Today one of the greats in the business let investors know the gold market may finally be poised for a big rally.

Gold may finally be poised to rally

March 1 (King World News) – Here is a portion of an important report from Jason Goepfert at SentimenTrader: The dollar’s big counter trend rally.

Key points:

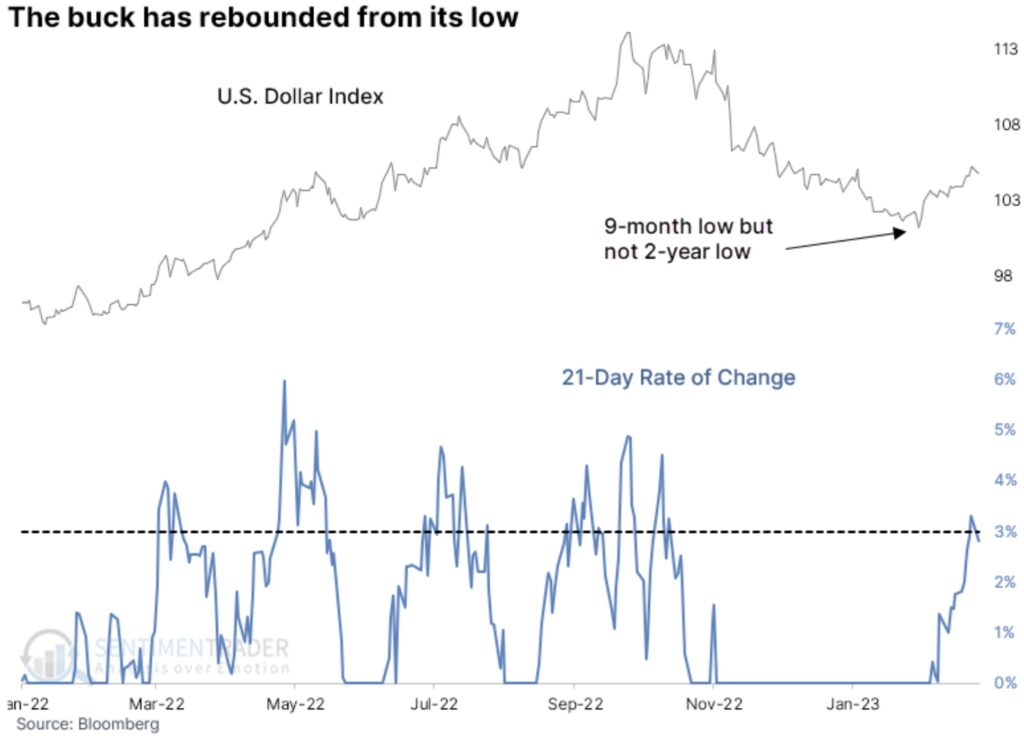

- Over the past month, the U.S. dollar has jumped more than 3%

- That comes on the heels of what had been a 9-month low

- Similar rallies in the dollar showed a strong tendency to fail, with positive implications for other markets

Strong counter-trend rallies in the dollar tend to fail

Investors have had a renewed focus on the U.S. dollar in recent weeks, which has helped to upend some trends in place since October…

ALERT:

This company is about to start drilling what could be one of the largest gold discoveries in history! CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

The dollar has enjoyed a strong rebound over the past several weeks, with a 21-day rate of change of more than 3%. The rally is coming on the heels of at least a 9-month low in the dollar, but not a 2-year low. Meaning, it has been a counter-trend rally that was not within a prolonged downtrend.

