Today billionaire Pierre Lassonde told King World News that a tsunami of crypto money is set to move more aggressively into gold. Lassonde also shared many of his top stock picks in this exclusive interview.

There has been some wild trading in the gold and silver markets today. Take a look…

The gold and silver mining stocks are still very early in a parabolic move higher.

It appears that this move higher in silver miners “will be epic.”

Catastrophic Fannie Mae and Freddie Mac are looking to unload massive liabilities onto the public.

It appears that despite record prices, demand for gold is still climbing.

Today one of the greats in the business noted that Fed rate cuts will add fuel to the gold and silver bull markets.

Gold futures are surging once again trading at $3,435 after fake downside breakout.

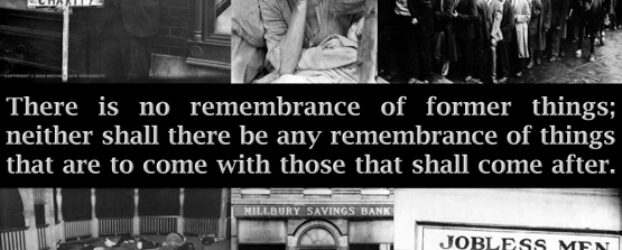

Legend Richard Russell warned every fiat currency in the world would be destroyed. Below is the warning Russell wrote along with many other amazing predictions. Richard Russell’s Memories Of The Great Depression August 5 (King World News) – From legendary Richard Russell: “In the 90 years that I have been on this earth I have never felt good about myself. But lately, after much soul searching, I finally accepted that I

Michael Oliver, the man who is well known for his deadly accurate forecasts on stocks, bonds, and major markets, sent King World News an update as gold and silver are now close to upside breakouts. Gold August 4 (King World News) – Here is a small portion of a major report from Michael Oliver, Founder of MSA Research: The stock market’s momentum action last week indicates renewed downside in that

Below is a jaw-dropping roadmap to $51,000 gold!

It appears that margin debt for stocks has now surged to a figure that totals over a staggering $1 trillion.

On the heels of the price of copper collapsing gold has rallied more than $50 surging above $3,400.

As we get ready to kickoff trading in the month of August, what is happening in the US housing market is wild.

Below is a $15,000 price target for gold as gold, silver and mining stocks set to crush US stock market performance, including tech.

The stock market is now seeing parallels of the year 2000 internet bust.

Is the Beast system now being activated?

Here is a bit picture look at the silver market while the metal remains below $40.

Michael Oliver, the man who is well known for his deadly accurate forecasts on stocks, bonds, and major markets, sent King World News an update as gold and silver are now close to upside breakouts.

The price of silver just hit an all-time high priced in global fiat currencies. Plus a look at another major breakout.