Investors across the globe need to pay attention because the fate of the world is being decided here.

Trouble For Stock Market Bulls

August 21 (King World News) – Art Cashin, Head of Floor Operations at UBS: The bulls attempt at a bit of a bounce is easily foiled when the yield on the ten-year once again flirting with that important area around 4.35%. Again, that 4.35% / 4.45% is a bit of a critical area.

The market will continue to check its own internals and see where they want to bring things along, but so far to me, it is as we repeated again and again in the pre-opening and have been saying for weeks, it is going to be a story about yields and what they may or may not be telling us and, it could be a critical outlook over the next several weeks.

So, keep your seatbelt fastened and keep your eyes trained on those yields and also the S&P, if it pulls back below 4360, it could induce some follow-on weakness.

The bulls are clearly playing defense here and they need to regroup as soon as possible.

Stay Safe.

Arthur

The fate of the world to be decided here…

Peter Boockvar: Again, the fate of the world and the economy and markets comes down to a central bank/economist gathering in the beauty of a valley. While we hang on their every word, the rate hike odds for September is just 10% and is 36% for one more by yr end. How long rather than how much more in terms of tight policy is MUCH more relevant. And that’s where we’ll hear from some about r* which I want to remind everyone that it is a made up central bank theory and econometric driven construct…

ALERT:

Billionaire mining legend Pierre Lassonde has been buying large blocks of shares in this gold exploration company and believes the stock is set to soar more than 150% in the next 6 months. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

But as long as they talk about it, we have to listen and it’s just the REAL rate they want and how is that measured. Should it be on one month of CPI/PCE or the TIPS market or something else. Longer term they want it to be .50% but for now it could be 1.5-2% and some believe that it is trending higher.

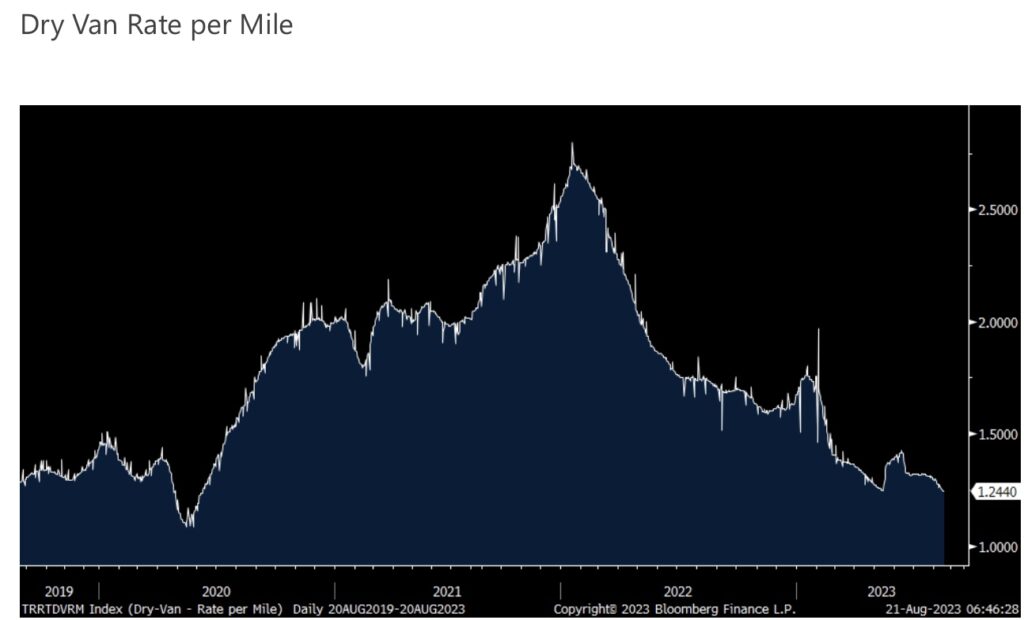

I’ll say again, there is one thing to see inflation fall back down but another to keep it there. Let’s talk transportation costs related to this. From February 2020 to January 2022 the per mile cost of trucking doubled (see chart below) and they’ve since collapsed to below where it was in early 2020.

Now with the Yellow bankruptcy, spot prices are stabilizing and signs are developing that we’re about to inflect higher again. The Journal of Commerce wrote a piece on Friday and said:

“For the LTL sector, the collapse of Yellow is an inflection point for pricing, if not for overall freight volumes.”

