Today market veteran James Turk told King World News that a massive gold catalyst is going to be unleashed in 2023.

February 21 (King World News) – James Turk: As you know Eric, I like to look at past events and relate them to the present to explain how markets are trading. Sometimes history repeats, but when it doesn’t, we need to take notice. Like now.

The Fed is fighting a different inflation battle than the one Paul Volcker fought when he was Fed chairman. It’s on a different path – and it’s a lot more dangerous.

The value of currencies like the dollar, euro and all the rest depends on their supply and demand. In this regard currencies are like every other useful good or service.

Volcker fought inflation by increasing the demand for the dollar. This time the Fed is decreasing the supply of dollars…

ALERT:

Powerhouse merger caught Rio Tinto’s attention and created a huge opportunity in the junior gold & silver space CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Volcker kept raising interest rates until real rates adjusted for inflation reached a sky-high 6%. That is 5 or 6 times normal real interest rates, but he needed to do that to save the dollar. Demand for the dollar had been falling, and its future looked uncertain.

So he used high real interest rates to entice people to hold dollars, increasing its demand. Throughout his eight year reign at the Fed, the quantity of dollars kept growing, but at an ever declining growth rate that lowered inflation rates. And demand for the dollar remained strong because real interest rates – though dropping from their peak to normal levels – remained positive.

When Alan Greenspan became chairman in 1987, he followed the same policy, continuing this period of disinflation. Prices of goods and services were still rising, but at a much slower rate.

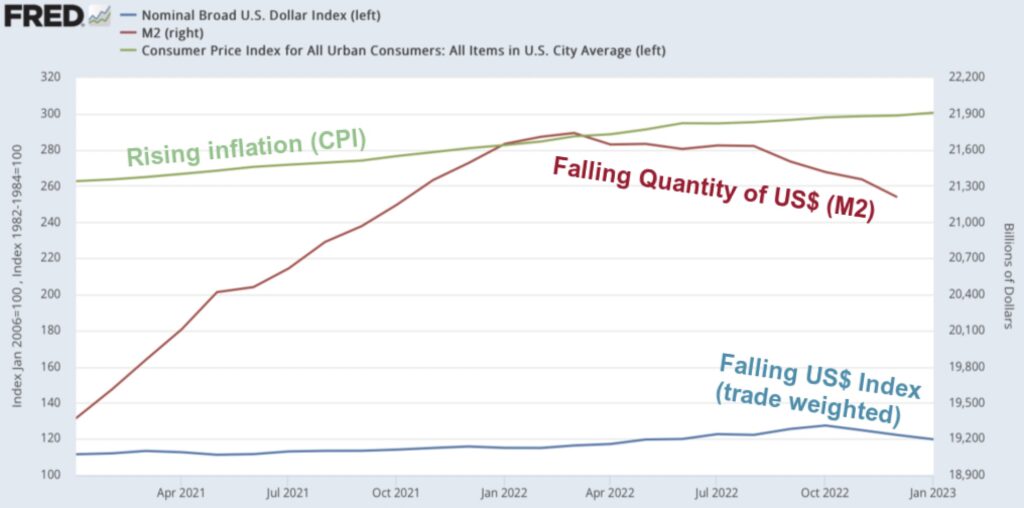

This disinflation continued until September 1992 when European Exchange Rate Mechanism fell apart, and George Soros’s short position on the British pound broke the Bank of England. Central banks and the Fed began pumping currency into the economy and continued doing that until recently, as we can see on the following chart.

M2, which is a measure of the quantity of dollars, has been dropping since the record peak last year. The trade weighted dollar average of late has also been turning lower. Similarly, the US dollar Index (not shown on the chart) has dropped 9% since its September peak. Yet inflation is still rising as seen by the Consumer Price Index on the chart.

So even though the ‘supply’ of dollars is declining, the purchasing power of the dollar is declining relative to other currencies and goods and services. There is only one possible conclusion.

The demand for the dollar is falling. It’s a reasonable conclusion to reach because real interest rates remain negative notwithstanding the recent increases engineered by the Fed. Here’s the kicker, Eric.

The Fed can’t raise real interest rates like Volcker did because there is just too much debt at every level…

ALERT:

Legendary investors are buying share of a company very few people know about. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

For example, in the first 4 months of the current fiscal year, the US government’s interest expense payout is 25% higher than last year, and the full impact of recent rate increases has not yet been felt. With the debt ceiling problem hanging overhead like Damocles sword, the Fed is stuck.

Although real rates are negative, the Fed is not going to worsen the US government’s interest expense burden. So it is hoping to contain inflation by focusing on the supply of dollars rather than demand, but we know from monetary history that demand for a fiat currency can evaporate in a heartbeat.

All of this analysis leads me to keep asking myself the big question. Has a flight from the dollar begun?

Yes, it has, and like all similar episodes throughout monetary history, the flight starts small. That conclusion leads to an unanswerable question because we can’t predict the future.

Will this flight out of the dollar accelerate? Only time will tell.

There is one last comparison to the 1970s. Back then people could escape the dollar and go into hard currencies like the Deutschmark and Swiss franc. Today there are no hard currencies. So the only safe escape is physical gold and physical silver, and if you are so inclined to make an investment, the shares of the companies that mine them.

ALSO JUST RELEASED: SPROTT: Preview Of What To Expect In 2023 CLICK HERE.

ALSO JUST RELEASED: NEW WORLD ORDER: This Collapse Will Be Breathtaking And Will Lead To Great Reset CLICK HERE.

ALSO JUST RELEASED: What’s Happening Now Is Exactly What Happened Before 2008 Panic & Dot-Com Bust CLICK HERE.

ALSO JUST RELEASED: Gold Has Been Pouring Out Of COMEX, Who Knows What’s Happening In London? CLICK HERE.

***To listen to Gerald Celente tell you what the mainstream media won’t CLICK HERE OR ON THE IMAGE BELOW.

***To listen to Alasdair Macleod discuss gold disappearing out of COMEX vaults as well as what’s happening with the Russians and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.