With silver rebounding sharply today, Stephanie Pomboy says manipulators are trying desperately to keep the price of gold below $2,000 for a reason.

Later today King World News will be featuring an interview with Nomi Prins, who has given keynote speeches to the World Bank, IMF and Federal Reserve. What she has to say about the current crisis is quite eye-opening. Until then…

Golden Canary

May 26 (King World News) – Stephanie Pomboy: Even as the manipulators try to keep gold below $2k, it continues to massively outperform copper. The canary in the financial crisis coalmine is singing….

War In Gold & Silver

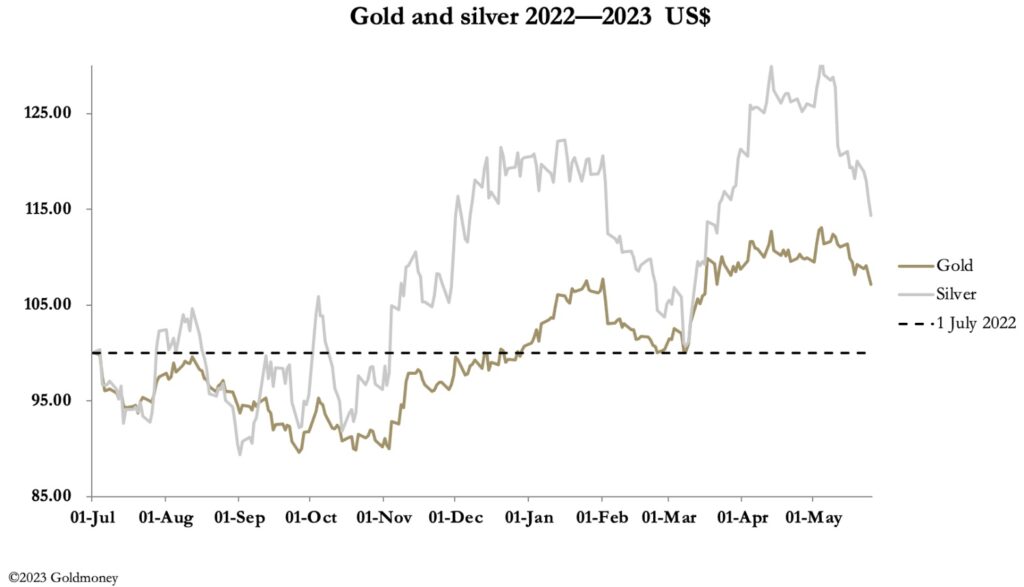

Alasdair Macleod: Gold and silver fell sharply ahead of the Comex June contracts expiry, whose first notice day is next Wednesday. Gold fell $23 from last Friday’s close to trade at $1954 in European trade this morning, and silver was down 68 cents at $23.12 on the same timescale.

End-of-month declines in futures prices are almost as predictable as sunsets because the shorts (predominantly the establishment market makers and bullion desk traders) work together to reduce their positions. From 15 May when speculators, predominantly hedge funds, were maximum bullish gold’s Open Interest has contracted by 66,995 contracts. That’s a positional profit for the shorts of $435m…

This Is Now The Premier Gold Exploration Company In Quebec With Massive Upside Potential For Shareholders click here or on the image below.

This month has also seen significant contract deliveries, 15.81 tonnes in gold, and 240 tonnes of silver.

Working in favour for the shorts has been a rally in the dollar’s TWI, encouraging the buy dollar/sell gold trade. This is our next chart.

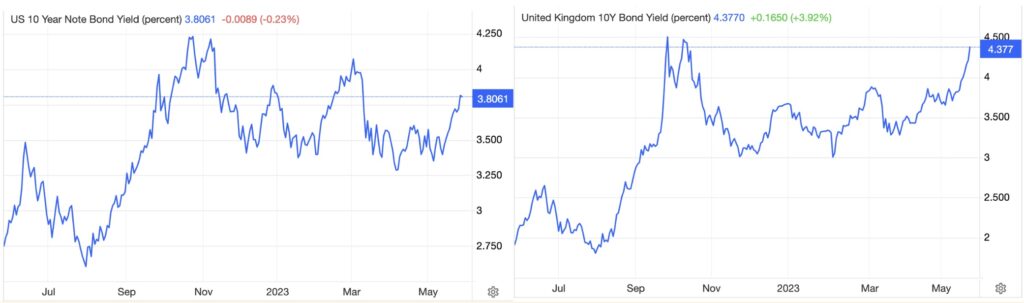

Having threatened to break below the 100 level, a reasonable technical rally has developed which is still playing out. This explains why gold and silver futures traders are becoming increasingly cautious over price prospects. Additionally, bond yields are rallying again, which suggests the interest rate penalty for holding precious metals is increasing. Our next chart shows 10-year yields for US Treasury bonds, and for sterling gilts.

It was rising bond yields that triggered a crisis among the US’s regional banks, and these pressures are returning. World-wide, the story is the same, which in the short-term may be encouraging international portfolio investors to buy dollars, selling other currencies.

Clearly, this is turning out to be very dangerous for holders of sterling, with the 10-year gilt yield returning to the crisis levels of last October, which led to the collapse of the Truss premiership. Our next chart is of sterling.

So far, it looks fairly innocuous. But traders are only just beginning to notice a developing interest rate crisis and their concerns are likely to deepen. Furthermore, those of us with long memories remember how multiple sterling crises developed in the 1970s, and will be refreshing our memories.

The first thing to observe is that the last time the 10-year gilt yield soared over 4%, it was accompanied by a fall in sterling against the US dollar, taking it down from 1.2200 to 1.0700, a fall of 12.3%. If that was replicated today and all else being equal, gold priced in pounds would rise from £1580 per ounce to £1801. Sterling-based holders of gold, who represent a significant proportion of Goldmoney customers would see their gold do what it is designed to do — protect them against fiat currency volatility and loss of purchasing power.

But all else is never equal, and while short-term traders based in dollars may be pessimistic for gold and silver prices as US interest rates and bond yields continue to rise, the threats to the US and global banking systems are returning to dangerous levels. Even for them, physical gold and silver will ultimately prove to be the safest of safe havens.

ALSO JUST RELEASED: Will US Credit Rating Be Downgraded? Plus Gold Takedown And Look At These Other Surprises CLICK HERE.

ALSO JUST RELEASED: COUNTDOWN TO MIDNIGHT: The Monetary Showdown And Gold’s Reaction To Financial Chaos CLICK HERE.

ALSO JUST RELEASED: BUCKLE UP: Housing Bubble Bursting As Financial Tsunami Approaches, Plus People Don’t Work Nearly As Hard CLICK HERE.

ALSO JUST RELEASED: Stunning Big Picture Look At Gold As Stock Markets Tumble Across The Globe CLICK HERE.

ALSO RELEASED: The Global Debt Market Time Bomb Is Close To Exploding CLICK HERE.

ALSO RELEASED: Look At Who Is Calling A Major Gold Bottom, Plus A Tale Of Two Economies And Relief For New Car Buyers CLICK HERE.

ALSO RELEASED: Unusual Money Flows Into Gold, Credit Crunch, Plus “Transitory” Deflation? CLICK HERE.

ALSO RELEASED: Greyerz On The Derivatives Nightmare, Plus Gold Bottom At Hand CLICK HERE.

ALSO RELEASED: Dollar Woes To Denial: The USA Is Screwed CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.