As we continue to work our way through the volatility in the metals markets, here is another major gold bullish catalyst, plus people are upset with high inflation.

More Inflation On The Way

September 18 (King World News) – Graddhy out of Sweden: I had patiently waited for the commodities bear market low when called it back in April 2020. Got a pink bull run followed by a shallow blue retracement, followed by a strong break out.

It really does not get any better than this…

ANOTHER GOLD BULLISH CATALYST:

Commodities Seeing An Extremely Bullish Breakout

Play this bull right = get out of the rat race.

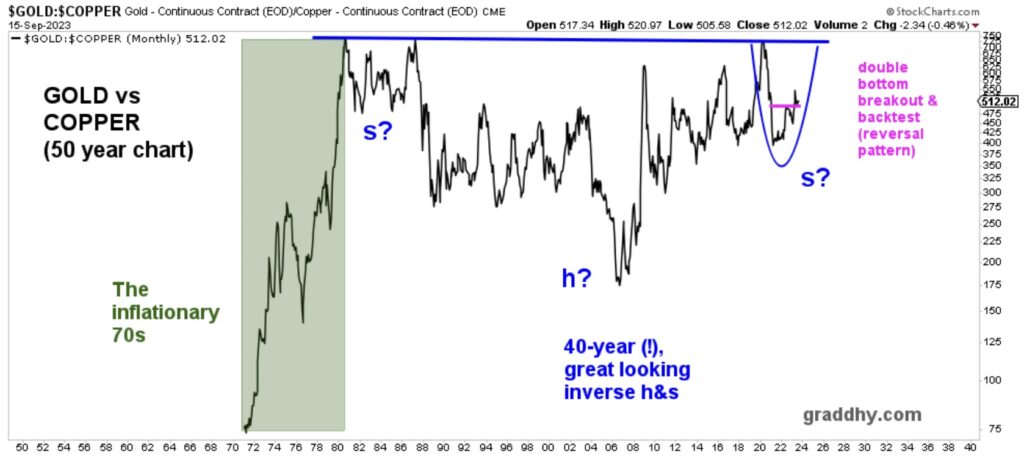

Gold vs Dr Copper

Graddhy out of Sweden: Gold is a proven safe-haven, and copper is a base metal that usually does well in good economic conditions (=”Dr Copper”). Look at the HUGE move during the inflationary 70´s (GREEN SHADED AREA).

Gold Preparing To Soar vs Copper?

Gold’s Multi-Decade Reverse Head & Shoulders vs Copper

This ratio has consolidated the 70´s move for 40 years. It now looks ready again…

ALERT:

Legendary investors are buying share of a company very few people know about. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

77% Of People Upset With High Inflation!

Peter Boockvar: While Japanese markets were closed overnight I’m going to start today talking about a growing political problem now being seen in response to the rising cost of living that the Japanese citizenry is dealing with and the Bank of Japan is still loathe to combat. Who will be the fall guy? Will this lead to a quicker end to negative rate policy and if so, are longer term interest rates going to continue higher? On the latter, I’ll still argue yes.

Bloomberg News is citing a poll that was taken by Asahi newspaper that revealed that?:

“More than three quarters of Japanese voters are unhappy with PM Fumio Kishida’s handling of price rises…About 77% of respondents to the survey carried out Sept. 16-17 said they didn’t rate his price policies positively, compared with 17% who said they did.”

This highlights the bizarre situation where the BoJ has wanted higher inflation for so long, now finally has it but its increases are exceeding wage growth, the Japanese people are now worse off and Kishida has responded with giving out subsidies to cover gasoline, electricity and household gas. So one arm of government continues to stoke inflation while the other is trying to mitigate its impact. I have to believe the pressure on BoJ Governor Ueda is only going to intensify from here as Kishida won’t want to be the fall guy.

Again, Japanese markets are closed but the yen is slightly up, other Asian bond markets sold off which carried over to European bonds and why the US 10 yr yield is kissing 4.35% which on a closing basis would be the highest since November 2007.

To highlight the pain that duration has wrought on holders of longer dated US Treasuries, TLT the 20+ yr maturity US Treasury ETF is down 46% since its peak in August 2020 not including the coupon’s collected which if included likely takes the full loss to the high 30’s percentage wise.

