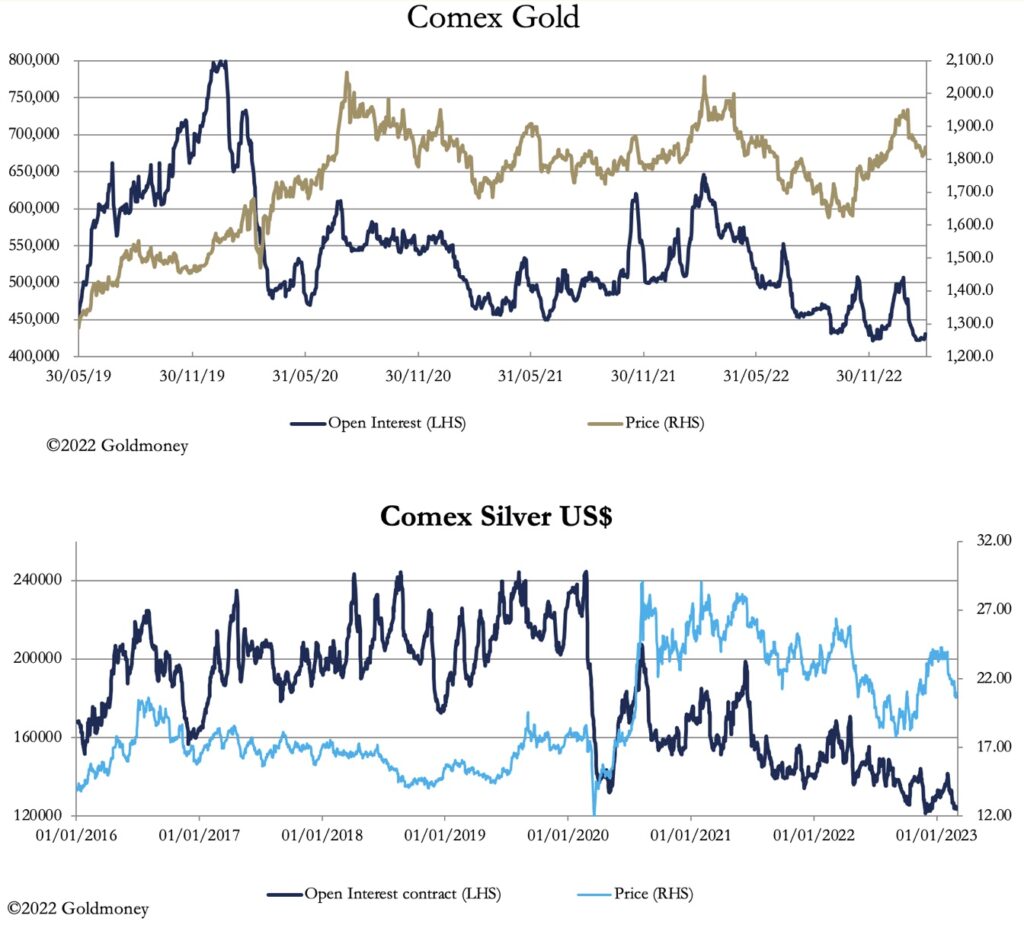

As we come to the end of another week of trading, Open Interest in silver has collapsed…again. Gold remains collapsed, lowest in many years. This is extremely bullish as the metals continue to form a historic bottom.

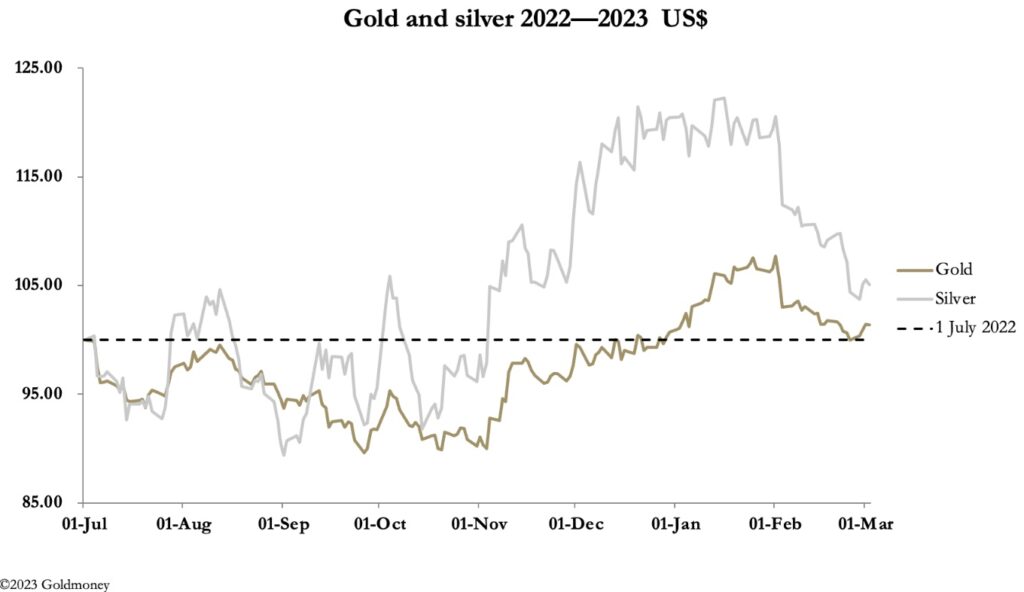

March 3 (King World News) – Alasdair Macleod, head of research at Goldmoney: After declining recently, gold and silver steadied this week in oversold conditions. This morning in European trade gold was $1847, up $37 from last Friday’s close, and silver was $21.10, up 50 cents. Turnover on Comex has been low in both contracts.

