The global debt market is now flashing red and the selloff is alarming.

September 20 (King World News) – Gregory Mannarino, writing for the Trends Journal: Last week Bloomberg reported this: “The Bond Market Has Not Flashed a Warning Sign for This Long in Over Six Decades.”

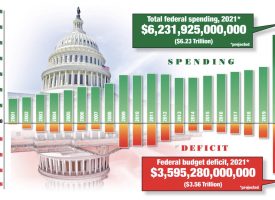

The world debt market consists of essentially promissory notes, a constant and ever-expanding debt black hole with no end in sight. But today, nations around the world have become totally dependent on borrowing epic and ever-increasing amounts of cash directly from their respective central banks just to function day to day.

Moreover, this already enormous amount of borrowing is only going to skyrocket from here. Ever increasing perpetual debt, with interest alone costing more and more to service every day, sucking an unknowing public totally dry. A twisted debt-based system, an out-of-control debt super-spiral which was destined to fail from its inception! Taking the middle class with it.

Over the last six weeks, the world debt market has been selling off at a rapid pace, causing bond yields to spike. This spiking in bond yields is a direct result of the debt market selling off, which in turn has put increasing pressure on world stock markets. (Nations such as China and Saudi Arabia are dumping large amounts of U.S. debt onto the market, which is a trend that will continue and expand.)

Today, the pace at which the bond/debt market is selling off is alarming…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Rapidly rising bond yields is a clear signal that there is increasing instability in the debt market. Instability in the debt market puts pressure on world stock markets.

The stock market itself derives value from action in the debt market. A stable debt market with low yields allows cash to flow into stocks, and never in the history of the world have central banks kept rates/bond yields this low for this long.

Central banks have been extremely successful in inflating the biggest stock market bubble in history by this very mechanism. Central banks working together, keeping rates artificially suppressed since the stock market/economic meltdown of 2008, has created distortions across the spectrum of asset classes to a degree which has never been seen before.

Today’s hyper-bubbles in both world stock markets and real estate, is a direct result of central banks collectively working together artificially suppressing rates.

Here in the U.S., the yield curve is THE most inverted in history. A downward-tending or “inverted” yield curve means that long term debt is yielding LESS than short term debt. This is a clear sign that something is dreadfully wrong in the economy.

Inverted yield curves have preceded every economic downturn, recession, and DEPRESSION, in history.

The current rapid selloff in the debt market, which is causing bond yields to spike, is pathognomonic of serious underlying problems in the financial system.

Today, the rapid rising of bond yields is a RED FLAG for the debt market, stock market, AND real estate markets.

ALSO JUST RELEASED: Silver Is Poised To Explode On The Upside, Plus Trouble Brewing On Wall Street CLICK HERE.

ALSO JUST RELEASED: Michael Oliver – Major US Dollar & Gold Update CLICK HERE.

ALSO JUST RELEASED: Monetary Policy Shifts My Rock Global Markets This Week CLICK HERE.

ALSO JUST RELEASED: Gold Coiling To Run Wild, Plus Trouble On The Home Front CLICK HERE.

ALSO JUST RELEASED: Another Gold Bullish Catalyst! Plus People Upset With High Inflation CLICK HERE.

ALSO JUST RELEASED: Global Systemic Change Is Now A Matter Of Survival CLICK HERE.

ALSO JUST RELEASED: China Gold Premiums Skyrocket vs US CLICK HERE.

ALSO JUST RELEASED: Pomboy: SHOCKING: Gold Price In China vs US CLICK HERE.

***To listen to Alasdair Macleod’s powerful audio interview about what is happening in China and the West in the gold market CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.