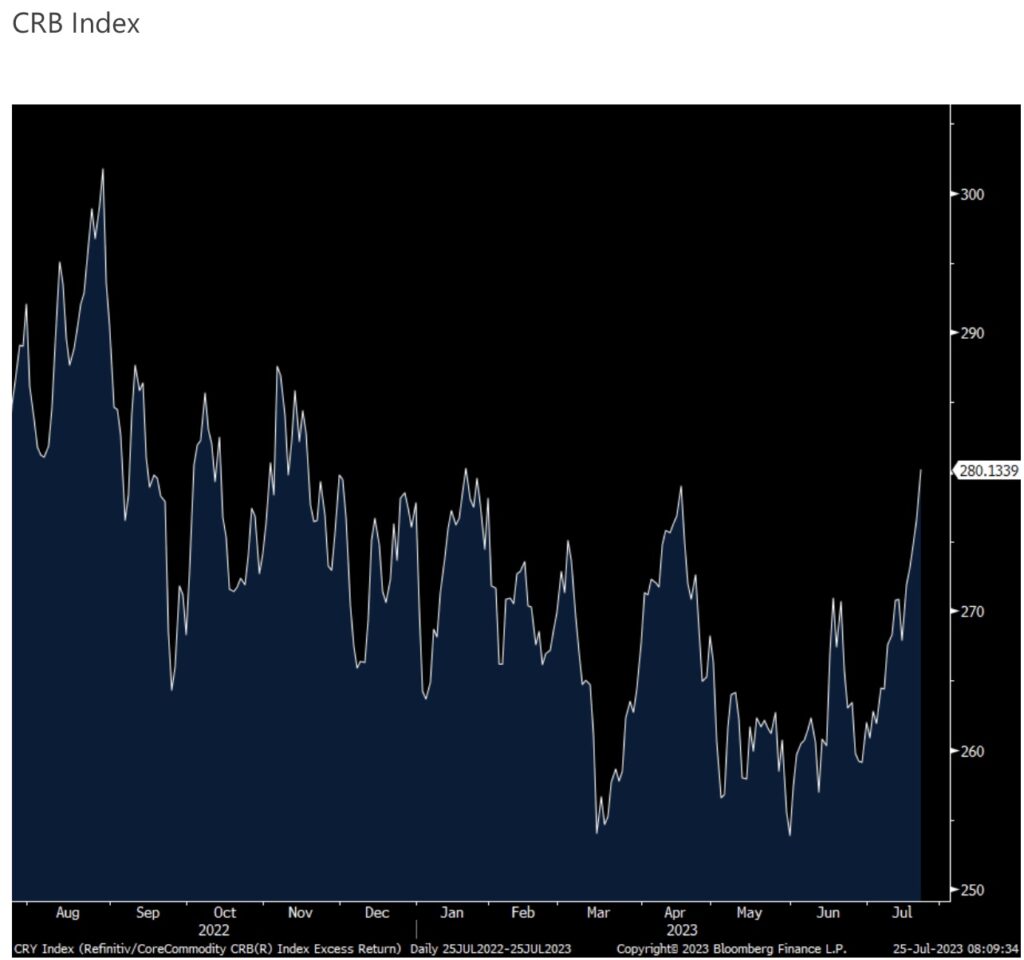

Ahead of the Fed’s decision on interest rates, the CRB Index is breaking out on the upside creating more worries about inflation.

CRB index quietly at highest level since November 2022

July 25 (King World News) – Peter Boockvar: The main story this morning is the seeming policy shift by the Chinese authorities towards their housing market in order to bring back the buyers and end the stress. In a statement after the Politboro meeting, they did not include “housing is for living, not for speculation” in their commentary on housing as they said they want to “adjust and optimize property policies timely.” Overall, restrictions, like downpayment requirements, will be eased. The property stocks there ripped higher. The Hang Seng property index jumped almost 6%. Specifically, China Overseas Land and Development was up by 12%, Longfor by 26% and Country Garden by 18%. The overall Hang Seng was up by 4.1%, the H share index Hong Kong rallied 5.3% and the Shanghai comp by 2.1%.

