On a day where the price of gold is down $25, here is the good news, plus a look at economic surprises.

June 7 (King World News) – Fred Hickey: On May 15 (3 weeks ago), gold was $2,016oz and gold futures open interest(contracts) was 536K. On June 5, open interest was just 434K, down a whopping 102K contracts (-19%), indicating little interest in gold and at a level where gold typically rallies. Yet gold is hovering above $1,960.

So far, gold’s decline over past month’s (healthy) correction has been limited. Assuming that continues during what’s left of seasonal weakness (historically optimal time to buy is mid-June/early-July), lift-off level could be relatively high, likely leading to record highs and more…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

Economic Surprises In The U.S. And Europe

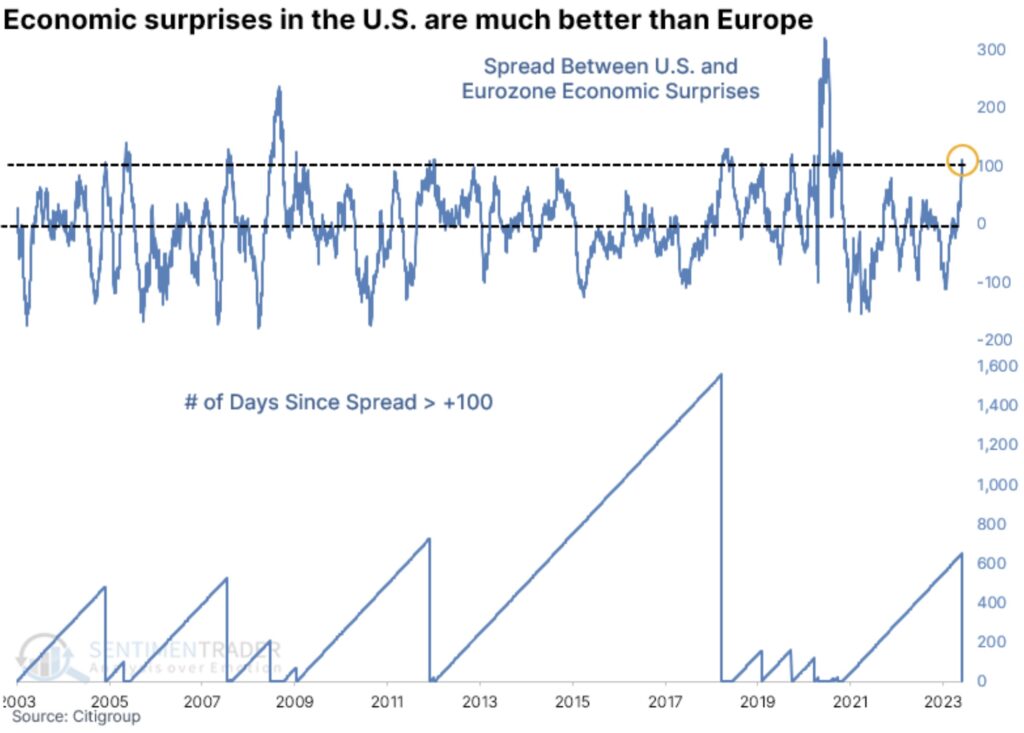

Jason Goepfert at SentimenTrader: Economic surprises in the U.S. far outpace the eurozone.

Key points:

- In recent months, U.S. economic reports have far outpaced the eurozone in positive surprises

- The spread between the two economic forces is now among the widest in 20 years

- After similar spreads, the S&P 500 tended to beat the Euro Stoxx 50, and the dollar beat the euro

The U.S. economy has been much more surprising than the eurozone

After a wretched 2022, stocks in the eurozone enjoyed a ripping rally off the fall lows, which continued into April of this year. It has only been in recent weeks that the U.S.-based S&P 500 has retaken its leadership position.

We wouldn’t know this by studying the flurries of economic reports. Based on those, the U.S. has massively outperformed the eurozone for months, and the spread is getting wider.

Recently, the Citi Economic Suprise Index for the U.S. was more than 100 points higher than the same index for the eurozone. That’s the widest spread favoring U.S. economic conditions in nearly three years. The past few days’ readings have ranked in the top 5% of all readings over the past twenty years.