I Am Extremely Bullish On Gold & Silver

I also want to use this moment to express my bullishness AGAIN on gold and silver. Gold historically trades off two main things, the direction of the US dollar and also real rates. Well, over the past 2 years, the 5 yr REAL interest rates has gone from -1.95% to 2.23% today and in the face of that usual major headwind for gold, gold has gone from about $1800 since September 2021 to $1948 today in the front month future. My response to why is maybe just the enormous amount of central bank buying over the past few years and the large amount of buying that is happening in the Eastern part of the world that is overwhelming this historical relationship of real rates and gold.

When looking at industrial metals, including iron ore and oil, we’re all so trained to just look at the economic data out of China without realizing that India is the growing powerhouse now when it comes to infrastructure spend. In case you missed this article last week, read it to understand, https://www.wsj.com/world/india/india-spends-big-on-what-it-needs-most-to-catch-up-to-china-198c28b4. We remain bullish and long Indian stocks and find it one of the most exciting economic stories in the world, maybe finally and also benefiting from shifting supply chains.

After the rise in C&I loans outstanding in the week ended 8/30 by $6.8b, it fell in the following week by $5.5b and continues to hover around one yr lows. Bank deposits rose by $23b after dropping by $70b in the week before.

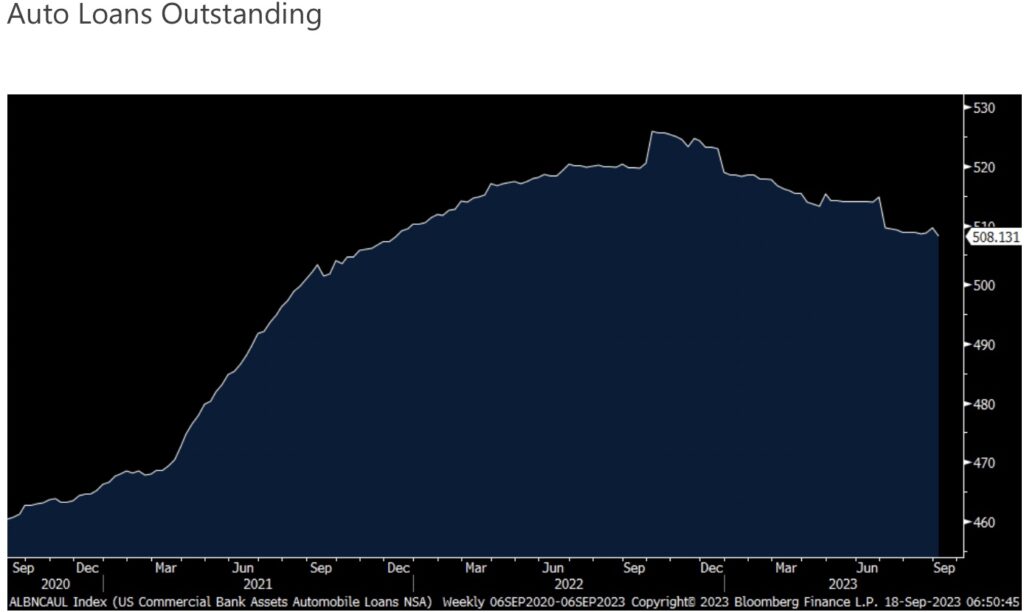

Auto Loans Outstanding Continue To Decline

I also want to highlight auto loans outstanding as they declined by $1.4b, the biggest one week drop since early July and it takes the absolute dollar figure outstanding down to $508b, the lowest since December 2021.

Bank Of Montreal Getting Out Of Indirect Finance

This also comes as on Sunday the Bank of Montreal announced that they are getting out of the indirect retail auto finance business. “By winding down the indirect retail auto finance business, we have the ability to focus our resources on areas where we believe our competitive positioning is strongest.” Indirect financing is where the lender helps the dealer who in turn helps the buyer.

This also follows the August vehicle sales figure seen a few weeks ago which totaled 15.04mm, about 350k cars less than expected. So, the UAW strike has now begun on the cusp of a likely slowdown in the auto business, the last major industrial area of strength because of the inventory normalization that has been going on up until now.

ALSO JUST RELEASED: Global Systemic Change Is Now A Matter Of Survival CLICK HERE.

ALSO JUST RELEASED: China Gold Premiums Skyrocket vs US CLICK HERE.

ALSO JUST RELEASED: Pomboy: SHOCKING: Gold Price In China vs US CLICK HERE.

***To listen to Alasdair Macleod’s powerful audio interview about what is happening in China and the West in the gold market CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.