Monetary policy shifts may rock global markets this week.

Fed, BoJ, BoE

September 19 (King World News) – Art Cashin, Head of Floor Operations at UBS: … not only is the Fed coming up this week, we have the Bank of Japan, the Bank of England and about nine other central banks. There will be nuances watched at every twist and turn, but in the meantime, as is customary at about this hour of the morning, we should take a look back and see what our friends offshore did overnight.

Overnight, global equity markets are mildly anxious as the first day of the two-day meeting begins this morning. No one expects the Fed to make any move, but the FOMC members will have a chance to revise their so-called Dot Plots and that may tell the markets a good deal about where they think yields will be moving and even the possibility of rate cuts next year. So, it will be an all-important meeting, but those details will have to wait until tomorrow afternoon.

We also got a little help from Australia, where the minutes of the reserve bank took a little wind out from under the sails of higher yields. So, as I say, things are calm, but anxious.

Japan closed down the equivalent of 280 points in the Dow. Hong Kong closed up about 100 points in the Dow and Mainland China was fractionally lower. India is closed for the birth anniversary of the Hindu god Ganesh Chaturthi.

Over in Europe, the markets there are also cautious. As we go to press, London is fractionally higher, and Paris and Frankfurt are not much different, showing a small gain of perhaps 80 points in the Dow. A lot will depend on how the markets interpret things going into the first day of the FOMC meeting.

The calendar is not particularly heavy. Before the opening, we will get Housing Starts and Building Permits, which are not thought to be exciting and, at 1:00 p.m., we will see the results of the 20-year bond auction. Other than that, the economic calendar in the U.S. is virtually blank,

So, as I just said, the key thing is tomorrow’s Fed meeting and press conference by Powell at 2:30 p.m. Will there be any revisions in the Dot Plots and what do the FOMC members see happening further down the line?

The yields will be watched critically. Again, they are moving in nano-steps and yet, that seems to be exerting an influence. As of this morning, they remain in that testing area on the ten-year, with the yield sluggishly trading between 4.32% and 4.36%. Again, if they move toward the higher end to that range they may bring some mild pressure, but, as we told you yesterday, a critical factor in the market’s check on yields will be where did the yields close and is any breakout from the testing range going to be validated by having a close outside that area. That could be of great importance to traders, so we will watch the trading particularly late in the day.

So, watch the yields and then we will watch geopolitical headlines as the U.N. General Assembly formally convenes this morning. Keep your microscope trained on the yields.

Otherwise, you know the current drill. With geopolitics swirling, stay close to the newsticker. Keep your seatbelt fastened. Stay nimble and alert, particularly alert to the yields and stay safe…

ALERT:

Billionaire mining legend Pierre Lassonde has been buying large blocks of shares in this gold exploration company and believes the stock is set to soar more than 150% in the next 6 months. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

