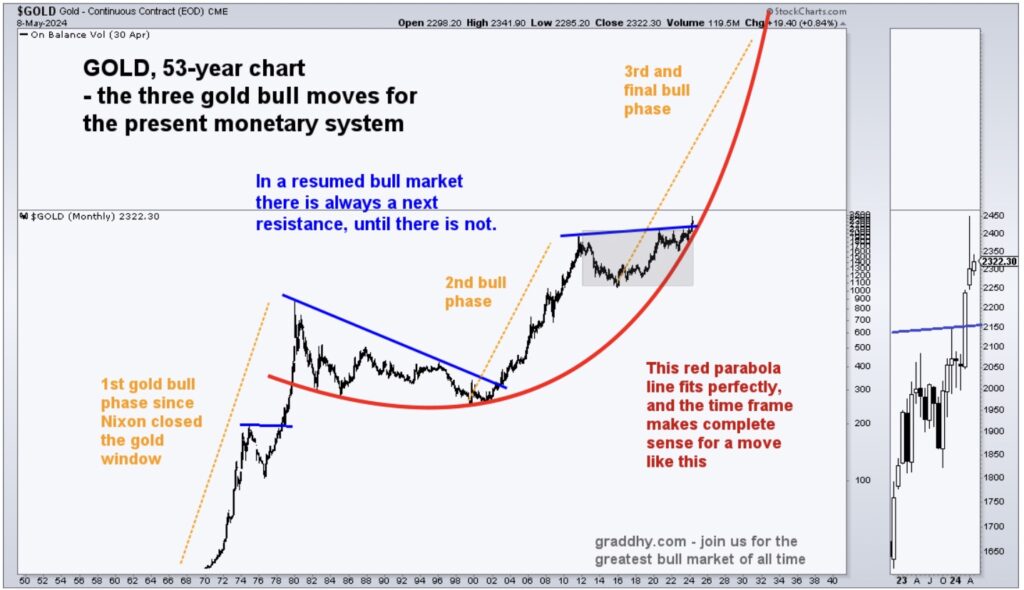

Here is more proof that gold has entered an upside acceleration phase…

Gold’s Acceleration Higher, Stocks Lower

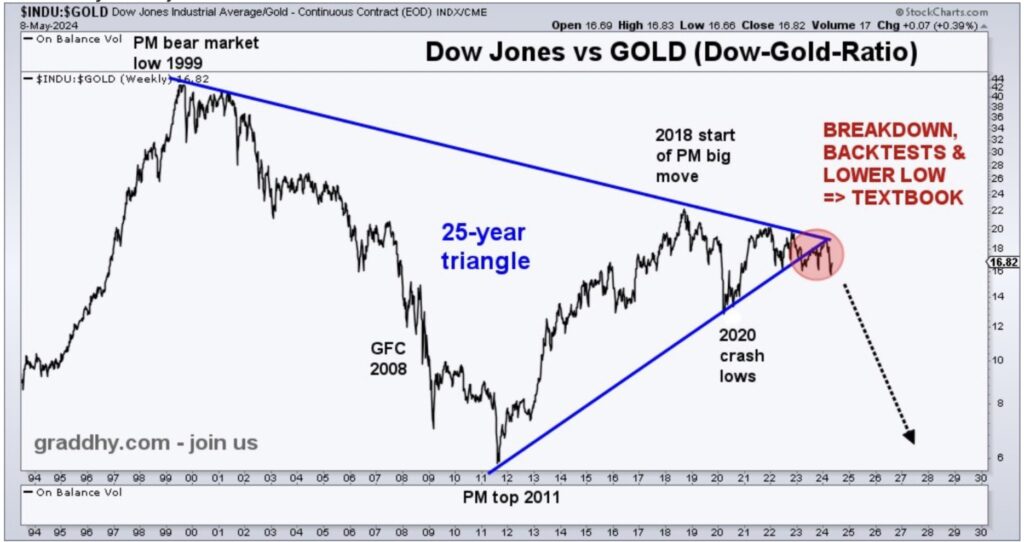

May 13 (King World News) – Graddhy out of Sweden: The Dow-to-Gold ratio now has a lower low. This confirms the chart breakdown is in progress.

