Here is a look at what is happening behind the scenes in the gold and silver markets.

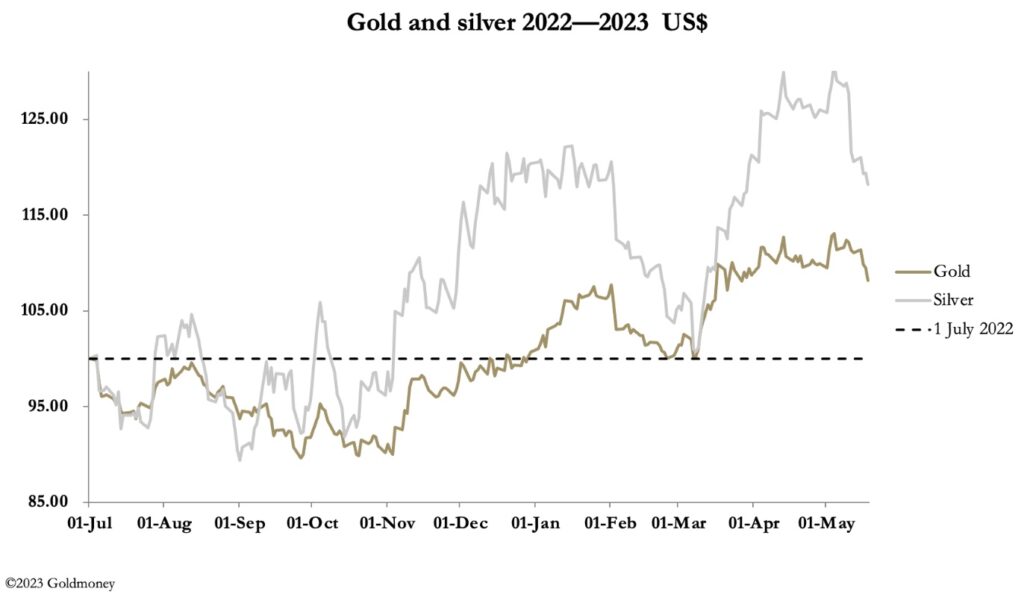

May 19 (King World News) – Alasdair Macleod: Gold and silver prices declined this week, as the shorts mounted an attack on speculating longs. In Europe this morning, gold was trading at $1965, down $46 from last Friday’s close, and silver was at $23.69, down 25 cents on the week.

Both metals have fallen significantly over the last two weeks, correcting some of the earlier rise. Comex turnover on Comex in gold was moderate, while in silver it was low.

Gold’s technical chart gives us some context. The price has declined to test the 55-day moving average, suggesting that the decline in mostly done.

