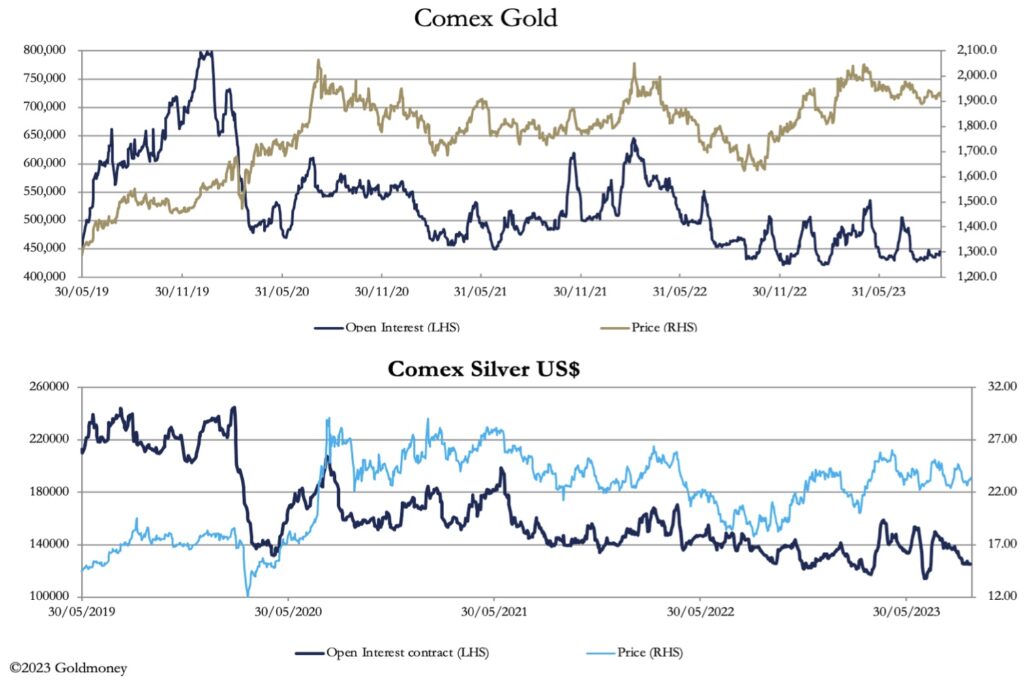

As we end another week of trading in September, gold and silver open interest has collapsed near the lowest levels in 5 years.

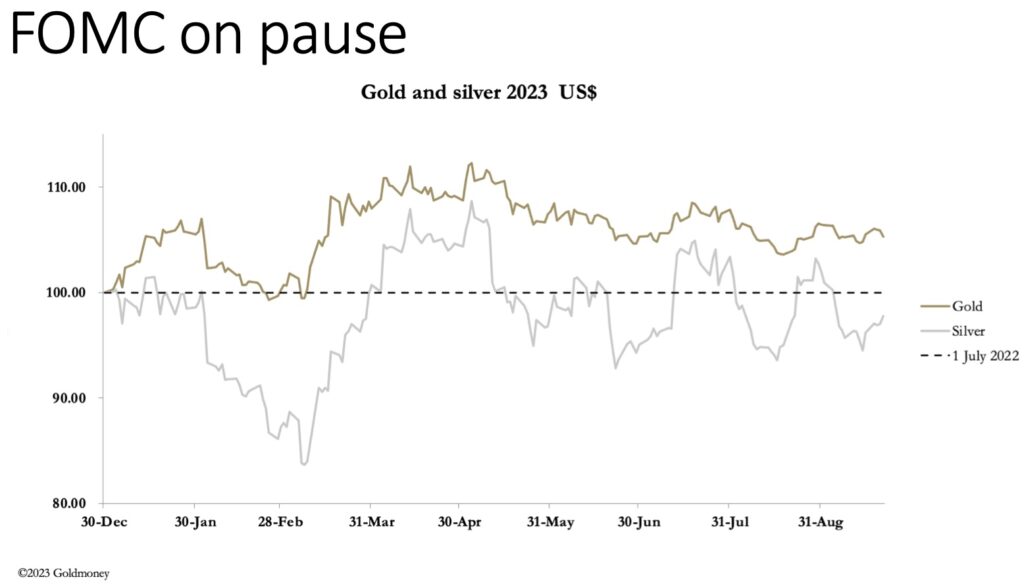

September 22 (King World News) – Alasdair Macleod: The FOMC and the Bank of England surprised markets by not raising interest rates this week as expected. Following the FOMC’s decision, gold and silver fell on the back of its hawkish statement before recovering slightly. In Europe this morning, gold was $1926 up a net $2 from last Friday’s close. Silver fared much better at $23.68, up 65 cents. Silver is obviously in a bear squeeze, while hedge funds have become disinterested in gold.

