The bear squeeze in the silver market continues with the price of silver solidly above $24 and gold trading near $2,000.

Silver Squeeze Continues

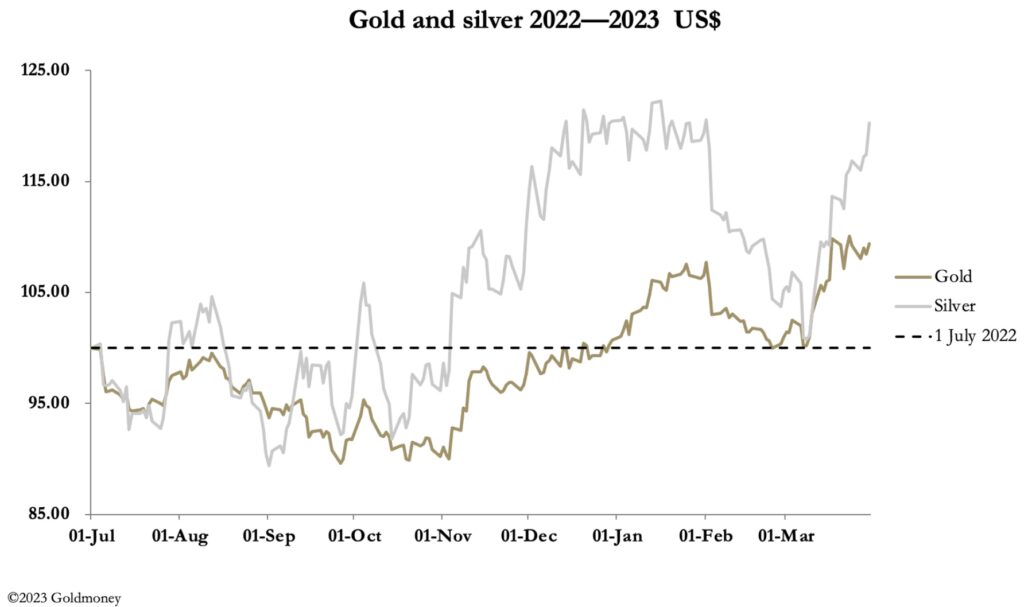

March 31 (King World News) – Alasdair Macleod: This week, gold continued to consolidate, while silver moved ahead. This morning, gold was at $1979, up $2 since last Friday’s close, while silver at $23.85 was up 66 cents, for a two week gain of $1.33. Admittedly, silver has not yet recovered the levels in January, unlike gold.

Much of this is down to silver’s volatility. But because silver is no longer regarded in the markets as a monetary metal, it is gold which has benefited from banking jitters, while derivative traders were busy shorting silver along with other metals, expecting a bank crisis to increase the odds of an economic slump.

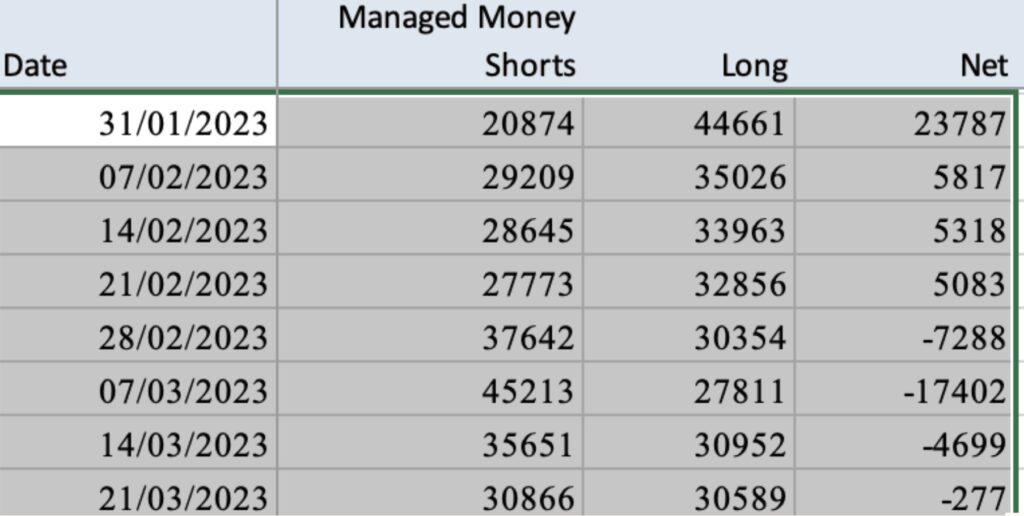

Now that the Commitment of Traders reports have been resumed, we can see that the hedge funds (Managed Money category) were seriously short in early-March, marking the lowest price at $20.

