As we near the end of the second month of trading in 2023, when it comes to global markets reality and delusion will soon collide.

Overnight

February 24 (King World News) – Art Cashin, Head of Floor Operations at UBS: Overnight, the global equity markets are showing a bit of a split personality. In Asia, Japan announced inflation had reached a 41-year high, and the incoming new BOJ member then announced that the current low rates were appropriate policy for what’s going on and that led the Tokyo market to celebrate closing up the equivalent of about 450 points in the Dow. Elsewhere in Asia, however, the other markets are showing mostly a very modest losses.

In Europe, the markets were hardly budging, the changes are fractional. London is up a touch, while markets on the continent are all down fractionally.

The market will be carefully watching the calendar. We have a saloon full of Fed speakers today, most notably Loretta Mester, who is a known hawk, she’ll be speaking before the opening on CNBC, and then at 10:30am she’ll be giving a regularly scheduled speech. And as I say, there are a bunch of others.

The market will pay very close attention to the 8:30am release of the personal income data, that the Fed pays very careful attention to and if it seems to show a stubborn spike in inflation that could move bond yields, which as we go to press or trading and rather neutral fashion. The yield on the 10-year, right around 390 and neutral to beneficial level. The slide rule still says up above 695, that starts to put pressure on stocks. And the closer it gets to 4%, the more that pressure intensifies.

Consumer Sentiment And New Home Sales

Otherwise we get, at midmorning consumer sentiment and new home sales, and then it being Friday at 1:00 o’clock, we get the rig count. But we’ll be watching the yields on the 10-year and look listening very carefully to the other Fed speakers to see if they are leaning in that same direction. The S&P closed above 4000, but should the selling become intense, the break of 3940/3945 would set off a couple of alarm bells.

Any way you know the drill. Stay close to the newsticker. Keep your seat belt fastened. Stay nimble and alert and watch the levels on the bond yields. But above all, stay safe and try to have a absolutely wonderful weekend. Thank you.

Arthur

Trouble In Japan Can’t Be Solved With Magic

Peter Boockvar: We heard from the incoming BoJ Governor overnight where Kazuo Ueda has been called upon to dig out of the massive monetary hole his soon to be predecessor Haruhiko Kuroda dug for him. The delicate dance Ueda has to conduct is removing negative rate policy, allow the market to set the rest of the yield curve but at the same time not allow interest rates to jump too much that the finances of the Japanese government are threatened because of the huge interest expense bill they are potentially subject to on that rate rise. Ueda said this on the job he has ahead, “If I’m appointed BoJ Governor, my mission isn’t to come up with some kind of magical, special monetary policy.” But, higher inflation is going to force him to act sooner rather than later.

Kuroda’s last meeting is on March 10th and I wouldn’t be surprised if he raised the short term rate from -.10% to back to zero. A nominal move but symbolic and something he can exit stage left with. Any further changes to YCC will be left to Ueda and I wouldn’t be surprised if his first move takes place in April by maybe widening the band by another 25 bps.

Reality And Delusion Collide

Ueda acknowledged some reality but also expressed some delusion. He said “It’s true there are various side-effects emerging from the stimulus. But the BoJ’s current policy is a necessary, appropriate means to achieve 2% inflation.” Specifically on YCC and rates, “There are various possibilities on what YCC could look like in the future…If trend inflation heightens significantly and sustained achievement of the BoJ’s 2% target comes into sight, the central bank must consider normalizing monetary policy.”

This re-introduction to Ueda came as Japan’s January CPI came out and rose 4.3% headline and 3.2% ex food and energy, about as expected and both are at multi decade highs if we don’t include value added tax increases. So Ueda talks about whether and when the 2% inflation target comes into sight, well it’s here. Also, the BoJ is beginning to get the wage gains they so hoped for but now which is just trying to offset the higher inflation they wanted. If you didn’t see on Wednesday Toyota raised pay for its 68,000 unionized workers at the fastest pace in 20 years. I couldn’t find the percentage increase but Honda followed and gave its workers a 5% raise.

I spent the morning writing about this all because I cannot emphasize enough that how this all plays out with BoJ policy, JGB yields and the yen has huge liquidity flow repercussions for the rest of the world. JGB yields didn’t move much in response but the yen is weaker and the Nikkei rallied by 1.3%. However, the Japanese bank stock index fell 1.2%. Irrespective of how this goes, we remain long Japanese stocks and especially like Japanese banks. If monetary policy tightens, the yen will rally but we’ll also see repatriation of money from overseas and back into Japan. As the largest foreign holder of US Treasuries, that will also be a big deal for that market. Corporate Japan will also benefit from the China reopening. On the other hand, higher JGB yields will likely have an upward lift to bond yields around the world.