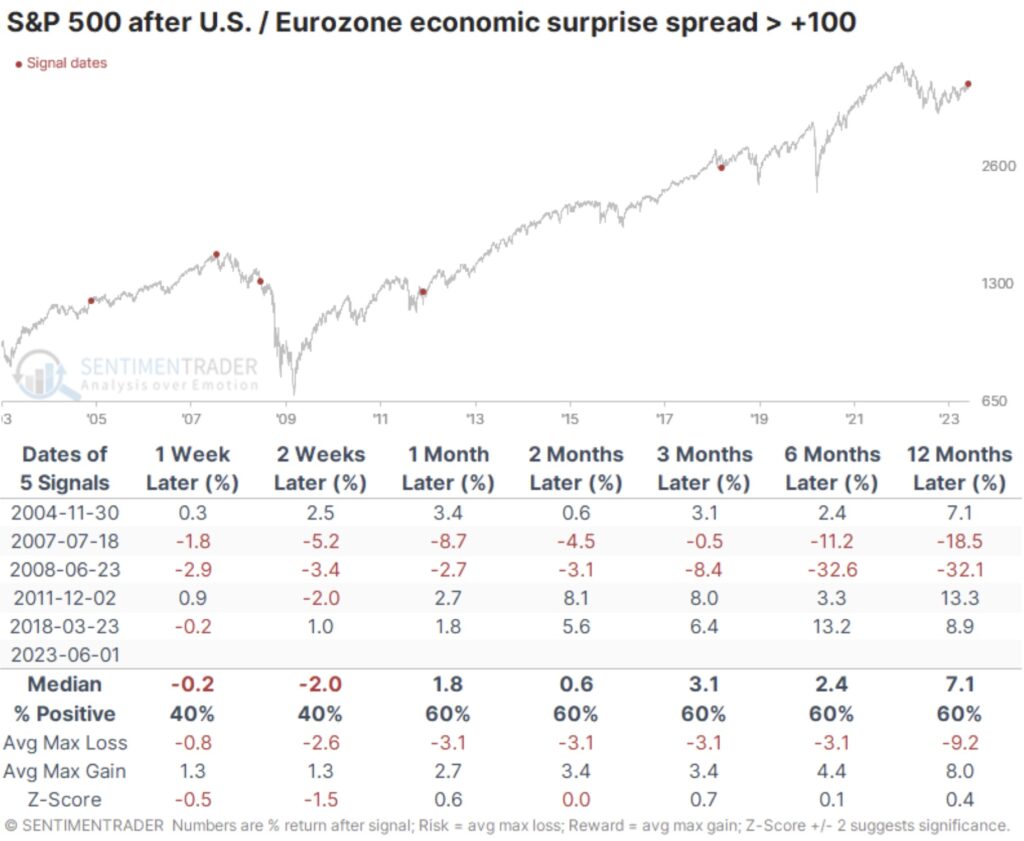

That’s all fine and good, but it doesn’t really help investors. The table below shows returns in the S&P 500 after the spread between U.S. and eurozone economic surprises surpassed +100. The limited data and extreme nature of the current environment mean that we necessarily have a tiny sample size and all the caveats that go along with that.

For the S&P, there isn’t much to say. It preceded medium-term rallies a few times and significant declines a couple of times, thanks to the 2008 financial crisis.

