With the price of gold is surging back toward $2,400 and silver heading back toward the psychologically important $30 level, here is the big surprise…

Gold & Silver Squeeze Continues

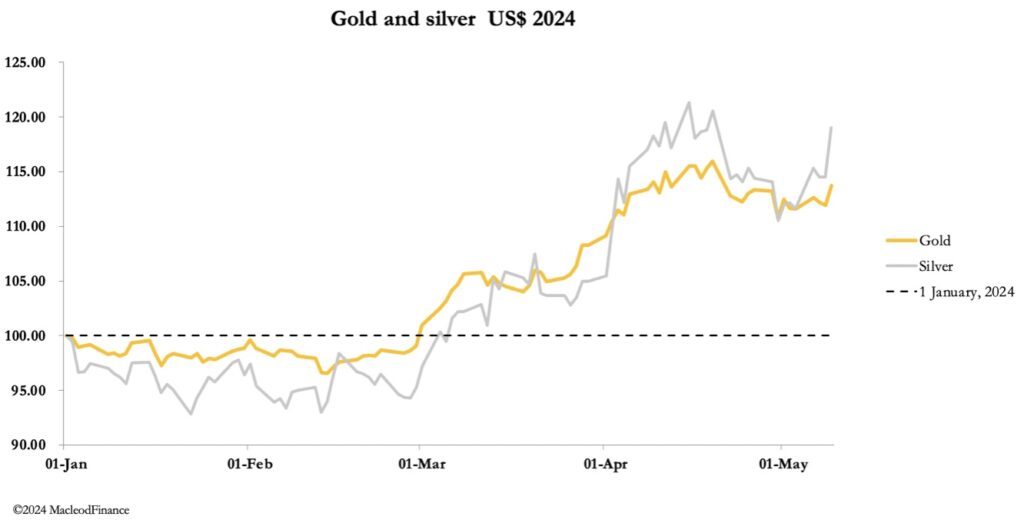

May 10 (King World News) – Alasdair Macleod: Gold and silver had a better week, with gold up $67 from last Friday’s close at $2369 in European trading this morning, and silver at $28.60 up $2.10 over the same time frame.

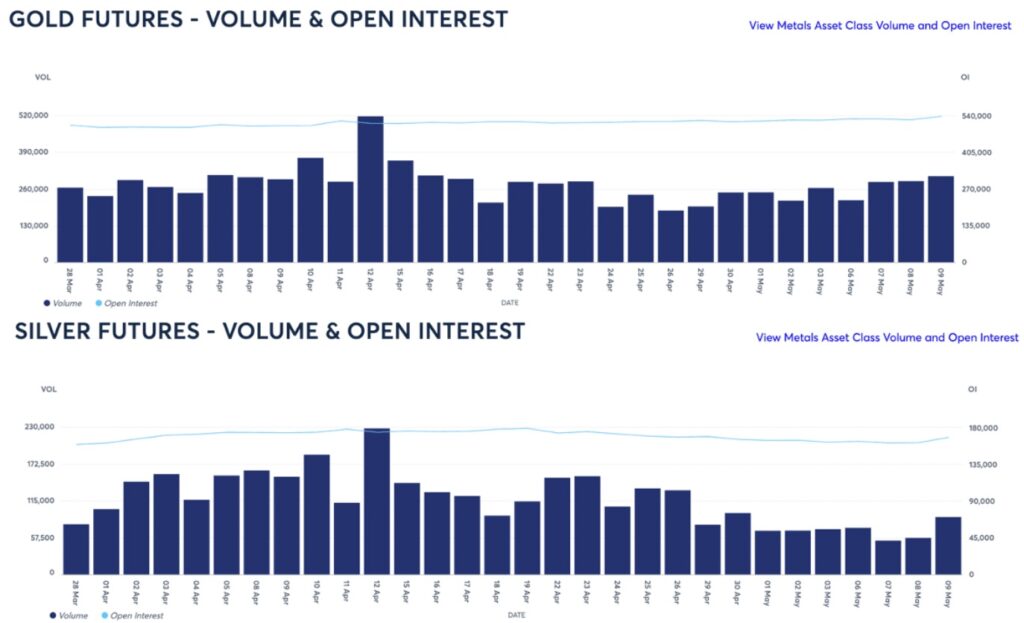

There was a little more volume in the Comex gold contract, but silver’s was vanishingly low, as shown below.

Most of the action was yesterday (Thursday) when a poor US jobless claims number sent gold and silver higher, and bond yields lower. This was taken by commentators to imply a greater chance of an early reduction in the Fed Funds Rate, which explains why bond yields declined. Furthermore, a successful 30-year US Treasury bond auction allayed fears of funding difficulties.

This is probably more noise in the background rather than meaningful information because jobless claims are notoriously misleading. A better clue as to what is happening is shown in the lower of the two charts above, for silver’s daily Comex volume. The clear explanation for silver’s performance is it is a bear squeeze on the shorts, rather than bullish buying.

Admittedly, there was a pickup in turnover yesterday, reflecting an increase in open interest. But that doesn’t negate the bear squeeze hypothesis. Furthermore, over 95 tonnes of silver have been stood for delivery in the first four trading days of this week, making a total of 2,312 tonnes this year so far. For reference, this is 21% of global mine output for the first five months of 2024.

The yield on the 10-year US Treasury Note is back to support levels at the 55-day moving average, as the next chart shows.

This suggests that a wise trader will look to sell bonds at current levels.

There is still delusion in markets over the outlook for interest rates, going right to the top. This week, Andrew Bailey of the Bank of England said that even though the Monetary Policy Committee held the rate at 5.25%, he thought with inflation coming down that the Bank would cut rates earlier than expected. What Bailey and the establishment investment cohort don’t yet realise is that it is foreign holders of sterling who ultimately set sterling’s interest rate agenda, as they do for the dollar. If they sell dollars they won’t be buying sterling. And there’s little doubt that they are net sellers of dollars.

Despite this week’s successful 30-year T-bond auction, with foreigners certain to turn away from dollars let alone duration risk the US debt trap is bound to drive rates higher along the yield curve. And those investors seeking solace in prospective inflation numbers are ignoring the continuing effect of the US’s enormous budget deficit on the dollar’s purchasing power.

Chinese Speculators vs Western Bullion Banks

The Peoples Bank of China is still selling dollars for gold. And Chinese speculators realise this, with enhanced activity on the Shanghai Futures Exchange. We know the Chinese to be avid speculators, and analysts assume that they will have to unwind their positions, leading eventually to a fall in the gold price. I will make two comments: Chinese punters know what the PBOC is doing and why, and these speculators can continue to buy, even to the point when western bullion banks are driven into bankruptcy.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.