They quote David Menzel who is the president and COO of Echo Global Logistics who “expects LTL rates to rise between 5 and 15% depending on how much exposure shippers had to Yellow.”

From another one in the industry:

“We’re already starting to see LTL prices creep up.” He expects rates to increase about 7% on average, “though companies that relied more on Yellow’s carriers will pay a higher price.”

Inflation No Longer In Check

I want to emphasize that what kept overall inflation in check in the 20 years leading into covid was zero core goods price growth on average. Services inflation ex energy averaged 2.8% per annum in those 20 years. Much more inflation volatility is what I expect in the next few years and with the 5 yr TIPS breakeven priced at 2.24%, I think TIPS are way too cheap here and we own them, expecting a higher average inflation rate over this time frame…

ALERT:

This company is about to start drilling what could be one of the largest gold discoveries in history! CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Energy Inflation

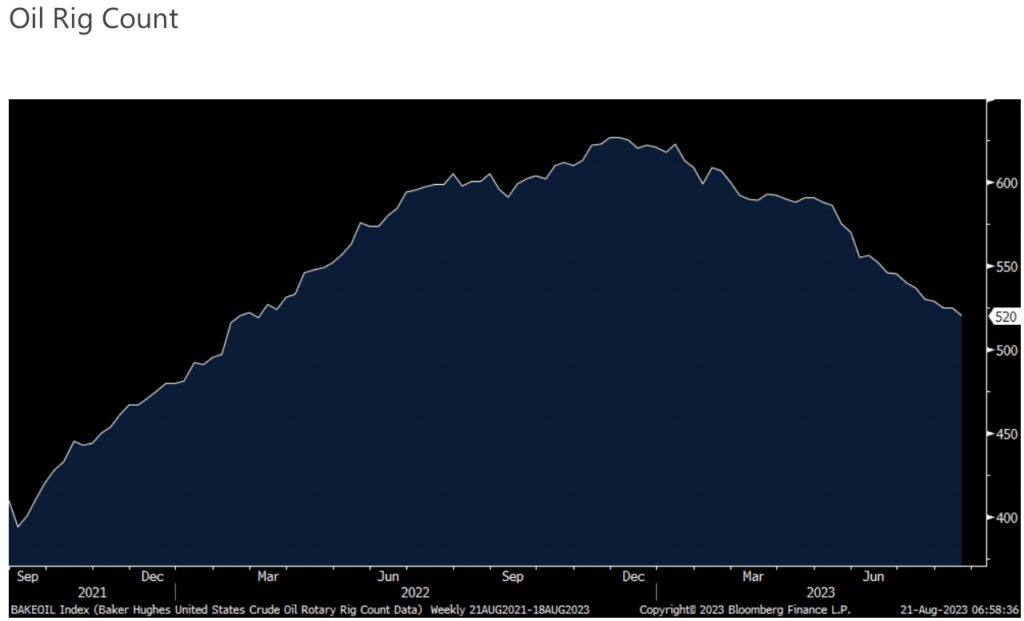

Let’s look at energy as a key variable in the inflation volatility I expect. Even with this move above $80 in WTI, the US oil rig count continues to drop and fell by another 5 rigs as of 8/18 to 520. It’s risen in just one week since April.

That’s the least amount of rigs since early March and in its own way, joins the Saudi’s in cutting production but not with the same purpose. We remain bullish and long energy stocks and believe WTI will be surprising on the upside.