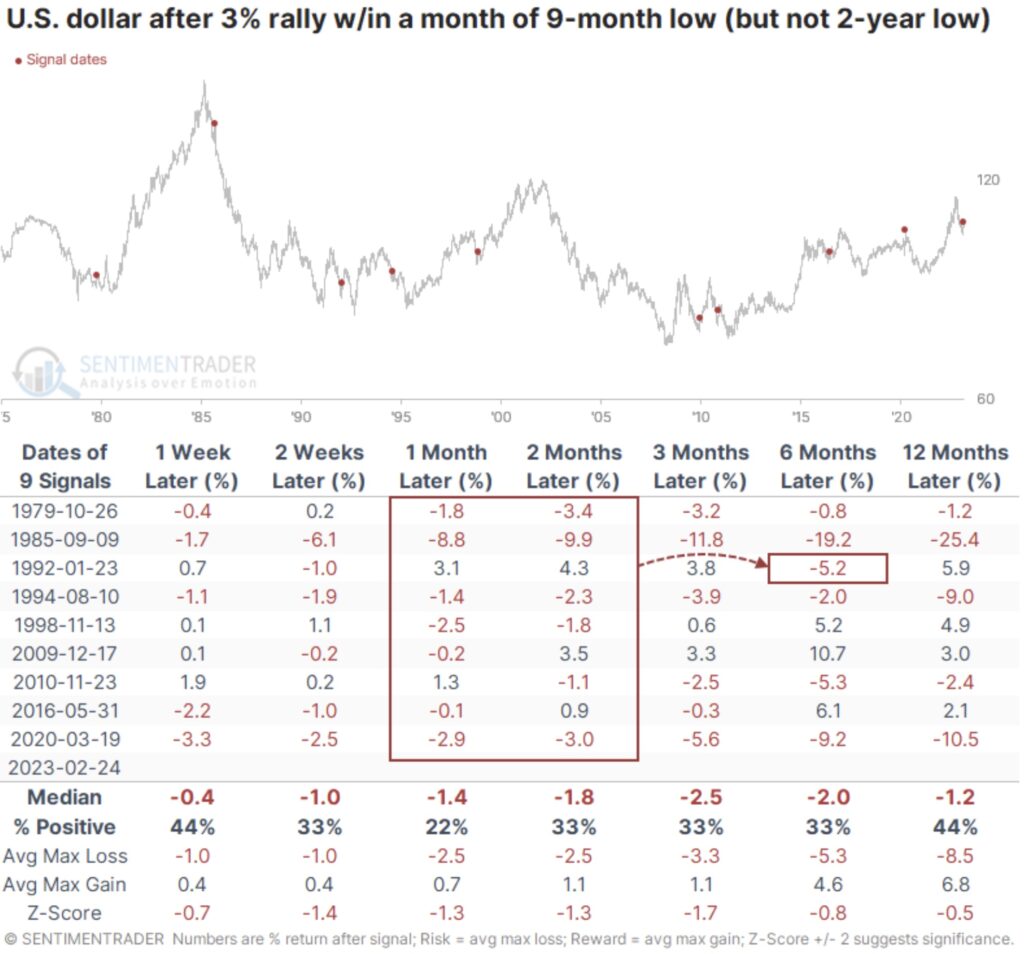

After similar rebounds, the dollar struggled to hold its gains. It sported a negative return after all but one signal either one or two months later. The only exception was in 1992; that rally petered out in the months ahead.

Gold Bull May Unleash On The Upside

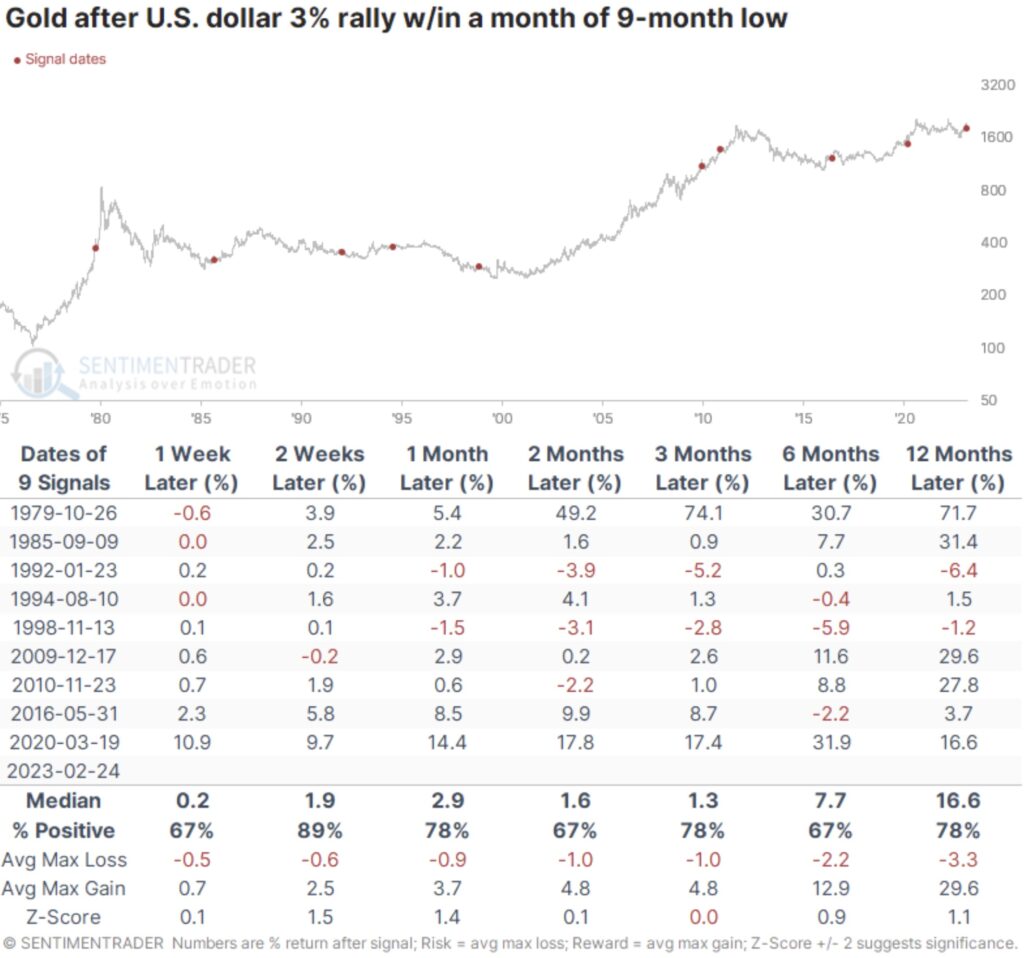

If the dollar struggles, that usually means good things for gold. While there were some losses, gold rallied over the next few months after 7 of the 9 signals. For the most part, gold did quite well, with mostly limited losses and potentially substantial gains.

