On the heels of the Fed pausing interest rate hikes, gold’s Open Interest has collapsed but the big surprise is silver.

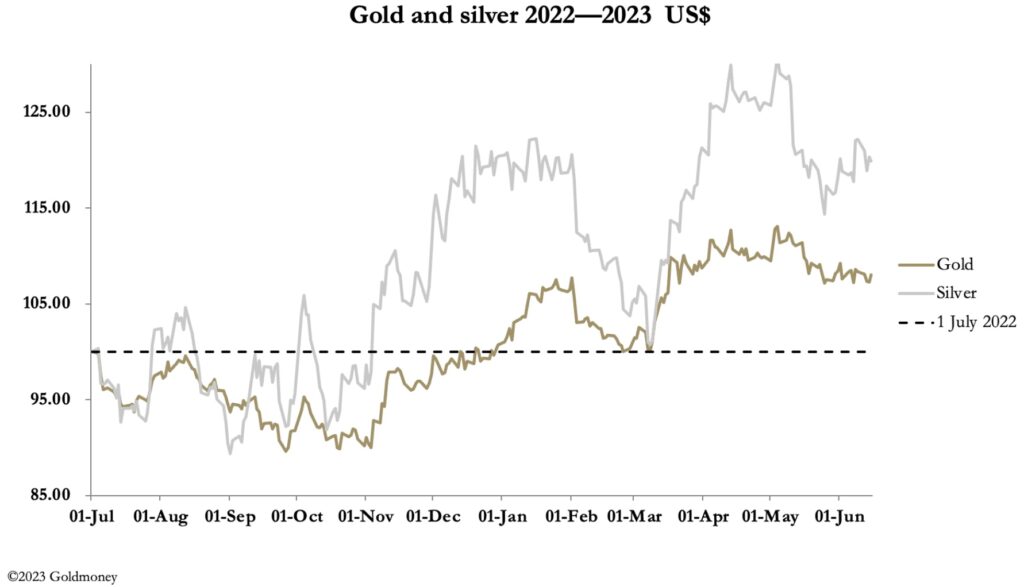

June 16 (King World News) – Alasdair Macleod: Gold and silver ended up little changed on the week after a sell-off in the Far East on Thursday morning, following the Fed’s decision to pause increases in interest rates. In Europe this morning gold was $1964, up $4 from last Friday’s close, and silver was $23.98, down 28 cents on the same timescale.

Comex turnover in both contracts increased, indicating they were finding some support at these levels.