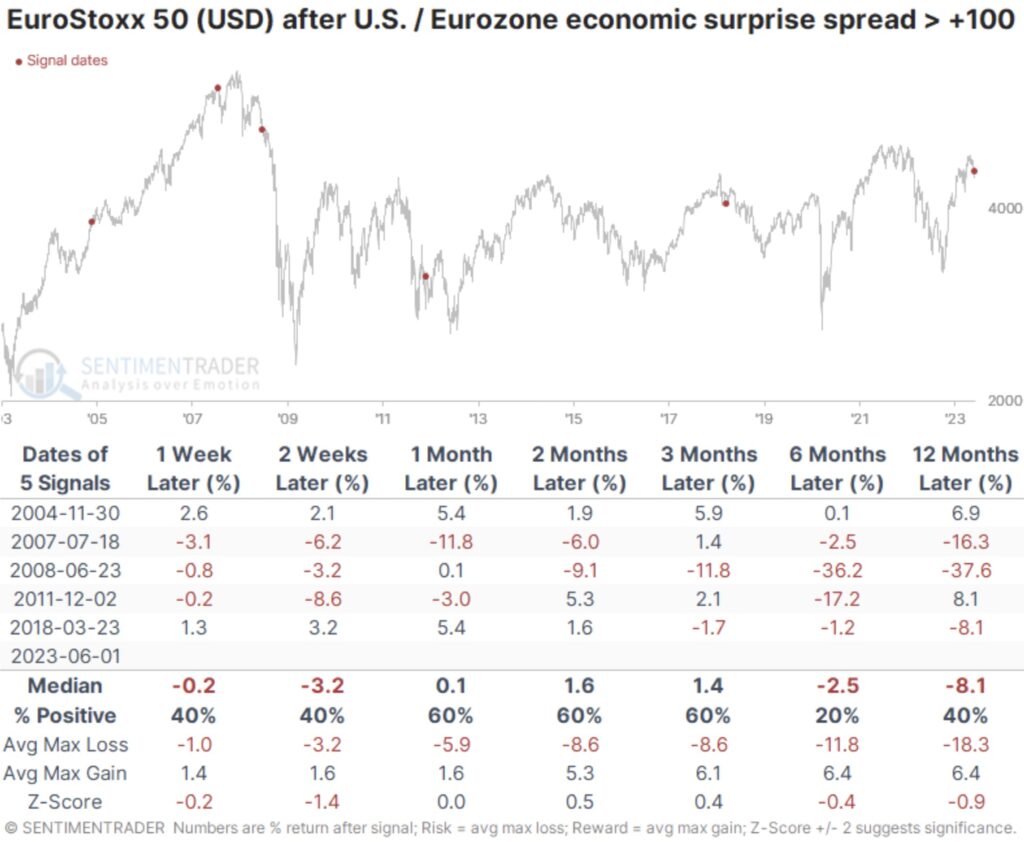

The Euro Stoxx 50 (priced in U.S. dollars) showed poor returns over the next six months. Only a single signal sported a positive return, and that was just barely. The risk/reward in those stocks was lopsided toward the risk side.