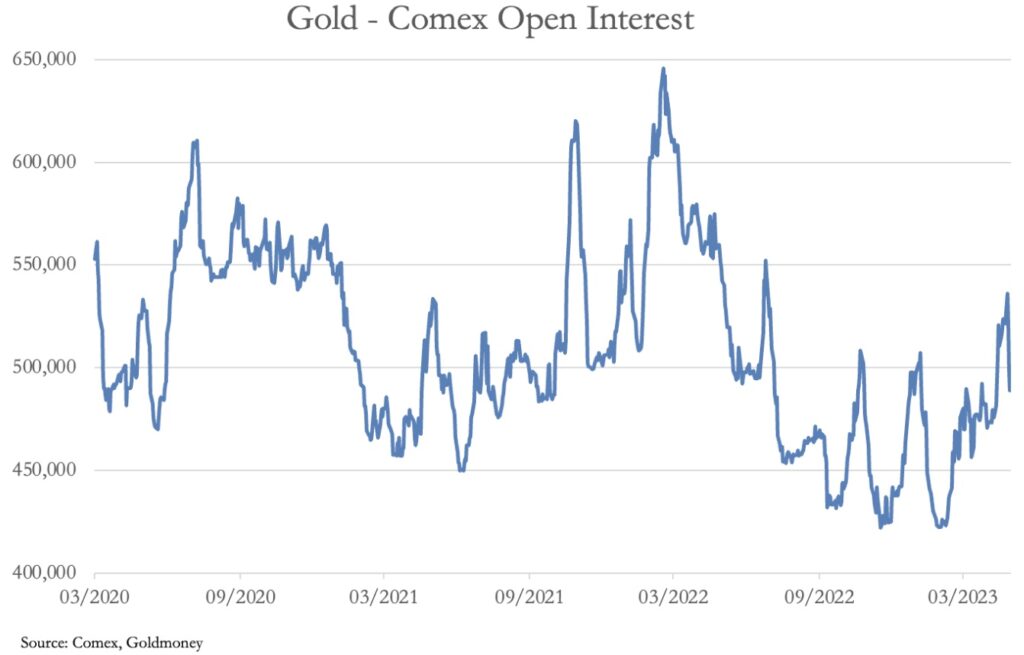

Furthermore, gold’s Open Interest on Comex indicates that futures are not overbought, suggesting that when it is over this decline could support a decent upward move.

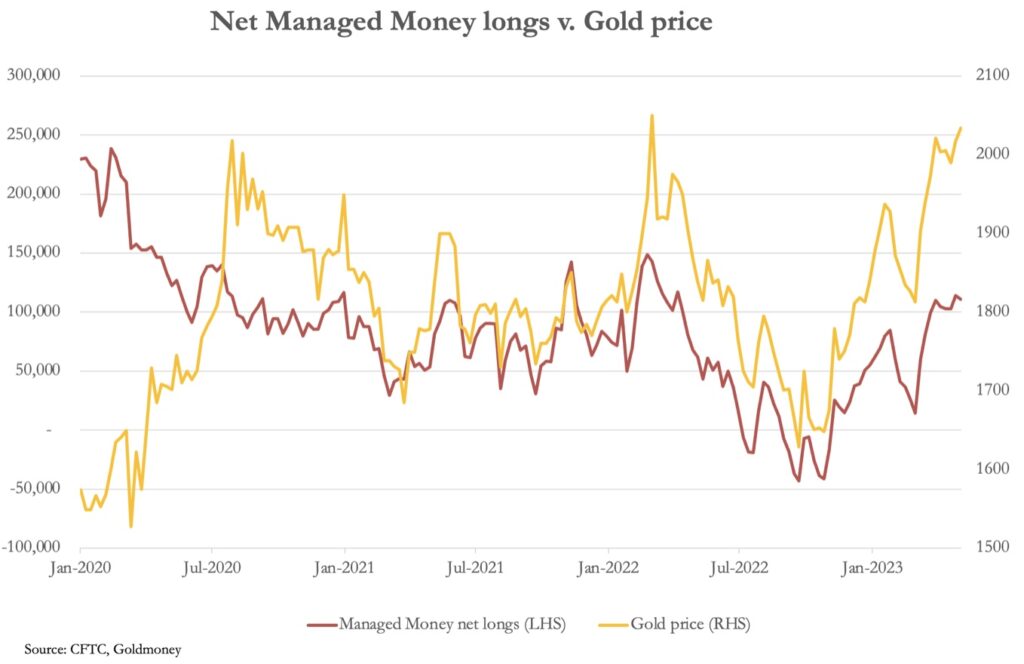

As always, the battle is between the bullion bank traders in the Swaps category, and the hedge funds (Managed Money). The last known net position of this category was on 9 May, when gold closed at $2034 and net longs stood at 110,986 contracts. This is our next chart:

This is not overbought by any means, and the decline in Open Interest has almost certainly brought this net figure down to about 90,000 contracts.

Besides the bullion banks’ obvious desire to close their shorts, the dollar has begun a rally against other currencies, which appears to be a short squeeze. This is next.

The TWI has rallied out of a bearish chart pattern. This rally is often a precursor to further falls. It is possible for the TWI to rally even further, perhaps to the 106 level seen in early March. That being the case, some might take the view that the dollar is the safe haven trade as the financial crisis emigrates to Europe and elsewhere.

