Today SentimenTrader issued a report of caution in the silver market. For those of you looking to accumulate physical silver and gold there is a note at the end of the piece discussing timing your purchases.

Careful Here With Silver

May 17 (King World News) – SentimenTrader: A swift reversal in silver suggests further downside.

Key points:

- Silver futures reversed from a 4-month high to a 6-week low in eight sessions

- Similar reversals preceded negative returns for the commodity over the next two months

- Additional factors like seasonality are negative and about to get a lot worse in June

Negative momentum begets more negative momentum

Silver, like gold, has benefitted from the weak dollar, which bottomed last October with stocks. Could the recent downside momentum in the commodity signal that the debt ceiling negotiations are nothing more than Washington theater? Perhaps, a buy-the-rumor, sell-the-fact event. Let’s avoid the narrative game and follow an objective approach to the latest price action…

This Company Has A Massive High-Grade Gold Project In Canada And Billionaire Eric Sprott Has A Huge Position! To Learn Which Company Click Here Or On The Image Below.

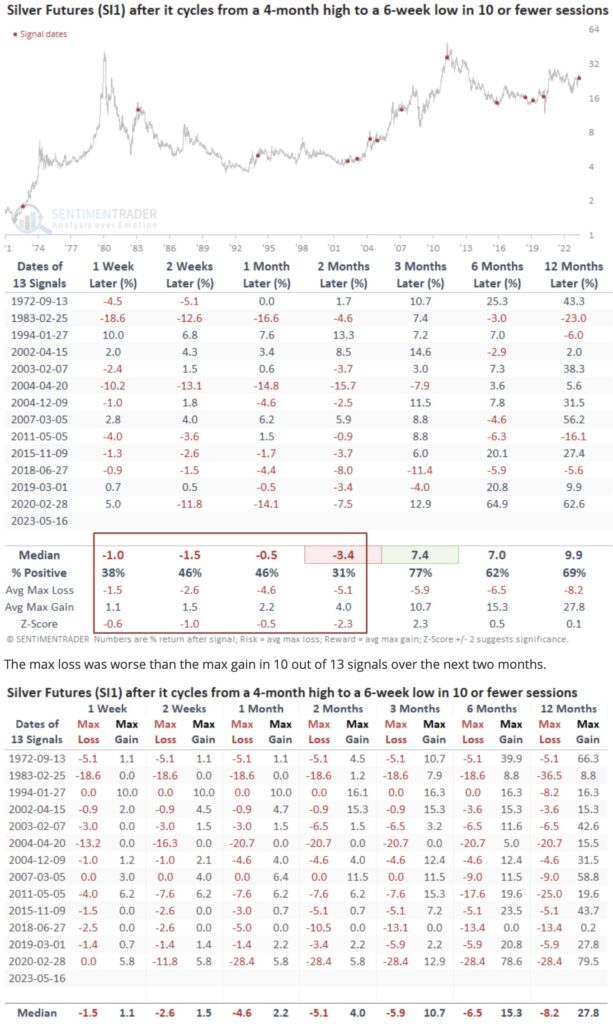

For only the 14th time since 1972, silver futures cycled from a 4-month high to a 6-week low in ten or fewer sessions. The previous signal occurred in February 2020, when everything crashed during the Covid meltdown.

Similar reversals in the price of silver preceded additional downside follow-through

The negative momentum continues over the next few months when the silver futures contract cycles from a 4-month high to a 6-week low in ten or fewer sessions. Once the downside price action subsides, silver tends to bounce back in the three-month time frame.

If you think silver and other precious metals are in a secular bull market, I would be mindful that the commodity showed a loss in the two-month horizon in 4 out of 6 precedents during the last secular bull between 2002 and 2011.