The figures in the spreadsheet above show that they were still net short by 277 contracts when the price had risen to $22.40, and the further rally to today’s level continues to be a squeeze on the shorts. Meanwhile the Swaps, who are normally short, had built their net long position to 11,710 contracts by the 21 March. We can expect these figures to be updated later this evening.

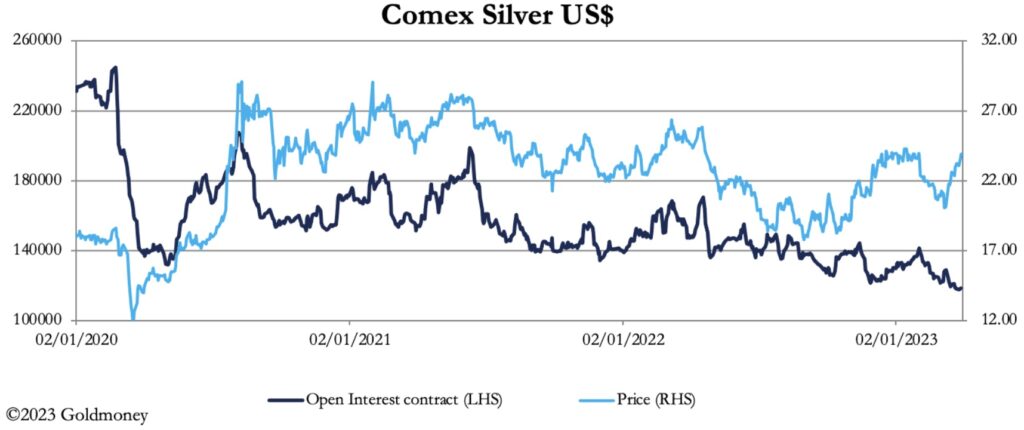

Evidence of the oversold condition is also found in Comex’s Open Interest, which on Tuesday at 117,395 contracts hit the lowest level since the 21 October 2013 — nearly ten years ago. This is next.

There are some technical similarities with the position in March 2020, when Open Interest dropped to 140,000 contracts, taking the price down with it, before both price and OI rallied smartly. Only this time the bullish dynamics appear to be more powerful.

The position in gold is different, as noted above. On 21 March, the Managed Money category was net long 81,229 contracts, against a long-term neutral position of about 110,000 net long. As usual, hedge funds give money to the bullion banks by selling low and buying high. So as the banking situation evolves and the dollar weakens, we can expect more buying attempted from this category…

ALERT:

This company is about to start drilling what could be one of the largest gold discoveries in history! CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

