The big question on everyone’s mind is, will the US suffer a credit rating downgrade? Below there is also a look at the gold takedown and a few other surprises.

Meanwhile…

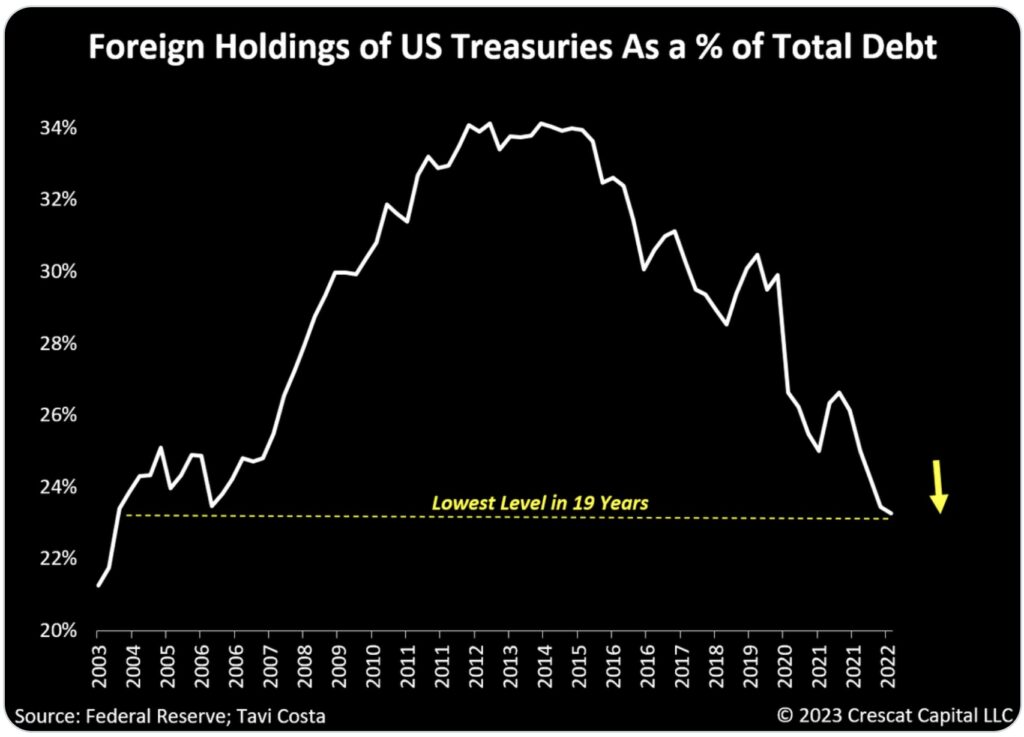

May 25 (King World News) – Otavio Costa: Foreign holdings of US Treasuries just reached the lowest level in 19 years. This concern is further amplified by the diminishing availability of buyers for Treasury securities. Market participants are beginning to recognize that the true risk this time around lies not in the failure to reach a debt ceiling agreement, but rather in the escalating and concerning nature of the debt problem…

ALERT:

This company is about to start drilling what could be one of the largest gold discoveries in history! CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Otavio Costa continues: In the last three years, the responsibility of absorbing this debt fell on the Fed and US banks, but now both entities have withdrawn from that role. The current lack of demand is indeed a growing problem that may ultimately necessitate the intervention of the Fed as the buyer of last resort.

Foreign Holdings Of US Treasuries Collapses To Lowest Level In 10 Years!

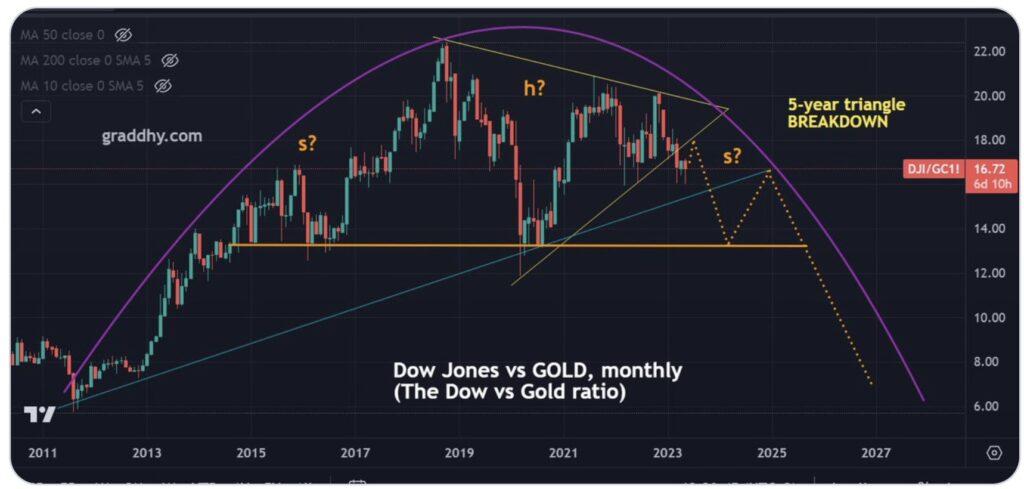

Dow/Gold Ratio

Graddhy out of Sweden: The Dow Jones vs gold ratio is in a massive topping process. Important chart for the next macro trend, showing that gold will outperform stock market going forward. Institutions globally watch this ratio. This chart is now changing global capital flows towards precious metals.