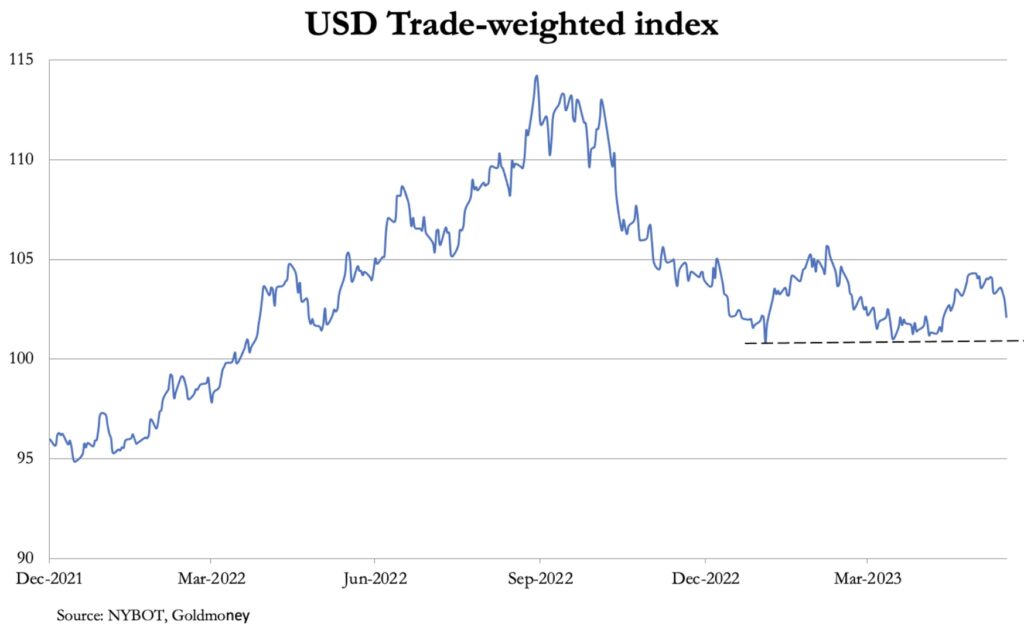

Gold’s action reflected speculator nervousness over how to interpret the Fed’s move, though it was as expected. The question on their minds was whether the Fed would resume its increases, having hinted that there are possibly one or two further rises to come. But the ECB’s rate increase yesterday, together with expectations of further rate increases by the Bank of England and others has undermined the dollar’s trade weighted index. This is next.

The decline from early March to test support at 101 was followed by a rally which peaked at the end of May, since when the TWI has resume its decline. That rally appears to be a Fibonacci 62% correction of the earlier decline, confirming it was most likely a rally in a bear market and that the 101 support will be breached.

The fundamentals leading to this possibility are in relative interest rate outlooks. Foreign exchanges now see a possible end to Fed hiking, while continuing at the ECB, the BoE, and elsewhere. The dollar will therefore be sold, and once it breaks below the 101 level on the TWI, subsequent falls could become significant.

This is particularly relevant for pairs traders — the hedge funds who buy or sell gold relative to the dollar. Therefore, on a break lower for the TWI, gold priced in dollars should rally strongly.

We are not there yet, but there is no doubt that a change is in the wind for currencies due to shifting relationships on interest rates. A weakening dollar might be seen to prolong the inflation problem, and rising bond yields everywhere are likely to lead to a resumption of bear markets for financial assets. Foreigners own nearly $25 trillion of long-term US dollar assets and will face a combination of a declining currency and falling asset values.

In BRICS+, increasing numbers of foreign governments and trading entities for the first time in living memory have in China’s yuan an alternative to the dollar for trade settlement. It could have the makings of a perfect storm for the dollar.

