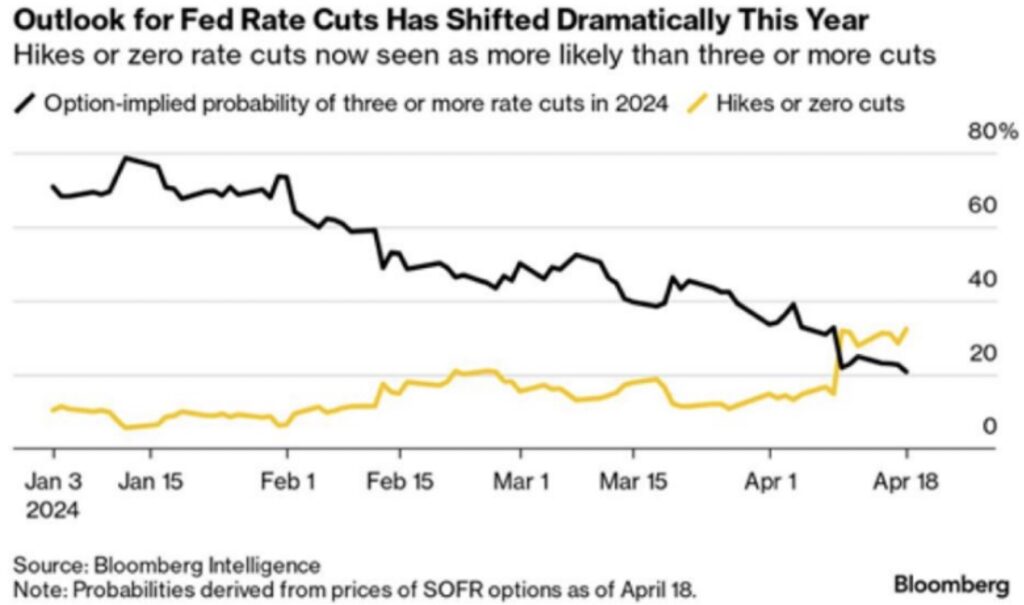

Everyone wants to know if rate cuts are happening in 2024. Take a look…

May 5 (King World News) – Matthew Piepenburg, partner at Matterhorn Asset Management: Poor America. Poor Jerome Powell…

A Real Cliff, Fake Smile

It is no fun to be openly trapped, and even less fun to be in open decline while meekly declaring all is fine.

I have the image of Uncle Sam (or Aunt Yellen) hanging off a cliff with a forced (i.e., political) smile.

Above the cliff is a grizzly bear; below the cliff is a pool of sharks.

In short: Whichever direction one picks, the end result is messy.

And yet the markets still wait for Powell to make the right choice.

What right choice?

Rate Cut Salvation?

As of today, the markets, pundits and FOMC circus followers are all wondering when Powell’s promised rate cuts will come to save the Divided States of America and its Dollar-thirsty, debt-dependent “growth narrative.”

In January, Powell was “forward guiding” rate cuts and thus, right on cue, the Pavlovian markets, which react to Fed liquidity in the same way Popeye reacts to spinach, ripped north on words alone.

YTD, the S&P, SPX and NASDAQ are rising on rising rates hoping to morph lower…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

Even gold and BTC are rising on rising rates—all of which makes no traditional sense—unless, of course, markets are just waiting for the inevitable rate cuts, right?

And who could blame them? After all, Powell promised the same, and Powell, the voice of “transitory inflation,” never mis-speaks, right?

But now the May markets, and even the Bloomberg Intelligence Reports, are worrying out loud about no rate cuts at all for 2024?

So, what will it be? Higher for longer? No more cuts? Three cuts in 2024?

What to do? How to know?

Break out the tarot cards? Read Powell’s palm? Beg?

Here’s My Take: Stop Caring, Because Either Way, We’re Screwed…

As for rate cuts, the case for them is fairly obvious, as I’ve opined elsewhere.

With trillions in USTs repricing in 2024, and over $700B in zombie bonds from S&P issuers doing the same, if Powell doesn’t cut rates, then sovereign and corporate bond markets are staring down a loaded barrel.

This is real. BofA’s own data confirms that Uncle Sam is looking at $1.6T in interest expense payments by year end if Powell doesn’t cut rates soon.

It’s also an election year, and a nice rate cut would be a tailwind for an incumbent (somnolent) White House that needs every possible tail wind it can get.

So, Why Wouldn’t Powell Cut?

The official answer, which, by the way, is never the honest answer, is that Powell and his “data dependent” Fed is still worried about inflation, which has failed to reach its “target 2%” level, whatever that is.

