Today Michael Oliver, the man who is well known for his deadly accurate forecasts on stocks, bonds, and major markets, shared with King World News a major update on the US dollar and gold.

US Dollar And Gold

September 19 (King World News) – Michael Oliver, Founder of MSA Research: The upside action of the past few weeks has no doubt excited the Dollar bulls. Price punched out its highs going back to April. You can bet that near-term price charts are certainly making the rounds in many market letters.

However, notice that so far the Dollar Index has not exceeded the initial bounce high it had in March (105.88) after its February low (which was after a nearly 15% collapse).

Also, the recent BRICS meeting did not unleash any overt threat to the Dollar as a reserve currency as so many had speculated. So why not dive back into the Dollar?! Apparently many have.

We all know that rates (and relative rate levels) are a factor for the Dollar. Note that as T-Bonds collapsed (and yields shot up) the Dollar was on the other side of that move. And so the Dollar put in a sharp high…

This Is Now The Premier Gold Exploration Company In Quebec With Massive Upside Potential For Shareholders click here or on the image below.

And now Bonds are back to their 2022 lows (yield at highs), but the Dollar is mucking around only 5% off its lows and so far not even above its March rally high. What’s the problem, Dollar? Got a weak Yen that’s

back to its late 2022 lows? Why not back up near 115? Obviously other competing fiats are not faring as badly as the Yen. Well, that’s an issue that reality will later explain, and one that MSA won’t chatter about. We’ll let others. So we focus on our technicals.

