Look at what consumers are doing as access to credit will only get more expensive from here. Plus a look at global markets and a surprising bull market.

A Sigh Of Relief

March 30 (King World News) – Art Cashin, Head of Floor Operations at UBS: As I just told Carl Quintanilla and Sara Eisen on Squawk on the Street, I think this may be a sigh of relief rally after last Friday’s brush with near collapse.

The seasonality is a little bit upside down. April is one of the very best months for the bulls and yet, I still think that once this sigh of relief rally wears off, we may rollover and see some serious testing.

That may have to, in fact, wait until earnings season begins in earnest in a couple of weeks, but we will see from there.

For now, there is very mild resistance around the 4060 level and, as we said in this morning’s Comments, up around 4080/4090 and, we will be keeping an eye on the yields. They are firming ever so slightly, but it is just a few basis points so, it is not catching everyone’s full attention. The rally probably can last through the day and possibly even into Friday, depending on what the early data comes out to be, although I am not so sure the inflation data will be as helpful as some think.

For now, the bulls are still in control and, I think, they may find some resistance as things move forward.

Stay safe.

Arthur

US Making A Big Mistake

Peter Boockvar: By the way, on refilling the SPR, a few days ago Energy Secretary Jennifer Granholm said they won’t start buying until the end of the fourth quarter. Complicating the decision is that two of the four SPR sites are down for maintenance. My money is on the refill taking place at much higher prices than currently seen. A good trade will be at risk of becoming not so much.

Very Interesting Comments

Four of the more entertaining days of the year come when RH has its quarterly conference call and CEO Gary Friedman tells us what he thinks. Here are some things he said last night:

“As noted in our previous shareholder letter, we expect business conditions to remain challenging for the next several quarters and possibly longer as a result of the accelerating weakness in the housing market, the uncertainty generated by the recent banking crisis and the cycling of record Covid driven sales and backlog reductions.”

“I think based on the times we’re in and the uncertainty we’re facing whether it’s the continued rise of interest rates or the next bank or two. It’s hard to be anything but conservative right now and I think it would be foolish to be not just from the perspective of disappointing investors but disappointing ourselves and possibly making decisions and investments before we can see around the next corner.”

“So we think there will be an inflection in the second half. What we don’t know is what will be the economic environment in the second half. What would be the condition of the banking industry in the second half? Where will interest rates be in the second half? Where will inflation be in the second half?”

“Look, do we think things are going to get significantly worse? I don’t think so. I’ve never seen a luxury home market down 45% a quarter ever (which it was this past quarter), not even in 2008 and ’09. So I think we’re near the bottom but could get a little worse.”

When looking at the interest rate history of the 1970’s and 1980’s, “There’s not many people on the planet in levels of authority and responsibility that were old enough to experience those times and I think that having a conservative view and being prepared, have a strong balance sheet and trying to see the whole board and all the moves.”

Access To Credit Will Only Get More Expensive From Here

We finally saw a high yield debt deal on Tuesday from Multi-Color Corp who raised $300mm but at a steep cost of 9.5% with a 5 yr maturity. That’s almost 600 bps over the 5 yr Treasury yield. For the broader high yield universe, the spread to Treasuries as of yesterday was 480 bps vs over 500 bps last week. The one yr high was 584 bps last July. Access to credit and the cost of it will only get more expensive from here…

To Find Out Which Uranium Company Is Positioning Itself To Become A Powerhouse In Nevada Click Here Or On The Image Below.

What Consumers Are Up To

Thanks for the heads up from Quill Intelligence, in the Conference Board’s consumer confidence report from Tuesday, they had a special question and “asked about consumers’ spending plans on services (not goods) over the next six months.

“The results reveal that consumers plan to spend less on highly discretionary categories such as playing the lottery, visiting amusement parks, going to the movies, personal lodging, and dining. However, they say they will spend more on less discretionary categories such as health care, home or auto maintenance and repair, and economical entertainment options such as streaming. Spending on personal care, pet care, and financial services such as tax preparation is also likely to be maintained.”

