Look at how parts of the economy have collapsed.

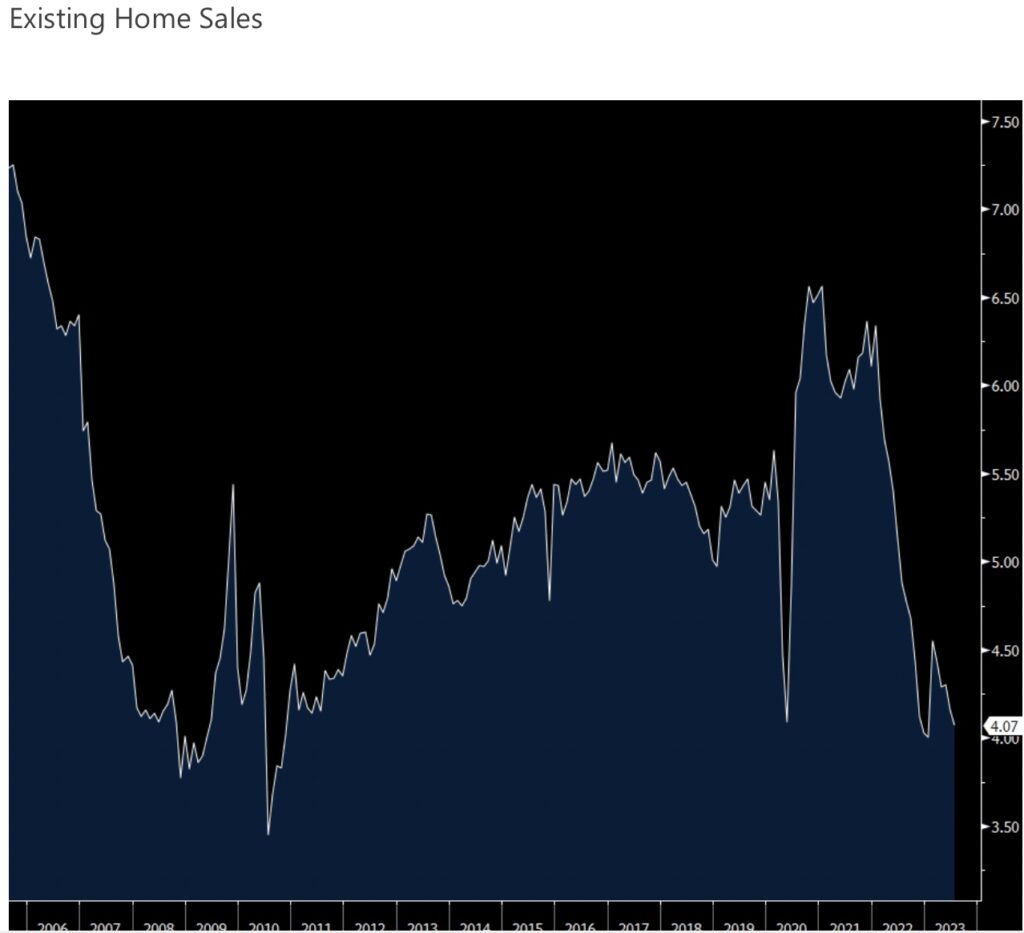

Existing Home Sales Remain Collapsed

August 22 (King World News) – Peter Boockvar: Existing home sales in July totaled 4.07mm, 80k less than expected and down from 4.16mm in June. That is the smallest number of existing home closings since January and just 50k from the least since 2010.

Months’ supply rose to 3.3 and does so every year during spring and summer. For comparison, it was 4.2 in July 2019 and 4.3 in July 2018. Actual homes for sale in July are down 15% y/o/y. The median home price rose 1.9% y/o/y.

The first time home buyer made up 30% of purchases, up from 27% in June and vs 29% in July 2022 and it’s hugely important that the first time buyer comes back to this market but affordability is terrible. Just as this data was hitting the tape from the NAR, the Atlanta Fed’s Home Ownership Affordability Monitor Index came out and it fell to the lowest since last October due to, you know what, “elevated mortgage rates and housing shortages across the United States.”…

ALERT:

Powerhouse merger caught Rio Tinto’s attention and created a huge opportunity in the junior gold & silver space CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Bottom Line

Bottom line, I’ll leave it to the NAR which echoed what the Atlanta Fed said, “Two factors are driving current sales activity – inventory availability and mortgage rates. Unfortunately, both have been unfavorable to buyers.” In what this means past the impact on actual transactions, less housing turnover means less new painting is needed, less need for new floors, carpet, furniture, etc…The retort then is, home owners will just do this for their existing homes but they mostly did that already in 2020 and 2021.

