. If they begin to tick back up again, up for example through the 4.28% / 4.30% area, that may trim some of the equity bids. Conversely, remaining down at the day’s lows and even moving lower, might add to the equity bids.

So, it is all about whether you think the test was merely a pop quiz or a monthly exam that was passed with flying colors. I remember way back when we thought about earnings and unemployment and stuff like that. Oh well, the market moves on.

Stay safe.

Arthur

ALERT:

Legendary investors are buying share of a company very few people know about. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

Stagflation Is An Ugly Thing

Peter Boockvar: I said this maybe 10 yrs ago that Apple became its own asset class when it was seeing its heady growth rates and each new phone iteration brought massive upgrade cycles. We had stocks, bonds and Apple. It seems that Nvidia is now playing that role.

At least for today, it’s weak economic data that is providing some relief on the interest rate front. The manufacturing and service PMI’s out of Europe were poor as a downturn in services is now following the weakness in manufacturing. The August Eurozone services index fell under 50 at 48.3 from 50.9 and below the estimate of 50.5. It’s the first trip under 50 since December 2022. Manufacturing rose 1 pt but to just 43.7, well less than 50. S&P Global said it was higher inflation that drove the service weakness, “in this sector input prices and thus wages increased at an accelerated pace in August. Meanwhile, stagnating employment combines with decreasing production and results therefore in lower output per head.” While manufacturing remains weak, just maybe we’re close to a bottom as there was a “slightly better order situation as well as slower destocking.”

Germany: Stagflation Is The Order Of The Day

Geographically, the Germany composite index fell to 44.7 from 48.5 with the services index in particular dropping 5 pts m/o/m to 47.3 and manufacturing still under 40, let alone 50, at 39.1. S&P Global said for Germany, similar to what they said above:

“Stagflation is an ugly thing. However, it’s exactly what is happening to the services economy, as activity has started to shrink while prices have shot up again, even picking up pace.”

The French composite index held at a soft 46.6 with services at 46.7 and manufacturing at 46.4.

United Kingdom: Hope For A Bottom?

As for the UK, its PMI fell to 47.9 from 50.8 with the services component also dropping under 50 at 48.7 from 51.5. The estimate was 51. The manufacturing sector weakened further to 42.5 from 45.3. As for the outlook:

“Service providers signaled a modest drop in business optimism since July, which survey respondents linked to worries about the broader economic outlook and the impact of higher interest rates on consumer spending.”

There is more hope here for a bottom in manufacturing due to “investments in new products and technologies, alongside a boost from falling input costs, and the eventual need for customers to replenish their depleted inventories.”

So in response to all of the above, European bonds are rallying across the board with yields down about 10-11 bps and in turn helping US yields to fall with the US 10 yr yield back down to 4.26% after getting near 4.35% yesterday. The euro and pound are lower vs the US dollar…

This Company Has A Massive High-Grade Gold Project In Canada And Billionaire Eric Sprott Has A Huge Position! To Learn Which Company Click Here Or On The Image Below.

This followed a rally in Australian bonds and in other Asian countries ex Japan after the Australian composite PMI fell to 47.1 from 48.2 with manufacturing at 49.4 and services weakening further to 46.7 from 47.9. Japanese services was the one bright spot with all the PMI’s as it rose to 54.3 from 53.8 while manufacturing is just below 50 at 49.7. The fly was the rise in oil prices as “input prices increased at the fastest pace in four months.” JGB yields rose slightly overnight.

Earnings Or Lack Thereof

Before I get to the retail earnings comments, you’ve heard me harp on the pernicious impact of higher rates for longer and the death by a thousand cuts influence that has on the economy in a long, drawn out process. I saw a Goldman Sachs report yesterday from Jan Hatzius that quantified the impact on capital spending and hiring. They said “We find that for each additional dollar of interest expense, firms lower their capital expenditures by 10 cents and labor costs by 20 cents.”

Foot Locker

Foot Locker, down sharply pre market, said this in their earnings release, “Our 2nd quarter was broadly in line with our expectations, despite the still tough consumer backdrop. However, we did see a softening in trends in July and are adjusting our 2023 outlook to allow us to best compete for price-sensitive consumers.”

Dicks

Dicks in contrast with respect to July said “sales accelerated significantly in July, when the back-to-school season kicked off and when we opened our newest House of Sport location.” House of Sport by the way is their new 50,000 sq ft new prototype store.

They expanded on the shrink situation:

“Organized retail crime and theft in general is an increasingly serious issue impacting many retailers,” which we all know but to have this much of an impact on numbers was pretty shocking as it accounted for 1/3 of their merchandise margin decline.

What can be done? “we are going to fight to the extent we can to keep our teammates, our athletes, and our stores safe, and that’s with increased security, with lockup cameras, and working with local law enforcement and with our industry partners.”

In terms of their 1.8% comp, 2.8% came from an increase in transactions and they lost 1% in average ticket size.

After seeing excessive inventory in the spring and the clearance activity since, they said “it’s really important to understand this is not a return to a promotional environment in any way, shape or form. This is us being surgical and keeping our inventory fresh.”

Macys

With Macy’s, they said inventories fell 10% y/o/y and down 18% from 2019. “We were disciplined with our approach to inventory commitments and flex the cadence and depth of promotions and markdowns…Promotional sell-throughs were better than expected and clearance markdowns were not as deep.”

