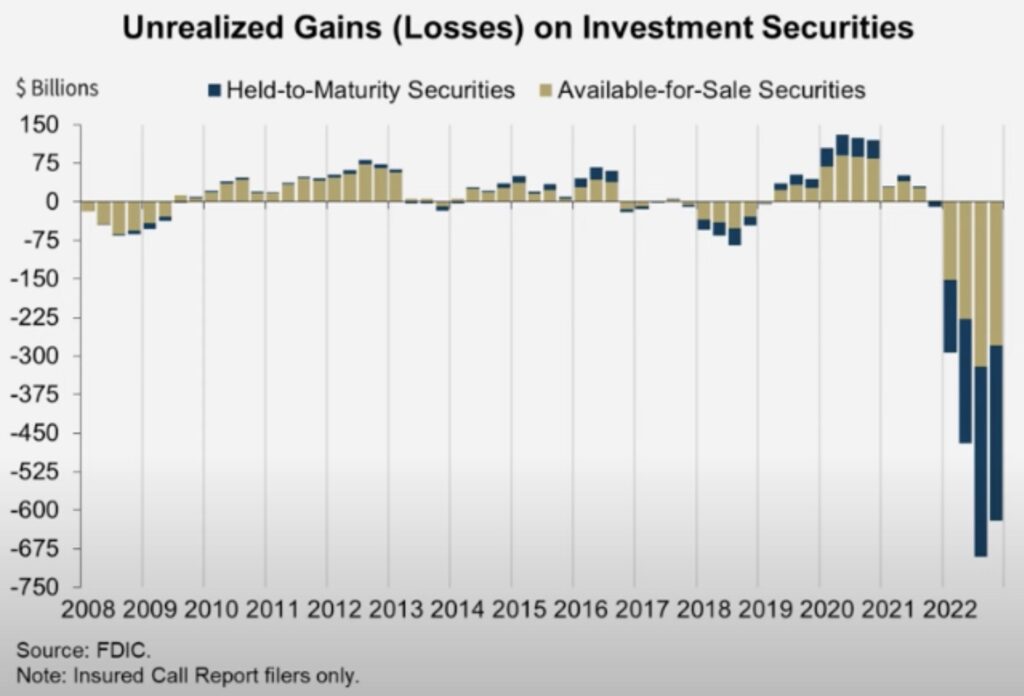

This is the chart that caused the collapse in bank stocks and frightened the markets.

King World News added the following note to James Turk’s article we released on Monday of this week when the bank panic was already in full swing:

King World News note: For those of you who are dollar cost averaging your physical gold and silver purchases, continue to purchase at the same time each month or quarter. But for those of you who do not have any physical gold and silver, what you have just witnessed is a classic warning sign of systemic instability that will get much worse over time. And this problem is definitely going to spread to Europe, which has a much weaker banking system than the United States. The ECB is going to have to print massive quantities of money to halt the contagion whenever the shorts begin to attack the banking system in Europe. And they will. This primary beneficiary of all of this chaos and instability will be gold and silver, which have been money for thousands of years.

Moving to today…

March 15 (King World News) – James Turk: Eric, this the chart that has spooked the markets and caused the collapse in bank shares. It shows the marked-to-market losses in bank investment portfolios. As of December 31, these unrealised losses totalled $620 billion.

THE CHART THAT KICKED OFF THE BANK RUNS:

Catastrophic Losses For Banks Holding Long Dated US Treasuries

The Crisis Is Similar In Europe But Possibly Much Worse

The chart was prepared by the FDIC, and while it is a good step forward in illustrating what the markets and bank managers are dealing with, the chart stops short in presenting all of the problems that banks face.

While bank managers had a hand in creating this mess by buying bonds paying low interest rates, they had few alternatives. The Federal Reserve and nearly every other central bank forced interest rates to zero, apparently presuming there would be no consequences. How wrong they were.

Bank asset values rise and fall as interest rates go down and up. But the above chart only illustrates the losses from rising interest rates on fixed income investments, like bonds. It ignores the loss impact from fixed interest rate loans like mortgages.

Let’s assume the mortgage or long-term loan is repaid on time until it matures. The problem is that the cash flow these loans generate for banks is inferior to the cash flow from new loans at higher interest rates. So bank stocks will underperform in a rising interest rate environment, but there is still more bad news for bank shareholders…

ALERT:

This company is about to start drilling what could be one of the largest gold discoveries in history! CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

As interest rates rise, companies with floating interest rate debt incur a rising interest expense burden. That can weaken their ability to repay their loan obligations if they are unable to stabilize their operating margins, which could mean they end up defaulting. The bank would then have to write-off the loan and incur a loss, while hoping for repayment from the liquidation of the bankrupt company.

Now consider not just one company, but the impact of rising interest rates on all debtors and indeed, on economic activity itself. If not enough new wealth is created by debtors to service their debts, lenders take losses. The bank losses and all the bank failures in the Great Depression are the extreme example of what can happen. And this is not just a US problem.

Central banks around the globe forced interest rates to artificially low levels that were not sustainable. Consequently, Silicon Valley Bank is not an isolated the problem. There are other banks out there in similar dire straits, and investors should not think that big banks are immune. They have been operating in the same interest rate environment as SVB.

So when it comes to banks – regardless of whether they are large or small – investors need to go back to fundamental principles by starting with the most basic investment question. How good is the management?

Those banks with good managers will survive. Those that don’t respond to the environment in which they operate will not. Depositor safety comes from high quality bank management, not bank size.

King World News note: As we warned on Monday, the bank panic was going to spread to Europe and the ECB was going to be forced to print massive amounts of money because the banking system in Europe is in far worse shape compared to the United States. Think about the bonds the banks were buying in the eurozone. Those were negative interest rate bonds in many cases and long dated. Regardless, today we are seeing a continued flight to gold because gold has been money for thousands of years and it does not have any counterparty risk if it is stored safely outside of the banking system.

ALSO JUST RELEASED: Forget All The Bear Talk And Look At This Major Bull Market Nobody Is Watching CLICK HERE.

ALSO JUST RELEASED: Is It Only Tuesday? A Sigh Of Relief For Markets But Here Is What To Watch CLICK HERE.

ALSO JUST RELEASED: I’ve Seen Many Bank Crises In My 75 Years. Here Is What I Learned CLICK HERE.

ALSO JUST RELEASED: Schiff On The Historic Fed Pivot. Art Cashin Warns: Keep Your Seatbelts Fastened CLICK HERE.

ALSO JUST RELEASED: Here Is A Look At The Ongoing Panic CLICK HERE.

ALSO JUST RELEASED: Bank Runs Set To Accelerate As Fear And Panic Spreads CLICK HERE.

***To listen to Matthew Piepenburg’s powerful KWN audio interview which has just been released CLICKING HERE OR ON THE IMAGE BELOW.

***To listen to Alasdair Macleod discuss the bank collapse, contagion and crisis as well as what this will mean for the gold market CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.