High Cost Of Living And Gas Price

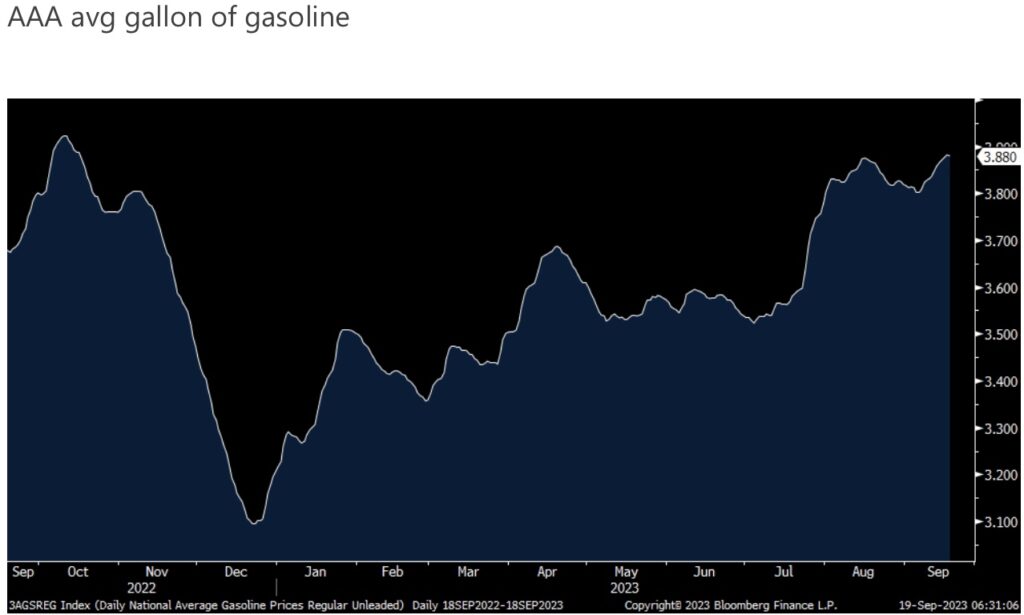

Peter Boockvar: While consumers are dealing with the cumulative 20% rise in their cost of living over the past 3 yrs (mitigated for sure by wage gains) and now a near $4 per gallon average price at the gas pump and the resumption of student debt repayments in coming weeks, Mastercard today released its 2023 holiday spending estimate and expects a 3.7% y/o/y increase not including autos. While they said “the anticipated growth in retail in the US reinforces continued consumer resilience”, they do not mention that this forecast is a nominal figure which would imply the real figure is around zero.

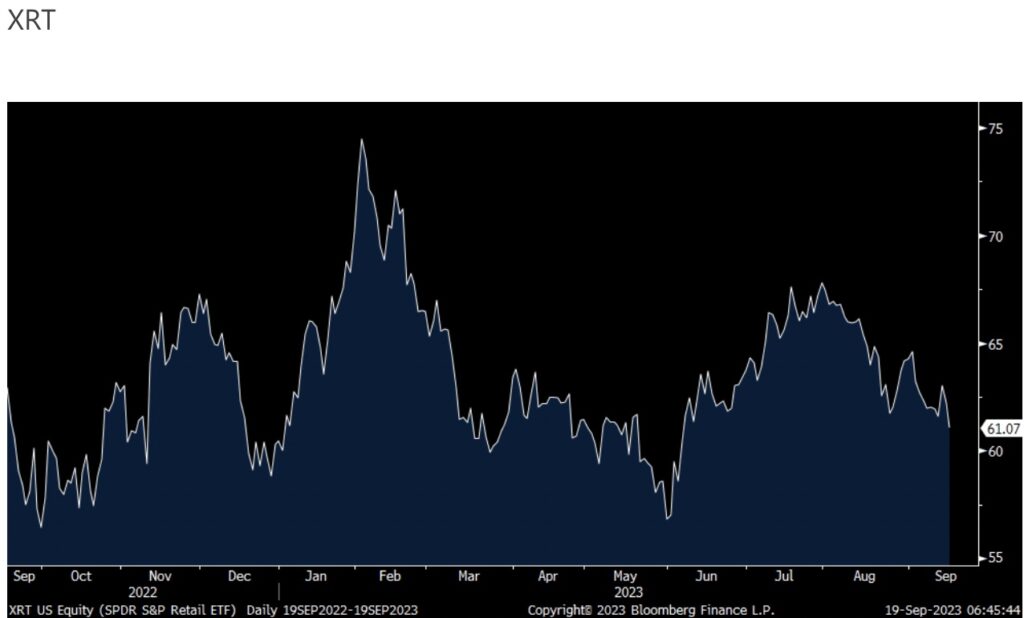

I will say that the action of some retail stocks since they reported earnings in July and August have been nothing but rough as investors fear how consumers are going to respond to the cost of living headwinds, and now the student loan issue and higher gasoline prices.

Here are some stock performances of a few retail stocks since the day they reported and which continue to bleed share performance. Burlington Stores -18%, DG -28%, DLTR -22%, DKS – 25%, TGT -4.5%, HD -4%, WOOF -38%, FIVE -14%, M -27% and apparel/sneaker maker NKE -16%. The winners have been WMT, TJX, ROST, SIG, ULTA and on the apparel side LULU to name some. XRT, the equal weighted retail ETF, yesterday closed at the lowest level since early June.

With respect to the business that moves all the goods we eventually consume, Cass Freight yesterday said its August shipments index rose .8% seasonally adjusted but are still down 10.6% y/o/y. They said “The freight market downcycle is now 20 months old, which compares to a range of 21 to 28 months in the past three downcycles.” The question with freight right now is how far into the inventory destocking are we in which will be eventually followed by an inventory rebuild. Hearing from some trucking companies over the past few weeks at a conference gives hope that the inflection point is near but even if it comes, end consumer demand will dictate the sustainability of it.