Commodity wise in response, iron ore is higher by 2% and copper by 1.5% to just within a few cents of the highest level since late April. The offshore yuan is rallying by .6% vs the US dollar. We know housing has been a major stress point in China ever since they shifted policy to try to break the debt binge and if they can use policy to stabilize the market, and if successful, it would be a big deal. We remain more positive on China’s economy in the coming years (has nothing to do with possible stimulus) than many (daily bashing of China every which way is widespread) due to their growing middle class and rising per capita income that will mitigate many of their other challenges like still having way too much debt and not enough consumer consumption as a % of GDP.

If this actually helps the Chinese economy, say goodbye to the disinflationary trends there and will further complicate the jobs of the Fed, ECB, BoE and others. This also comes as the Chinese government, very authoritarian of course, has completely backed away from the foot on the neck of parts of the private sector, particularly in technology and is trying to make nice. They’ve seen the error of their private sector bullying ways it seems. Lastly, they are announcing more steps on dealing with the debt bomb that is local government financing vehicles. It will remain to be seen if this can be managed effectively.

If you didn’t see yesterday, the CRB index rallied more than 1% and it’s now matching the highest level since November 2022.

Before I get to earnings commentary of note, it seems that the time bomb that is the repricing of debt that is maturing is going off every day in commercial real estate, along with other parts of the economy that goes under the radar. Just yesterday I saw a story on Bloomberg News titled “Cerberus, Highgate Miss Payments on $415 million Hotel Mortgage.” This was a portfolio of 30 Marriott Courtyards and the servicer report said “Borrower stated that they do not have enough funds to cover the shortage and the regular monthly debt service.” Another on Reuters, “Office Landlord Offers Glimpse of What’s to Come.” They talk about Piedmont Office Realty Trust, “The $910mm owner of high quality buildings in Boston, Dallas and beyond just borrowed at 9.25%, more than twice the interest rate it’s replacing.”

Bottom Line

Bottom line, understand that outside of the best credits, the private sector in the US economy has a cost of capital now of 8-12% give or take. That is double at least what was seen just a few years ago. And again, this will take years to adjust to, assuming rates stay high for a while, as more and more debt reprices.

On to earnings of importance. If you’re long any smartphone maker, and you know who I’m talking about, AAC Technologies in Hong Kong yesterday who is a supplier, lowered guidance citing weakness in mainland China but also “the uncertainty of the global economy, resulting in sluggish demand of the global smartphone market and increased intensified competition in the industry.” This follows what Taiwan Semi said…

ALERT:

Billionaire mining legend Pierre Lassonde has been buying large blocks of shares in this gold exploration company and believes the stock is set to soar more than 150% in the next 6 months. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

Inflation commentary from Domino’s Pizza, “During the second quarter, the average price increase across our US system was 3.9%. We expect average pricing to be similar in the third quarter before moderating in the fourth quarter to approximately 2%.”

Here was the outlook from Sherwin Williams, whose paints go into a lot of things, earnings release where they raised their own guidance, “At the same time, our 2nd half comparisons remain challenging, and demand is likely to vary widely by region and end market…In the Paint Stores Group, we expect demand to remain solid in commercial, property maintenance, protective and marine and residential repaint. We expect new residential demand to remain soft due to continuing slowing of completions, though share gains should enable us to outperform the market. In the Consumer Brands Group, North America DIY demand remains soft, Europe demand has stabilized and Latin American markets are mixed. In the Performance Coatings Group, North America demand has slowed, and Europe and Asia remain choppy.”

