Here is the good news for gold, plus interest rates are surging…again.

Good News For Gold

May 18 (King World News) – Fred Hickey: Good news! Gold futures contracts open interest plummeted by 37K contracts over past 2 days, & based upon this A.M.’s early action, trend will continue today. Hot money hedge funds dumping long gold contracts & shorting. Will start to show up in Friday COT reports (Managed Money).

The 2-day plunge in gold futures contracts’ open interest, plus declines in DSIs, RSIs etc. show we’re making progress in this correction period. Indicators are not yet at levels that would herald the end of the gold decline, but we’re certainly heading in the right direction.

We’re in a secular gold bull mkt (from $1,050 low to $2,000+ high) & I simply hold my long gold position. But miners are much more volatile & if one can take advantage & trim back near the tops & then rebuy near bottoms, one can appreciate the 2 steps back opportunities…

ALERT:

Legendary investors are buying share of a company very few people know about. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

Losses For Banks Rising

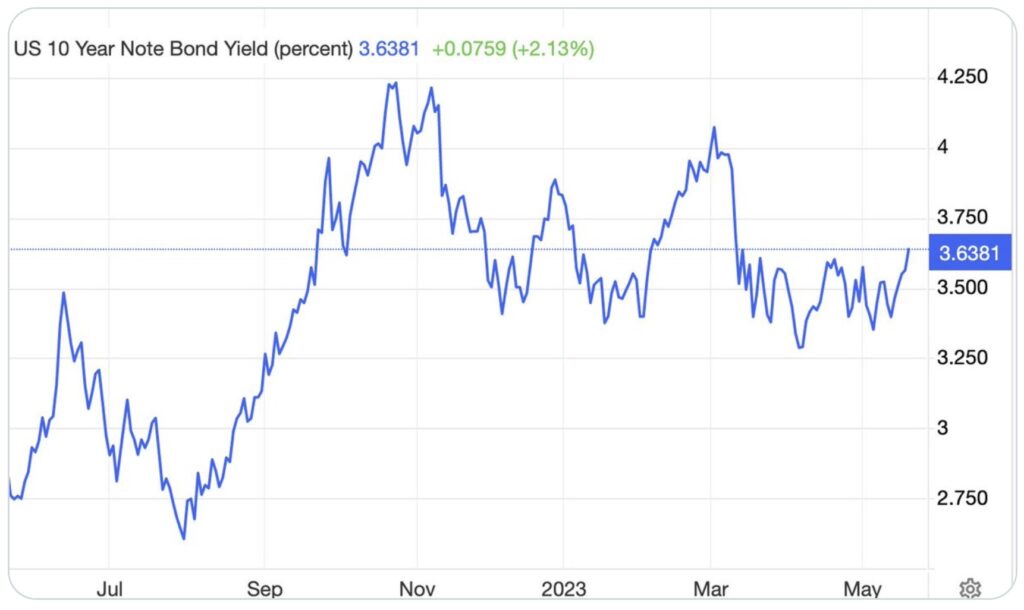

Alasdair Macleod: Here is the US 10-year note Losses at the Fed and at commercial banks will be rising…

Interest Rates Rising…Again

Concern About Stocks

Art Cashin, Head of Floor Operations at UBS: The bulls are attempting to regroup after a bit of an air pocket selloff that was primarily in the Dow Jones.

The financial media is roundly attributing the selloff to comments by Lorie Logan of the Dallas Fed, in which she said that current data does not indicate that a pause is in order, but she would remain data dependent. It certainly was coincidental with the comments but was intriguing that the selling was primarily in the Dow and that the other indices did not react in exactly the same fashion. So, it may have again been somewhat triggered by the algorithmic trading because the selling was so directional. Nevertheless, it was limited and, as we go to press, it looks like they are putting things back in order.

There was one other concern. In the morning, there were reports that the Treasury’s cash on hand may have dipped below one hundred billion dollars, which can be gone in less than two weeks. That seems to put renewed pressure on the negotiations, and traders are taking note, but don’t seem to be concerned and the feeling is that if they can’t strike a deal because time is running out, they will simply kick the can and extend the debt ceiling to sometime in September or there about and give everybody more time.

That having been said, the difficulty will be that if you extend the debt ceiling, you have to put some limitation on it ordinarily. So, what would be the new debt limit, which would be very contentious.

Back to the markets.

The S&P is contending with that 4155/4165 and we will see if they can possibly punch above it. As we go to press, they are clearly through it and trading around 4175.

