The man who is connected at the highest levels in China warned of a collapse in the US dollar is only a matter of time and says gold is headed higher.

Too Big to Save?

May 14 (King World News) – John Ing: The return of calm in the financial markets following the overnight rescue of Credit Suisse may signal the worst is over. But as we learned, borrowers still face a squeeze. Bank runs can surface overnight the moment confidence is tested. Governments were unprepared for the change in the global interest rate environment. Spending particularly in Canada remains a priority, despite widening deficits. In Washington, the administration does not seem to be overly concerned about the cost of the federal bailouts nor to stop the next one. Permanent bailouts, guarantees and subsidies are part of its playbook, including guaranteeing every deposit in America. It is estimated that the banking crisis alone resulted in another $2 trillion addition in global liquidity which not surprisingly boosted stock prices again. Yet the underlying problems are plain to see.

Stock market history is littered with crashes and on average 20% or more pullbacks happen every seven years. In decades past, the implosions of Long Term Capital, Enron, Madoff, 2008 global meltdown and lately FTX crypto, the Fed flooded the economy with liquidity, worrying about the consequences later. Money matters. Print too much and history shows that inflation always follows. However unlike in 2008 when inflation was a non-event, debt levels today are much higher and the trifecta of soaring inflation, record debt levels and another banking crisis leaves government little room to spend their way out of trouble.

The Fed is now caught between rising inflation and a banking crisis caused in part by the Fed’s run-up in rates. Inflation is embedded. Services output (excluding energy) is up 7.3%. Labour remains tight. Shelter is up, car prices returned to highs. Consumers are spending some of that pandemic largesse. Simply today’s inflation is a product of yesteryears’ policies in response to the last crisis in 2008. At that time, the federal debt was $9.5 trillion, or 67% of GDP. It is now $31.4 trillion, or 130% of GDP, and it is constantly rising.

Nearly 10% of federal revenues are used to pay interest on the debt. For the second year in running, the non-partisan Congressional Budget Office (CBO) predicted that the government deficit would be $1.4 trillion, or 6% of GDP, which would be unsustainable for other nations.

Debt Default?

And yet, the Fed increases its influence after every crisis, while the government continues to fuel inflation. Deficit spending, we are told is necessary. All carry a price tag. The US ended the 1990s with a national debt of $5.7 trillion. Little is mentioned that today the US government breached the $31.4 trillion borrowing limit, and particularly worrisome is that the Republicans are threatening to push America into default, unless there are spending cuts. A political deadlock on debt rescheduling would have disastrous consequences given the high level of US debt relative to GDP and the fact that 25% of the country’s debt is owed to foreign creditors. Still, investors and the Federal Reserve remain complacent in the belief that another short-term fix is in the cards. However, America’s spiraling debt is not going away and next year in an echo of 2016, markets will face round two of Biden versus Trump.

Worrisome is that like its dysfunctional banking system, America is too big to fail and, who will save America? The Fed’s reverse repo facility at $2.2 trillion is just another stealth QE III, with banks borrowing $500 billion in a week. As the Fed finances the banks, money market participants, and now the market with the aftershocks and contagion, a greater issue, the plumbing is blocked. As long as the government keeps using taxpayers’ funds to save its banking buddies, trust is absent. The US economy is no longer exceptional.

More broadly, what happens when cautious international investors, fearful of this new era of banana- type financial chaos, decide to dump dollars which would spark a run on the dollar, particularly when the risk of default looms over the debt ceiling stalemate. One thing is clear. Inflation is here for the long haul and the self-inflicted wound of a sovereign default would topple the dollar with catastrophic consequences. In a few months the US might not be able to pay its own bills, let alone bailout its banking sector. Who then will bailout Uncle Sam?…

ALERT:

Powerhouse merger caught Rio Tinto’s attention and created a huge opportunity in the junior gold & silver space CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

US Dollar Collapse

America’s reliance on credit – consumer, corporate and federal, like its banking system has a breaking point. The world’s financial system was established at Bretton Woods in 1945 and subsequently from the end of World War II through the early 70s, currencies were fixed against the dollar, making it the de facto global currency. But the system fell apart when soaring debts caused by Lyndon Johnson’s “guns and butter” era helped fuel the inflation of the 1970s, forcing President Nixon to devalue the dollar and abandon its gold backing at $35/oz. The problem is that since severing the gold standard in 1971, there was a massive increase in the supply of fiat money, credit and derivatives which has debased the dollar, made worse since the US Treasury was forced to mint more and more dollars to pay for an ever-expanding deficit, the pandemic and now the war in Ukraine.

Unsurprisingly global debt to GDP also soared to all-time highs aided by Wall Street’s derivatives or the weapons of mass destruction which are many times the world’s GDP. President Biden is spending $2 trillion on restructuring the economy, but he has been silent on the price of becoming green or, similarly, the price of aiding Ukraine. Less is spoken about having to pick between “guns and butter” as spending keeps rising and the dollar’s foundation is undermined. President Biden has the worst fiscal record of any president in modern times. No one else is even close, not even President Trump.

