The final move for gold is about to be unleashed, plus travel booming and the bank credit crunch has just begun.

The Final Move For Gold

June 6 (King World News) – Graddhy out of Sweden: The final and 3rd gold bull move since Nixon closed the gold window is upon us.

End of the rainbow investing stuff, if you play it right. And if you don’t, you will get wiped out.

Big change goes slow, until it goes fast.

Get Ready For Big Upside In Gold

Travel Remains Strong And The Credit Crunch Is On

Peter Boockvar: Over the past two days on CNBC we’ve heard from the CEO’s of Marriott, Hyatt, Hilton and Loews. The tone was very positive from all, particularly with regards to leisure travel. The Marriott CEO yesterday on Squawk Box said:

“If there are any questions about the resilience of travel, those have been answered over the last couple of years…It’s across every segment and every part of the world.”

He did say though specifically with luxury that the strong rate trends of 2022 have moderated a bit this year. The Hyatt CEO this morning said that leisure travel is trending about 30% above 2019 levels, that group travel is looking good for the summer but business travel, while still improving, is more uncertain as it trends still below 2019 levels. He said that small and medium sized business employees are back on the road more so than those from large companies.

Sara Eisen interviewed the CEO of Hilton Chris Nassetta also yesterday and who said he’s “not so far” seeing any signs of a travel slowdown. He said leisure, business (also being led by small and medium sized business employees he said and where revenue is just above 2019 levels) and meetings/events (pent up demand with planning seen for 2024 and 2025) are all strong notwithstanding signs of slowing economic growth he pointed out. He was optimistic about international travel which is still lagging the recovery (inbound to the US just 60% of pre-Covid levels), particularly out of China (outbound is just 10% of pre-Covid)…

This Company Has A Massive High-Grade Gold Project In Canada And Billionaire Eric Sprott Has A Huge Position! To Learn Which Company Click Here Or On The Image Below.

Nassetta also pointed out something really important and something I coincidentally read about yesterday from Reuters but having been watching for signs of this post SVB. He mentioned the lack of development that will limit the amount of supply of hotels in the coming years. Here was the title of the article from Reuters, “US Hotel Developers Run Out of Cash as Construction Lending Dries Up.” The article said “Hotel developers, private equity firms, and general contractors told Reuters the financial stress on regional banks – the largest lenders to hotels and other CRE markets – has forced developers to postpone projects or find other creative ways to raise capital.”

The piece highlighted that post SVB’s failure a California developer paused construction on a 21 story hotel and casino in Vegas as they were trying to “secure more funding.” Notably, “Since March, 59 of the 98 total US hotel projects that broke ground or were in the pre-construction phase this year have been paused, according to previously unreported data shared with Reuters by Build Central Inc, a subscription based research and analytics firm used by some large hotel brands to gauge market opportunities by location.” I bolded the comment.

From the CIO of MCR Hotels, the 3rd largest US owner-operator of hotel brands, including Hilton, “The regional banks that used to be active for us 9 to 12 months ago are not showing up to finance hotels for us today.”

Yes, private equity is trying to step into the breach but offering 9-10% interest rates does not get a project done vs 4% a few years ago…

ALERT:

Billionaire mining legend Pierre Lassonde has been buying large blocks of shares in this gold exploration company and believes the stock is set to soar more than 150% in the next 6 months. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

The Bank Credit Crunch Has Just Begun

Bottom line, the bank credit crunch has only just begun.

Black Knight had a story yesterday on residential real estate titled “Tightening Credit Availability Adds to Affordability Struggles as Rates Remain Elevated, Inventory Shortages Worsen and Home Prices Strengthen.” Their data “showed home sales volumes fell in April, as a lack of both affordability and inventory continue to create major market headwinds.” On inventory, “for-sale inventory is now at its lowest level since April 2022, with inventory deteriorating in 95% of major markets since the start of 2023.” Home prices rose again in April as a result m/o/m, up for a 4th month but are now flat y/o/y which is the first time they haven’t been higher “since the market began to recover in the wake of the GFC.”

