Here is a look at the Great Credit Crunch and a frozen market.

May 7 (King World News) – Peter Boockvar: I haven’t discussed shipping rates for a few weeks but will today as I forgot to mention what Maersk said yesterday and has been in the news recently. “The risk zone has expanded, and attacks are reaching further offshore…This has forced our vessels to lengthen their journey further, resulting in additional time and costs to get your cargo to its destination for the time being” said the company.

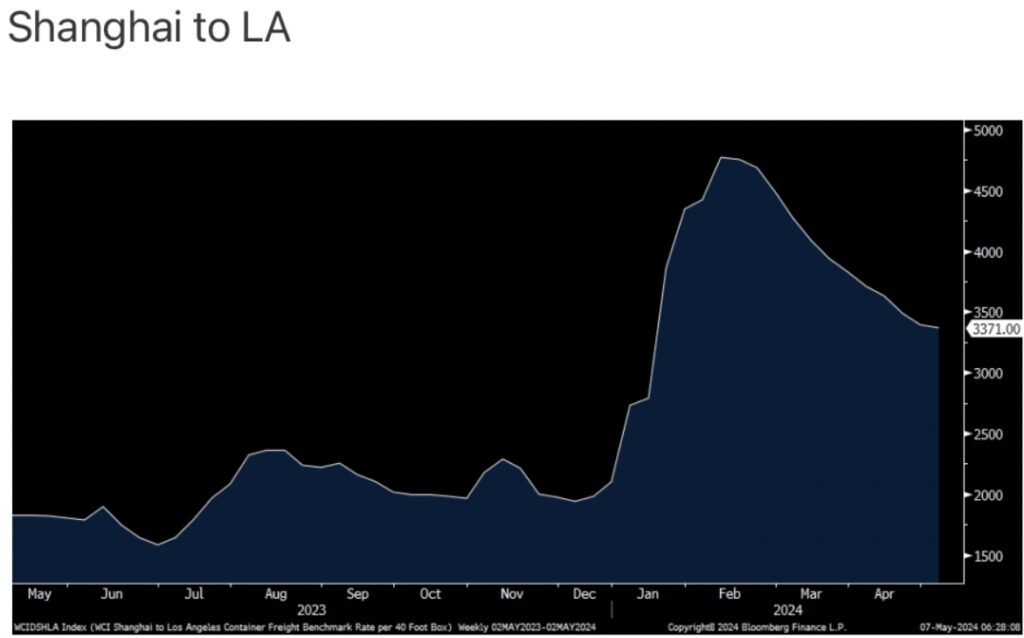

Over the past two weeks container shipping rates for the Shanghai to Rotterdam trip has rebounded by $114 after 12 weeks of declines following the January spike.

A LITTLE MORE “TRANSITORY” INFLATION?

If Shipping Costs Head Higher It Will Feed Into Global Inflation

The Shanghai to LA route has continued to fall but the drop in the week ended 5/2 was the smallest since mid February.

“Brother, can you spare a loan?”

Here were the notable comments from the Fed’s Senior Loan Officer Survey for April:

“Regarding loans to businesses, survey respondents reported, on balance, tighter standards and weaker demand for commercial and industrial (C&I) loans to firms of all sizes over the first quarter. Meanwhile, banks reported tighter standards and weaker demand for all commercial real estate (CRE) loan categories.”

“Banks also responded to a set of special questions about changes in lending policies and demand for CRE loans over the past year. For all CRE loan categories, banks reported having tightened all queried lending policies, including the spread of loan rates over the cost of funds, maximum loan sizes, loan-to-value ratios, debt service coverage ratios, and interest-only payment periods.”

The Great Credit Crunch

“For loans to households, banks reported that lending standards tightened across some categories of residential real estate (RRE) loans while remaining unchanged for others on balance. Meanwhile, demand weakened for all RRE loan categories. In addition, banks reported tighter standards and weaker demand for home equity lines of credit (HELOCs). Moreover, for credit card, auto, and other consumer loans, standards reportedly tightened and demand weakened.”