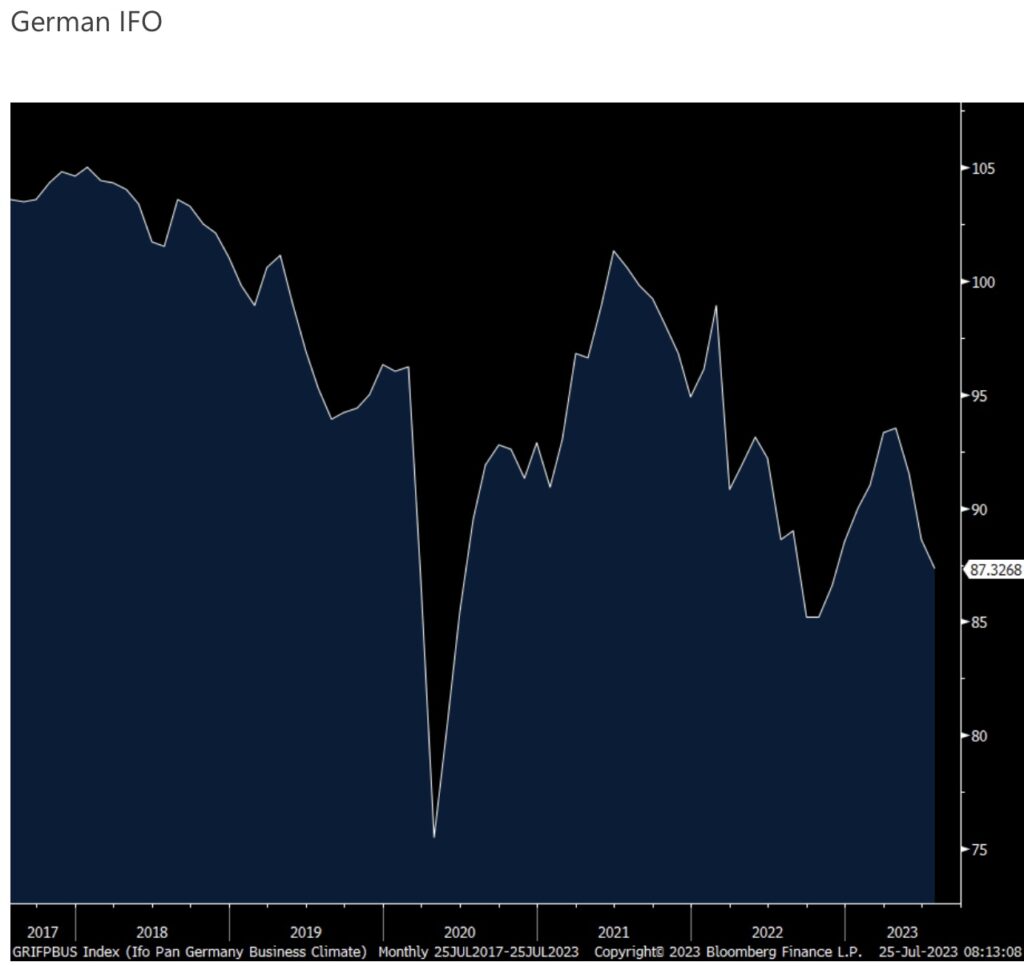

The German July IFO business confidence index fell to 87.3 from 88.6. That was below the estimate of 88 and the lowest print since November 2022. Both main components were down and the IFO said simply and honestly, “The situation in the German economy is turning bleaker.” In terms of industry groups, manufacturing, services, and trade all fell and construction declined to the weakest since February 2010. The number didn’t move markets today but the euro is a touch lower for a 6th straight day after an 8 day winning streak.

Just as the Fed has its quarterly survey of senior loan officers, the ECB does the same. And both lending standards tightened further and demand for loans shrunk. The former is protecting its balance sheet while the former is rethinking the current cost of capital.

ALSO JUST RELEASED: CAUTION: The Public Has Now Gambled All In On Stocks CLICK HERE.

ALSO JUST RELEASED: What To Expect As BRICS Gold-Backed Currency Launch Approaches CLICK HERE.

To listen to Alasdair Macleod discuss where gold and silver prices are set to spike higher and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.