The evidence continues to pile up that the silver market is forming a major bottom right now, plus “Rent too damn high!”

This Is How You Make A Bottom In The Silver Market

February 28 (King World News) – Peter Brandt: Speculators have lost interest in Silver. Open interest is lowest in nine years as traders have abandon the industrial/semi-precious metal.

Speculators Have Left The Silver Market – Open Interest Lowest Level In 9 Years!

Not At All On Target

Peter Boockvar: Here were the key comments from the Target earnings press release where you can drive a truck thru their quarterly and full year guidance that were both below expectations.

The macro “continues to be a very challenging environment. Strength in Food & Beverage, Beauty and Household Essentials offset ongoing softness in discretionary categories.”

“We’re planning our business cautiously in the near term to ensure we remain agile and responsive to the current operating environment.”

“Inventory at the end of the quarter was 3% lower than 2021…Inventory in discretionary categories was approximately 13% lower than a year ago, partially offset by higher inventory in frequency categories.”…

ALERT:

Legendary investors are buying share of a company very few people know about. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

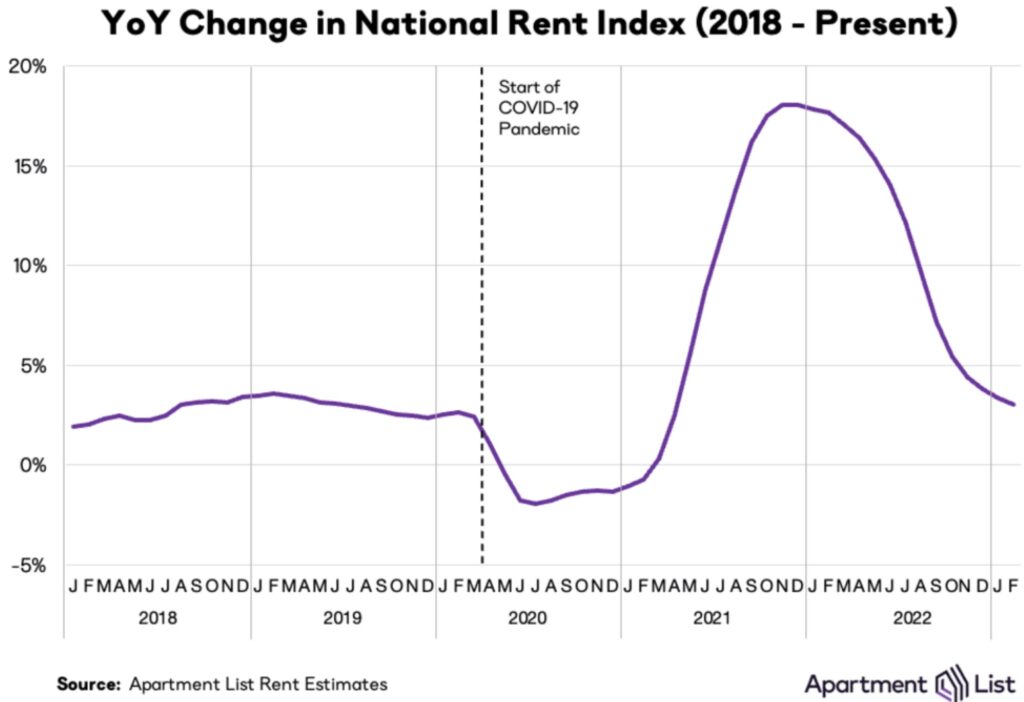

“Rent Too Damn High”

Apartment List released its March National Rent Report and it saw a .3% m/o/m increase in new rents (doesn’t include extension of expiring leases) in February, “marking a return to positive rent growth after five straight m/o/m declines. This month’s increase is of a similar magnitude to the typical February price change that we saw in pre-pandemic years.” The y/o/y increase was 3% which is just above the 2019 pace of 2.8% “and is likely to decline further in the months ahead.”

The supply side continues to pick up with the vacancy rate at 6.4%, the highest in two years” with a lot of construction taking place. This added supply could result in “property owners competing for renters, rather than the other way around.” In terms of breadth, rents rose in 62 of the 100 largest cities with Boston leading the way.

Bottom Line

Bottom line, in the coming quarters the slowdown in rent growth will show up in CPI and PCE and will stop the acceleration seen in the services side of these stats. The still robust demand, though many are much more price sensitive, for renting will still be apparent as the cost of buying a home is a real challenge for many but the supply side is finally catching up. That said on the supply side, I’m hearing more stories of new construction plans being canceled because the numbers just don’t make sense anymore with the higher cost of funding and the moderating rental gains.

