Take a look at the shocking retail stock bloodbath.

Retail Stock Bloodbath

August 24 (King World News) – Dean Christians writing for SentimenTrader: Should we buy the retail stock bloodbath?

Key points:

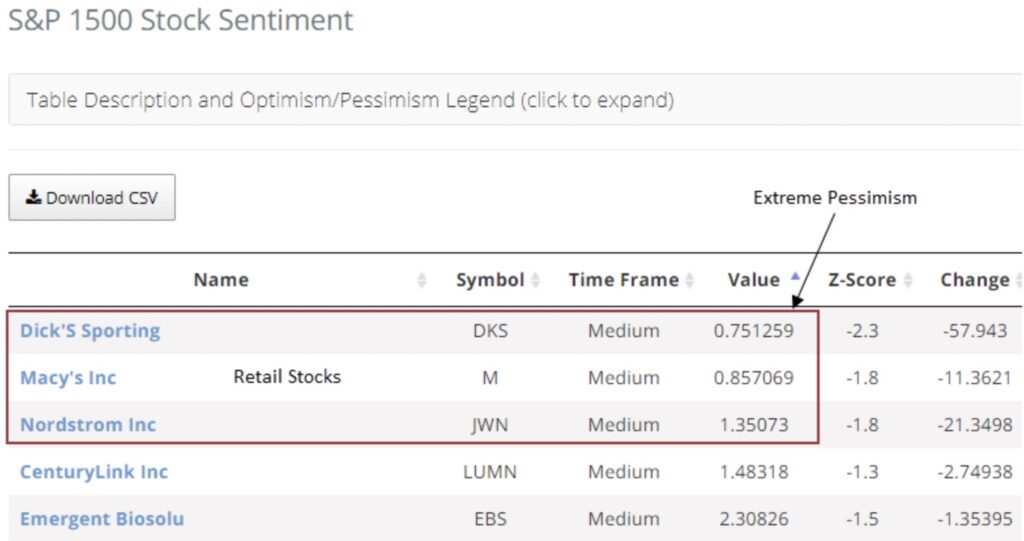

- The Optimism Indexes for several retail stocks plunged to some of the lowest levels in history

- Similar sentiment extremes suggest further downside over the next few months

Harnessing the power of the Backtest Engine to identify sentiment extremes

Each night, I sort the website’s S&P 1500 Optimism Index table to research potential trade ideas. On Tuesday evening, the lowest three values for our proprietary sentiment composite pointed toward retail stocks: Dicks, Macy’s, and Nordstrom’s…

ALERT:

Billionaire mining legend Pierre Lassonde has been buying large blocks of shares in this gold exploration company and believes the stock is set to soar more than 150% in the next 6 months. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

With sentiment composites falling to some of the lowest levels in history, let’s fire up the Backtest Engine to assess if the current extreme sentiment readings can provide a trading edge.

Designed with a point-and-click interface that requires no programming skills, the Backtest Engine allows users to quickly and efficiently test trading ideas with our expansive library of indicators and models.