So, after a bit of a stumble in the minutes before the opening, the bulls seem to be getting control back. We will watch over the balance of the day to see where things go. The VIX is still below 17, which is far too complacent, but it doesn’t appear to be disturbing other traders.

The yields are also near the day’s highs as the regional banks continue to behave themselves. There should be some technical resistance on the yield on the ten-year at 3.67% to 3.70%. So, we will keep an eye to see if they ratchet them higher.

So, for now, the bulls look to have regained control and let’s see if they can punch above their weight and get us out of this range, which is going on for weeks and months.

The coin is in the air. Stay safe..

Arthur

Fear & Greed

Peter Boockvar: Starting with stock market sentiment, the ‘professionals’ remain pretty bullish according to Investors Intelligence as Bulls rose .6 pts w/o/w to 45.2. Bears were 24.7 vs 24.3 in the week prior and the 20.5 pt Bull/Bear spread remains around the widest in a while but nothing extreme. Those surveyed are likely chasing tech and momentum in the big indices. In contrast, today’s individual investor AAII survey saw a jump in those that are Neutral as this category rose 8 pts to 37.4, only a few points from the highest since March 2022. Of the 8 pts, 6.5 came from the Bulls which fell to 22.9 and that is the least since late March (and didn’t include yesterday’s rally). Bears were down 1.5 pts to 39.7. Those surveyed are likely feeling the economic softness. The CNN Fear/Greed index, measuring actually market behavior, closed yesterday at 62, close to the middle of the ‘Greed’ range…

ALERT:

Powerhouse merger caught Rio Tinto’s attention and created a huge opportunity in the junior gold & silver space CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

We know the stock market is rallying on the possibility of a debt deal but a debt ceiling raise is not a positive, it would just be a lack of a negative. Also, we have to stretch the analysis and understand that when the ceiling gets raised, and we know it will, the Treasury will have to issue $500b plus of paper quickly to refill its General Account which according to their website was sitting at just $95b as of Tuesday. That will suck liquidity out of many other places in order to fund.

US Treasuries are selling off again with the 2 yr yield approaching 4.20% and the 10 yr back to 3.60%. Bond yields rose in Asia and are higher in Europe too across the board.

Here’s what Cisco said of note in their earnings call and resulting in the drop in the stock pre market:

“As it relates to customer demand, it is being shaped by a few factors that we believe are impacting the entire industry. First, our increase in product shipments is often leading customers and partners to absorb these shipments prior to placing new orders. Second, the significant reduction in product lead times reduces the need for extensive advanced ordering by our customers. And third, macroeconomic conditions.”

From Target’s call yesterday:

“As it did throughout last year, pressure from inflation and rising interest rates affected the mix of retail spending in Q1 with a further softening in discretionary categories in the March and April timeframe. This coincided with a deterioration in consumer confidence, reflecting recent events such as the banking crisis that emerged in March. These continued signs of caution among consumers have reinforced why we entered this year with a conservative inventory position.”

In terms of product mix, “we continue to benefit from traffic and sales growth in our frequency categories, food and beverage, household essentials, and beauty, which help to offset y/o/y sales in our more discretionary home, apparel, and hardline categories. Within the quarter, total sales were strongest in February, began decelerating in March, and soften further near the end of April.” I bolded that comment.

Target didn’t specifically say it but lower tax refunds is one reason why things weakened as the quarter progressed I’m guessing. In yesterday’s Manheim used car press release where prices fell 2.1% in the first two weeks of May vs April seasonally adjusted, they talked about this refund issue (which is not new news by the way). They said “Tax refunds in 2023 are down compared to last year in all key metrics…The number of refunds issued is down 1% from last year, 8% less has been disbursed than last year, and the average refund at $2,803 is down 7% y/o/y.”

ALSO JUST RELEASED: Benefitting From Gold Takedown, Big Surprise On Car And Truck Pricing, Plus Consumers Are Broke CLICK HERE.

ALSO JUST RELEASED: SentimenTrader – Caution In The Silver Market CLICK HERE.

ALSO JUST RELEASED: Celente – Consumer Debt Just Hit $17 Trillion For First Time But It Gets Worse CLICK HERE.

ALSO JUST RELEASED: WARNING: The Economy Is Already In Full Collapse CLICK HERE.

ALSO JUST RELEASED: The Economic Collapse Continues, Plus Silver Looks Explosive CLICK HERE.

ALSO JUST RELEASED: Greyerz Just Warned The World Is Facing A Catastrophic And Disorderly Reset CLICK HERE.

ALSO JUST RELEASED: Man Connected In China At Highest Levels Warns Of US Dollar Collapse CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.