We still lack Commitment of Traders Reports following the ransomware attack on ION, one of the software providers used to submit data. The last report was for 31 January. There is no way of knowing how many traders own systems have been breached by the Russian ransomware attacker through ION. But if the attack has not only accessed data but trading systems, there is no knowing how much damage there is to paper markets and disruption yet to be caused.

With respect to gold and silver, all we know is that physical is still being stood for delivery. 5.9 tonnes of gold are stood for delivery so far this week, bringing the total to 94.5 tonnes this year. And in silver, the figures are 399.4 tonnes this week, and 1,370.3 tonnes respectively. Note that silver deliveries this week have been particularly heavy in a market where there is little physical available…

ALERT:

Legendary investors are buying share of a company very few people know about. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

Furthermore, according to the World Gold Council, central banks added a further 31 tonnes to their gold in January. And other reports are of significant premiums on the Shanghai Gold Exchange over the paper gold price on Comex.

The next chart shows how oversold these two contracts have become.

If we had COT figures, they would probably show the Managed Money category net short in both contracts, setting them up for a decent bear squeeze.

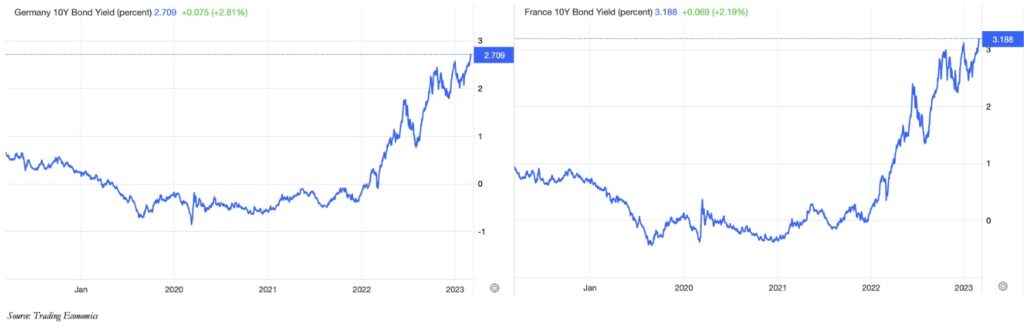

But in the background, there are big-picture changes in progress. Bond yields are on the rise again, disappointing those looking for a policy pivot from the Fed. The next chart is of the 1-year UST bond.

And this is not the only bond market saying goodbye to a pivot and lower interest rates. The next chart is of the two major European 10-year bonds — Germany and France.

That these bond yields are now hitting new highs is significant. Spanish bond yields are also hitting new highs, and the 0.5% cap on Japan’s 10-year JGB has been breached for the last three trading sessions.

Many traders would see higher bond yields as bad fo gold, which is probably why the Managed Money category has sold out of gold and silver. But interestingly, this trend is beginning to be challenged with gold prices rising this week with bond yields.

Doubtless, there will come a point where the interest rate differential narrative will give way to an understanding that the higher bond yields and interest rates rise, the more destabilising they will become. Today, Credit Suisse’s share price hit new lows (CHF2.66) on news that they are being forced to offer higher interest rates to stop a run on deposits.

The message is clear: rising interest rates and bond yields are beginning to threaten a banking crisis. Gold is the safe haven.

ALSO JUST RELEASED: SILVER: If You Are Only Going To Read One Thing Today Let It Be This CLICK HERE.

ALSO JUST RELEASED: Interest Rates Will Continue To Rise Threatening The Entire Western Financial System CLICK HERE.

ALSO JUST RELEASED: SentimenTrader – The Gold Market May Finally Be Poised For A Big Rally CLICK HERE.

ALSO JUST RELEASED: Yes US Housing Market Plunged $2.3 Trillion, Biggest Since 2008, But Here Is The Big Surprise CLICK HERE.

ALSO RELEASED: This Is How You Make A Major Bottom In The Silver Market, Plus “Rent Too Damn High!” CLICK HERE.

ALSO RELEASED: Worried About The Recent Plunge In Gold And Mining Stocks Just Read This… CLICK HERE.

ALSO RELEASED: US Stock Valuations Have Entered Dangerous “Death Zone”, Plus Latest Time We Saw This Gold Bottomed CLICK HERE.

ALSO RELEASED: Greyerz – You Better Have Escape Plans For The Next Global Collapse CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.