Their best performing sectors included “beauty, particularly fragrances and prestige cosmetics, women’s career sportswear, and men’s tailored clothing” along with textiles and housewares in the soft home categories. “Active casual and sleepwear remain challenged.”

On the macro:

“As we plan for the remainder of the year and we think about 2024, we remain cautious on the pressures impacting our customer, especially at Macy’s, where roughly 50% of the identified customers have an average household income of $75,000 or under. Over the last several quarters, we have seen the Macy’s customer more aggressively pull back on spend in our discretionary categories. They are not converting as easily and becoming more intentional on the allocation of their disposable income, with an ongoing shift to services and experiences.”

To repeat pretty much what was said in the earnings release which I quoted yesterday, this was in the call on the credit situation:

“We experienced an increased rate of delinquencies within the credit card portfolio across all stages of aged balances. While we had expected delinquencies to rise as part of our normalizing credit environment, the speed at which the increase occurred for us and the broader credit card industry since our first quarter earnings call was faster than planned. This negatively impacted 2nd quarter results and led to an increase in the portfolio’s bad debt outlook.”

What are they doing about this? “We are working closely with our bank partner, Citibank, to mitigate the rising bad debt by adjusting underwriting strategies.” In other words, credit standards will tighten further.

BJ Wholesale

With BJ Wholesale, spending on non-discretionary things led the growth there as “Our grocery and consumables business continues to be very strong.” As for spending on other things, “the discretionary dollar is harder for our members to part with and buying habits are returning towards normal. This has affected sizable general merchandise categories such as consumer electronics, along with more seasonal categories like patio and outdoor furniture. The reality is that if you needed something in these categories over the last couple of years, you likely already bought it and purchase cycles are long.”

Lowe’s

Lowe’s said pretty much what Home Depot said about its sales mix. Growth was seen in Pro, “which helped to offset softer DIY discretionary spending” and disinflation from lumber was seen.

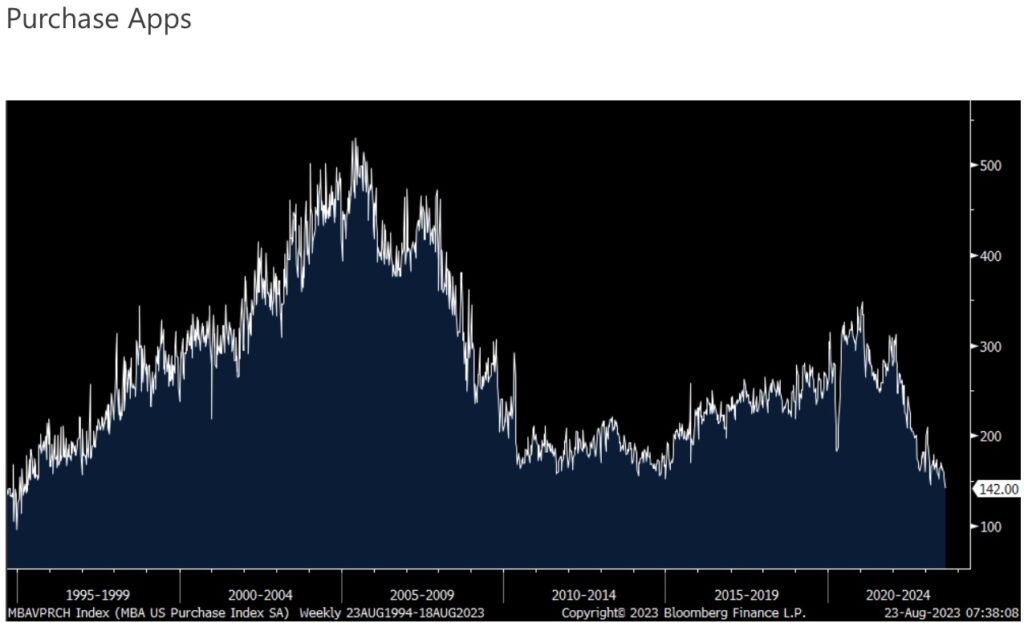

New Home Purchase Apps Tumbl 5% – Lowest Since 1995

Finally, with the 23 high in the average 30 yr mortgage rate around 7.5% according to Bankrate, the MBA said purchase applications fell 5% w/o/w to the lowest level since 1995 and lower by 30% y/o/y.

Refi’s fell by another 2.8% w/o/w and down by 35% y/o/y.

ALSO JUST RELEASED: Central Banks Are Fostering An Extinction Level Event CLICK HERE.

ALSO JUST RELEASED: Look At How Parts Of The Economy Have Collapsed CLICK HERE.

ALSO JUST RELEASED: STOCK MARKET SELL SIGNAL: Major Breakout In The Most Important Interest Rate CLICK HERE.

ALSO JUST RELEASED: Take A Look At How Bad It Is For Banks Right Now CLICK HERE.

ALSO JUST RELEASED: The Fate Of The World Is Being Decided Here… CLICK HERE.

ALSO JUST RELEASED: The Global Debt Bubble Is Going To Unleash Havoc CLICK HERE.

To listen to Alasdair Macleod discuss the plunge in gold and silver prices, the historic BRICS meeting that will take place next week and so much more CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.