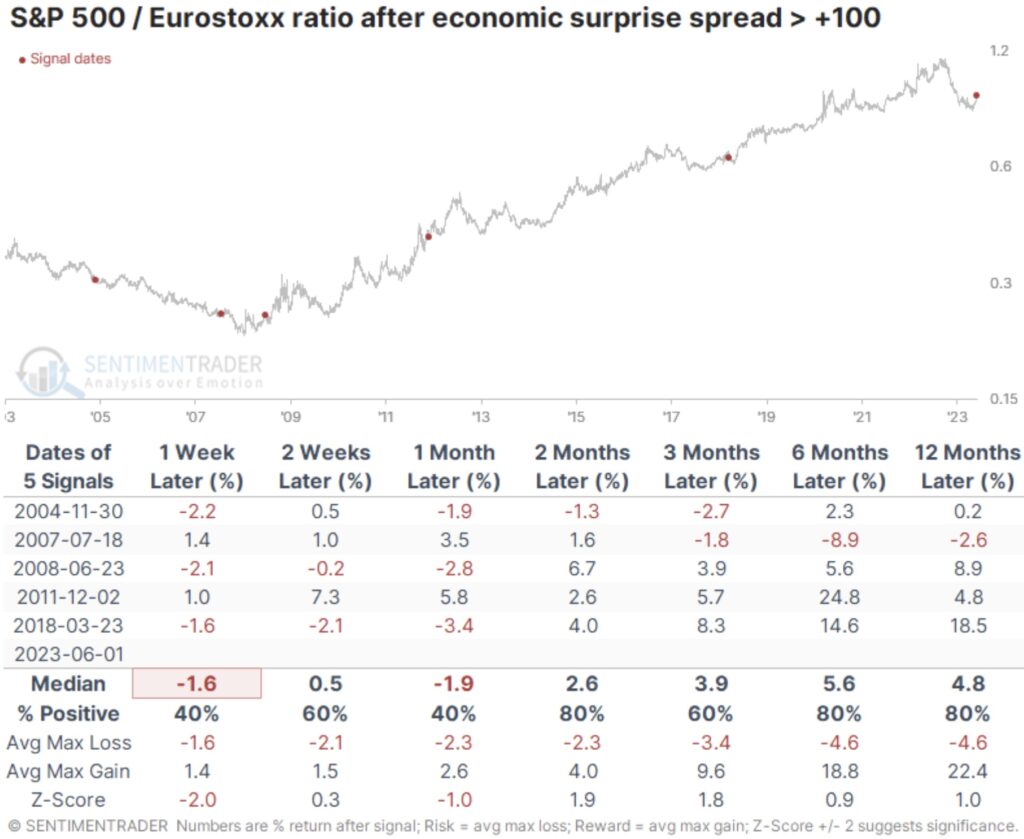

When we look at the ratio of the S&P 500 to Euro Stoxx 50 (in dollars), then we can see that – as much as we can conclude from a sample size of five – similar spreads in economic performance also favored gains in the S&P relative to the Euro Stoxx. Over the next two to twelve months, the S&P consistently gave investors better returns.

Currencies showed the same pattern

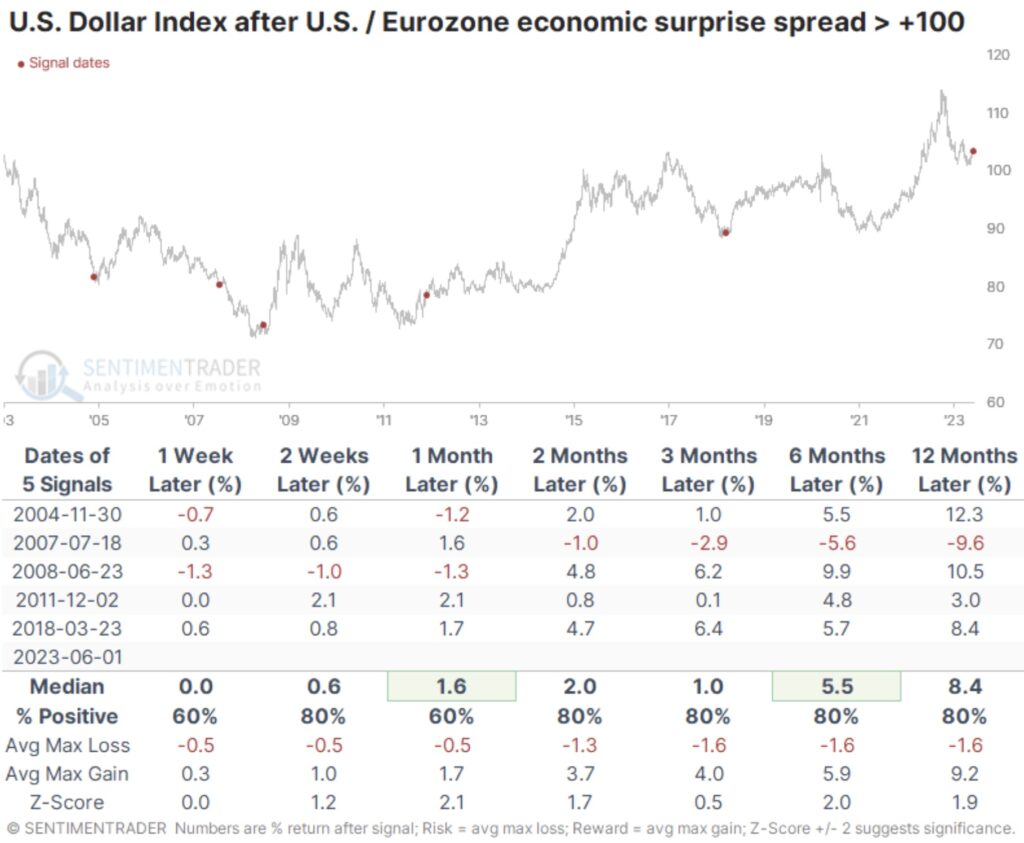

An outperformance of U.S. assets over eurozone assets was also evident with the currencies. The U.S. Dollar Index rallied after four of the five instances.