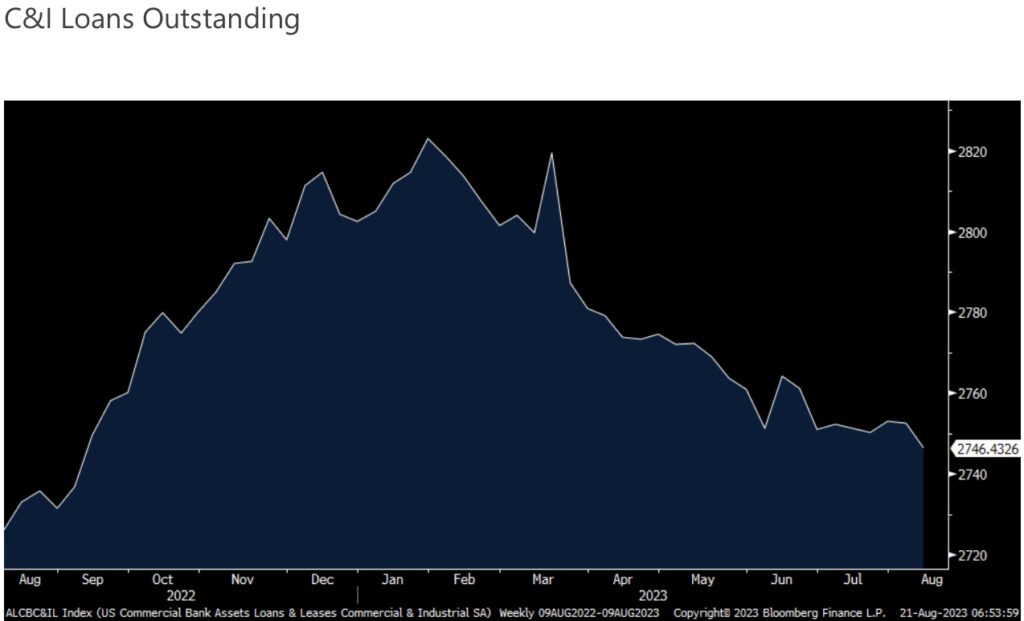

Whether its the creeping credit crunch and/or slackening demand, C&I loans outstanding for the week ended 8/9 fell by $6.1b to the lowest level since early September 2022.

Bank deposits fell by $11b but after rising by $18b in the week before.

Yields Rising All Over The World

I’m a broken record but the rise in bond yields is global and today again is an example. The 10 yr JGB yield rose 1.4 bps to .65% and is retesting the closing high after the YCC move. Their 40 yr yield which I love to watch was up by 2 bps to 1.83% and that is the highest since early February. Yields rose elsewhere in Asia, are higher across the board in Europe and the US 10 yr yield is back to 4.30%.

Shifting To China

Shifting to China, after the PBOC cut its one yr medium term lending facility last week by 15 bps, there were expectations that banks would cut their 1 yr and 5 yr loan prime rates by a like amount today. Instead, they left the 5 yr rate unchanged at 4.20% and cut the 1 yr loan prime rate by just 10 bps to 3.45%. Maybe they want to slightly improve their profit margins, maybe they realize that this is all pushing on a string. As they were not cut as much as market participants hoped, Chinese stocks sold off again.

Unwinding this epic residential real estate bubble and distress for many developers will take years but bankruptcies and the lack of bailouts is what is needed in order to cleanse this debt. And I want to emphasize that the debt pain is mostly felt on the developer side as homeowners make large downpayments when they buy and many have been recently paying down their mortgages. Where homeowners will feel the impact will be on lower valuations of their largest asset and in turn could be resulting in the cautious consumer.

No evidence that global trade has bottomed yet as South Korea said exports in the first 20 days of August fell by 16.5% y/o/y while imports were lower by 28%. Smoothing out for days, daily shipments were lower by 10.7% y/o/y with semi sales down by 25% y/o/y and exports to China down by 27.5%. The Kospi was up .2%.

In July, Taiwan said its export orders were lower by 12% y/o/y but not as much as the expectations of a 15.5% drop. The TAIEX was flat overnight.

Meanwhile In Germany

Germany said its July PPI fell by 1.1% m/o/m, down well more than the forecast of -.2%. The y/o/y drop was 6%.

Long Rates Rising For A Very Bad Reason

Maybe because this is just a commodity drop thing that is not sustainable or just discounting to their Chinese customers that is temporary, or the realization that the comp was a 37% rise in July 2022 so wasn’t going to take much to see a drop or maybe because the markets focus more on CPI, the 10 yr inflation breakeven in Germany is up 1.4 bps to 2.39% and remaining sticky between 2.25-2.5% over that past 4 months. The 10 yr German bund yield is up by 5 bps. Again, LONG RATES ARE RISING FOR NOT GOOD REASON. ECB QT will only pick up further from here.

ALSO JUST RELEASED: The Global Debt Bubble Is Going To Unleash Havoc CLICK HERE.

To listen to Alasdair Macleod discuss the plunge in gold and silver prices, the historic BRICS meeting that will take place next week and so much more CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.