This week the price of gold broke above $2,000 once again as the banking crisis continues and the Dow trades near its recent low.

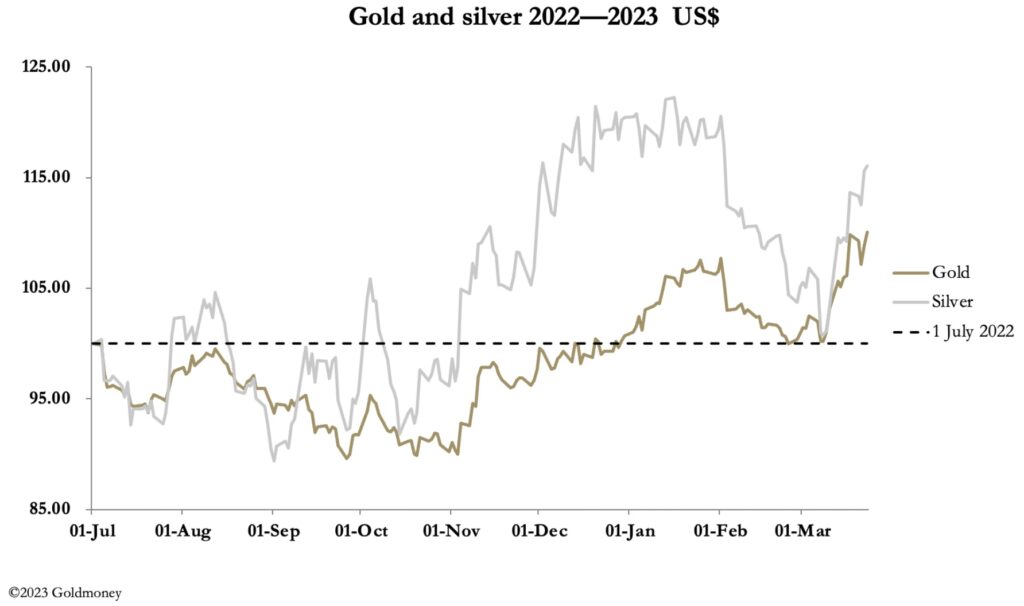

March 24 (King World News) – Alasdair Macleod: Gold and silver consolidated recent gains before rallying to test higher ground. In European morning trade, gold was $1992, up a net $4 from last Friday’s close. Silver outperformed gold at $23.15, up 55 cents.

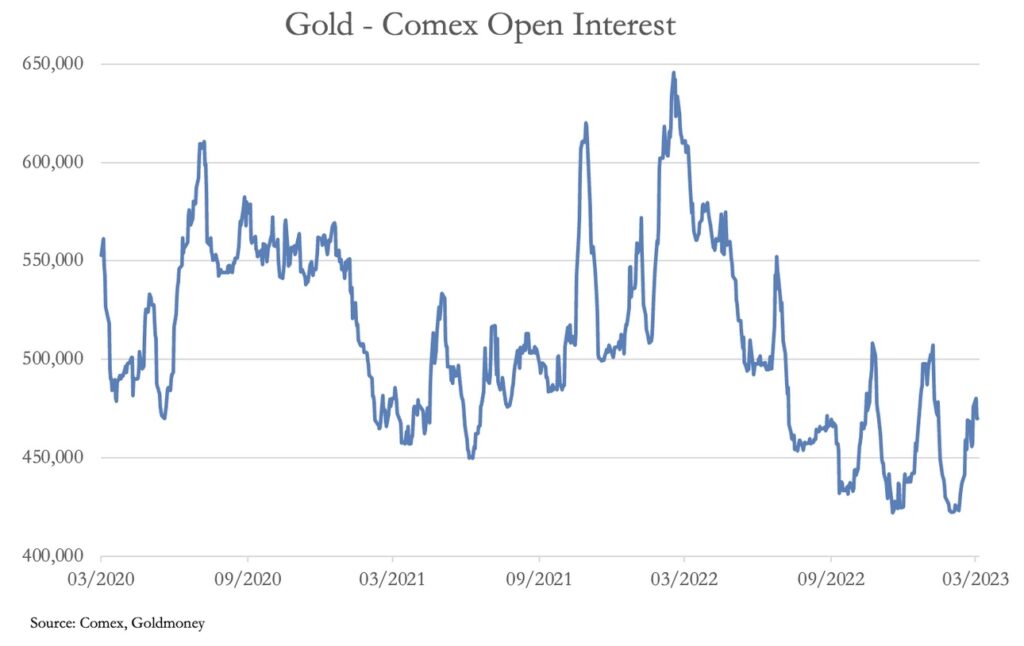

Open interest in gold has increased from February lows as the next chart shows, but still has considerable headroom.

Analysts following relative strength indicators claim that gold and silver are overbought, but they are looking at the wrong indicator. Comex Open Interest clearly shows that there has been a pick-up in speculator positions — they are one side of OI which has increased since February by nearly 55,000 contracts. But there is still considerable upside in this indicator before it screams overbought at 600,000 contracts.