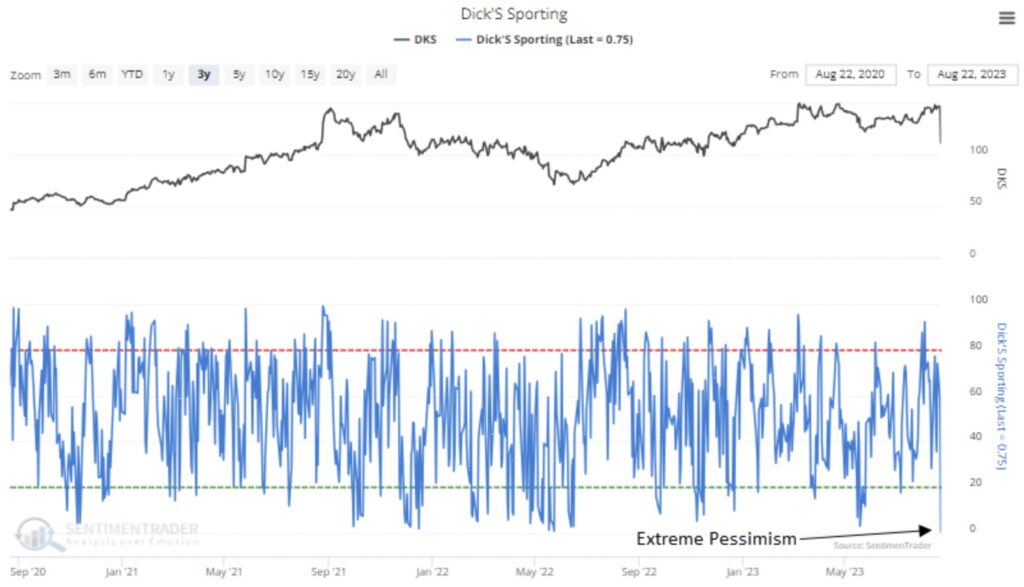

The Optimism Index for Dick’s Sporting Goods (DKS) plunged to 0.75%, the lowest level since March 2020.

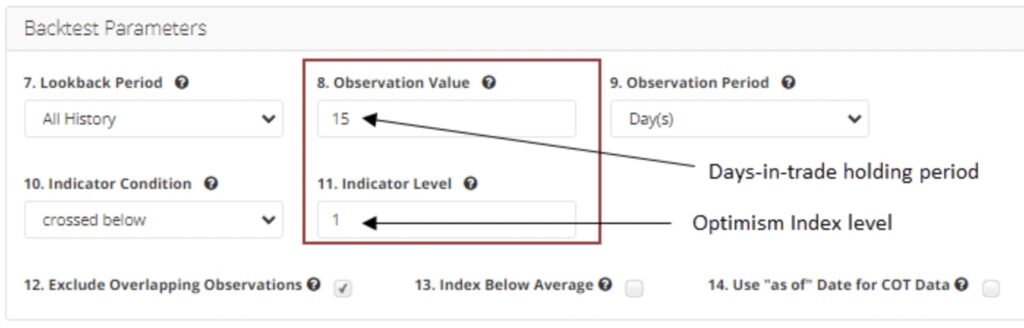

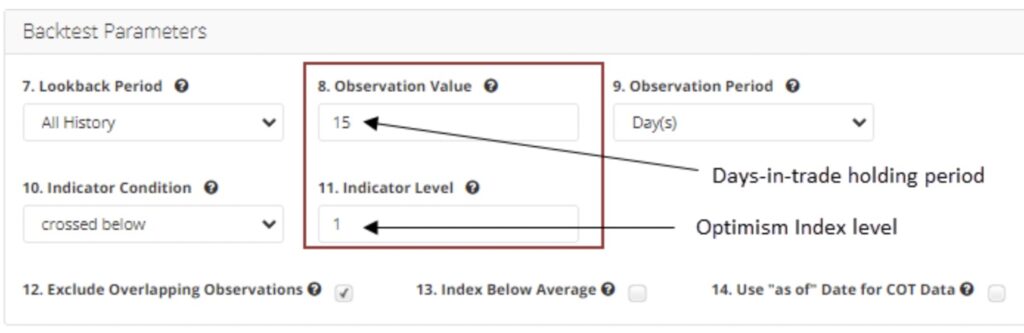

In the Backtest Engine parameters section, I’ll apply an Optimism Index reading of 1% to give the signal some breathing room and use a holding period of 15 trading sessions.