12 Months Later Silver Price Higher 9 Out Of 13 Times After This Signal Occurred

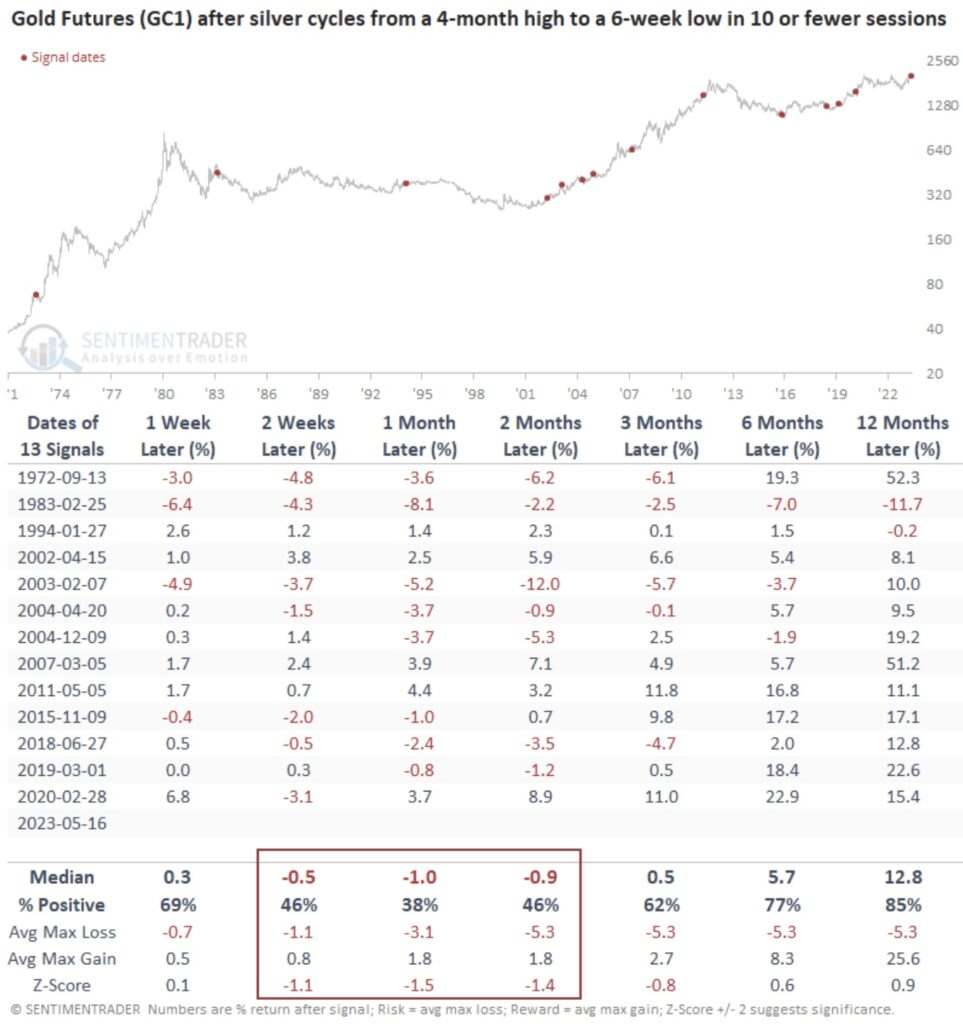

What about gold?

The reversal in silver suggests the precious metals complex could be in the penalty box over the next few months. And seasonality for gold is entering a soft patch, which my colleague Jay Kaeppel recently highlighted in a research note.

12 Months Later Gold Price Higher 11 Out Of 13 Times After This Signal Occurred

Seasonality is about to become a significant headwind

Silver is a few weeks away from entering the worst month of the year for seasonality.

What the research tells us…

Silver futures cycled from a 4-month high to a 6-week low in less than ten trading sessions. After similar price reversals, the commodity tends to exhibit further downside momentum over the next few months. Gold could follow silver lower, albeit the outlook is not as adverse. With seasonality for precious metals turning unfavorable in June, the weight of the evidence does not bode well for silver or gold.

The Good News For Silver & Gold

King World News note: If you are dollar cost averaging your purchases of physical gold and silver do not get cute and try to time these markets. Just buy your physical gold and silver at the same time each week, month or quarter. For those of you who feel like you missed the move in silver and have been looking for a good entry point, use any significant weakness to establish your position.

If you look at the data chart showing the 13 previous times this signal has occurred in the silver market, 9 out of 13 times the price of silver was higher 12 months later and 6 out of those 9 times the price of silver was significantly higher 12 months later and for gold the price was higher a staggering 11 out of 13 times this signal occurred. The bull market in gold and silver has been and continues to be fueled by the reckless behavior of central banks around the world and one thing you can count on is the fact that they will continue to be reckless in the years ahead. Continue stacking physical gold and silver.

This is another example of why Jason Goepfert is the best in the world at what he does – providing actionable market data. To subscribe to the internationally acclaimed work Goepfert produces at SentimenTrader CLICK HERE.

ALSO JUST RELEASED: WARNING: The Economy Is Already In Full Collapse CLICK HERE.

ALSO JUST RELEASED: WARNING: The Economy Is Already In Full Collapse CLICK HERE.

ALSO JUST RELEASED: The Economic Collapse Continues, Plus Silver Looks Explosive CLICK HERE.

ALSO JUST RELEASED: Greyerz Just Warned The World Is Facing A Catastrophic And Disorderly Reset CLICK HERE.

ALSO JUST RELEASED: Man Connected In China At Highest Levels Warns Of US Dollar Collapse CLICK HERE.

***To listen to Alasdair Macleod discuss the takedown in the silver market and what’s next for the precious metals markets CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.