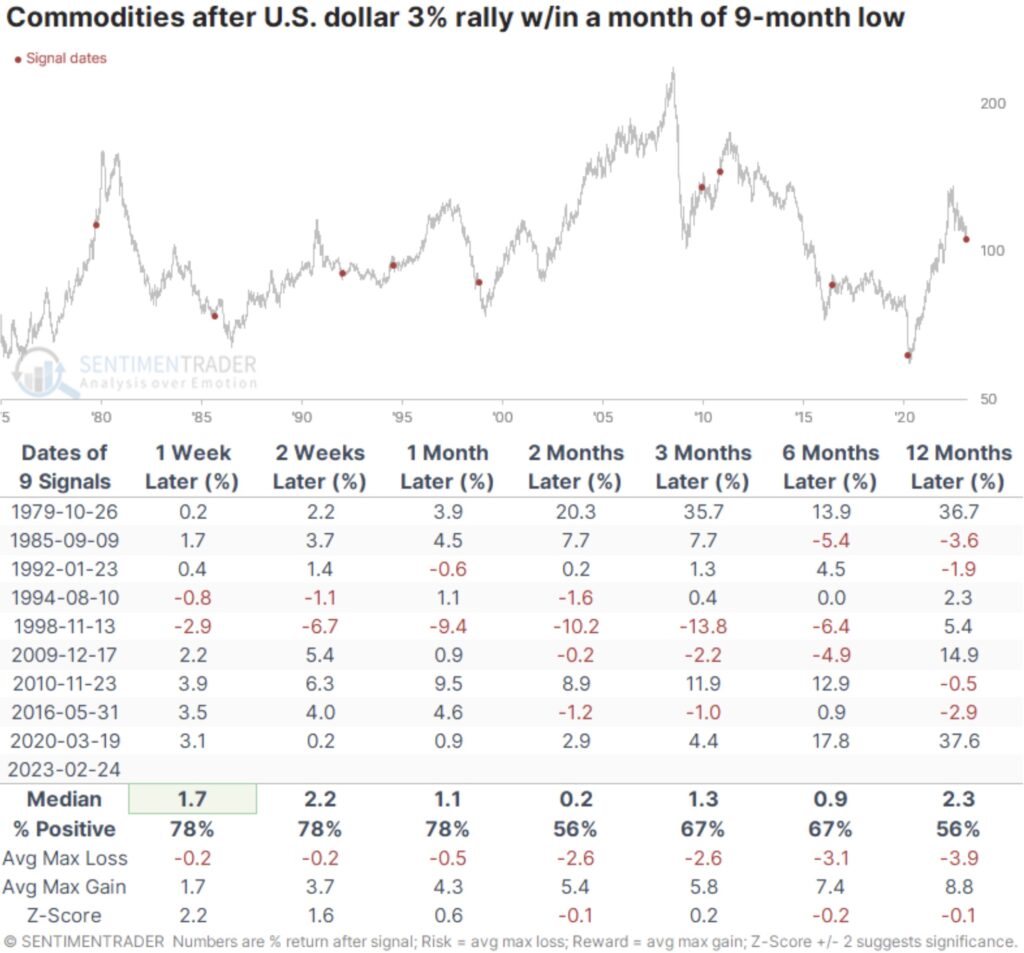

Commodities, in general, also tended to rebound, though it was primarily loaded in the short term.

What the research tells us…

In recent weeks, many trends in place across markets since October have reversed. Some of that has been driven by a rebounding U.S. dollar, which has a powerful impact on commodities and overseas returns. However, the type of rally the dollar has enjoyed appears to be counter-trend. Similar patterns had a strong tendency to reverse once again, leading to negative returns for the dollar and positive ones for most other markets. This is another example of why Jason Goepfert is the best in the world at what he does – providing actionable market data. To subscribe to the internationally acclaimed work Goepfert produces at SentimenTrader CLICK HERE.

ALSO JUST RELEASED: Yes US Housing Market Plunged $2.3 Trillion, Biggest Since 2008, But Here Is The Big Surprise CLICK HERE.

ALSO JUST RELEASED: This Is How You Make A Major Bottom In The Silver Market, Plus “Rent Too Damn High!” CLICK HERE.

ALSO JUST RELEASED: Worried About The Recent Plunge In Gold And Mining Stocks Just Read This… CLICK HERE.

ALSO JUST RELEASED: US Stock Valuations Have Entered Dangerous “Death Zone”, Plus Latest Time We Saw This Gold Bottomed CLICK HERE.

ALSO JUST RELEASED: Greyerz – You Better Have Escape Plans For The Next Global Collapse CLICK HERE.

***To listen to Michael Oliver discuss what to expect for the stock and bond markets as well as the gold, silver and mining share markets CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.