The issue is not brand-new. The trust people had in the dollar was the foundation of America’s reputation and banking systems. It serves as the cornerstone of our global monetary system. The dominant currency in the world, however, is structurally weak as a result of political polarisation and poor economic management. Like its banks, the nation has piled up debt with the printing presses working overtime. The strain in the financial system caused by the return of inflation and consequential higher rates has led to banking turmoil, the bursting of a series of bubbles and a breakdown in trust. The pandemic too led to a welfare state and the rescue of households, and the cult of the bailout saw central banks forced to rescue their financial sector. All of this cost money, and the CBO estimated that US federal expenditure will account for 24% of GDP. This vast misallocation of capital damages trust, particularly in the wake of bailouts and the violation of investors’, shareholders’, and bondholders’ rights. America itself is a bubble.

America Is in Denial

The world is flooded with dollars from the decades of easy money and the accumulation of debt on an horrendous scale. For a decade the US Dollar Index (DXY), which measures the currency against a basket of six currencies, was strong as investors flocked to safety. Lately the dollar however has lost some of its lustre, falling more than 10% from its peak late September. We believe the dollar’s reign is coming to an end, particularly since America risks isolation as the world moves to multi blocs with non-Western countries conducting trade lately in other currencies to counterbalance a reliance on the dollar after Washington weaponized the currency…

ALERT:

Billionaire mining legend Pierre Lassonde has been buying large blocks of shares in this gold exploration company and believes the stock is set to soar more than 150% in the next 6 months. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

Confidence in currency matters too. Lose it and trust disappears. Without confidence in the dollar, there is no reserve currency. America is in denial. In the midst of the deadlock over raising the US debt ceiling, America’s divided democracy is currently dealing with a crisis of confidence in their banks, regulators, and an erosion of faith in the dollar. With trillion-dollar deficits stretching as far as the eye can see and coupled with the explosion in monetary growth, the burden of debt grows in a world where the Fed’s main policy tool is to let inflation help pay America’s debt.

Worst of all, America’s confrontational stance with China raises questions as to who will fund its savings deficit, particularly since the government, banks, corporate and household balance sheets have deteriorated. The dollar is the world’s most popular currency for trade. However, China is the world’s largest trading nation and as Chinese trade expands, the usage of the renminbi increases. Today four of the five largest economies in terms of purchasing power are Asian. More and more trade is being conducted without usage of the dollar and which has fallen to 58.4%, the lowest since 1994. Finance depends on confidence, trust and the maintenance of a nation’s laws which has lately been corrupted. The dollar is not forever.

Gold, the End of Cheap Money

All this and the de-dollarization trend have led to growing geopolitical tensions as central banks seek alternatives to the dollar. More and more nations are requesting that trade be conducted in currencies other than the US dollar. China recently inked deals with Saudi Arabia, purchasing oil in exchange for renminbi. The Saudis once sold oil for dollars but as the US became a leading competitor and exporter of oil, usage of petrodollars declined and as trade with China expands, renminbi usage will increase too. The globe needs fewer dollars today. All of this indicates that the world’s reserve currency is being put to the test amid the capital conflicts. Gold is an alternative to the dollar.

Gold’s store of value caused inflows into the gold ETFs for the first time in 10 months. In the past gold acted as a currency hedge and last year although gold went up 13% in pounds, and 15% in yen, the performance in dollars was flat. Today the US has accumulated the world’s largest international debt because its politicians won’t stop spending and new borrowings are necessary to pay bills. As a result, the dollar has declined, notably as a result of the sanctions and the drive towards dedollarization. China at the same time has been building up the world’s largest monetary reserves including gold at the expense of the dollar. China in fact has reduced its Treasury holdings for six months in a row and only a quarter of their $3.2 trillion of foreign exchange reserves are in dollars. France too has been selling. The problem is that other currencies, including gold, are replacing the dollar, taking a larger share of the market, and as America’s burden of debt grows, foreign investors will be reluctant to put all their eggs in the dollar basket.