If one believes this narrative, then higher rates are still needed to “win the war on inflation.”

The great irony, and comedy, however, is that actual inflation, as even Larry Summers (or John Williams at Shadow Stats) would remind, is deeply in the double digits, and hence the Fed’s “data dependence” is nothing but a comical lie of “data manipulation.”

Another case for no rate cuts is Powell’s fear of making the “Volcker mistake” of 1980, when the then-Fed Chairman, believing inflation was tamed, cut rates too soon, and what followed was a dramatic spike in well: Even more inflation.

Perhaps Powell has a similar fear of cutting too soon and getting more inflationary egg on his politically two-faced brow?

Furthermore, if Powell cuts rates, demand for USTs, already a global joke since 2014, could worsen, and the US survives off others purchasing its increasingly unloved IOUs.

A rate cut, or series of rate cuts, would only add to this embarrassing demand lag, and hence put even greater pressure on finding new sources of fake money to pay America’s increasingly pathetic bar tab.

In short, cases can be made for looming rate cuts, and cases can be made for no rate cuts, but regardless of what happens, the case for a palpably tanking America stays the same.

Here’s why.

The No-Cut Scenario

If Powell stays higher-for-longer just about everything (from stocks and bonds to mortgages and economies) will break but the USD—at least as measured by the DXY’s relative strength.

In this regard, America can brag about being one of the best horses in the global currency glue factory.

But soon thereafter, the rising cost of Uncle Sam’s interest expense on ever-increasing UST issuance will become so high that the only way to pay for those higher-for-longer rates will be via fake money, which I remind Mr. Powell, is, well: Inflationary.

This is the classic, but undeniably real matter of “Fiscal Dominance,” which simply means that Powell’s war on inflation via rising rates ends ironically in an inflationary end-game of mouse-clicked liquidity.

We saw this same pattern (rising rates and QT) in 2018, which lead to falling rates and unlimited QE by 2020.

But then again, it seems for most investors, that kind of history (and hence lesson) is just too far away to recall…

Of course, the Fed, and BLS, will then… mis-report actual inflation.

The Three or More Cut Scenario

Alternatively, Powell could cut rates in 2024, weaken the USD, save the debt (and hence rate) sensitive stock markets and let inflation creep further north as whoever is running the Biden White House seeks to bribe the electorate.

Of course, the Fed, and BLS, will then… mis-report actual inflation.

In short, and in either scenario, the end-game is inflationary, and however misreported the CPI scale will be to hide this embarrassment, the inherent purchasing power of the USD (a melting ice cube) by which many measure their wealth, will get weaker and weaker, as the rich get a little less rich and the poor American serfs just get knee-capped.

But this is the lesson and warning of a nation and economy at the full mercy of a central bank rather than natural and free price discovery.

A Not-So-Free-Market Reality

The sad fact is capitalism died long ago.

Instead, we are all slowly frog-boiling within a centralized economy whose central planners/bankers, in cahoots with a failed, pathologically power-hungry and vote-purchasing DC “leadership,” who circa 1913 sold the nation down the river of a fatal debt quagmire paid for by fake liquidity and the open fantasy-made-mainstream-policy that one can save a debt-strapped nation with more, well…debt.

Or stated more simply, the US will desperately seek to inflate away its self-inflicted debt disaster (and increase its wealth inequality index) on the backs of ordinary, inflation-soaked citizens.

But as John Cougar Mellencamp once noted, “Awe, but aint that America…”

In all fairness to America, however, such historical slides into open mediocrity and a currency-debased debt quagmire are nothing new.

[Ignored] History Lessons

All failing nations ultimately resort to killing their currencies in order to buy time and “save” a system that is mathematically beyond the ability to be saved.

As Niel Ferguson recently reminded, “any great power that spends more on debt service than on defense will not stay great for very long. True of Hapsburg Spain, ancient regime France, the British Empire…”

It frankly staggers us that so few “sophisticated” market participants understand the simple (though increasingly “cancelled”) lessons and patterns of yesterday.

History, far more than an MBA or the promises of your Private Wealth Managers at banks X, Y or Z, can teach far-sighted investors how and where to position themselves.

Rising Gold Patiently Getting the Final Say

This slow but then sudden death of fiat money, seen countless times in our collective past yet ignored by our collective policy makers and day traders, makes history-confirmed anti-fiat solutions like gold all too obvious to ignore.

And yet, as my colleague Egon Greyerz recently observed, only about 0.5% of global financial asset allocations are made to gold.