Bottom line, if you don’t have access to the capital markets, this sure sounds like a credit crunch to me and the high cost of money is also further dissuading both businesses and households from borrowing. Specifically on the lending side, there was a sharp rise in 2023 in the number of those banks that were tightening standards and so far in 2024 they are pretty much holding those standards, though most not tightening them further…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Meanwhile in Australia

The Reserve Bank of Australia kept its cash rate at 4.35% as expected and seems pretty intent on sitting there for a while longer. Governor Bullock said “What the most recent data do reinforce is we must continue to be vigilant about the continued risk of high inflation…Right now we believe that rates are at the right level to achieve this, but there are risks and at this stage, the board is not ruling anything in or out.” While they likely won’t be raising rates, Bullock did not rule it out, “I hope that we don’t have to raise interest rates again but having said that if we think we have to, we will.”

The market doesn’t believe they will hike, as they shouldn’t right now, and similar to how US rates responded here last week to Powell saying they won’t hike, the 2 yr Aussie yield dropped 10 bps overnight and the Aussie$ is a bit weaker vs the US dollar. There was also a broad rally in Asian bonds helping too, that was followed in Europe and the US today.

Here was a lay of the commercial real estate land from Jones Lang Lasalle yesterday:

The Frozen Market

“The year started with some positive momentum highlighted by an increase in bidders and the closing of several large deals in North America. These green shoots encapsulate investors’ willingness to deploy capital when market conditions warrant. However, once inflation data came in higher than expected and the hope for several interest rate cuts later this year diminished, real estate capital markets became much quieter again.”

Some more, “Debt market conditions improved in early 2024, both in terms of pricing and liquidity. However, CRE markets have taken a pause over the last several weeks as lenders and investors adapt to a shift in the interest rate outlook. Lender confidence remains buried and it’s strongest for industrial living and data centers, especially for high quality assets at smaller deal sizes.”

On office, “Both the US and Asia-Pacific saw increases in demand as occupiers continue to upgrade to premium quality, sustainable space that improves the employee experience. In Europe, limited available space continues to dampen transaction activity. A number of large lease transactions improved in the quarter, but it’s still well below pre-pandemic levels. The global office vacancy rate ticked up 30 bps to 16.5% in the 1st quarter, driven mainly by North America where the market continues to process leases that require 10% to 15% less space.”

On industrial, “first quarter leasing activity declined globally as decision making slowed amid geopolitical and economic uncertainty. In the US, occupiers continue to manage through the record amount of space that was leased following the pandemic.”

People Are Still Traveling

“Finally, in the retail sector, consumer spending and international tourism remains resilient, supporting demand for space in prime locations.”

Meanwhile in Germany

Back overseas, German factory orders in March were softer than expected, down by .4% m/o/m vs the estimate of flat and February was revised lower by 100 bps to a drop of .8%. Order weakness came domestically and from non Eurozone countries. Capital goods were soft while consumer goods did tick up. Nothing market moving here but highlights the challenges still in the German economy.

Inflation

King World News note: Inflation remains a serious problem, but the US is trying to bring down the oil price ahead of the election. This would, in theory, help to alleviate inflation. The question is how do global producers respond to the US interfering with the price of oil by releasing oil from their Strategic Reserves. Producers could respond with cuts in production. Regardless, the oil market is something KWN will keep a close eye on in the coming months.

Nomi Prins Correctly Predicted $2,400 Gold, But Her Next Prediction Will Shock You

To hear one of Nomi Prins’s most powerful interviews ever where she discusses her correct prediction that the price of gold would hit $2,400 in 2024 as well as where the price of gold is headed next and when, and what surprises to expect in 2024 CLICK HERE OR ON THE IMAGE BELOW.

To listen to Alasdair Macleod discuss the wild things happening in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

We May See Terrifying Hyperinflation

To listen to one of the greatest interviews ever with the man who oversees $150 billion globally CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.