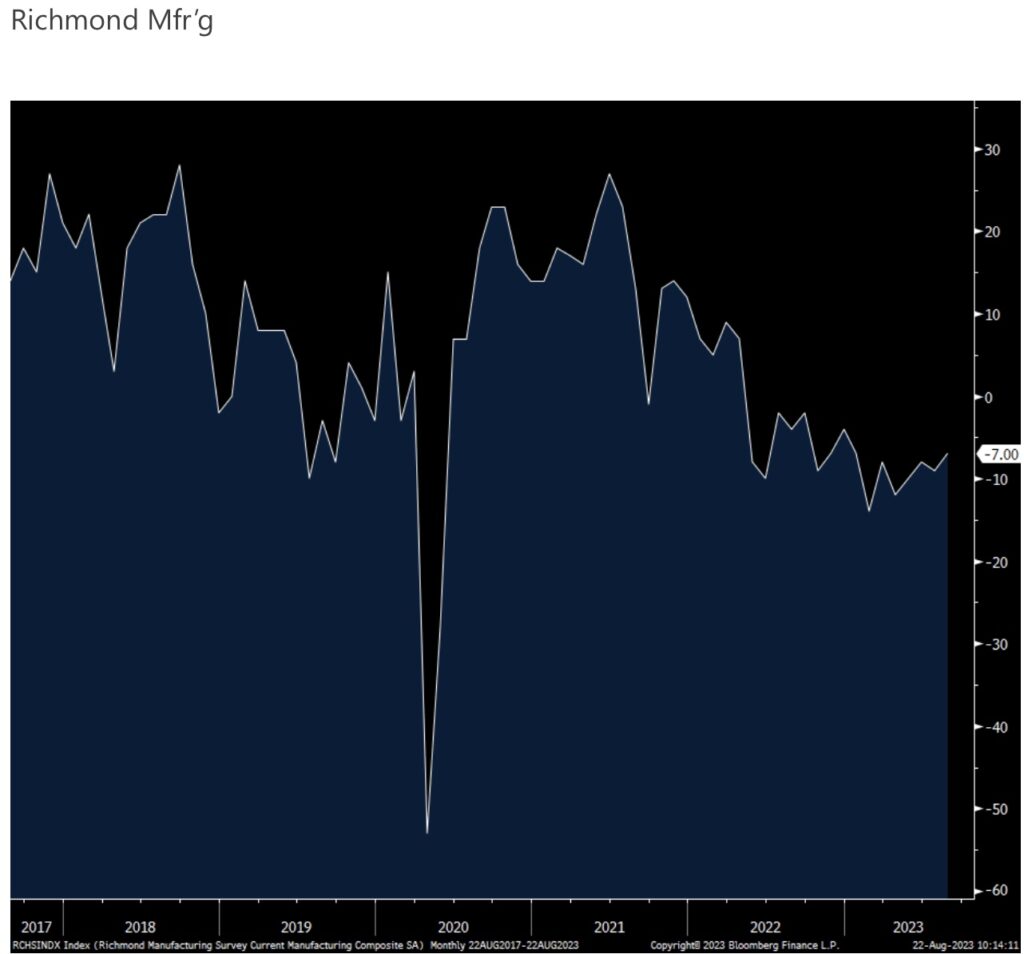

Manufacturing Continues To Struggle

The August Richmond manufacturing index was -7 vs -9 and marks the 16th month in a row of contraction. For comparison, from late 2007 into mid 2009 it was down 21 months in a row.

This follows the NY survey which went negative followed by Philly which was above zero.

New orders did improve by 9 pts but is still negative at -11, though the least negative since December 2022. Backlogs were little changed but deeply below zero at -26. Inventory levels for finished goods bounced but just got back the sharp drop in July. Capital spending plans declined m/o/m as did employment. Wages improved to a 4 month high. While prices paid and those received fell again from July, expectations for each rose to 5 month and 6 month highs respectively.

Expectations for new orders for the coming 6 months also rose and were less negative for backlogs. Inventory expectations fell 4 pts after rising by 5 last month. They did also increase for employment and the wage growth expectation figure rose to the highest level since November 2022.

Bottom Line

Bottom line with manufacturing, in the US but global too, is when is the destocking going to be done? When will restocking start taking place. While we’ve heard from retailers this week and last about their growing comfort with right sizing inventories, there hasn’t been any talk about rebuilding inventories just yet.

ALSO JUST RELEASED: STOCK MARKET SELL SIGNAL: Major Breakout In The Most Important Interest Rate CLICK HERE.

ALSO JUST RELEASED: Take A Look At How Bad It Is For Banks Right Now CLICK HERE.

ALSO JUST RELEASED: The Fate Of The World Is Being Decided Here… CLICK HERE.

ALSO JUST RELEASED: The Global Debt Bubble Is Going To Unleash Havoc CLICK HERE.

To listen to Alasdair Macleod discuss the plunge in gold and silver prices, the historic BRICS meeting that will take place next week and so much more CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.