Overseas

Overseas, the March Eurozone Economic Confidence index fell to 99.3 from 99.6. The estimate was for a modest rise to 100. All five components fell m/o/m in manufacturing, services, consumer, retail and construction. This figure was 105 in February 2020. We know Europe has benefited from a mild winter and the China reopening in fits and starts but the flow of credit is now slowing while lending standards rise at the same time about 80% of the credit comes from banks.

Spain saw an almost halving of its March inflation rate to 3.3% y/o/y from 6% but it was all energy. The core rate held little changed at a still very high pace of 7.5%. Spanish bond yields are down a touch but are also so for the whole region. Germany’s headline CPI at 8am estimate is expected to rise by 7.5% y/o/y vs 9.3% in February. Energy too is the big influence as well as energy subsidies. The euro is quietly rising to near a 2 month high vs the US dollar. While the Fed is likely done hiking, the ECB has more catching up to do and ECB members seem to quite comfortable with the balance sheet condition of its banks. After all, they went thru NIRP and QE hell for almost 10 years.

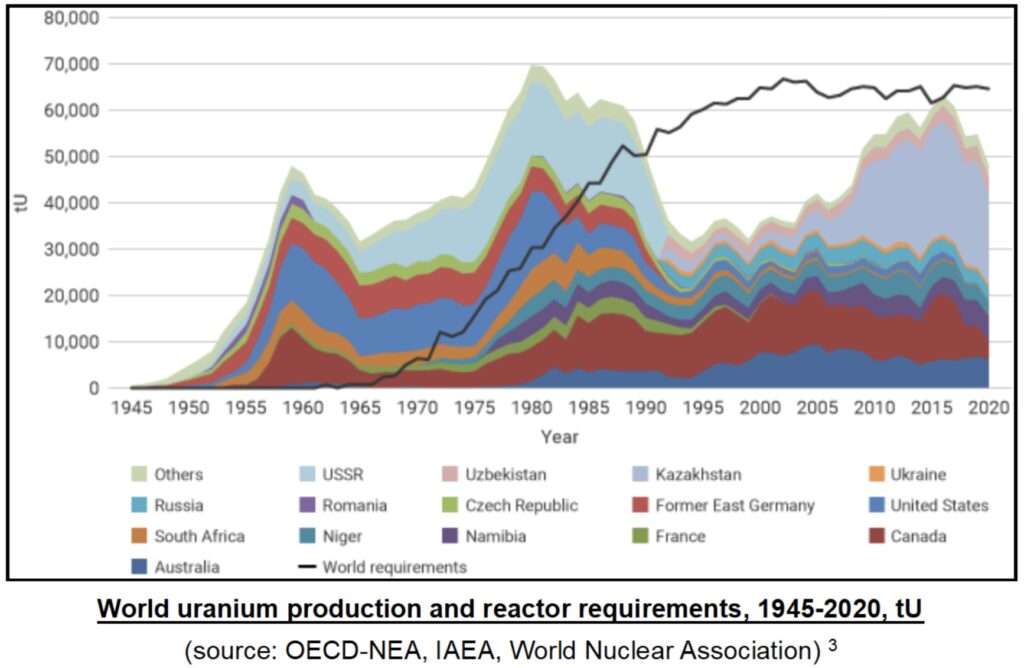

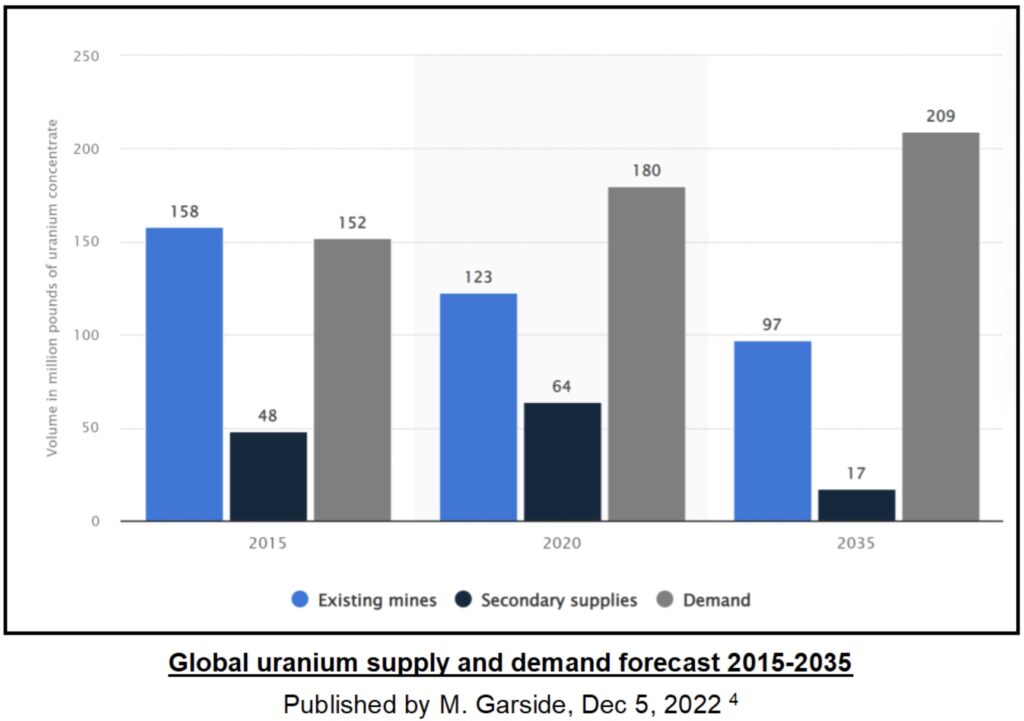

King World News note: There should be a massive bull market in uranium and uranium stocks as the world moves more toward green energy mandates….

Matthew Schwab: “I’m very optimistic about the short and long term potential for uranium investments right now. The uranium market is long overdue for a true bull market that realizes the rapidly escalating requirement for increased production and supply to satisfy worldwide energy requirements. As demand continues to increase in contrast to lessened production, the forecasted deficit continues to grow and inherently so does the risk of supply shortages for the world’s energy needs. Between only the US and China, we can expect an increased demand to supply over 300GW.