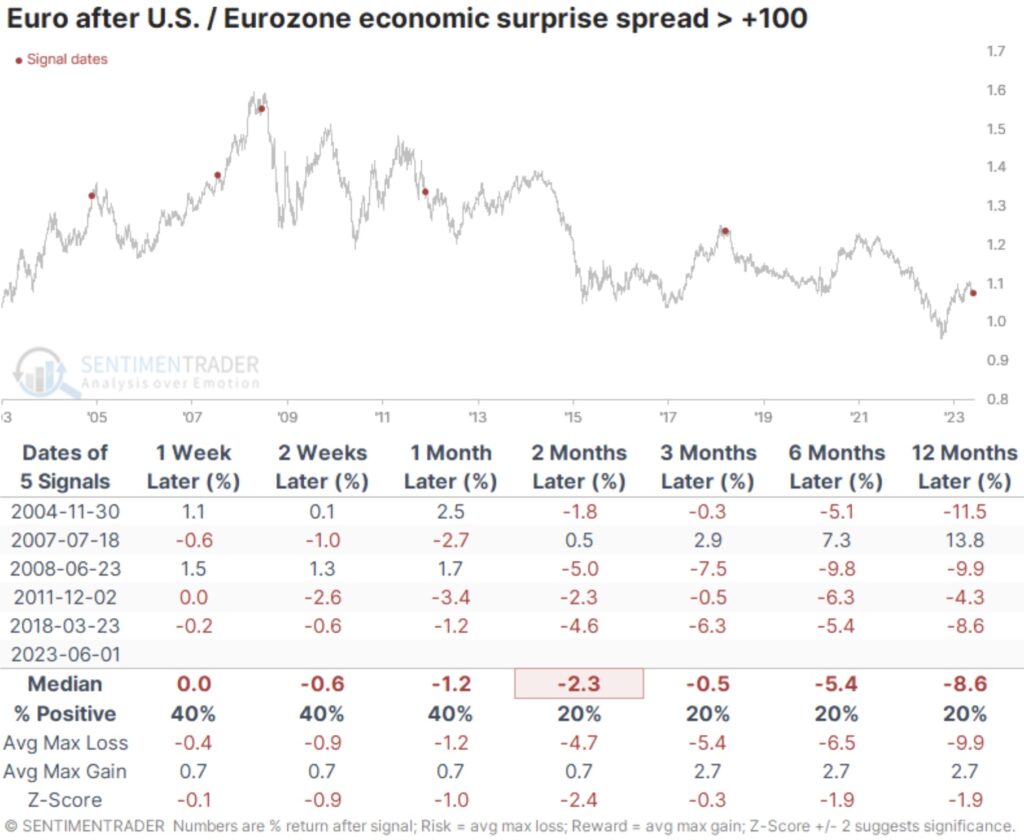

The euro, however, suffered the opposite fate. That’s not surprising, given its heavy weight in the Dollar Index, but still.

