Here is where things stand after yesterday’s gold and silver takedown.

Weak holders shaken out of PMs

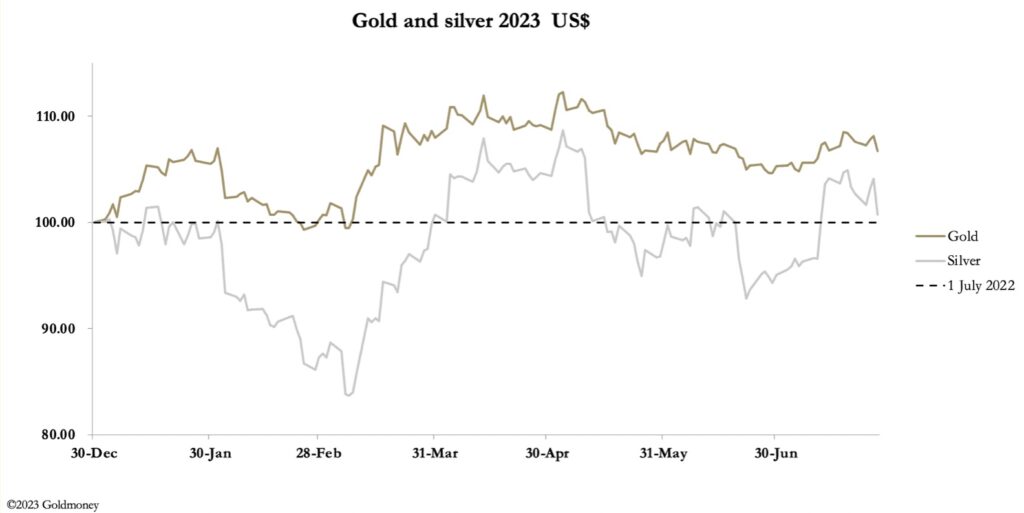

July 28 (King World News) – Alasdair Macleod: Yesterday (Thursday) figures were released estimating that US GDP grew by 2.4% annualised in the second quarter, compared with expectations of 2%. Buoyant consumer demand is expected to defer any monetary easing by the Fed, so gold and silver were marked down sharply on the news. This morning in European trade gold was at $1948, down $13 from last Friday’s close after hitting $1982 before the GDP news. And silver is at $24.12, down 43 cents after a high of $25.14.

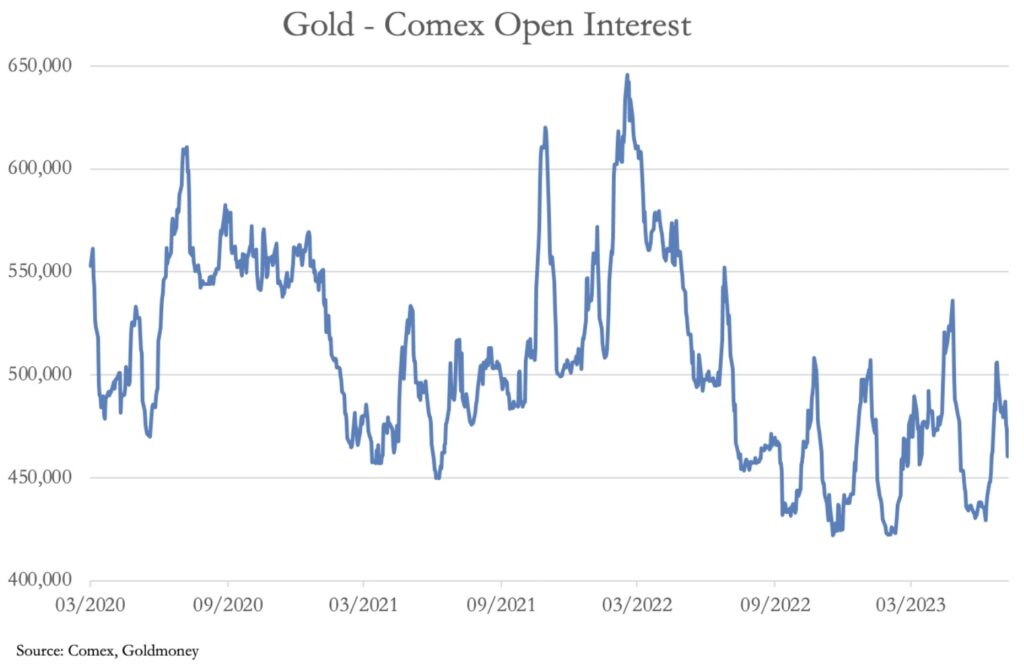

On Comex, turnover in gold futures was high yesterday and Open Interest fell 13,194 contracts on preliminary estimates. The short-term bullishness since late-June has been mostly corrected, with the net long position of the Managed Money category (hedge funds) reduced. This is reflected in gold’s Open Interest, which is our next chart.