We know the home builders are trying to fill the inventory gap but affordability challenges exist there too and why they are still employing incentives.

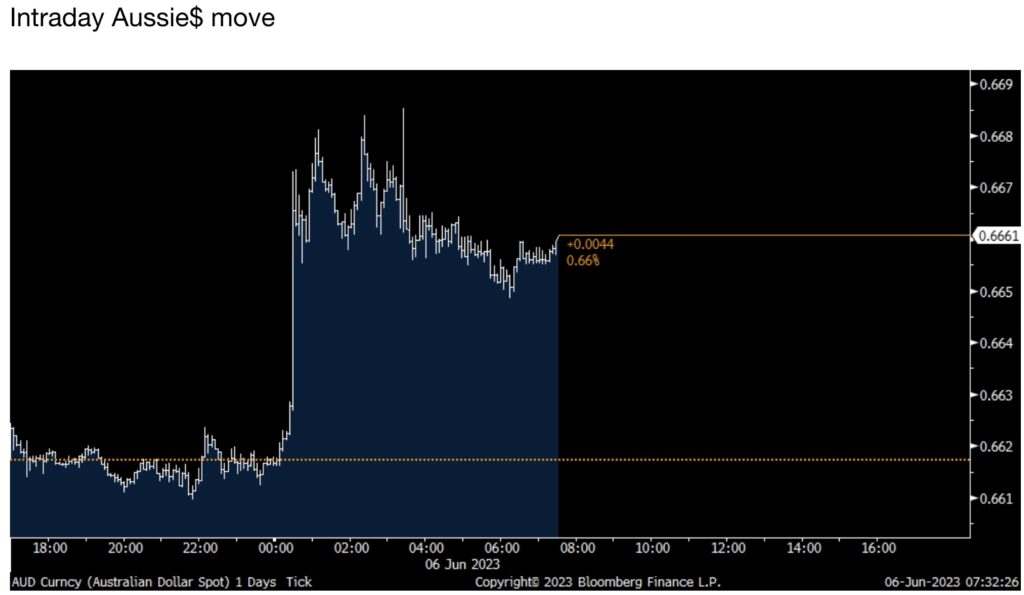

Bank Of Australia Surprise

The Reserve Bank of Australia surprised everyone with a 25 bps rate hike to 4.10%. Governor Lowe left open the door for more, “Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable time frame, but that will depend upon how the economy and inflation evolve.” He seemed to be honing in on rising labor costs as the impetus for the hike with labor productivity little changed, “unit labor costs are also rising briskly, with productivity growth remaining subdued…The Board remains alert to the risk that expectations of ongoing high inflation contribute to larger increases in both prices and wages, especially given the limited spare capacity in the economy and the still very low rate of unemployment.” The Aussie$ is rallying by .6% to a 3 week high and yields are higher too. The ASX fell 1.2%.

ALSO JUST RELEASED: The Price Of Gold Is Going To Be Unleashed To A New All-Time High CLICK HERE.

ALSO JUST RELEASED: SHOCKER: Look At What Had A Mind-Blowing 4,256.47% Return (And It Wan’t Bitcoin) CLICK HERE.

ALSO JUST RELEASED: The World Is About To See Serious Deflation Followed By Massive Money Printing CLICK HERE.

ALSO JUST RELEASED: Billionaire Pierre Lassonde Says Ignore Volatility, Gold Is Headed Into A Mania CLICK HERE.

ALSO RELEASED: A Jaw-Dropping 232 Tonnes Of Gold Has Now Been Delivered Out Of COMEX CLICK HERE.

***To listen to billionaire investor Pierre Lassonde discuss what he is doing with his own money right now and why investors should ignore volatility in gold because it’s headed into a mania CLICK HERE OR ON THE IMAGE BELOW.

***To listen to Alasdair Macleod discuss what is happening behind the scenes in the war in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.