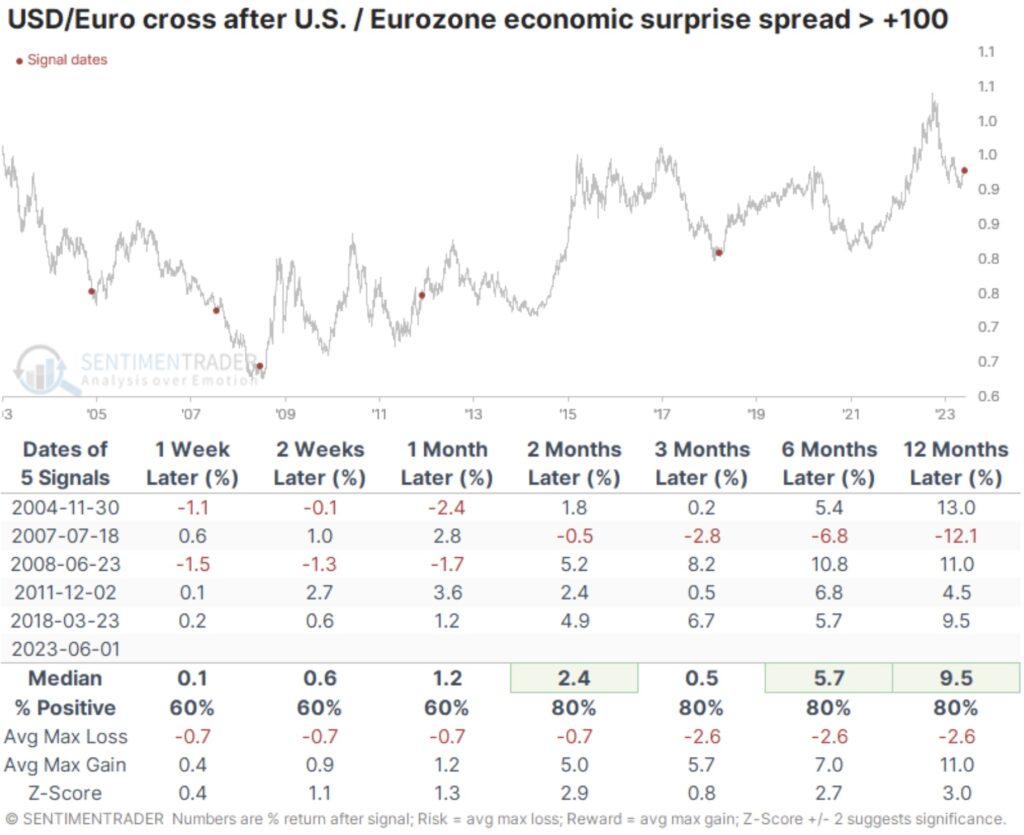

If we look specifically at the U.S. dollar/euro cross, it pretty much matches the U.S. Dollar Index but was a bit better depending on which metric one prefers.

What the research tells us…

We’ve learned time and again over the years that the economy is not the market, no matter which market we’re talking about but usually stocks. Often, stocks (and other markets) move one way when the economy suggests it should do the opposite. This is one of the relatively rare examples when there is a more linear relationship between economics and markets. While it’s hard to rely too much on a tiny sample size, when economic surprises in the U.S. far outpaced those in the eurozone, it showed a consistent tendency to lead to better returns in U.S. stocks and the dollar than eurozone stocks and the euro. This is another example of why Jason Goepfert is the best in the world at what he does – providing actionable market data. To subscribe to the internationally acclaimed work Goepfert produces at SentimenTrader CLICK HERE.

ALSO JUST RELEASED: INFLATION ALERT: Expect High Food Inflation To Continue, Especially In Europe CLICK HERE.

ALSO JUST RELEASED: The Final Move For Gold, Plus Travel Booming And The Bank Credit Crunch Has Just Begun CLICK HERE.

ALSO JUST RELEASED: The Price Of Gold Is Going To Be Unleashed To A New All-Time High CLICK HERE.

ALSO JUST RELEASED: SHOCKER: Look At What Had A Mind-Blowing 4,256.47% Return (And It Wan’t Bitcoin) CLICK HERE.

ALSO RELEASED: The World Is About To See Serious Deflation Followed By Massive Money Printing CLICK HERE.

ALSO RELEASED: Billionaire Pierre Lassonde Says Ignore Volatility, Gold Is Headed Into A Mania CLICK HERE.

ALSO RELEASED: A Jaw-Dropping 232 Tonnes Of Gold Has Now Been Delivered Out Of COMEX CLICK HERE.

***To listen to billionaire investor Pierre Lassonde discuss what he is doing with his own money right now and why investors should ignore volatility in gold because it’s headed into a mania CLICK HERE OR ON THE IMAGE BELOW.

***To listen to Alasdair Macleod discuss what is happening behind the scenes in the war in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.