Forget The Gold Takedown:

Dow/Gold Ratio Preparing To Collapse In Favor Of Gold As Gold Set To Radically Outperform Stocks

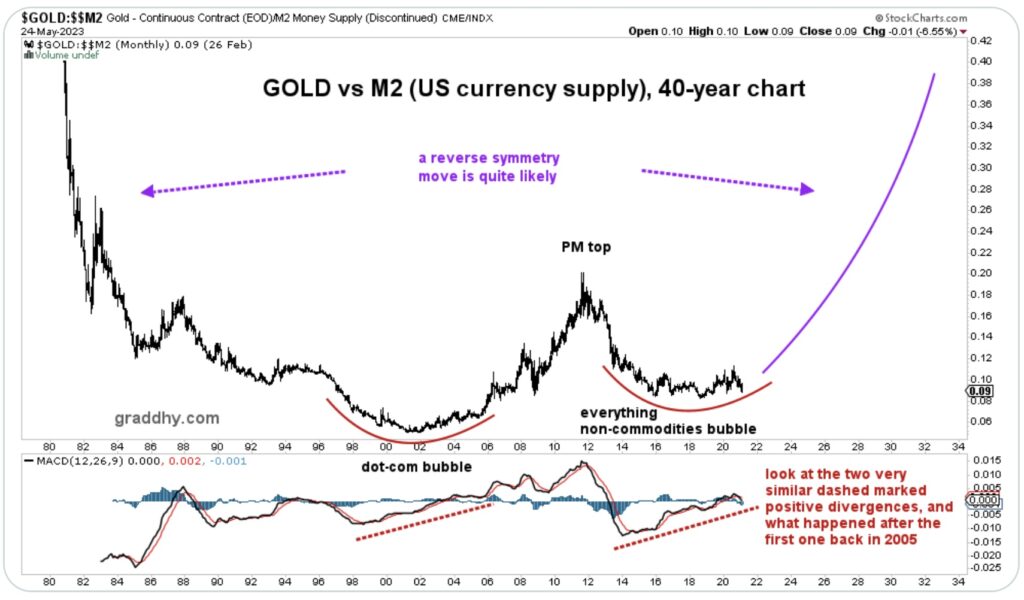

Gold And Money Supply

Graddhy out of Sweden: This chart shows how undervalued gold is relative to the US money supply. So gold has a very long way to go compared to M2. And silver will outperform gold.

Gold Price Will Skyrocket vs US Money Supply

Will US Credit Rating Be Downgraded?

Peter Boockvar: This is what Fitch said in their negative outlook on the finances of the US government:

“The Rating Watch Negative reflects increased political partisanship that is hindering reaching a resolution to raise or suspend the debt limit despite the fast-approaching X date. Fitch still expects a resolution to the debt limit before the X date. However, we believe risks have risen that the debt limit will not be raised or suspended before the X date and consequently that the government could begin to miss payments on some of its obligations.

The brinkmanship over the debt ceiling, failure of the US authorities to meaningfully tackle medium term fiscal challenges that will lead to rising budget deficits and a growing debt burden signal downside risks to US creditworthiness.”

Reputationally, this ain’t a good look but economically and market speaking with regards to paying bills it doesn’t mean much as long as the US has an electronic printing press to help us meet our obligations. The problem though is the cause of this negative outlook and that is the exploding size of our debts and deficits that may now matter in terms of the rates we will pay to borrow and what the value of the US dollar will be as this plays out…

ALERT:

Powerhouse merger caught Rio Tinto’s attention and created a huge opportunity in the junior gold & silver space CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Back on August 5th 2011 when S&P took away our AAA rating, the 10 yr Treasury yield actually fell in the weeks that followed. On August 1st, the 10 yr yield was at 2.75%. By the end of August it was at 2.22%. The S&P 500 had a more violent response, dropping almost 7% on the Monday after the ratings cut but a week later had recaptured that loss. Forgotten though was the market correction of almost 20% that was already taking place in response to the end of QE2 in March 2011. The Dollar index fell slightly in response to the downgrade in the month that followed.

In 2011 our federal debt was about 100% of GDP vs today at 124%. It was at 65% pre GFC.