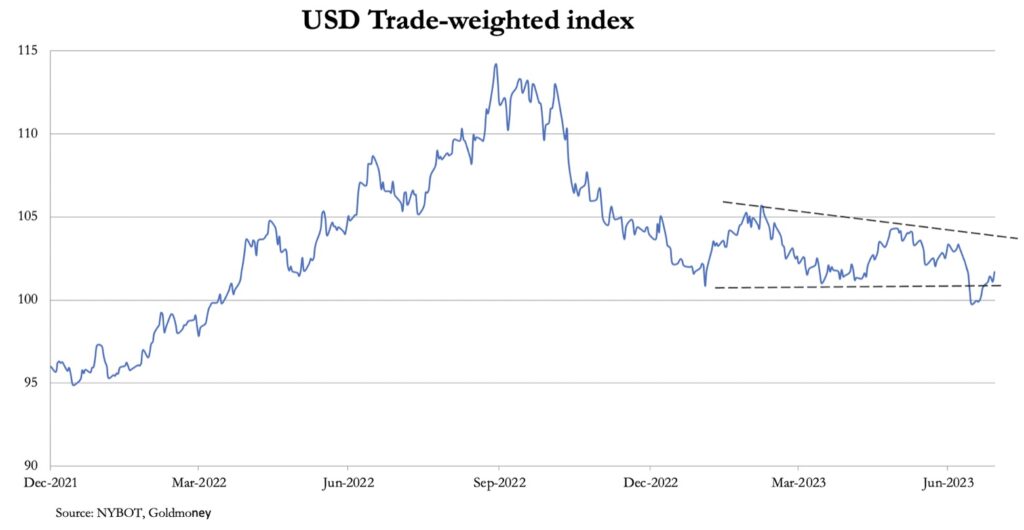

By this measure gold is certainly not overbought, telling us that the current setback should be read as a healthy correction. The background has been one of higher-than-expected interest rates, and a dollar that has moved sideways against other currencies. The dollar’s trade weighted index reflects the dollar’s current position vis-à-vis those currencies. This is next.

On balance, the TWI has not changed much this year so far. But in the days following Russia’s announcement that a new gold-backed trade settlement currency will be on the agenda for the August BRICS+ summit, the TWI broke down below the crucial 100.5 level, confirming that the pattern from end-January was a pennant flag likely to be followed by a significant move to the downside. The rally testing the 100.5 break is perfectly normal with a pattern of this nature, before the TWI continues to weaken.

Time will tell if this reading is correct, but the odds strongly favour it. However, this is just the dollar against other fiat currencies comprising the TWI. Nearly all of them face the same economic problems of a combination of a prospective recession, contracting bank credit, persistent consumer price inflation, and yet higher interest rates. The similarity with the troubles of the 1970s are striking but bewildering for market participants without that memory…

This Company Has A Massive High-Grade Gold Project In Canada And Billionaire Eric Sprott Has A Huge Position! To Learn Which Company Click Here Or On The Image Below.

Furthermore, the oil price is now rising, up 17% in the last month along with food staples. You can blame Russia, but inflation is a problem that just won’t go away.

In addition to the 1970s precedents, we can throw in additional factors, such as a military war in the Ukraine, sabre-rattling over Taiwan, and a financial war which is bound to devolve onto gold — the culmination of China and to a lesser extent Russia arming themselves with bullion before attacking the fiat soul of the western alliance. That soul is the need to fund the combination of spiralling budget deficits and debt accumulation by debasing their currencies.

These factors are increasingly likely to result in the end of the fiat currency era. Interest rates and the dollar’s TWI will become irrelevant. And the end of fiat means a return to the legal money of history — physical gold.

ALSO JUST RELEASED: Celente: Oil Surges Above $80 But Wildcards Could Send Price To $130 CLICK HERE.

ALSO JUST RELEASED: US Dollar, Gold, Bulls & Bears And Real Estate CLICK HERE.

ALSO JUST RELEASED: MAJOR GOLD BULL CATALYST: US Dollar In Danger Of Breaking Down CLICK HERE.

ALSO JUST RELEASED: Gold Moves Higher After Fed Decision And Post Hike Powell Interview CLICK HERE.

ALSO JUST RELEASED: What’s Next After Big Banks Turn Bearish On US Dollar CLICK HERE.

ALSO RELEASED: Ahead Of Fed Decision CRB Is Breaking Out On The Upside CLICK HERE.

ALSO RELEASED: CAUTION: The Public Has Now Gambled All In On Stocks CLICK HERE.

ALSO RELEASED: What To Expect As BRICS Gold-Backed Currency Launch Approaches CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.