Yesterday the February Dallas manufacturing index joined all of its regional peers in not seeing any growth with its -13.5 print, confirming again the recession that US manufacturing is currently in.

Here were some of the key quotes from different companies in a variety of industries. While there are a few spots of optimism, most reflect the slowdown…

To Find Out Which Uranium Company Is Positioning Itself To Become A Powerhouse In Nevada Click Here Or On The Image Below.

Chemical Manufacturing

“There has been some improvement in orders, but it is spotty and material specific, and is not showing a broad trend that influences a six month outlook.”

“January and the start of February resulted in headwinds following a strong fourth quarter. Customers are decreasing inventories held and asking for better terms.”

Computer and Electronic Product manufacturing

“After a slow start to the year, we saw a lot of new orders in late January and early February. Despite the talk of recession, we believe that we’ll continue to grow.”

“We are seeing all markets slow with the exception of automobiles. Personal electronics is in its third quarter of correction; all other markets (except automobiles) are in their second.”

“I am currently worried about the time I am seeing it take for my customers to pay me.”

Food Manufacturing

“The market seems to have stabilized. Costs have leveled out, but we are seeing an uptick in protein raw material costs.”

Misc Manufacturing

“All markets serviced have slowed down and are ordering lower quantities as compared with last year. Automotive OEM customers’ volumes are most affected by lower quantities.”

Paper Manufacturing

“We have seen a slowing the last two quarters and expect the same moving forward.”

Plastics and Rubber Products Manufacturing

“Revenue dollars per sale are going down. People are watching their money.”

Primary Metal Manufacturing

“We expect recession in the 2nd half of this year. We already had a first round of layoffs, if and when business slows down again.”

“Our residential building and construction business has decreased dramatically over the past few months due to mortgage rate increases, inflation and other factors.”

Printing and Related Support Activities

“It seems like someone turned off the spigot, as we have gotten stupid slow, as others have in our industry.”

“A continued lack of labor (semi-skilled) is crippling.”

Textile Product Mills

“February has been a slow month; it is hard to know why, but our outlook has worsened for both our business and retail activity in general.”

“Customer volumes in soft goods, specifically bed subcomponents, mattresses, comforters and pillows, have seen a sales reduction of 55% over last year.”

Transportation Equipment Manufacturing

“There is nothing positive with respect to the economy.”

“We do believe that the 2nd half of 2023 will see a general reduction in business levels but no contraction in pricing.”

Overseas

Moving overseas. The trade data out of Vietnam, the growing manufacturing prescence, saw exports in February unexpectedly rise by 11% y/o/y, well better than the estimate of a drop of 21%. Because of the China Lunar New Year holiday, the US was their biggest export market in the January/February time frame. Industrial production in February also was better than estimated.

Bond yields again are moving higher in Europe, and in turn the US, after Spanish CPI for February rose more than expected. CPI was up 6.1% y/o/y, above the estimate of 5.8%. Also, French CPI was higher by 7.2% y/o/y vs the forecast of up 7%. Because of the influence of energy subsidies, it’s tough to know what the ‘organic’ figures would be but either way, the ECB is raising 50 bps in March. The German 2 yr yield is up another 4 bps and the 10 yr is higher by 6 bps.

Lastly, the yen is weaker after the incoming deputy governor Shinichi Uchida spoke today and doesn’t seem to be in much of a rush to tighten policy. He said “I feel it would be more appropriate for a new leadership to take time, a broader angle and conduct a wide-ranging review.” Spoken like a true bureaucrat. And on actual policy, “It is necessary to continue monetary easing and firmly support the Japanese economy.” The mentality that negative rates and QE is a support to their economy remains the problem.

ALSO JUST RELEASED: Worried About The Recent Plunge In Gold And Mining Stocks Just Read This… CLICK HERE.

ALSO JUST RELEASED: US Stock Valuations Have Entered Dangerous “Death Zone”, Plus Latest Time We Saw This Gold Bottomed CLICK HERE.

ALSO JUST RELEASED: Greyerz – You Better Have Escape Plans For The Next Global Collapse CLICK HERE.

***To listen to Michael Oliver discuss what to expect for the stock and bond markets as well as the gold, silver and mining share markets CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.