Another inflation wave is hitting as economic pain continues to worsen.

Fed’s Lack Of Confidence Is Telling

May 1 (King World News) – Peter Boockvar: There was not much of a change in the statement wording except the Fed added this, “In recent months, there has been a lack of further progress toward the Committee’s 2% inflation objective.” This is code for the Fed doesn’t have more confidence relative to the March meeting to commit to when to start cutting rates.

The surprise was in the QT tapering plans where expectations were widely held that Treasury drawdowns would be $30b per month from $60b but instead the Fed went down to $25b. I’d like to hear what Powell gives as the reason. As expected, there is no change to MBS QT. Either way, I do think he’ll make it clear that their eventual end game for QT and where bank reserves settle out at won’t change and slowing monthly QT will only stretch out the timeline on it further than otherwise.

On the bigger QT reduction, Treasury yields are slipping a hair, by about 1 bp for both the 2 yr and 10 yr.

The presser, as usually the case, will end up again possibly being the market moving news, or not.

I’ll add one more thing, on the topic of whether the Fed shifts to more rate hikes if they don’t get the further inflation moderation they want I see no chance as just by keeping rates at current levels for a longer period of time is itself a continued form of monetary tightening because of the daily debt coming due that was priced pre 2022.

Economic Pain Getting Worse

The ISM manufacturing index slipped back below 50 in April at 49.2 vs 50.3 in March and vs the estimate of exactly 50.

Manufacturing Index Back Below Key 50 Level

New orders dropped by 2.3 pts m/o/m to 49.1 while backlogs remain well below 50 at 45.4 vs 46.3 in the month before. No sign yet either of inventory build as this category held at 48.2 and customer inventories were 47.8, though up from 44 in the month before. In contrast to what ADP said, the employment component remained below 50 again at 48.6 with only 4 of 18 industries asked adding staff. Export orders fell back under 50 at 48.7 vs 51.6 in March.

Specifically with inventories, ISM said “Panelists’ companies continue to indicate a willingness to invest in manufacturing inventory to improve on-time deliveries, gain precision in revenue projections and improve customer service. However, they are proceeding judiciously on this objective, preferring to wait for additional demand.”

Of note, prices paid jumped 5.1 pts to 60.9 and that is the highest since June 2022.

ANOTHER INFLATION WAVE:

A Little More “Transitory” Inflation!

Supplier deliveries fell 1 pt to 48.9 so no supply chain issues and the prices paid jump is most likely due to the rise in commodity prices. ISM said, “Commodity prices continue to increase, especially crude oil, aluminum, steel and plastics. Thirty-one percent of companies reported higher prices in April, compared to 24 percent in March.”

With respect to breadth, it was similar to March with 9 industries seeing growth and 7 experiencing a contraction (vs 6 in March).

Bottom Line

Bottom line, it seems that after a manufacturing recession that started in late 2022, a bottom is trying to be found but no rebound yet seen. The inventory comment above sort of sums that up. And now we have the rise in commodity prices which likely is calling a bottom too in goods prices.

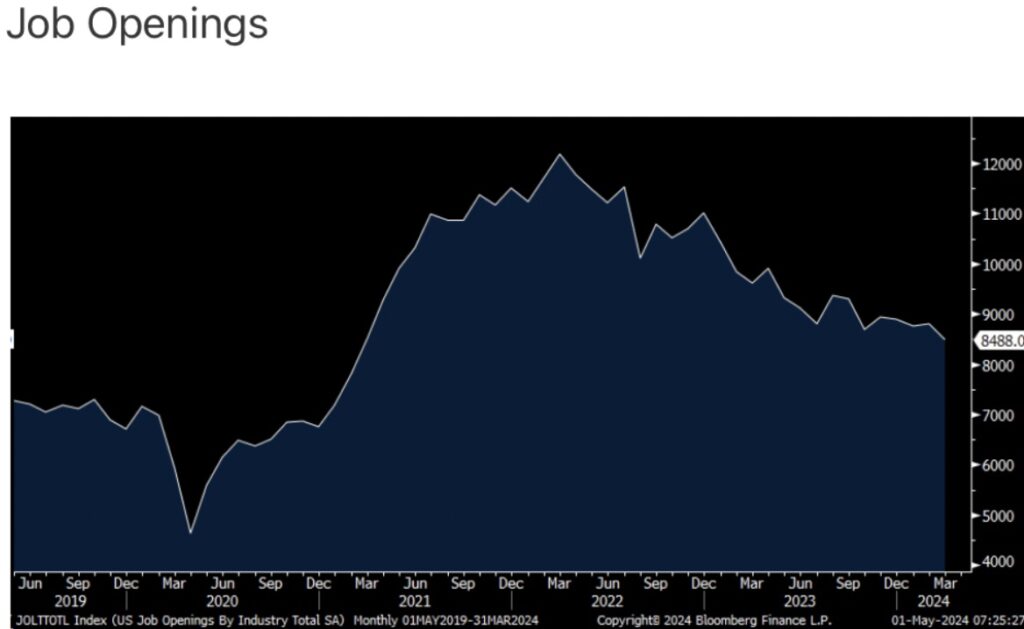

Job Openings in March shrunk by 325k jobs m/o/m to 8.488mm. That’s the least since February 2021.

Job Openings Continue To Decline

The hiring rate fell to 3.5% from 3.7% and that matches the lowest since 2014 not including Covid.

Hiring Rate Tumbles To Lowest Since 2014!

Also, the quit rate fell one tenth to 2.1%, the lowest since January 2018 not including Covid.

It Appears People No Longer Want To Quit Their Jobs

Bottom line, while ADP and the BLS continue to reflect good job growth, absorbing the influx in the labor force each month, other signs like JOLTS are pointing to a lessened demand for workers.

King World News note: Another inflation wave is hitting as economic pain continues to worsen. King World News has been discussing stagflation for many years but it appears that term is finally being discussed in the mainstream media. We saw painful stagflation in the 1970s with high inflation and economic stagnation. We expect this pattern to continue, just like it did in the 1970s. The only winner after the brutal 1970s ended was hard assets with gold soaring 25.5x higher and silver skyrocketing 38x higher. The mining and exploration stocks also had a decade to remember.

To listen to one of the greatest interviews ever with the man who oversees $150 billion globally CLICK HERE OR ON THE IMAGE BELOW.

To listen to Alasdair Macleod discuss what will make investors a fortune in the coming storm CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.