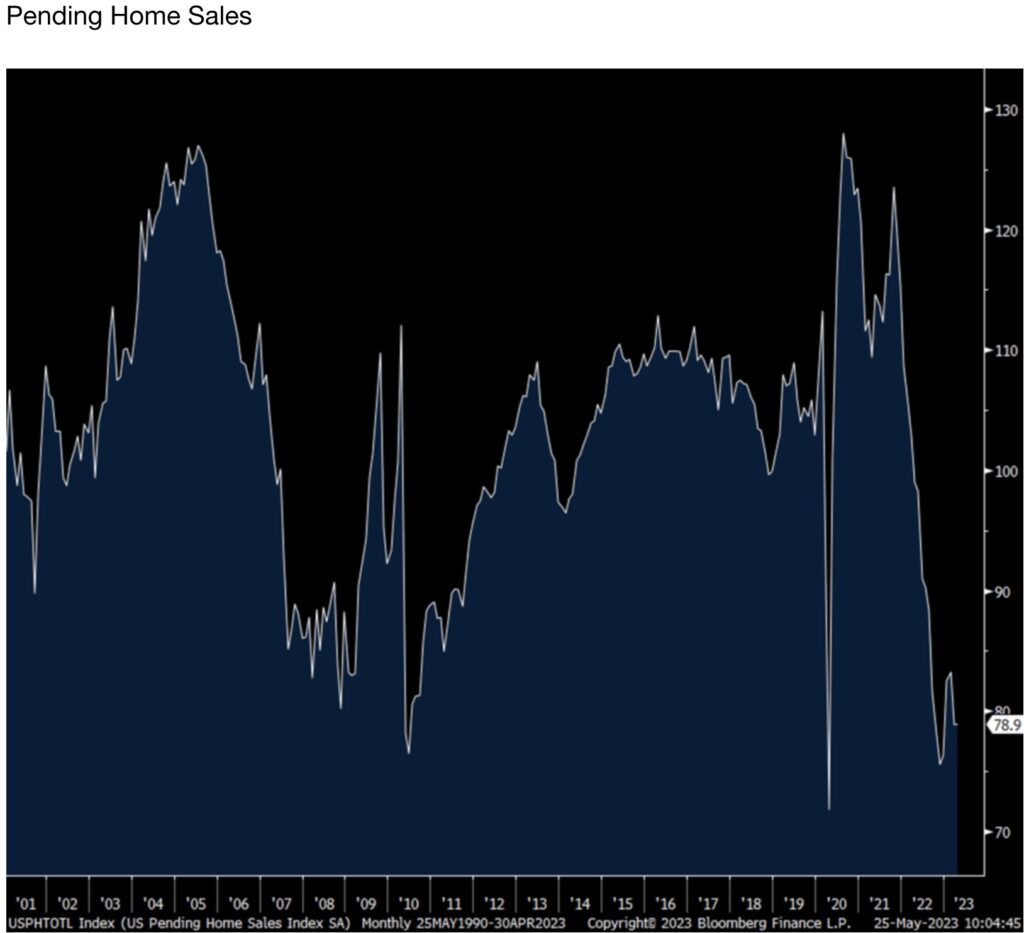

Pending Homes Sales Near Multi-Decade Lows

National Association of Realtors (NAR): “April pending home sales, measuring activity for existing home sales only, was flat m/o/m vs the estimate of up 1% and follows a 5.2% drop in March. There was an outsized drop in sales in the Northeast which dropped 11.3% m/o/m after an 8.1% fall in March. Sales in the south were flat and rose out West and in the Midwest.”

Home Sales Have Collapsed To One Of The Lowest Levels In US History

To this the NAR said: “Minor monthly variations in regional activity are typical. However, cumulative results over many years clearly point towards a much greater number of home sales in the South.”

Bottom Line

Bottom line, yes we can blame the near lowest level of existing home sales in decades to a dearth of inventory but a 40% rise in home prices over the past few years on top of a now 7% mortgage rate is its own headwind. Toll Brothers can do just fine as I’m sure many of their customers pay in cash and Toll can help buy down that mortgage but that doesn’t reflect a broad healthy housing market. It’s just their own dynamic…

ALERT:

Legendary investors are buying share of a company very few people know about. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

The NAR said: “Not all buying interests are being completed due to limited inventory. Affordability challenges certainly remain and continue to hold back contract signings, but a sizeable increase in housing inventory will be critical to get more Americans moving.”

I’ll say again that the Federal Reserve has truly turned the housing market upside down by trapping millions in their homes who don’t want to lose their low rate mortgage and thus prevents the proper supply flow and price drop needed in order to mitigate the spike in mortgage rates. And to think about all the mortgage backed securities they were buying up until early 2022 as home price were spiking like meme stocks.

ALSO JUST RELEASED: COUNTDOWN TO MIDNIGHT: The Monetary Showdown And Gold’s Reaction To Financial Chaos CLICK HERE.

ALSO JUST RELEASED: BUCKLE UP: Housing Bubble Bursting As Financial Tsunami Approaches, Plus People Don’t Work Nearly As Hard CLICK HERE.

ALSO JUST RELEASED: Stunning Big Picture Look At Gold As Stock Markets Tumble Across The Globe CLICK HERE.

ALSO JUST RELEASED: The Global Debt Market Time Bomb Is Close To Exploding CLICK HERE.

ALSO RELEASED: Look At Who Is Calling A Major Gold Bottom, Plus A Tale Of Two Economies And Relief For New Car Buyers CLICK HERE.

ALSO RELEASED: Unusual Money Flows Into Gold, Credit Crunch, Plus “Transitory” Deflation? CLICK HERE.

ALSO RELEASED: Greyerz On The Derivatives Nightmare, Plus Gold Bottom At Hand CLICK HERE.

ALSO RELEASED: Dollar Woes To Denial: The USA Is Screwed CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.