Shifting gears, Square in its earnings call said of note, “Looking at recent volume trends, we saw a moderation in the GPV (gross payment volume) growth rates for discretionary verticals in the US beginning in November, primarily for food and drink and retail. And we have seen these trends continue into the first quarter.” They did though say loss rates on consumer receivables remained below 1%.

Also notable in the Square earnings call was non macro related but maybe a sign of things to come from others. And that is recognizing that stock based employee compensation while technically non-cash is in reality a real expense that so many tech related companies exclude from their P&L and which they call ‘adjusted’. Jack Dorsey acknowledging this said “So we’re going to include it on how we assess our investments and performance…As a result, we’re shifting our focus to an adjusted operating income margin. With this metric, profit margins will include certain non-cash expenses like stock based compensation and depreciation and amortization.”

If all companies properly expensed stock based comp, the earnings on the S&P 500 would be lower.

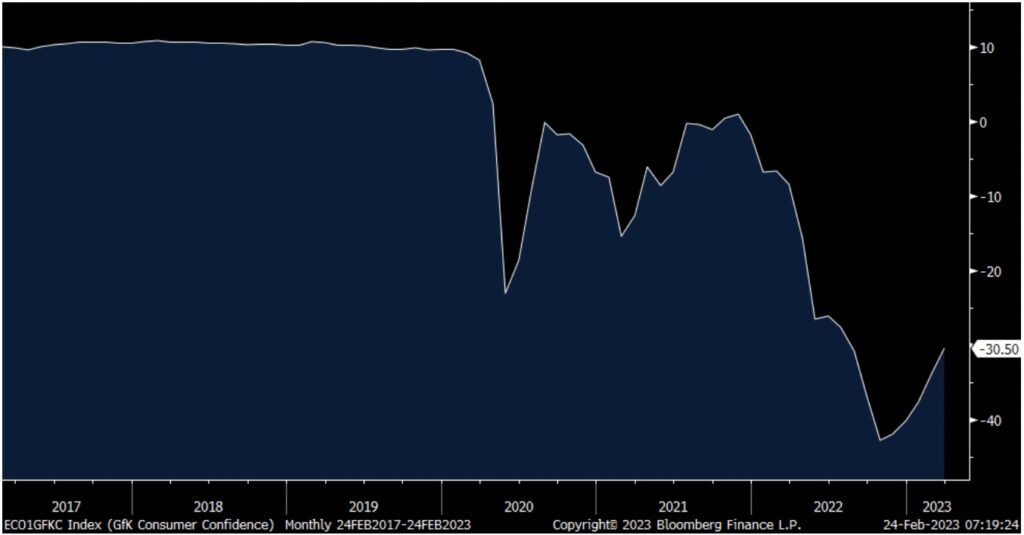

Consumer confidence in Germany rose 3.3 pts m/o/m but still remains deeply negative at -30.5. It was at +9 in February 2020. GFK said “Recent drops in energy prices and reports that experts believe a recession in Germany this year can now be avoided mean that optimism is slowly returning.”

Germany Consumer Confidence

French February consumer confidence fell 1 pt m/o/m but January was revised up by 3 pts so the net result was better than expected. At the current 82, it compares with the February 2020 print of 105. A much higher cost of living is not just hurting the confidence of Americans, but Europeans too.

ALSO JUST RELEASED: Some Thoughts On Buying The Dip In Gold Stocks CLICK HERE.

ALSO JUST RELEASED: RUSSIA, CHINA, WEST: Digital Currencies And Collapsing Fiat Currencies CLICK HERE.

ALSO JUST RELEASED: 2023 & Beyond: Tremendous Change Is Coming CLICK HERE.

ALSO RELEASED: A Massive Gold Catalyst Is Going To Be Unleashed In 2023 CLICK HERE.

ALSO RELEASED: SPROTT: Preview Of What To Expect In 2023 CLICK HERE.

ALSO RELEASED: NEW WORLD ORDER: This Collapse Will Be Breathtaking And Will Lead To Great Reset CLICK HERE.

ALSO RELEASED: What’s Happening Now Is Exactly What Happened Before 2008 Panic & Dot-Com Bust CLICK HERE.

ALSO RELEASED: Gold Has Been Pouring Out Of COMEX, Who Knows What’s Happening In London? CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.