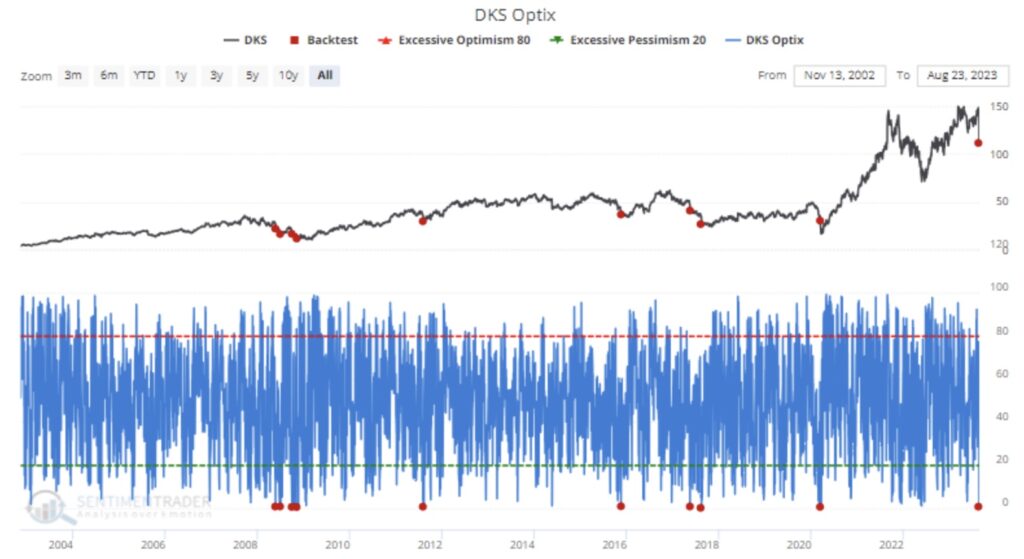

The plunge in the Optimism Index below 1% suggests Dick’s (DKS) could mean revert higher in the first week. However, two months later, the stock was lower 67% of the time, with a median return of -2.25%.