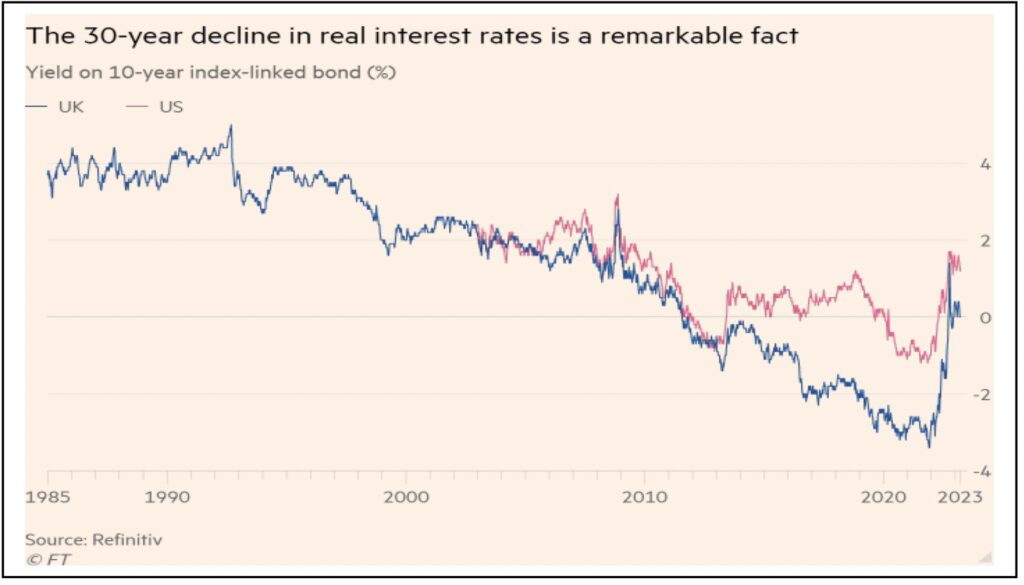

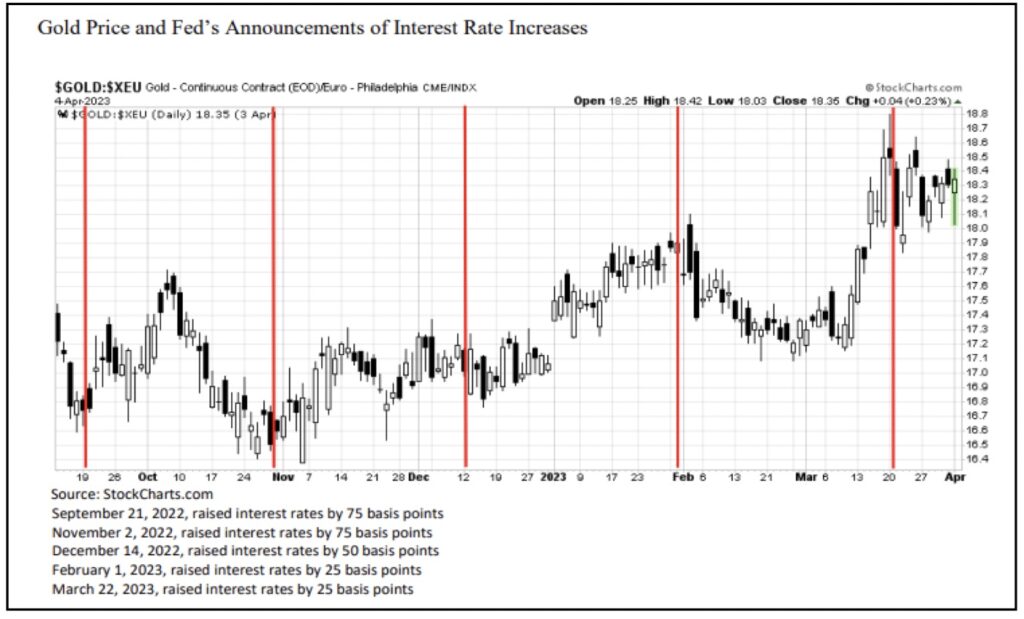

In the past, interest rate increases were accompanied by gold corrections, momentarily bolstering the dollar. Although the dollar has fallen since the autumn, recent strong talk from Fed Chair Powell has strengthened the greenback. However as shown, Fed’s pronouncements only temporarily impact gold before gold reaches new highs. We believe that gold’s performance is telling us that all is not well with the dollar.

Then there is demand for gold, underpinned last year by central banks who bought 1,136 tonnes of gold, the most on record as the bankers diversified their holdings. In the first quarter they added 228 tonnes or 176% more than a year ago. Singapore added 69 tonnes. India added 3.5 tonnes holding 794.6 tonnes in its reserves. Overall annual gold demand jumped 18% to 4,741 tonnes, the largest since 2011. Supplies are limited. A growing number of developed countries also joined the crowd although cash strapped. Turkey was an exception, selling 15 tonnes in March.

Moreover, the growing usage of sanctions made enforcement difficult for some central banks with some purchasing gold at the expense of dollars to circumvent the sanctions. Coincidentally Russia’s reserves increased by 31 tonnes to 2,330 tonnes. China bought more than 120 tonnes, for the sixth month in a row holding 2,076 tonnes, the sixth largest after Russia. The United States holds the largest stockpile of gold at 8,100 tonnes.

Since the start of the year, gold has risen 11%, reaching a 12-month peak at $2,053/oz in April, close to its all-time record on central bank demand and fears over the health of US banks. Gold is an alternative to the dollar. This time amid the banking wipeout, gold spiked $180/oz overnight, surging past $2,000/oz while the dollar weakened. We believe gold is a hedge against the chance that confidence in dollar is not forever. Gold’s bull market has only just begun, and we continue to believe gold will top $2,200/oz this year.

***To listen to Alasdair Macleod discuss the takedown in the silver market and what’s next for the precious metals markets CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.