In short, the ignoring (or ignorance) plunges forward…

But when this relatively finite asset of infinite duration reaches and surpasses its 40-year mean allocation of just 2%, the 4X increase in gold demand, and hence price, will be just the beginning of gold’s final response to unsound money.

Meanwhile, The Circus Continues

For now, clever traders and speculators can, will and should keep their eyes on a DXY (and Dollar) which, like the markets, can and will gyrate on the wings of a vast range of current and pending liquidity (backdoor QE) tricks, from the Treasury General Account, the repo markets and Supplementary Leverage Ratios to the Treasury’s Quarterly Refunding Announcements.

These same tricks (artificial liquidity-deck-chair shuffling on the Titanic) can have short-term implications on moving equities as well, perhaps buying more time for an otherwise narrow and entirely Fed-supported basket case S&P et al.

But what these same liquidity tricks are hiding in plain site is that America’s fiscal problems have gone from embarrassing to the iceberg-level desperate, and investors are measuring their “liquidity-supported” returns with an openly diluted Dollar.

As F. Gump would say, “stupid is as stupid does.”

From Frog Boil to Fully Cooked

Tax receipts and debt-driven GDP forecasts will never, not ever, be sufficient to plug the hole in the bow of the sinking US debt ship.

Despite whatever the trapped Powell or forked-tongued DC says, the only option forward is inflationary, (with a little bit of war to keep us distracted).

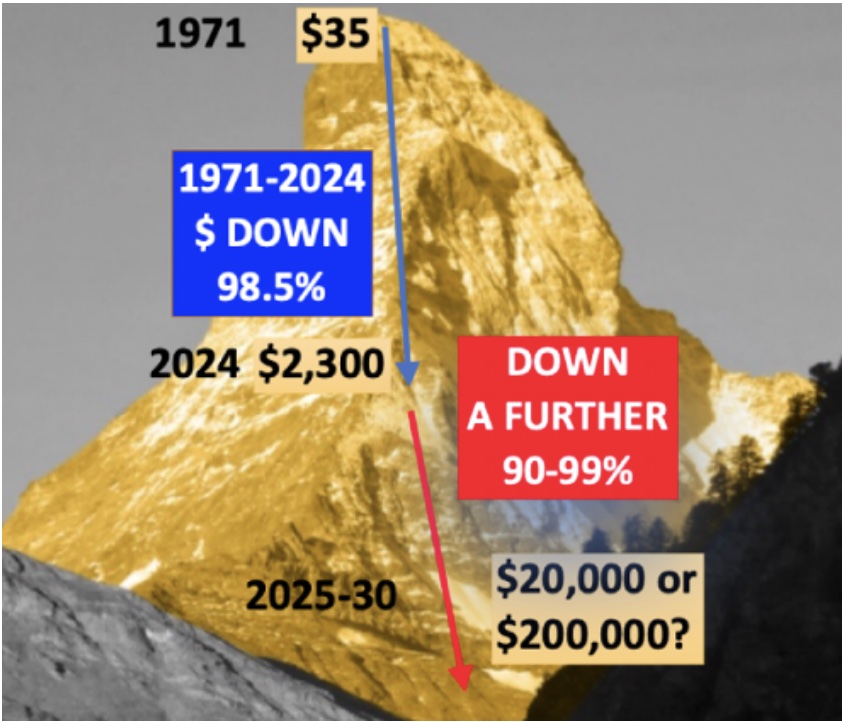

In fact, since Nixon decoupled from gold in 1971, that frog boil toward an ever-debased USD has been in full swing, losing purchasing power against physical gold at levels now too obvious to be ignored:

Apologists, however, will rightfully argue that compared to other currencies, including the poor Japanese Yen, which is experiencing multi-decade lows against the Greenback, that the USD is one’s best “relative choice.”

But why compare one fiat currency against another, when gold outperforms them all?

Just a thought, no? This will link you directly to more fantastic articles from Matthew Piepenburg and Egon von Greyerz CLICK HERE.

Nomi Prins Correctly Predicted $2,400 Gold, But Next Prediction Will Shock You

To hear one of Nomi Prins’s most powerful interviews ever where she discusses her correct prediction that the price of gold would hit $2,400 in 2024 as well as where the price of gold is headed next and when, and what surprises to expect in 2024 CLICK HERE OR ON THE IMAGE BELOW.

To listen to Alasdair Macleod discuss the wild things happening in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

We May See Terrifying Hyperinflation

To listen to one of the greatest interviews ever with the man who oversees $150 billion globally CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.