The Japanese yen is particularly weak, having broken through the early March level. But the Bank of Japan is still keeping a lid on its government bond yields — but for how long? The dollar-yen rate is next.

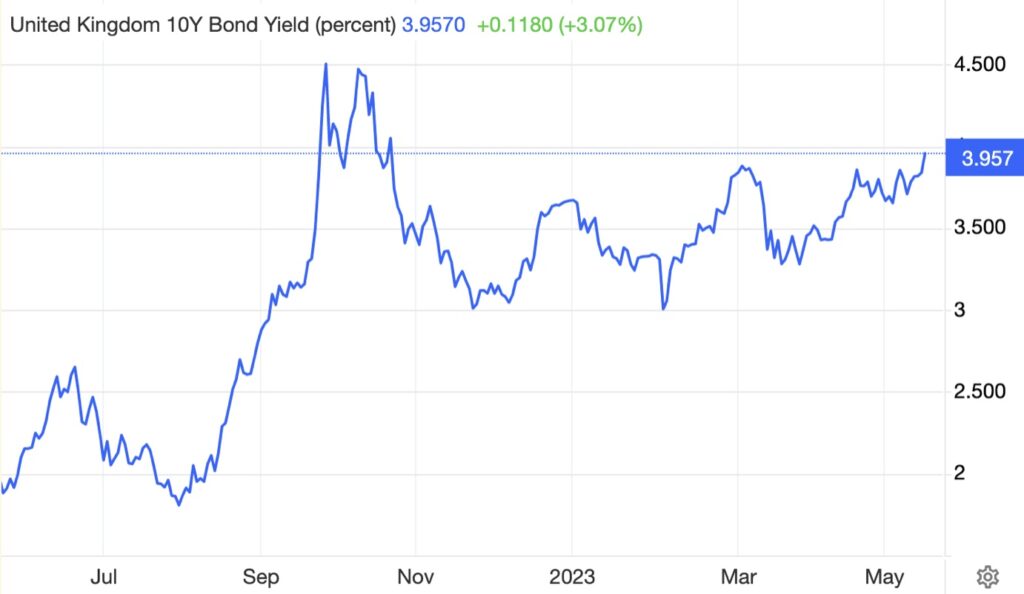

But the bond market which is most concerning is UK gilts, whose yield has been rising in recent weeks. This is next.

This is particularly bearish for gilt prices, suggesting that they are on the way to test the 4.5% yield level.

The background is debt ceiling negotiations in the United States. Until that problem is resolved everything is on pause. It might be leading to some bear closing in forex markets, favouring the dollar. But this could turn out to be a side show, diverting attention away from the emergence of banking problems elsewhere. Particularly concerning is the signal from the UK gilt market: if banking problems emerge in the UK, sterling could easily decline back to GBP 1.10, the yen is already weakening, and the euro won’t be immune to these trends either.

Our best guess is that the financial crisis is entering a new phase likely to undermine the purchasing power of all major currencies in a flight out of them into Chinese yuan, commodities, and precious metals.

ALSO JUST RELEASED: The Human Bubble And The Global Debt Hyper-Bubble May Finally Be Set To Burst CLICK HERE.

ALSO JUST RELEASED: Here Is The Good News For Gold, Plus Interest Rates Surging Again CLICK HERE.

ALSO JUST RELEASED: Benefitting From Gold Takedown, Big Surprise On Car And Truck Pricing, Plus Consumers Are Broke CLICK HERE.

ALSO JUST RELEASED: SentimenTrader – Caution In The Silver Market CLICK HERE.

ALSO RELEASED: Celente – Consumer Debt Just Hit $17 Trillion For First Time But It Gets Worse CLICK HERE.

ALSO RELEASED: WARNING: The Economy Is Already In Full Collapse CLICK HERE.

ALSO RELEASED: The Economic Collapse Continues, Plus Silver Looks Explosive CLICK HERE.

ALSO RELEASED: Greyerz Just Warned The World Is Facing A Catastrophic And Disorderly Reset CLICK HERE.

ALSO RELEASED: Man Connected In China At Highest Levels Warns Of US Dollar Collapse CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.