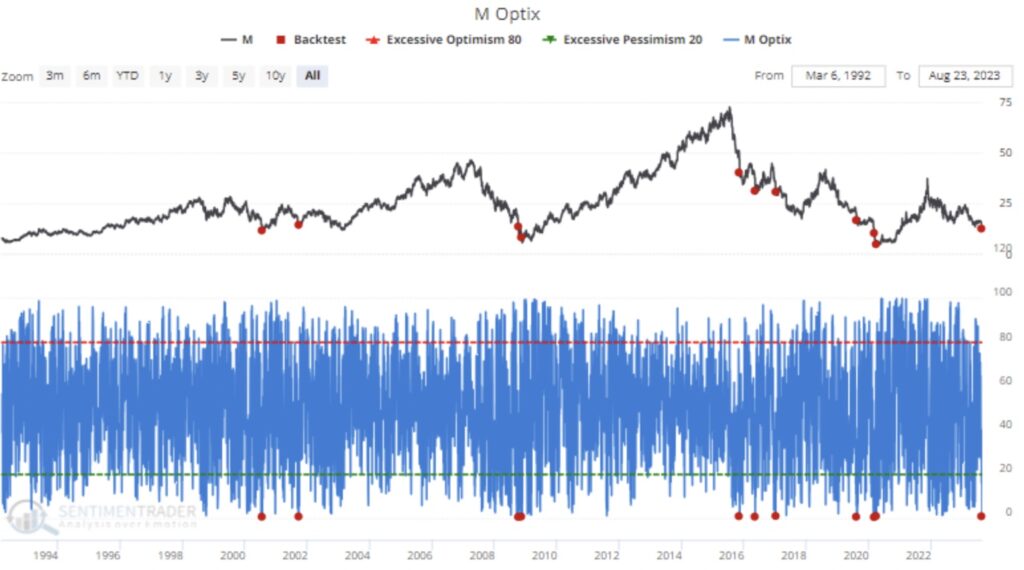

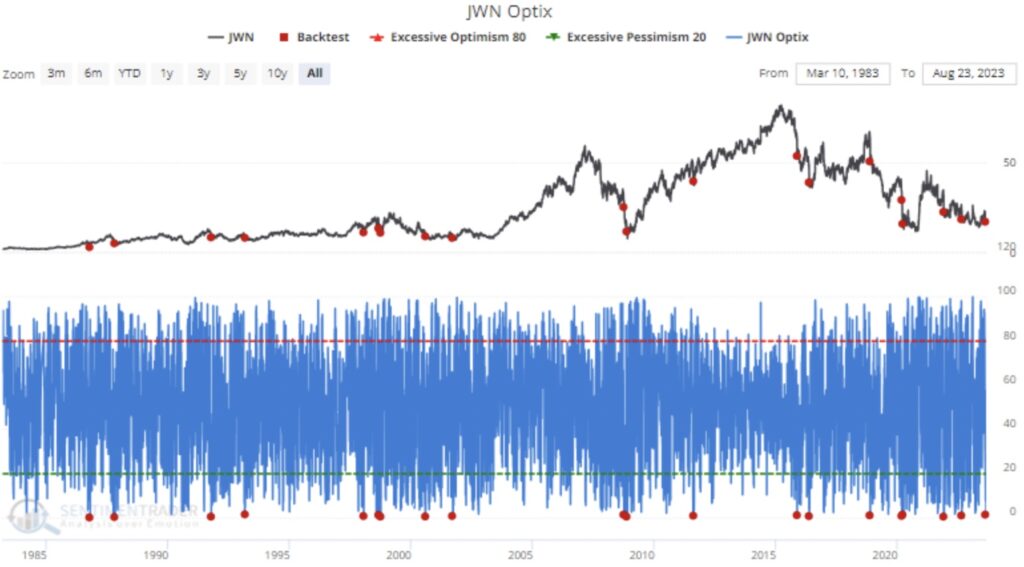

The Backtest Engine provides a chart with historical trading signals (red dots) so users can visualize the context for triggered alerts.

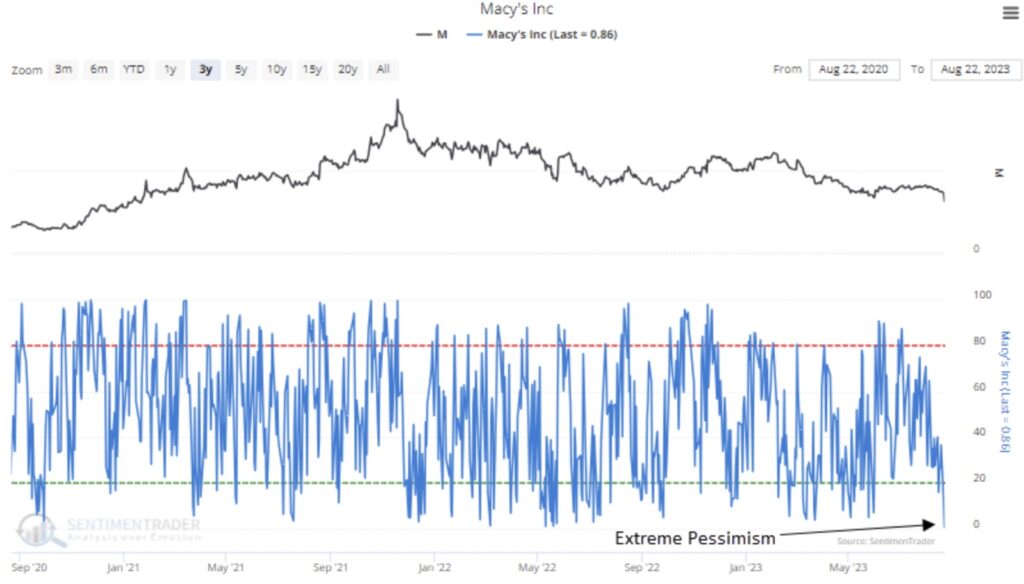

Macy’s (M) witnessed its Optimism Index drop to less than 1% for only the 11th time since 2000. The pessimistic extreme reached the lowest level since April 2020.

In the Backtest Engine parameters section, I’ll apply an Optimism Index reading of 1% and use a holding period of 15 trading sessions, similar to Dick’s setup.

When the Optimism Index for Macy’s plunges to a level like now, the stock tends to fall further in the near term. At some point over the next two weeks, Macy’s was lower in 8 out of 10 cases.

Pessimistic sentiment readings like now typically occur in significant downtrends for Macy’s and the broad market. So, with the S&P 500 in an uptrend, this time is different.

