We are about to see the 3rd gold bull market in the past 50 years unleash on the upside.

There has been so much noise in the gold market recently that it is extremely important to take a step back and look at the big picture so investors can remain focused and not let their emotions get the better of them. Here it is…

Gold’s Big Picture

August 25 (King World News) – Graddhy out of Sweden: Big picture, gold is now back above blue support line, as expected. One cannot play a resumed gold bull with a bearish mindset. The right mindset, tools and experience is needed. Must ignore bias, emotions, narratives and all those talking heads.

Long Term Monthly Chart Shows Gold Poised For Major Upside Breakout

Gold Priced In World Currencies

Graddhy out of Sweden: $XAUWCU is the collected chart for gold priced in the major currencies.

Gold Holding Strong After Major Breakout Priced In World Currencies

Note, it does not have a cup and handle like $XAUUSD does, but just a stream of higher highs and higher lows, forming a parabolic structure. This chart is your call to action. GET READY…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

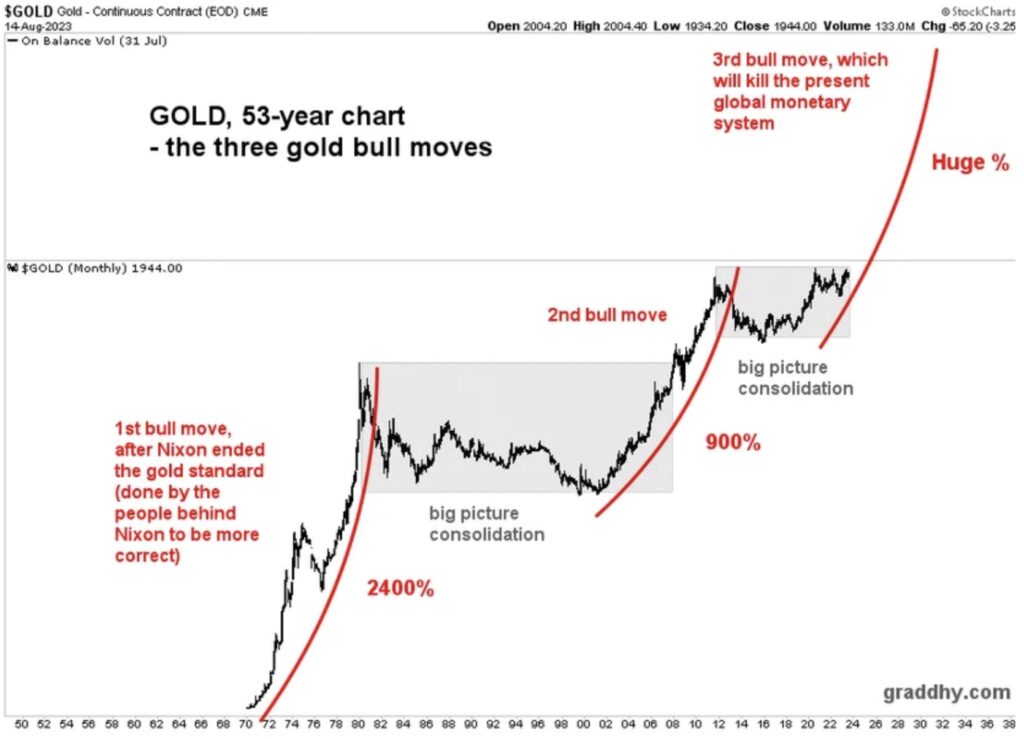

3rd Gold Bull Move Since Nixon

Graddhy out of Sweden: The final and 3rd gold bull move since Nixon closed the gold window has started.

1st Gold Bull Skyrocketed 2,400%. 2nd Gold Bull Soared 900%. 3rd Gold Bull ????% Gain Should Be One For The History Books!

There is no such thing as a triple top in a resumed bull so it should break out on 4th or 5th try, kicking off the 2nd inflationary phase.

End of the rainbow investing opportunity.

Big picture for silver just released! CLICK HERE

About the stock market…

What A Selloff Overseas

Art Cashin, Head of Floor Operations at UBS: Overnight, global equity markets are looking in somewhat different directions depending on what continent you are on. In Asia, things were primarily weaker as those markets played catch-up to the reversal selloff that we saw in New York yesterday. All of which happened after the Asian markets closed.

So, overnight, Japan closed down the equivalent of about 750 points in the Dow. Hong Kong closed down about 540 points in the Dow. Mainland China off about 170 points in the Dow.

For the plus ticks, we move over to our friends in Europe and, as we go to press, London is up 150 points in the Dow. France is up about 170 points in the Dow. We have a somewhat similar move in Frankfurt.

The markets are anxious awaiting Powell at 10:00 a.m. and then in early afternoon, we will hear from Christine Lagarde of the ECB and see if her tone varies at all from what Powell said, although they usually try to coordinate a little bit.

Away from Powell and Lagarde, the economic calendar is kind of summertime slow. We will get Consumer Sentiment at 10:00 and the Rig Count at 1:00 p.m. Other than that, it is just Powell and Lagarde. We will continue to watch. We think the measuring stick for the Powell commentary will be what happens in the yield on the ten-year, which is what the markets are critically interested in over the past two weeks.

Again, in case you have been sleeping through banking class, the key is testing the recent highs in yields at 4.35% or there about. A move toward 4.40% or so, might shake up equity traders and any pull back below 4.25% would be helpful.

The general sense around the Wall Street watering holes last evening was that Powell would not appear under a banner with the unfortunate slogan that we saw in Iraq “Mission Accomplished” but rather, in all likelihood, it will say “Mission in Progress”. Traders painfully recall Powell’s speech in 2022, which was a brief 8 minutes long, but immediately seemed to take 3 to 5% off the equity indices as he talked about extensive pain and the markets took him at heart.

The bottom line as I keep pounding, is keep an eye on the ten-year yield. Not just for the initial reaction, but how they sit 15 minutes to a half an hour after Powell is through. If they look like they are pushing above that 4.35% level, it could put pressure on equities. If they look only to be testing that area with no threat of pushing above, then we could get a relatively calm equity move and conversely, if we see the yield dip down below 4.25%, you might get a little bargain hunting in equities. Even though we assume it is coordinated, don’t rule out a possible surprise around 2:00 p.m. when Christine Lagarde comes to the microphone.

Anyway, you know the current drill. Given the geopolitical background, stay close to the newsticker. Keep your seatbelt fastened. Stay nimble and alert. Try to have a fun Friday (and stay dry if you are in the Northeast) and follow with a wonderful weekend and above all, stay safe.

ALSO JUST RELEASED: A Global Wildcard Is Acting Like A Giant Wrecking Ball CLICK HERE.

ALSO JUST RELEASED: SHOCKING: Take A Look At The Retail Stock Bloodbath CLICK HERE.

ALSO JUST RELEASED: Gold Rallies As Stagflation Is An Ugly Thing CLICK HERE.

ALSO JUST RELEASED: Central Banks Are Fostering An Extinction Level Event CLICK HERE.

ALSO RELEASED: Look At How Parts Of The Economy Have Collapsed CLICK HERE.

ALSO RELEASED: STOCK MARKET SELL SIGNAL: Major Breakout In The Most Important Interest Rate CLICK HERE.

ALSO RELEASED: Take A Look At How Bad It Is For Banks Right Now CLICK HERE.

ALSO RELEASED: The Fate Of The World Is Being Decided Here… CLICK HERE.

ALSO RELEASED: The Global Debt Bubble Is Going To Unleash Havoc CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.