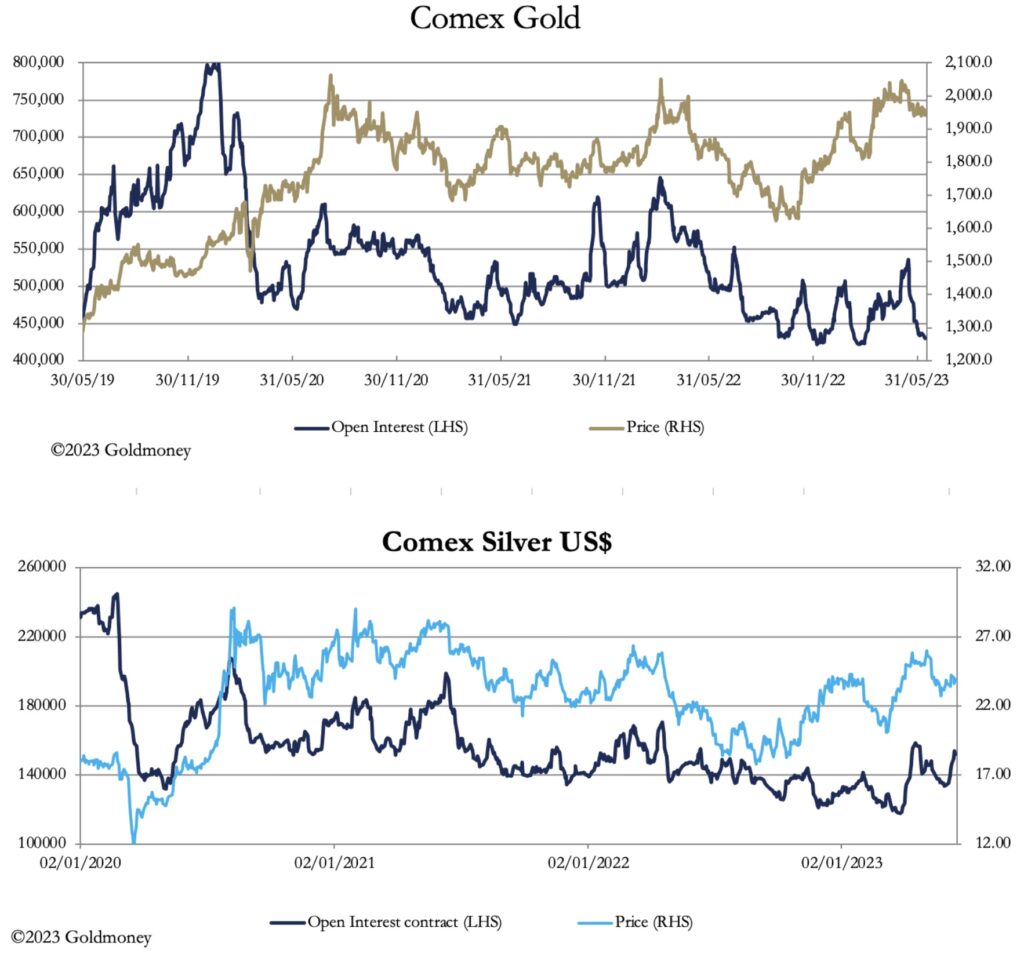

Meanwhile, there is an interesting divergence in Open Interest in Comex gold and silver contracts. This is up next.

Gold’s Open Interest Has Collapsed (Extremely Bullish). Gold To Hit New All-Time Highs Shortly

While gold’s OI has fallen back to its lowest levels, silver’s OI has been rising taking the gold/silver ratio down to 81.8. This relative outperformance is visible in our headline chart and could be indicative of silver leading the way in a wider squeeze on the shorts, fuelled by solid physical demand.

And lastly, 30.7 tonnes of gold have been stood for delivery on Comex this month so far.

In case you missed it…

Another High-Grade Gold (354 g/t) Discovery

John Lewins, K92 Chief Executive Officer and Director, stated, “We are very pleased to be announcing the discovery of a high-grade zone at the J2 vein from our drilling at Judd South, recording 2.40 m at 345.36 g/t AuEq, one of the highest grade intersections at the Kainantu Gold Mine reported to date. The discovery zone features multiple other high-grade intersections at the J2 vein including 11.20 m at 12.69 g/t AuEq and 3.80 m at 10.19 g/t AuEq, and this zone is particularly significant as the J2 vein is not part of our current resource, until recently was not an exploration priority and adds yet another prospective sub-parallel vein to target at the Kainantu Gold Mine.

Discovery Open In Multiple Directions

The discovery is open in multiple directions and located approximately 800 metres north of the A1 Porphyry target. A1 is interpreted to be the heat source for the Kora-Kora South and Judd-Judd South vein systems. Exploration drilling to test for extensions of this zone is already underway. The latest results also continue to demonstrate the high-grade, continuity and expansion potential of the Kora-Kora South and Judd-Judd South vein system. K92 Mining, symbol KNT in Canada and KNTNF in the US.

***To listen to Alasdair Macleod discuss the big catalyst for the price of gold, silver and much more CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED: $4,821 Price Target For Gold And Look At This Collapse No One Is Talking About CLICK HERE.

ALSO JUST RELEASED: $370 Price Target For Silver And A World Drowning In Debt CLICK HERE.

ALSO JUST RELEASED: The Elites’ Plan For The World Is Absolutely Terrifying CLICK HERE.

ALSO JUST RELEASED: SPROTT: The Gold Bull Market May Finally Be Unleashed! CLICK HERE.

ALSO RELEASED: “There Are No Free Markets Anymore, Just Interventions” CLICK HERE.

ALSO RELEASED: ALERT: Look At Silver And Silver Stocks CLICK HERE.

ALSO RELEASED: Big Fed Decision This Week, Plus The Credit Crunch Is Here CLICK HERE.

ALSO RELEASED: The US Economic Nightmare And The Great Unwind Set To Accelerate CLICK HERE.

ALSO RELEASED: Man Who Predicted The Banking Collapse Three Years Ago Says It Will Get Much Worse CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.