Often, silver leads the way upwards and this may be the case today. The next chart shows how Open Interest on Comex remains low in both contracts, indicating that downside is limited.

These are the sort of doldrums that can support a substantial bull leg, so on balance the danger is being short rather than long. But there is one big hurdle to overcome, and that is a firm dollar and rising T-bond yields. These are up next:

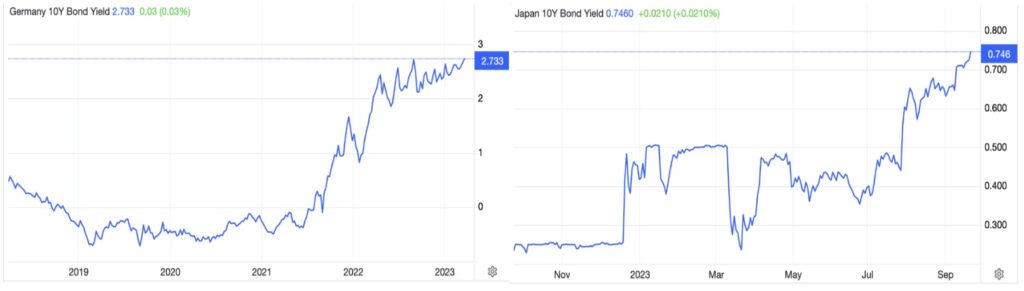

It is not just a problem facing dollar markets. The next two charts show 10-year bund and JGB yields.

Both yields are only beginning to reflect the transition from negative to positive interest rates, and their charts show they are on course to rise considerably higher. Yet we are clearly faced with a global economy which is no longer growing, and contracting bank credit is forcing a squeeze on borrowers who cannot afford their debt at these higher interest rates.

So far, hedge funds have believed that high interest rates and bond yields are bad for the gold price, and that is what has driven the relationship between the dollar and gold. More likely, we are going through a transition to fear of the economic and monetary outlook for fiat currencies.

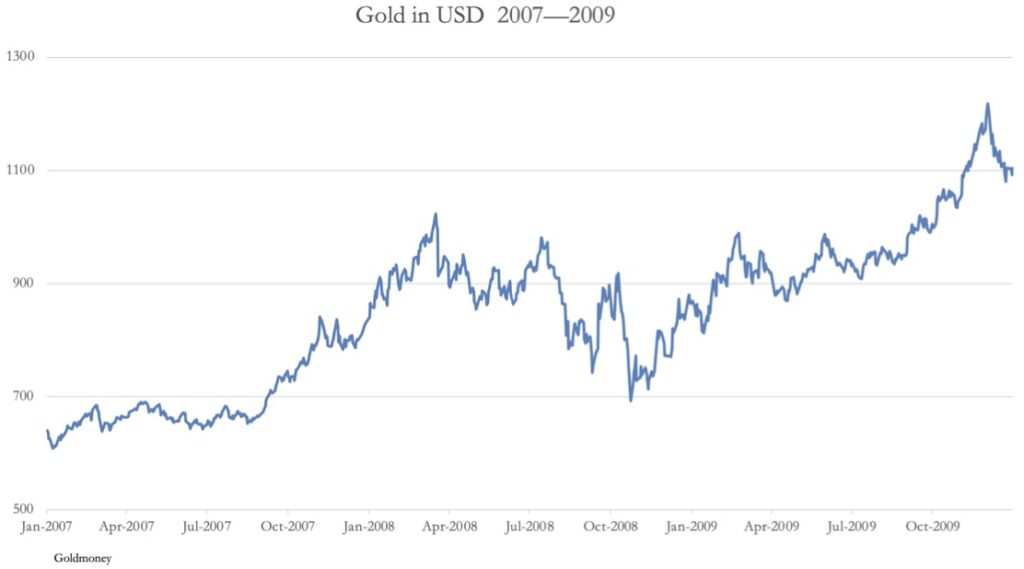

There is no doubt that these fears have led to dollar strength in recent months, because in a fiat currency world, the dollar is safety. We saw this thinking at the time of the Lehman crisis and the next chart is of gold during that period.