Gold Is Now Set To Radically Outperform The Dow, NASDAQ, S&P

So gold is now set to outperform the general stock market.

VERY important chart for the next macro trend.

Institutions – time to wake up! So it begins…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Gold

Graddhy out of Sweden: This very simple chart WILL play out. Doubting this will be the biggest mistake in your lifetime.

Gold Now Entering Upside Acceleration Phase

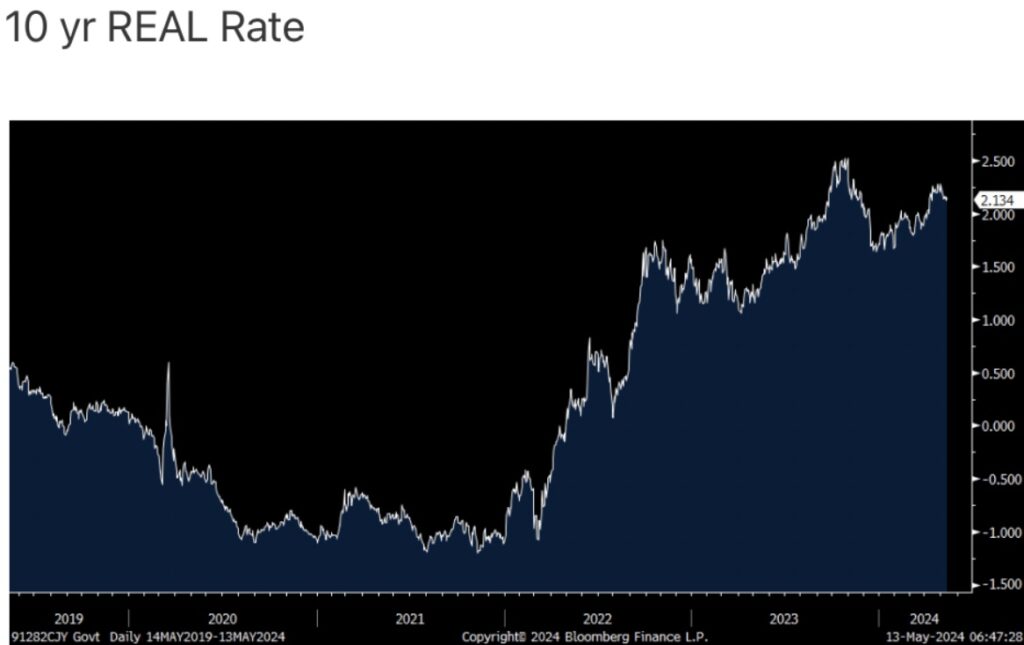

To Cut Or Not To Cut

Peter Boockvar: While Jay Powell could change her mind, as can the economic data, Fed Governor Michelle Bowman said on Friday “I, at this point, have not written in any cuts” for 2024. “I’ve sort of had an even expectation of staying where we are for longer. And that continues to be my base case.” She continued by saying “It is of utmost importance that we maintain credibility in pursuing our fight against inflation by proceeding carefully and deliberately to achieve our 2% goal.” As a Governor, what she says matters but we know any new data point could change her opinion.

With regards to non-voting member Neel Kashkari, who gave a duel interview with Austan Goolsbee given by Steve Leisman on Friday, he’s throwing out a market stat that he (thus us), is now watching to help guide him. He’s given speeches on this in the past and repeated it last week. That being the 10 yr implied inflation rate in the 10 yr TIPS market and/or the 10 yr REAL rate. He believes that it is “the single best proxy for the overall stance of monetary policy.” For perspective, the inflation breakeven started 2020 at 1.79% and is trading this morning at 2.36% and peaked at 3.04% in April 2022 right before the hottest inflation prints were seen.

He then compares this with conventional rates to get to the REAL rate and then determines whether policy is tight or not, in his mind. While I do think this is an important thing to watch, we have to understand that it is just a reflection on how people think today the 10 yr inflation average will be. It changes every single trading day as more information gets absorbed into those thoughts.

Michael Oliver: Gold’s Upside Acceleration Phase And How Investors Can Target Which Mining Stocks To Buy Ahead Of The Gold & Silver Mania

To listen to one of Michael Oliver’s most important audio interviews ever discussing the gold and silver mania, what to expect from mining stocks, the stock market in 2024 and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.