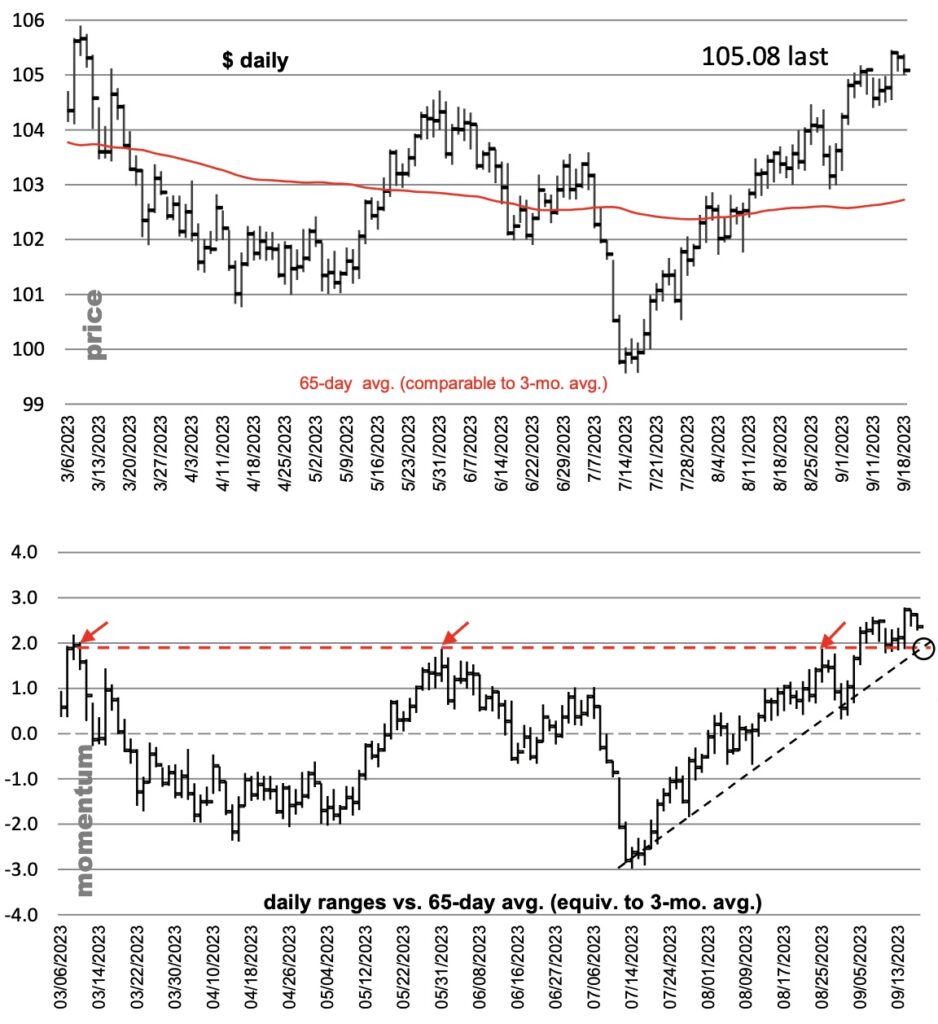

Monthly momentum (price vs. the 65- day avg., comparable to a 3-mo. avg.) is shown here in daily bar format.

Momentum action has reached a level as high above the zero line as the sharp low in July was below it. Near three points under to that much over. And in the process momentum cleared a high-level structure. Meaning an upside breakout (in the recent post-BRICS excitement), but at a “breakout” at high or overdone oscillator level. That breakout took out three prior horizontal peaks all just below two points over the zero line. A peak close and two intraday peaks, nicely spaced.

Action sat down on that line last week for several days and popped back up. Meaning the momentum action affirmed the structure as valid through its use as support.

Don’t slip down from these fairly high oscillator levels and close credibly back below that red horizontal. If that occurs, MSA will deem it an abort, a failure or negation of that overbought signal…

This Company Has A Massive High-Grade Gold Project In Canada And Billionaire Eric Sprott Has A Huge Position! To Learn Which Company Click Here Or On The Image Below.

The 65-day avg. is at 102.76 and rising by about .04 per day. We’re going to be tolerant and demand to see a close 1.75 over the zero line. That will be amply below the red line and will take out the pullback lows seen last week on momentum, and also break a trend line plotted through lows and low closes going back to July. The breakage level is 104.51 today, that number adjusting up .04 per day.

Let’s check another metric.

Weekly momentum (price vs. the 3-wk. avg.) shows that since closing a week back above the pivotal zero line nine weeks ago, the zero line has been support with no weekly closes below it. This week the zero line is 104.56; next week it’s estimated to be 104.99. Do not close a week back below that rising average. This metric will shift to negative very tightly with the monthly momentum abort signal.

Gold

Reminder to gold investors: As we have said many times, do not let the Dollar’s moves unduly shape your view of gold. Yes there are times that they are almost perfectly inverse. But there are other times they are not. And in the broader sweep of time the correlation withers.

When gold produced its last major bear market low in December 2015 the Dollar Index was trading at 99. Now almost eight years later the Dollar is 6% above that level. But since its December 2015 low gold has doubled and is not far from those peak levels now! Correlation to the Dollar’s long-term trend? Intermediate trend swings are sometimes inverse, but in the longer term…To receive the special KWN discount to subscribe to Michael Oliver’s internationally acclaimed MSA Annual Research which is used by serious investors and professionals all over the world CLICK HERE.

ALSO JUST RELEASED: Monetary Policy Shifts My Rock Global Markets This Week CLICK HERE.

ALSO JUST RELEASED: Gold Coiling To Run Wild, Plus Trouble On The Home Front CLICK HERE.

ALSO JUST RELEASED: Another Gold Bullish Catalyst! Plus People Upset With High Inflation CLICK HERE.

ALSO JUST RELEASED: Global Systemic Change Is Now A Matter Of Survival CLICK HERE.

ALSO JUST RELEASED: China Gold Premiums Skyrocket vs US CLICK HERE.

ALSO JUST RELEASED: Pomboy: SHOCKING: Gold Price In China vs US CLICK HERE.

***To listen to Alasdair Macleod’s powerful audio interview about what is happening in China and the West in the gold market CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.