Gold had a historic upside breakout many weeks ago, but now silver just had its historic upside breakout as well. So the party is just getting started in the metals markets. Plus look at the shocking US interest payments on their growing debt.

Here is more proof that gold has entered an upside acceleration phase…

Today Michael Oliver, the man who is well known for his deadly accurate forecasts on stocks, bonds, and major markets, told King World News that the coming gold, silver and miner mania will be epic and all have entered a massive acceleration phase that will light people’s hair on fire. This is one of Michael Oliver’s most important interviews ever.

With the price of gold is surging back toward $2,400 and silver heading back toward the psychologically important $30 level, here is the big surprise…

Today James Turk told King World News this could finally be the Big One for gold, silver and miners as today we got a trifecta of upside breakouts.

It’s shocking how broke people are, including those earning $100,000+. Take a look…

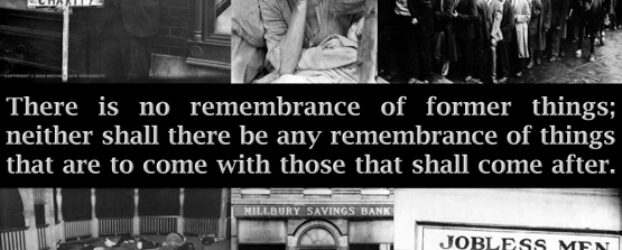

Look at this economic depression happening right now…

This is how bad it is for the average person right now…

One thing you can count on in 2024; expect market distortions to get much worse from here.

Here is a look at the Great Credit Crunch and a frozen market.

Today Michael Oliver, the man who is well known for his deadly accurate forecasts on stocks, bonds, and major markets, shared with King World News precisely how to know when gold’s correction is over, and the upside acceleration phase in the gold market will resume.

Today James Turk told King World News that the gold and silver correction is ending, but he also highlighted what is getting ready to soar.

Everyone wants to know if rate cuts are happening in 2024. Take a look…

Today Nomi Prins, who has given keynote speeches to the World Bank, IMF, Federal Reserve, and many other prominent institutions, spoke with King World News about her correct prediction that the price of gold would hit $2,400 in 2024, but her next prediction will leave you shocked.

This is the biggest surprise about the massive rally in gold.

As the gold and silver market continue to consolidate their large gains, a massive short position in the silver market may prove risky. Take a look…

The number one worry in the US is inflation. Well, here is what people are doing in the United States to feed themselves.

It appears a NATO war with Russia may come sooner rather than later. This is something no rational person wants to see, but the West seems to want to aggressively antagonize Russia until something breaks. Let’s hope it doesn’t.

Another inflation wave is hitting as economic pain continues to worsen.

One thing is crystal clear, as the West has been selling gold China has been buying it. Billionaire Pierre Lassonde predicted this would happen — Chinese speculators fueled gold’s spectacular rise to new all-time highs, but this is how fevered the market trading became in Shanghai.