In the run up to the crisis, the gold price rose to $1023 in March 2008. The crisis then began to evolve, leading to the Lehman failure on 15 September 2008. The week before the event, gold was trading at $742, a fall of 27% from the March high. And aPer a brief rally on the news, it subsequently fell back to $692 on 24 October, before rallying to new highs against the dollar.

There are many other examples of an initial flight to the supposed safety of the dollar in a crisis, so much so that we should expect it as the contractionary phase of the bank credit cycle progresses. This time, it may be too early to rule out a further fall in the gold price, but clearly, investors should be looking through the current weakness at subsequent developments.

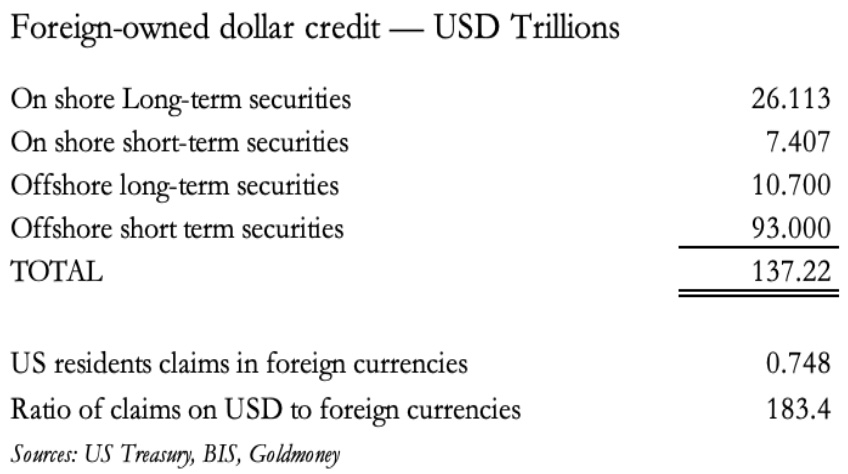

They could be very dramatic, and it behoves the reader to understand the following table.

It consists of all dollar investments and interests in foreign hands, both onshore and also in offshore eurodollars, totaling a staggering $137 trillion. Meanwhile, Americans have only $748 billion (with a B!) in foreign currency to absorb dollar liquidation. And it will be a miracle if rising interest rates and bond yields don’t cause initial liquidation of $26 trillion in onshore long-term assets, leading to a wider liquidation of dollar credit. There is simply next to nothing to absorb it.

Conclusion: higher interest rates will end up crashing the dollar. And it could be unexpectedly sudden.

Got gold? To listen to Alasdair Macleod discuss what to expect next week in the gold and silver markets as well as what surprises are in store across the globe CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED: This Is What The World Now Faces And It Will Send Shockwaves Through Global Markets CLICK HERE.

ALSO JUST RELEASED: Here Is A Look At What Triggered The Global Selloff In Stocks CLICK HERE.

ALSO JUST RELEASED: The Global Debt Market Is Now Flashing Red! CLICK HERE.

ALSO JUST RELEASED: Silver Is Poised To Explode On The Upside, Plus Trouble Brewing On Wall Street CLICK HERE.

ALSO RELEASED: Michael Oliver – Major US Dollar & Gold Update CLICK HERE.

ALSO RELEASED: Monetary Policy Shifts My Rock Global Markets This Week CLICK HERE.

ALSO RELEASED: Gold Coiling To Run Wild, Plus Trouble On The Home Front CLICK HERE.

ALSO RELEASED: Another Gold Bullish Catalyst! Plus People Upset With High Inflation CLICK HERE.

ALSO RELEASED: Global Systemic Change Is Now A Matter Of Survival CLICK HERE.

ALSO RELEASED: China Gold Premiums Skyrocket vs US CLICK HERE.

ALSO RELEASED: Pomboy: SHOCKING: Gold Price In China vs US CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.