Monetary Policy In Europe

With regards to monetary policy in Europe, with its economic weakness but still high inflation, otherwise known as stagflation, ECB Governing Council member Francois Villeroy wants to be done raising interest rates but with regards to inflation, “To treat this sickness, it’s necessary to be tenacious with the remedy that is interest rates. We’ll maintain the ECB’s rates at their current level of 4% as long as needed.” The euro is a touch higher while bonds are mixed as ‘higher for longer’ is a global monetary theme.

As I’ve said many times here, the selloff in long term sovereign bonds is not due to a vibrant global economy and there is no better example than the action we’ve seen in German bund yields. Germany is in a clear recession and stagflationary squeeze and its 10 yr bund yield is just 4 bps from the highest level since 2011, also boosted by what the ECB has done on the short end with its rate hikes.

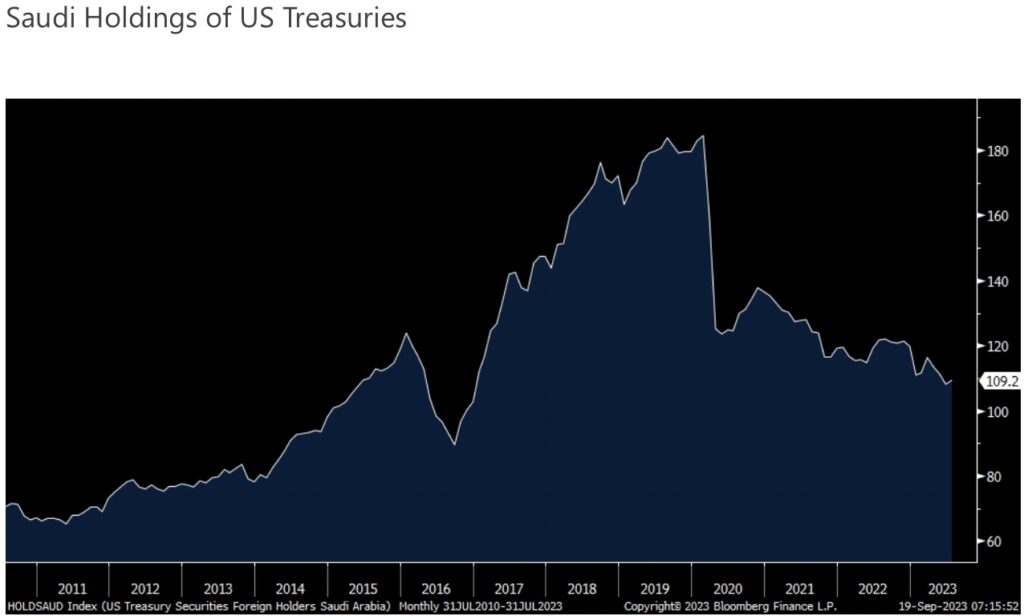

Speaking about US Treasuries and the money flow, the July Treasury International Capital data was out last night and there was no net change into notes and bonds. It would have been a drop but it wasn’t because of a $32b increase in buying from the Cayman Islands, the geography that has provided a lot of buying over the past year and which tends to be from hedge funds and insurance companies.

Holdings by the Japanese, the largest holder, rose about $7b while falling by $13.6b in China. We watch to see when there will be another leg lower in Japanese holdings as JGB yields continue to rise.

As we watch the fate of the petro dollar, Saudi’s holdings of US Treasuries rose by $1.1b after three straight months of declines which took their holdings to the lowest since 2017. We will see more and more oil deals done in currencies not named the US Dollar and instead in the Chinese Yuan, the Indian Rupee for example.

With a huge need from Uncle Sam to sell its bonds, foreign ownership of US Treasuries has fallen from about 45% 10 yrs ago to about 30% now.

I forgot to mention the crude oil rig count yesterday which on Friday rose by 2 rigs after the 1 rig add in the week before. This is the 1st time since last November that we’ve seen two weeks in a row of increases, however modest. If this continues, it would seem that about $90 per barrel is what will bring on more supply.

ALSO JUST RELEASED: Gold Coiling To Run Wild, Plus Trouble On The Home Front CLICK HERE.

ALSO JUST RELEASED: Another Gold Bullish Catalyst! Plus People Upset With High Inflation CLICK HERE.

ALSO JUST RELEASED: Global Systemic Change Is Now A Matter Of Survival CLICK HERE.

ALSO JUST RELEASED: China Gold Premiums Skyrocket vs US CLICK HERE.

ALSO JUST RELEASED: Pomboy: SHOCKING: Gold Price In China vs US CLICK HERE.

***To listen to Alasdair Macleod’s powerful audio interview about what is happening in China and the West in the gold market CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.