This is what the world now faces and it will send shockwaves though global markets.

The outcome is almost guaranteed

September 21 (King World News) – Alasdair Macleod: The planners’ assumption is that falling consumer demand will lead to lower prices. But to the extent that the authorities believe this is true merely exposes the levels of their economic ignorance, because output of production declines first and then consumption reduces as employees are laid off. Far from reflecting a decline in consumption, instead the purchasing power of central bank credit, or its base money, is undermined by a combination of its expansion and loss of faith in it by foreign holders.

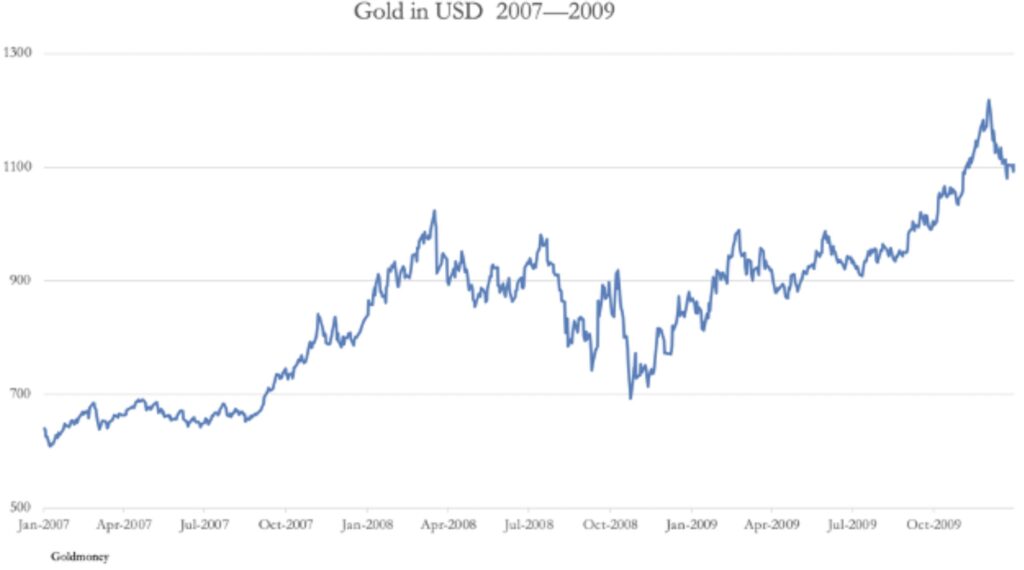

In the case of the dollar, this may not be initially true. When financial markets awaken to the prospect of higher interest rates and lower bond yields, their initial assessment is usually to fly to the supposed safety of the dollar from lesser currencies. We certainly saw this at the time of the Lehman crisis, reflected in the chart below of gold priced in dollars.

In the run up to the crisis, the gold price rose to $1023 in March 2008. The crisis then began to evolve, leading to the Lehman failure on 15 September 2008. The week before the event, gold was trading at $742, a fall of 27% from the March high. And after a brief rally on the news, it subsequently fell back to $692 on 24 October, before rallying to new highs against the dollar.

There are many other examples of an initial flight to the supposed safety of the dollar in a crisis, so much so that we should expect it as the contractionary phase of the bank credit cycle progresses.

The outcome, however, will bring all those elephants unnoticed in the room to life. Interest rates and bond yields will probably rise first, which appears to be already happening as illustrated below.

Furthermore, yields on bonds issued by many other governments are challenging new 5-year highs, so these are not isolated cases. Further increases in bond yields will crash bond and stockmarkets and undoubtedly lead to bank failures, probably in the Eurozone first because the Fed is already bailing out banks suffering from mark-to-market bond losses.

With rising bond yields and falling stock markets, global sentiment can be expected to rapidly turn bearish. Instead of ignoring it, market participants will almost certainly view the parlous state of central bank balance sheets and their further deterioration extremely negatively, while at the moment this is not being taken seriously. Government finances will then be taken to be a serious problem, not only undermined by rising interest rates, but an unwillingness of foreigners to recycle capital flows into government stocks. This will hit both the US and UK particularly hard, forcing up government borrowing costs substantially.

This is where all the previously unseen elephants in the room begin mounting a combined charge against the status quo. The common element of their attack will be fiat currencies, led by the dollar. Foreign holders of US securities will face massive losses on their $32 trillion invested, including $7.5 trillion in deposits and short-term bills. To this must be added the accumulated Eurodollars, a further $15 trillion of bank liabilities, a further $78 trillion of mostly short-term off balance sheet positions., and the $10 trillion of long-term eurobonds. That’s $135 trillion asking to be liquidated.

ALSO JUST RELEASED: Here Is A Look At What Triggered The Global Selloff In Stocks CLICK HERE.

ALSO JUST RELEASED: The Global Debt Market Is Now Flashing Red! CLICK HERE.

ALSO JUST RELEASED: Silver Is Poised To Explode On The Upside, Plus Trouble Brewing On Wall Street CLICK HERE.

ALSO JUST RELEASED: Michael Oliver – Major US Dollar & Gold Update CLICK HERE.

ALSO JUST RELEASED: Monetary Policy Shifts My Rock Global Markets This Week CLICK HERE.

ALSO JUST RELEASED: Gold Coiling To Run Wild, Plus Trouble On The Home Front CLICK HERE.

ALSO JUST RELEASED: Another Gold Bullish Catalyst! Plus People Upset With High Inflation CLICK HERE.

ALSO JUST RELEASED: Global Systemic Change Is Now A Matter Of Survival CLICK HERE.

ALSO JUST RELEASED: China Gold Premiums Skyrocket vs US CLICK HERE.

ALSO JUST RELEASED: Pomboy: SHOCKING: Gold Price In China vs US CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.