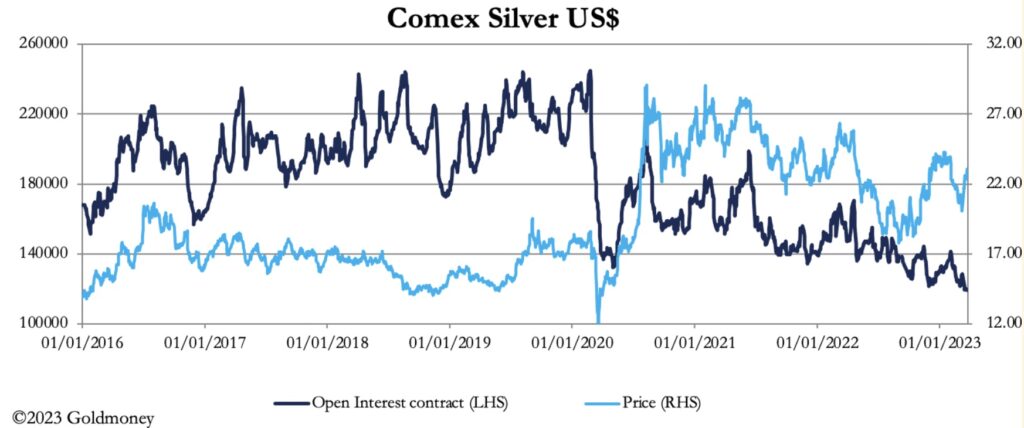

The position in silver is amazing — there’s no other word for it. Open Interest is as low as it gets. This chart is next.

Open Interest In Silver Remains Collapsed – Very Bullish

At only 119,281, OI has not been this low for many years. It indicates zero bullishness in the Managed Money category (hedge fund speculators). This divergence from gold does have an obvious explanation — the gathering storms over global banks. It has led to genuine hedging demand for gold contracts, but not for silver which is regarded more as an industrial metal than a financial hedge.

That said, industrial metals have been quietly firm as well, with copper rising 5% over the last month, while energy prices have declined by about 8%. But the big story is all about failing banks. While we are acutely aware of a depositor run on some banks sparked by fears of counterparty risk, we are less aware of a run on physical gold (and silver to a lesser extent) as Asians dump dollars for bullion…

This Company Has A Massive High-Grade Gold Project In Canada And Billionaire Eric Sprott Has A Huge Position! To Learn Which Company Click Here Or On The Image Below.

We see this manifest in a different set of completely unrelated numbers. While bank share prices in the US, EU, UK, Switzerland, and Japan have been tanking, in China they have been rising. In other words, the banking and credit crisis is solely a Western phenomenon from which Asians are trying to escape.

But returning to paper markets, gold appears to be consolidating for an assault on the $2,000 level. Undoubtedly, there are some short-term bulls driven by the sell-dollar/buy-gold and vice-versa trade, who on the slightest sign of a rally in the dollar’s trade weighted index will reverse their positions, or be shaken out by bullion banks which have taken the short side.

For what it’s worth, next up is the technical chart, which suggests that more consolidation for the dollar price of gold would be healthy.

The move above these popularly followed moving averages confirms the whole move is in bullish sequence, but the sideways consolidation which started from the $2070 level in August 2020 is still intact. Only when the price breaks above that convincingly will pattern chartists be fully satisfied.

In silver, the equivalent level which was achieved in August 2020 and February 2021 is $30. But for now, it’s all about a banking crisis and the buying of physical gold.

ALSO JUST RELEASED: Billionaire Investor Pierre Lassonde Just Warned “It’s Not Going To Be Pretty This Fall” CLICK HERE.

ALSO JUST RELEASED: Upside For Silver May Be Quite Jaw-Dropping For Many Years To Come CLICK HERE.

ALSO JUST RELEASED: ALERT: Here Is What You Need To Know Post-Bank Runs And Bailouts CLICK HERE.

ALSO JUST RELEASED: Why Six-Figure Earners Still Rent A Home Instead Of Buying CLICK HERE.

ALSO RELEASED: The Most Important Chart Of 2023 Will Blow Your Mind CLICK HERE.

ALSO RELEASED: The Great Rotation Out Of Stocks Has Begun. Here Is Where The Money Is Going CLICK HERE.

ALSO RELEASED: Legend Richard Russell Warned Every Fiat Currency In The World Will Be Destroyed CLICK HERE.

ALSO RELEASED: Greyerz – THIS IS IT! The Global Financial System Has Started To Collapse CLICK HERE.

ALSO RELEASED: Gold Nears Record High As James Turk Warns US Dollar May Collapse In 2023 CLICK HERE.

ALSO RELEASED: CHAOS ERUPTS: It’s Going To Get Much Worse As The Collapse Will Spread To Currencies And Gold Shines CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.