At Kraken Energy our team as been working to advance our brownfield projects as we move towards the goal of having assets in a production ready state. Concurrently with drilling at Garfield Hills, our geologists have continued to prospect and ground truth our airborne geophysical targets. In the past months they have now outlined a mineralized strike length on surface at Garfield Hills of over 4 km stretching east and west from our current area of drilling. As we continue to see surface readings with the handheld RS-125 spectrometer exceeding 15,000-30,000 cps we are very excited to continue developing the prospectivity at Garfield Hills.

The continued intersection of elevated radioactivity across drill targets at Garfield Hills combined with a 4 km strike of confirmed surface mineralization is highly encouraging as we continue to build the extent of uranium resource potential on the property. With the known drilling area open in all directions and at depth, our team is eager to begin planning a follow-up Phase 2 drilling program at Garfield Hills for 2023. Kraken Energy, symbol UUSA in Canada and UUSAF in the US.

ALSO JUST RELEASED: Don’t Let Stock Rally Fool You, The New Normal Is New World Disorder CLICK HERE.

ALSO JUST RELEASED: Money Flowing Into Gold In Europe But Some Gold Bulls Are Being Left Behind CLICK HERE.

ALSO JUST RELEASED: Central Banks Must Now Hyperinflate As Minsky Moment In “Ponzi Finance” Looms CLICK HERE.

ALSO JUST RELEASED: INFLATION ALERT: Prices Heading Higher In This Key Area, Plus A Look At Gold And Banks CLICK HERE.

ALSO RELEASED: Michael Oliver – We Are Now In A Major Upside Trend Shift For Silver Bulls CLICK HERE.

ALSO RELEASED: We Are Still Facing Major Economic Problems CLICK HERE.

ALSO RELEASED: To Bond Killers And Other Villains Destroying Our World CLICK HERE.

ALSO RELEASED: Leeb – JP Morgan’s Massive Gold Derivative Short Position May Be Larger Than The Bank’s Assets CLICK HERE.

ALSO RELEASED: Gold Breakouts Everywhere As Bank Crisis Now Set To Accelerate CLICK HERE.

***To listen to Dr. Stephen Leeb discuss JP Morgan’s precarious short position in the gold market and much more CLICK HERE OR ON THE IMAGE BELOW.

***To listen to Alasdair Macleod discuss available physical gold and silver inventories disappearing, why the bank runs and crisis are set to accelerate and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.