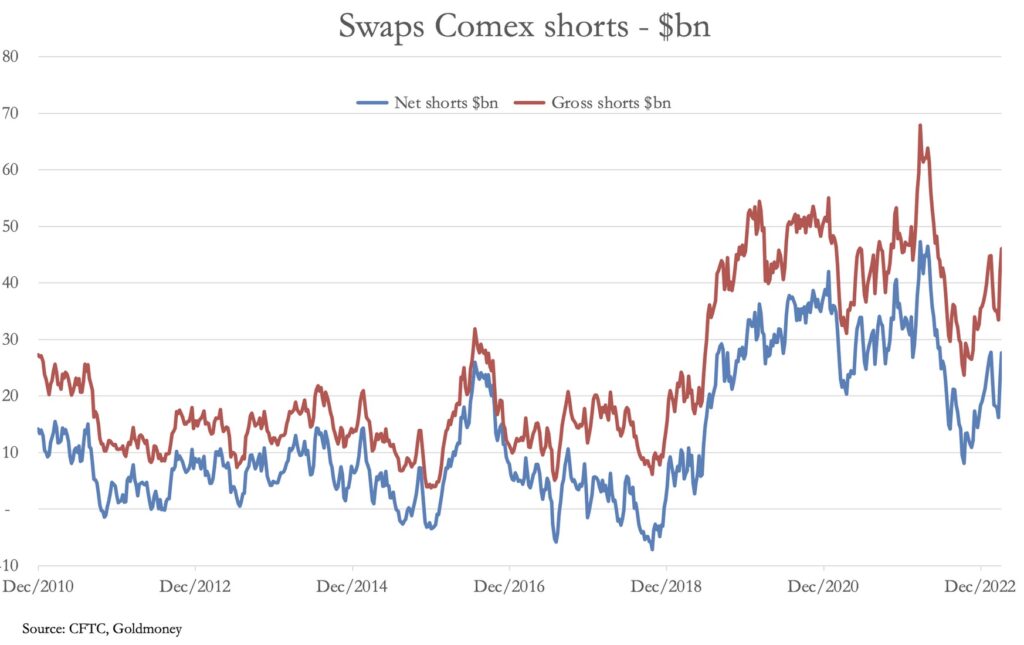

But we can be certain that banks will be looking carefully at their risk exposure in the widest sense, not just to contain losses, but to foster a reputation for sound management — no bank can afford to do otherwise for fear of a run on deposits. The position on Comex, reflected in the COT Swaps figures, is shown below.

Specifically, the value of their gross and net shorts is $47bn and $28bn respectively. This is about as low as it gets, and banks are unlikely to want their books to get any larger. This means that they will duck out of selling to hedge funds and the Other Reported category as much as possible. Furthermore, the drain on their physical stocks continues, with nearly 15 tonnes stood for delivery in March alone.

While the squeeze on silver is obvious, the developing position in gold looks likely to get more interesting as well.

King World News note: There should be a massive bull market in uranium and uranium stocks as the world moves more toward green energy mandates….

Uranium Market Long Overdue

Matthew Schwab: “I’m very optimistic about the short and long term potential for uranium investments right now. The uranium market is long overdue for a true bull market that realizes the rapidly escalating requirement for increased production and supply to satisfy worldwide energy requirements. As demand continues to increase in contrast to lessened production, the forecasted deficit continues to grow and inherently so does the risk of supply shortages for the world’s energy needs. Between only the US and China, we can expect an increased demand to supply over 300GW.

At Kraken Energy our team as been working to advance our brownfield projects as we move towards the goal of having assets in a production ready state. Concurrently with drilling at Garfield Hills, our geologists have continued to prospect and ground truth our airborne geophysical targets. In the past months they have now outlined a mineralized strike length on surface at Garfield Hills of over 4 km stretching east and west from our current area of drilling. As we continue to see surface readings with the handheld RS-125 spectrometer exceeding 15,000-30,000 cps we are very excited to continue developing the prospectivity at Garfield Hills.

The continued intersection of elevated radioactivity across drill targets at Garfield Hills combined with a 4 km strike of confirmed surface mineralization is highly encouraging as we continue to build the extent of uranium resource potential on the property. With the known drilling area open in all directions and at depth, our team is eager to begin planning a follow-up Phase 2 drilling program at Garfield Hills for 2023. Kraken Energy, symbol UUSA in Canada and UUSAF in the US.

ALSO JUST RELEASED: ALERT: Money Supply Shocker, Plus Silver On The Cusp Of A Major Breakout CLICK HERE.

ALSO JUST RELEASED: Look At What Consumers Are Doing As Access To Credit Will Only Get More Expensive From Here CLICK HERE.

ALSO JUST RELEASED: Don’t Let Stock Rally Fool You, The New Normal Is New World Disorder CLICK HERE.

ALSO JUST RELEASED: Money Flowing Into Gold In Europe But Some Gold Bulls Are Being Left Behind CLICK HERE.

ALSO RELEASED: Central Banks Must Now Hyperinflate As Minsky Moment In “Ponzi Finance” Looms CLICK HERE.

ALSO RELEASED: INFLATION ALERT: Prices Heading Higher In This Key Area, Plus A Look At Gold And Banks CLICK HERE.

ALSO RELEASED: Michael Oliver – We Are Now In A Major Upside Trend Shift For Silver Bulls CLICK HERE.

ALSO RELEASED: We Are Still Facing Major Economic Problems CLICK HERE.

ALSO RELEASED: To Bond Killers And Other Villains Destroying Our World CLICK HERE.

ALSO RELEASED: Leeb – JP Morgan’s Massive Gold Derivative Short Position May Be Larger Than The Bank’s Assets CLICK HERE.

ALSO RELEASED: Gold Breakouts Everywhere As Bank Crisis Now Set To Accelerate CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.