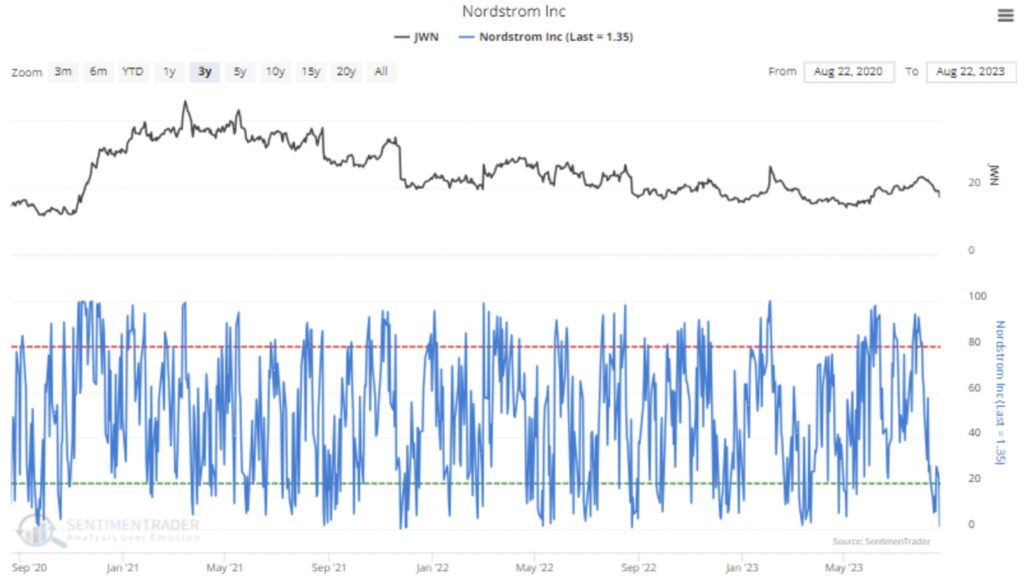

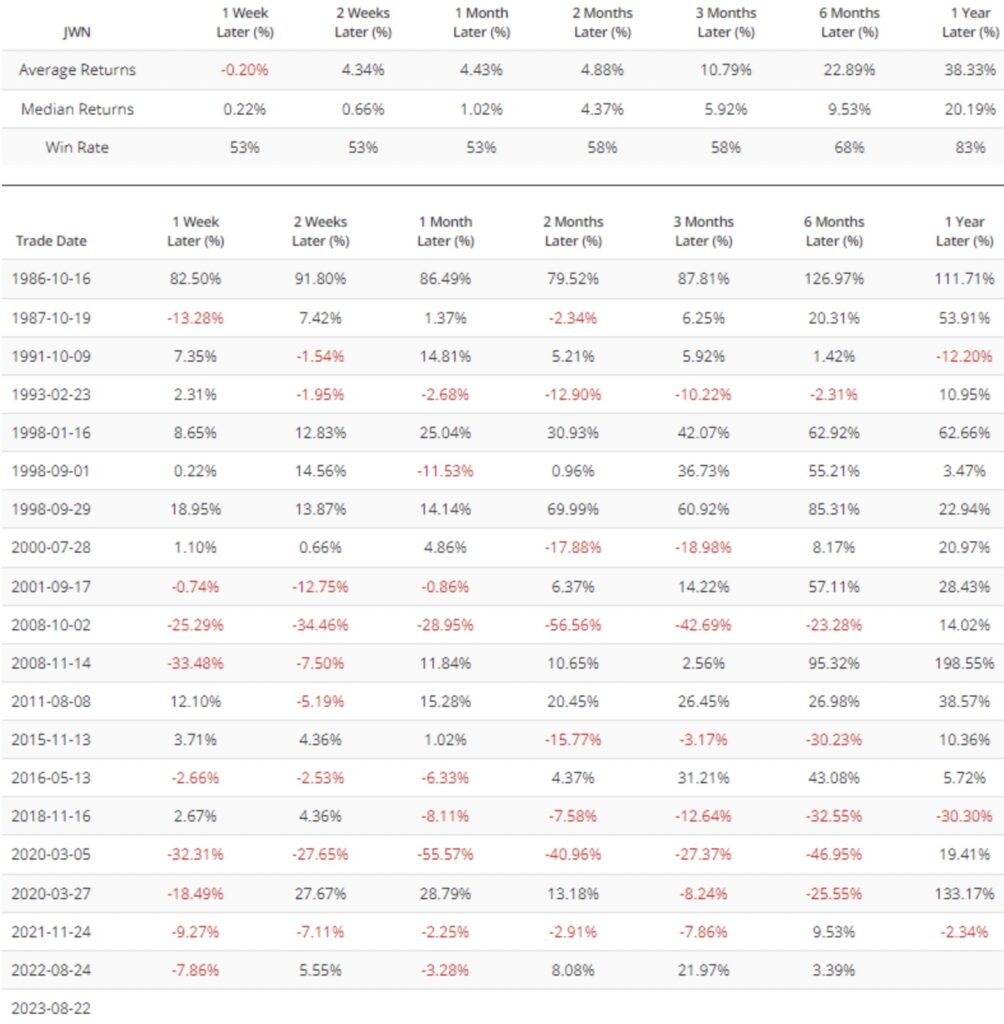

For only the 20th time since 1986, the Optimism Index for Nordstrom (JWN) plunged below 1.5%, the lowest level since August 2022.

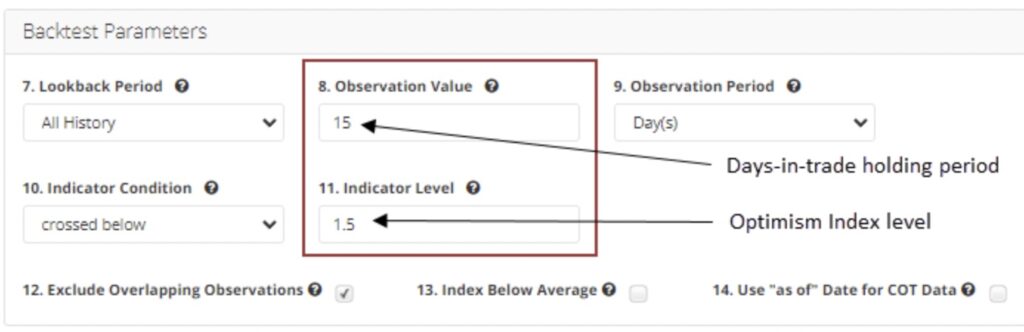

I’ll use a similar days-in-trade holding period for Nordstrom but adjust the Optimism Index level to 1.5% to reflect a slightly higher reading in sentiment when compared to Dick’s and Macy’s.

Recent results over the next month have been weaker, with 9 out of 11 instances closing lower at some point over that time frame. Overall, Nordstrom doesn’t provide a significant, long, or short edge.

Like the other stocks, pessimistic extremes like now tend to occur in significant drawdown periods.

What the research tells us…

The Optimism Indexes for Dick’s, Macy’s, and Nordstrom’s plunged to some of the lowest levels in history, suggesting extreme pessimism. After similar signals, the stocks tend to decline further over the next few months. When stocks react unfavorably to pessimistic sentiment conditions like now, all is not well. By using our proprietary indicators, data visualizations, and backtest engine, investors can quickly and efficiently test trading ideas like the ones in today’s research note. This is another example of why Jason Goepfert and the SentimenTrader team are the best in the world at what they do – providing actionable market data. To subscribe to the internationally acclaimed work Goepfert produces at SentimenTrader CLICK HERE.

ALSO JUST RELEASED: Gold Rallies As Stagflation Is An Ugly Thing CLICK HERE.

ALSO JUST RELEASED: Central Banks Are Fostering An Extinction Level Event CLICK HERE.

ALSO JUST RELEASED: Look At How Parts Of The Economy Have Collapsed CLICK HERE.

ALSO JUST RELEASED: STOCK MARKET SELL SIGNAL: Major Breakout In The Most Important Interest Rate CLICK HERE.

ALSO RELEASED: Take A Look At How Bad It Is For Banks Right Now CLICK HERE.

ALSO RELEASED: The Fate Of The World Is Being Decided Here… CLICK HERE.

ALSO RELEASED: The Global Debt Bubble Is Going To Unleash Havoc CLICK HERE.

To listen to Alasdair Macleod discuss the plunge in gold and silver prices, the historic BRICS meeting that will take place next week and so much more CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.